2011/7/19 Shanghai 2009/1/9 シノペック四川ビニロン、重慶で酢酸ビニル第二期計画スタート

Sinopec starts up Vinyl Acetate project in Chongqing

On July 18, 2011, Sinopec announces that recently it has started up the vinyl acetate project in Chongqing Chemical Industry Park, Changshou, Chongqing. 重慶市長寿区

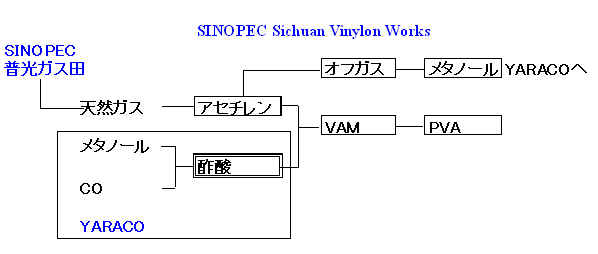

The project is operated by Sichuan Vinylon Works (SVW シノペック四川ビニロン) - a subsidiary of Sinopec, which was started construction in Dec. 2008. According to the release of Sinopec, with total investment of RMB 5.28 billion, the project including 300 kt/a Vinyl Acetate; it also has 100 kt/a Acetylene, 100 kt/a Polyvinyl Alcohol (PVA), and 770,000 t/a Methanol.

The feedstock for Acetylene is natural gas, which will be supplied by Sinopec through the “Sichuan-to-East China Gas Pipeline”, which is started from Puguang Natural Gas Field, Dazhou, Sichuan, and pipeline to Shanghai.

The Vinyl Acetate will be produced by Acetylene and acetic acid, and then the Polyvinyl Alcohol produced by vinyl acetate. The offgas of Acetylene production will be used for Methanol synthesis. The acetic acid feedstock is sourced from YARACO - a jv between Sinopec and BP, while in return, the methanol can supply to YARACO for acetic acid production.

SVW has existing 200 kt/a vinyl acetate and 60 kt/a PVA and 350 kt/a methanol capacities. After the startup of new project, the total capacities of vinyl acetate, PVA and methanol of SVW will reach 500 kt/a, 160 kt/a and 1.12 Mt/a respectively.

China’s import of vinyl acetate is 258 Kt in 2010 and 256 Kt in 2009.

重慶のYangtze River Acetyls Company(揚子江アセチル 通称YARACO)

BPが51%、SINOPECが44%、重慶投資建設公社が5%を所有する。2005年末に15万トンの増設工事 が完成し、35万トンとなった→その後40万トン。一部は隣接の「SINOPEC 四川ビニロン工場」の20万トン酢ビモノマーのプラントに供給される。

BP と Sinopec はYARACO で65万トンの酢酸の新工場建設の覚書に調印した。2011年に生産開始の予定。

各社の能力は以下の通り。

| 第一期 | 第二期 | ||

| 四川ビニロン工場 | アセチレン | 6万トン | 10万トン |

| 酢酸ビニル | 20万トン | 30万トン | |

| PVA | 6万トン | 10万トン | |

| VAEラテックス | 3万トン | ||

| ビニロン | 2万トン | ||

| メタノール | 35万トン | 77万トン | |

| フォルマリン | 5万トン | ||

| YARACO | 酢酸 | 40万トン | 65万トン |

| エステル | 8万トン |

Yanchang Petroleum to focus on petrochemicals

陝西延長石油

Shaanxi Yanchang Petroleum (Group) Co, China's

fourth-biggest oil producer by output, is planning to strengthen its

petrochemical division and cut the weighting of its oil and gas unit in its

total portfolio, after its oil resources were squeezed by China's top three oil

companies.

Yangchang Petroleum will reduce the proportion of sales by its oil and gas

division to 60 percent of the group's total sales by the end of 2015 to 120

billion yuan ($19 billion), Zhang Jiyao, general manager of the company, which

is based in the northwestern province of Shaanxi, told China Daily. The sector

accounted for approximately 80 percent during 2006-2010.

Meanwhile, the company expects the petrochemical sector, including its

coal chemical division, to account for 40 percent

of the group's sales, equal to 80 billion yuan, Zhang said. The past five years

have seen the petrochemical division provide around 20 percent of total sales.

Yanchang Petroleum said earlier that it aims to double its sales to 200 billion

yuan in five years from the 100 billion yuan recorded in 2010.

The increased role for the petrochemical division is part of the company's

solution to a shortage of crude oil supplies.

Yanchang Petroleum will instead exploit alternative resources, such as coal, to

maintain growth, said Wang Jintao, an analyst at chem365.net, an online

information provider for the petrochemical industry.

Yanchang Petroleum is one of only four qualified Chinese

oil companies that hold oil and gas exploration rights in China, and the

only outfit among the four to be owned by a provincial

government.

The other three, including China National Petroleum Corp (CNPC) and China

Petroleum & Chemical Corp (Sinopec), are directly owned by the central

government. At present, CNPC and Sinopec control the majority of crude oil

supplies in China. (+CNOOC 中国海洋石油)

For Yanchang Petroleum, the development of the company's operations that are

heavily reliant on crude oil and gas has been hampered by the shortage of

resources,said a fund manager based in Beijing, who declined to be named.

"We'll make full use of the abundant coal resources we have and find our own way

for growth," Zhang said, adding that the company will use 150 billion yuan of

its total 260 billion yuan corporate investment between 2011 and 2015 to develop

projects that integrate coal, oil, gas and salt.

At present, Yanchang Petroleum produces 3 million tons of

coal tar annually.

That figure is expected to double within five years.

In addition, Zhang said that the company is set to raise its annual refining

capacity by 5.14 percent from 2010 to 13.5 million tons this year.

It also plans to invest about 14 billion yuan to expand its network of gasoline

stations by 700 within five years, bringing the total number to 1,000.

Currently, most of its 300 existing stations are situated in the provinces of

Shaanxi and Sichuan. "We're preparing to establish some in Shanxi province,"

Zhang said.

"The planned stations will include some jointly established with Shell," said

Zhang, who declined to reveal specific figures.

2005年10月14日、陝西省国有資産管理・監督委員会は、陝西省北部地域における石油資源の統合を推進するため、石油探鉱開発企業21社(陝西省の所管する延長油鉱管理局所属の石油開発会社7社、陝西省北部各区・県の所管する石油開発会社14社)ならびに製油所3社(延煉集団、永坪精油所、楡林製油所)を統合し、全額出資企業「陝西延長石油(集団)有限責任公司(以下、延長石油集団)」を設立した。また、同公司は傘下に延長油田股(株式)有限公司(以下、延長油田株式会社)を設立した。今後、傘下の石油探鉱開発企業および製油所は延長油田株式会社が統一管理する。

延長石油集団傘下の石油開発企業の原油生産量は合計720万トン/年(14.4万バレル/日)であり、中国全体の原油生産量の4%にすぎないが、今回の統合により、三大国有石油企業に次ぐ第4の石油開発会社が誕生したと言える。

ただし、延長石油集団の活動範囲はあくまで陝西省に限られ、今後、他省あるいは国外において、石油の探鉱開発や精製事業を行うなどの事業規模拡大を行う可能性は極めて少ない。

http://oilgas-info.jogmec.go.jp/pdf/0/646/200511_102t.pdf------

2007/5/23 PetroChina、陝西省延安でエチレン100万トン計画

------

2010/10/11

延長石油が大連に超大型石油化学コンビナート建設 (

陝西延長石油集団と大連市は10日、協力枠組協定に調印した。延長石油集団は長興島臨港工業区に超大型石油化学コンビナートを建設する。

June 27, 2011陝西延長石油(集団)とKBRが合弁会社設立の意向を発表

陝西延長石油(集団)有限責任公司(延長石油集団)とKBRは本日、合弁会社を中華人民共和国に設立する契約を締結したと発表しました。この合弁事業の目的は、KBRがBPと交わしたVeba Combi Cracker(VCC)技術に関する提携契約に従って、同技術のマーケティング、販売、提供、サポートを実施することにあります。

合弁事業の運営は、延長石油集団子会社の北京石化工程有限責任公司(BPEC)とKBRの技術事業部門が行います。

VCC技術とは水素添加技術であり、石油精製、油田現場における改質、石炭液化(CTL)の過程において、精製残留物、コールタール、石炭石油混合物を高品質の蒸留物または合成原油へと処理するのに適した技術です。

Fight against illegal rare earth mining continues

Although the government has been working to

crack down on illegal rare earth mining since last year, villagers from East

China's Fujian province 福建省 have complained that profiteering still prompts

unlawful miners to take risks by playing "hide-and-seek" with local law

enforcement.

Li Chukai, head of the village of Xianghu, described the illegal mining as

"rampant."

"It's very hard to crack down on them," he said.

Tucked away in the southeastern mountains of Fujian province, the village has

been severely affected by illegal rare earth mining. At one of the illegal mines

identified by villagers, trees have been toppled and leaking waste barrels have

contaminated the ground.

At another illegal mine, polluted water has been diverted to the villagers'

farms, destroying rice fields and killing off a large number of fish and shrimp,

Li Chukai said.

"Illegal rare earth mines were set up here three years ago. They use

ammonium sulfate and oxalateシュウ酸塩

to extract rare earth metals, while contaminated water is pumped into farms

without being treated," said villager Li Sida.

Since then, more than 100 local residents have volunteered to patrol the

village, looking for illegal mines. The volunteers have resorted to vandalism,

destroying water pipes and equipment belonging to illegal mines after locating

them. However, they always end up coming back, according to Li Chukai.

"A crackdown by the local government fared no better, as a majority of the

miners managed to flee when the government's enforcers came. They return to

their mines after the enforcers leave," Li Chukai said.

A report from the Hushan township government showed that another four villages

in the region have also been affected by illegal rare earth mines.

"China has limited the exploitation of rare earth metals, so their prices have

started to surge. People have taken to illegal mining to reap significant

profits," said Fan Linyun, head of Hushan township.

Widely used in the manufacturing of high-tech products such as flat-screen

monitors, electric car batteries, wind turbines, missiles and aerospace alloys,

rare earth metals are some of China's most valuable natural resources.

Currently, the country supplies more than 90 percent of the world's rare earth

metals. However, China's rare earth metal reserves only account for about

one-third of the world's total, according to government statistics.

Guo Zhibiao, an inspector from the Land and Resources Bureau of Yongding county,

said it has been very difficult to halt the exploitation of the region's rare

earth metal reserves.

"We can't completely destroy the mines, as the mountains prevent us from

transporting large machinery to their work sites," he said.

"In addition, some of the miners have connections with the villagers. When we

arrive, many of the miners run away and we cannot get evidence to arrest or

punish them," said Guo.

Guo said local inspection teams have identified 12 illegal mines, issued 28

production-halting notices, demolished 23 temporary housing units built for the

miners and damaged 31 generators and 64 settling ponds since January.

Since China has yet to map out regulations specifically targeting illegal rare

earth metal mining, local law enforcement can only punish miners based on

regulations regarding damage to forests and other national resources, which

typically bring only mild administrative punishments, Guo said.

Under regulations passed by the region's forestry authorities, miners only have

to pay a fine of 10 yuan ($1.6) for every square meter of forest that they

damage.

"Such a light punishment is hardly a deterrent," said Guo.

Chen Qingxiang, director of an inspection team from the Land and Resources

Bureau of Yongding county, said that coordinated enforcement by police,

forestry, land and resource and transportation departments must be conducted to

break the production and trade chains of the illegal mines.

"Our inspection team is made up of just a few people, and they are poorly

equipped. Therefore, we must count on the help of villagers and government

departments. Otherwise, the problems we are currently facing will continue to

plague us in the future," said Chen.

Zhejiang Hongji Petrochemical starts up PP

project in Jiaxing

On Aug. 17, 2011, Zhejiang Hongji Petrochemical Company浙江鸿基石化

started up its PP project and produced on-spec product in Zhapu Industry Park乍浦工業園,

Jiaxing嘉興市, Zhejiang Province.

With the investment of RMB 320 million, the

project has nameplate capacity of 120 kt/a PP. The project was started

construction in Sep. 2009. It uses the China domestic developed PP process(ZHG法).

The feedstock will be sourced from overseas market, most probably S. Korea,

while the PP products will be manly for captive use.

Hongji is a private

company, investor is based on Wenzhou, Zhejiang Province浙江省温州市, and who also has

another plant for plastics production in Yichang, Hubei Province湖北省宜昌市 – named

as Yichang Shuanglong Plastics Company.宜昌雙龍塑料公司。

浙江鸿基石化は2009年7月に設立された。事業目的はPPとプロピレンとなっており、今回が事業のスタートとなる。

(プロピレンの製造計画は今のところなく、輸入品を一部外販する見込み。)

同社は浙江省温州市の投資家が設立したもので、オーナーは湖北省宜昌市に宜昌雙龍塑料公司を持ち、コメ袋、小麦粉袋、セメント袋などの製造販売を行っている。

浙江鸿基石化のPPは主として宜昌雙龍塑料に供給され、一部は外販される。

Hongji has planned to invest 300 kt/a PP

capacity in Zhapu, Zhejiang by two stages. The first stage is 120 kt/a while the

second stage is 180 kt/a. This time is the startup of first stage project. The

second stage 180 kt/a PP project is under preparing, while the detailed schedule

is not disclosed.

In 2010, China’s net imports of propylene monomer are 1.52

Mt and PP 3.79 Mt; in 2011, the estimated net imports of propylene monomer are

approximate 1.5 Mt and PP 3.5 Mt respectively.

China to review foreign M&A

A new regulation issued by China's Ministry

of Commerce (MOC) on Friday states that the government will review mergers and

acquisitions of domestic companies by foreign investors for national security

purposes.

If any mergers and acquisitions involving foreign investors are determined to be

a threat to national security, those deals should be terminated, according to

the regulation.

In addition, any past mergers and acquisitions of domestic companies by foreign

investors that are found to have threatened national security will be

terminated. As an alternative, the MOC may "take relevant measures such as

equity and asset transfers or other methods to eliminate their (mergers and

acquisitions) influence on national security," according to the regulation.

The regulation will take effect from Sept 1 of this year, the ministry said.

According to a circular concerning the review system, which was issued in

February by the general office of the State Council, or China's cabinet, the

review process will involve foreign mergers and acquisitions of domestic

military-industrial enterprises and supporting firms, companies near "major and

sensitive military facilities" and other mergers and acquisitions that are

deemed to be relevant to national security.

Reviews will be also needed for foreign mergers and acquisitions of domestic

enterprises operating in security-related sectors that may be controlled by

foreign investors after being acquired, such as

agriculture, energy and resources, infrastructure and transportation.

Government departments under the State Council, national industry associations,

competitors, suppliers and other related parties may apply for reviews,

according to the regulation.

The State Council announced on Feb 12 that it would create a mechanism for

overseeing foreign mergers and acquisitions of domestic firms. A ministerial

joint committee will be established for this purpose, according to the commerce

ministry.

2011-08-25

Ministry of Commerce Notice No. 53 of 2011

http://www.mofcom.gov.cn/aarticle/b/c/201108/20110807713530.html

2011/8/29 Shanghai ブログ

Qinghai Salt Lake Selects UNIPOL Process for

PP Project

Recently, Qinghai Salt Lake Industry Company (Qinghai Salt Lake) selected UNIPOL™

Polypropylene Process Technology from Dow Chemical Company (Dow) for its new 160

kt/a polypropylene unit. The unit is part of Qinghai’s integrated magnesium

metal and coal chemical integrated complex in Qarhan Salt Lake, Geermu, Qinghai.

Qinghai Salt Lake planned the magnesium metal project, for the balance of

chlorine; it also plans the PVC project. The PVC comes from both two routes; the

one is the carbide route, while another is the ethylene route, and the ethylene

is from the coal based olefins via methanol to olefins (MTO).

The proposed products and capacities of Qinghai Salt Lake complex (kt/a)

|

Products

|

First stage

|

Total

|

|

Magnesium metal

|

100

|

400

|

|

Methanol

|

1000

|

2400

|

|

MTO

|

1000 (methanol

feeding)

|

2400 (methanol

feeding)

|

|

PVC

|

500

|

2000

|

|

Soda

|

1000

|

2000

|

|

Coking

|

2400

|

2400

|

|

Calcium carbide

|

800

|

2000

|

|

Calcium dichloride

|

100

|

100

|

|

Propylene

|

165

|

400

|

Source: ASIACHEM Consulting

In Jul. 2010, Qinghai Salt Lake has started construction for the first stage of

magnesium and coal chemical complex. The first stage is scheduled to start up by

H2 2013. In the first stage, the company plans a 160 kt/a PP project for captive

use of the propylene; while it is not disclosed that how to use the additional

propylene in the next stage of the MTO project.

Qinghai Salt Lake is the largest salt lake resources development enterprise and

potassium chloride base in China with a wide range of products including

potassium carbonate, potassium nitrate and potassium metal.

Zhejiang Julong start construction for

propylene project in Jiaxing

On Aug. 26, 2011, Zhejiang Julong Petrochemical Company (ZJLPC 浙江聚龍石油化工)

started construction for its propylene project in Dushan Port, Jiaxing嘉興市独山港区

, Zhejiang Province浙江省.

With investment of RMB 1.63 billion, the project will have propylene capacity of

450 kt/a, which is the first stage project of ZJLPC and is expected to start up

in 2013. The company also planned the second stage project, with investment of

RMB 2.85 billion, it will have propylene capacity of 750 kt/a. The second stage

project is under feasibility study.

The project will use the propane dehydrogenation process -

Oleflex Technology provided by UOP.

According to UOP, the technology was commercialized in 1990, and the company has

commissioned nine C3 Oleflex units for propylene production worldwide.

Aug. 2, 2011 — UOP LLC, a Honeywell company, announced today that it has been selected by Zhejiang Julong Petrochemical Co. Ltd to provide key technology for a new unit to produce propylene at its facility in Pinghu City, Zhejiang Province, China.

Earlier this year(June 23, 2011), UOP announced a similar project with Abu Dhabi Oil Refining Co., also known as Takreer.(500,000 metric tons)

The feedstock of propane will be sourced from overseas market, particularly the

mid-east market; while the propylene product will provide to the domestic users

in China . Up to now, ZJLPC has not planned propylene derivatives projects.

ZJLPC is located in Pinghu, Jiaxing , Zhejiang province嘉興市の平湖市, a fully owned

subsidiary of Zhengjiang Changjiang Energy Development Co., Ltd. (CJNY浙江長江能源發展有限公司).

CJNY is based on Wenzhou city温州市, Zhejiang Province , which is a private company

with the main business in LPG transportation, storage, and distribution. CJNY

will take the advantage of experiences in LPG business, to supply the propane

raw materials for the ZJLPC’s propylene project.

In late June 2011, Tianjin Bohua Petrochemical Company has started construction

for its new propylene project by the propane dehydrogenation (PDH) technology in

Binhai New District, Tianjin濱海新區

. With total investment of RMB 3.75 billion, the project will have designed

propylene capacity of 600 kt/a. The PDH technology is licensed by CB&I Lummus

and the catalyst will be supplied by Sud-Chemie. The project will use overseas

import propane feedstock, it is expected to start up by June 2013.

China’s net import of propylene monomer is 1.5 Mt/a. It can be estimated that the propylene monomer imports will be decreased while the propane imports will be increased in the future.

天津渤海化工集団の子会社Tianjin

Bohua Petrochemical は2010年9月、60万トンのプロピレンの設計を開始した。技術はCB&I

Lummusから導入

(CATOFIN®)、設計はSinopec

Qilu Petrochemical が行う。

2012年9月完成予定で、世界最大のプロパン脱水素プラントとなる。

Siemens Energy は2011年8月、2基のガスタービンコンプレッサーを受注した。

According to Lummus、the unit will be the largest operating PDH plant in the

world and the first PDH plant in China.

CB&I Lummus は2011年8月、寧波海越新材料(Ningbo Haiyue New

Material)からプロパン脱水素技術を受注した。

CATOFIN®脱水素技術で寧波市に60万トン設備を建設、2014年にスタートの予定。

寧波海越新材料は浙江海越(Zhejiang Haiyue Co.)の子会社で、同社の主製品はプロピレン、メチルエチルケトン、イソオクタン。

ーーー

Honeywell’s UOP Selected to Provide Technology for Propylene Production in China

UOP LLC, a Honeywell company, announced today that it has been selected by Zhejiang Julong Petrochemical Co. Ltd (ZJLPC) to provide key technology for a new unit to produce propylene at its facility in Pinghu City, Zhejiang Province, China.

Honeywell’s UOP will provide engineering design, technology licensing, catalysts, adsorbents, equipment, staff training and technical service for the project. The unit is expected to start up in 2013 and to produce 450,000 metric tons of propylene per year.

China’s propylene consumption accounts for more than 15 percent of worldwide demand and is growing at about 5 to 6 percent per year.

“This project is a significant milestone for UOP because it is the first propane dehydrogenation unit we have licensed in China,” said Pete Piotrowski, senior vice president for UOP’s process technology and equipment business unit. “We are pleased to work with Zhejiang Julong Petrochemical on this project and to provide the technology that will help meet the world’s growing propylene demand.”

Bichao Lv, general manager for ZJLPC, said, “We look forward to working with UOP to adopt this technology at the Zhejiang Julong Petrochemical plant, which will add propylene to our product portfolio.”

The new propane dehydrogenation unit at the facility will use UOP’s C3 Oleflex ™ technology to convert propane to propylene, a material used in the production of chemicals and materials such as films and packaging.

The UOP Oleflex process uses catalytic dehydrogenation to convert propane to propylene. Compared to competing PDH processes, Oleflex technology provides the lowest cash cost of production and the highest return on investment, enabled by low operating and capital costs, high propylene yield and reliability, and maximum operating flexibility. Since the technology was commercialized in 1990, Honeywell’s UOP has commissioned nine C3 Oleflex units for on-purpose propylene production. Earlier this year, UOP announced a similar project with Abu Dhabi Oil Refining Co., also known as Takreer.

Zhejiang Julong Petrochemical Co. Ltd. (ZJLPC), located in Pinghu City, Zhejiang province, is a fully owned subsidiary of Zhengjiang Changjiang Energy Development Co., Ltd. (CJNY). CJNY is headquartered in Wenzhou City, Zhejiang Province, China.

UOP LLC, headquartered in Des Plaines, Illinois, USA, is a leading international supplier and licensor of process technology, catalysts, adsorbents, process plants, and consulting services to the petroleum refining, petrochemical, and gas processing industries. UOP is a wholly-owned subsidiary of Honeywell International, Inc. and is part of Honeywell’s Specialty Materials strategic business group. For more information, go to www.uop.com.

Honeywell International (www.honeywell.com) is a Fortune 100 diversified technology and manufacturing leader, serving customers worldwide with aerospace products and services; control technologies for buildings, homes and industry; automotive products; turbochargers; and specialty materials. Based in Morris Township, N.J., Honeywell’s shares are traded on the New York, London, and Chicago Stock Exchanges. For more news and information on Honeywell, please visit www.honeywellnow.com.

Shaanxi Yanchang licenses Ineos PP technology

Shaanxi Yanchang has licensed Ineos’ Innovene processing

technologies for the manufacture of homopolymer, random copolymer and impact

copolymer polypropylene.

The Chinese company’s 300,000 tpa plant will produce a range of PP products to

serve the growing demand in China, according to a statement from Hampshire-based

Ineos.

Shaanxi Yanchang also used Innovene PP and Innovene S technologies for the 2009

expansion of its facility in Yulin, Shaanxi province.

Ineos 発表では相手は Shaanxi Yanchang

Petroleum Yanan Energy and Chemical Company

陝西延長石油延安能源化工

March 19th 2010 IneosINEOS TECHNOLOGIES WINS PP and HDPE TECHNOLOGY LICENSE CONTRACTS IN CHINA

INEOS Technologies is pleased to announce that it has licensed its ‘Innovene PP Process' for the manufacture of homopolymers, random and impact copolymers and its ‘Innovene S Process' for the manufacture of HDPE and MDPE to the Yulin Energy and Chemical Co., Ltd. of Yanchang Petroleum Group Co., in Shaanxi, China.

榆林能源化工有限公司The 300 KTA Innovene PP plant and the 300 KTA Innovene S plant will produce a wide range of products to serve the growing demand of China.

Peter Williams, CEO of INEOS Technologies, commented: "INEOS Technologies is proud of the fact that Yanchang Petroleum Group Co. has chosen INEOS' technology platforms to be key assets in their petrochemical expansion. We look forward to ensuring that the planned investments benefit fully from our continuing investment in the advancement of our technologies."

INEOS Technologies has licensed its Innovene PP process for the manufacture of

polypropylene homopolymers, random copolymers and impact copolymers to the

Ningxia Baofeng Energy Group Company Limited

寧夏寶豐能源集團有限公司

in Ningxia, China. The 300 KTA

Innovene PP plant will produce a wide range of polypropylene products to serve

the growing market in China.

The olefin feedstock for the polypropylene plant will be produced using locally

sourced coal via the Methanol-to-Olefins (MTO) process – an increasingly

important route to olefins in China. INEOS Technologies participates in this new

sector by offering state of the art process technologies to make polyolefins and

other chemicals from olefins. It is the fourth licence acquired by Chinese

companies building MTO plants.

Peter Williams, CEO of INEOS Technologies, commented: "INEOS Technologies is

proud to serve this growing coal chemicals sector in China and is pleased to be

recognised by this industry as a leader in polyolefins technologies.”

Notes to Editors

Licenses in China - 2011

6th September - Ningxia Baofeng Energy Group Ningxia, China. PP process for the

manufacture of polypropylene homopolymers, random copolymers and impact

copolymers. 300 ktpa Polypropelene (PP).

1st September - Shaanxi Yanchang Petroleum Yanan Energy and Chemcal company

Shaanxi Yanchang , China - PP Process for the manufacture of homopolymers,

random copolymers and impact copolymers. 300 ktpa Polypropelene (PP)

4th August -

Qingdao Haijing Chemical (Group) co. Ltd. Qingdao, China. Vinyl

Chloride Monomer (VCM) and Suspension Polyvinyl Chloride (S-PVC) technologies.

400 ktpa VCM, 300 ktpa S-PVC

INEOS Technologies is a leading developer and licensor of technologies for the

global petrochemicals industry. It offers the broadest range of petrochemical

technologies on the market today and also supplies catalysts, additives and

coatings that our customers require to obtain the best possible performance from

their investments.

INEOS Technologies’ complete portfolio of leading licensed technologies

includes:

Innovene PP - gas phase technology for the production of polypropylene

Innovene S - slurry technology for the production of mono and bi-modal HDPE

Innovene G -swing gas phase technology for the production of LLDPE and HDPE

BICHLOR - membrane electrolyser technology for chlor alkali production

Vinyls - technology for the production of EDC, VCM and PVC

Nitriles - technology for the production of Acrylonitrile and Maleic Anhydride

Officials take action in solar factory pollution

Environmental authorities in Haining, East China's Zhejiang province浙江省海寧市,

announced on Sept 18 the actions that are being taken to prevent further

pollution from a solar panel producer, following angry protests by villagers.

More than 500 people from the nearby Hongxiao village紅曉村 began gathering outside

the Zhejiang Jinko Solar Co Ltd (ZJS:晶科能源公司) factory on Sept 15 night, demanding

an explanation of large-scale fish deaths in a local river last month, according

to the Haining people's government.

The company was formerly known as Zhejiang Sun Valley Energy Application Technology Co., Ltd. and changed its name to Zhejiang Jinko Solar Co., Ltd. in September 2009. The company is based in Jiaxing, China. As of June 30, 2009, Zhejiang Jinko Solar Co., Ltd. operates as a subsidiary of JinkoSolar Holding Co., Ltd.

JinkoSolar Holding Co., Ltd. is one of the few PV manufacturers that has 1.5 GW capacity in 2011 with a vertically integrated model, producing high quality crystalline ingots, wafers, cells, and mono- and multi- crystalline PV panels with factories in Shangrao (Jiangxi 江西省上饒市) and Haining (Zhejiang)

The company produces mono- and multi-crystalline photovoltaic panels,

cells and wafers, which are sold around the world, according to its official

website.

Protesters overturned eight company vehicles and destroyed the company's offices

before police arrived.

Additionally, four police cars were damaged as the officers dispersed the crowd,

according to the government.

The factory's waste disposal system has failed

pollution tests since April, according to Chen Hongming, the deputy head of

Haining's environmental protection bureau.

The bureau had warned the factory before the protest, but the factory did not

take effective measures to control the pollution, Chen said.

Before the protest, a 33-year-old resident of Hongxiao village identified only

as Sun posted a comment on the Internet saying that the latest health

examination of the villagers showed that among 3,300 people, six were diagnosed

as having leukemia 白血病 and another 31 had other kinds of cancer.

Local health authorities subsequently said that Sun's post was inaccurate, as

the number of villagers who were diagnosed with cancer was four in 2010 and two

in 2011.

Sun was detained by police for dissemination of false information, which caused

considerable repercussions, according to the local government.

Also, three employees of ZJS were detained on Sept 17 for interfering with

interviews by two reporters from the Hangzhou-based Qianjiang television station

and damaging their video cameras on Sept 15.

Police are still investigating the ZJS employees' actions.

The fish kills were related to contamination of the

river near the factory, according to the local environmental protection

authorities.

The Haining people's government will step up its investigation into the

pollution and water quality monitoring near the factory.

Further, production safety inspection authorities

ordered the factory to stop production, according to a press release from the

Haining people's government regarding a news conference held on Sept 17

afternoon.

"Villagers told me that they smelled a strong odor as the factory emits

yellowish smoke between 1 am and 3 am, and we are going to investigate to see if

it is true," said an official with Yuanhua county, where Hongxiao village is

located.

The official spoke on condition of anonymity on Sept 18.

It is not easy to gather evidence and the investigation might not go smoothly,

said the official.

The official said the local government has sent teams to meet with villagers,

village cadres and enterprise owners to understand their demands.

A villager who would only give his name as Liu said he and his family are

worried that their crops might be polluted and could not be sold.

Liu said he did not join the protest, but he hoped that the demonstrators'

voices were heard.

"I know that some protesters also grabbed money and things from the company on

the past two nights, and some of them were not even villagers. They were just

being selfish and breaking the law.

"On the other hand, I also want to live without worrying," said Liu.

Grupo KUO to create a new JV with Jiangsu GPRO to manufacture Nitrile Rubber in China

Grupo KUO, S.A.B. de C.V. (BMV: KUO), hereinafter Grupo KUO, today announced an agreement to form a 50/50 joint venture with the Chinese company Jiangsu GPRO Group Co. Ltd. (GPRO).

This agreement stipulates that Grupo KUO and GPRO will establish a company named INSA GPRO (Nanjing) Synthetic Rubber Co. Ltd. and will jointly invest US $60 million in a new plant located in Nanjing, Jiangsu Province, China, with an initial production capacity of 30,000 metric tons per year in its first phase. Grupo KUO’s wholly owned subsidiary, INSA (Industrias Negromex, S.A. de C.V.) will be the technologist of the new joint venture.

The Nanjing plant will create 100 direct jobs and is expected to begin operations by the beginning of 2014. Construction will begin after approval by Chinese authorities.

Nitrile Rubber (NBR) is used in a wide array of industries such as tire, footwear, industrial rubber goods, adhesives and sealants, paper coatings and the textile industry. Grupo KUO, through INSA, already sells NBR to China, thus this venture is a natural step for the company to better serve the Chinese market.

"Grupo KUO brings to this venture its differentiated and innovative technology, which allows it to produce high end and sophisticated NBR rubbers to meet the increasing demand of products with improved performance ", said Juan Marco Gutiérrez Wanless, CEO of Grupo KUO. "This way we contribute to position the new company above other producers to competitively serve the Chinese market primarily –the fastest growing market globally– and also other Asian countries", he also remarked.

"Nanjing, a central city along the Yangtze River at the Yangtze Delta Region, is one of China’s cities with the highest economic growth rate and is uniquely positioned to tend to our customers’ needs in China and to tap other export markets", pointed out Mr. Guo Jindong, Chairman of GPRO. "This partnership is a perfect fit with our strategy of strengthening our comprehensive competition power to form a world-class enterprise group."

About Grupo KUO

Grupo KUO is a leading industrial conglomerate in Mexico, with annual sales

amounting to approximately US $1.8 billion; it exports to more than 70 countries

and it has more than 14,000 employees. Its current business portfolio includes:

Aftermarket, Particle Board, Bioenergy, Dynasol (solution rubber), Elastomers,

Herdez Del Fuerte (brand processed foods), KUO Aerospace, Macro-M, Plastics,

Pork Meat and Power Systems.

Industrias Negromex, S.A. de C.V. (INSA).

Products: Synthetic rubber emulsions.

We are the only producer in Mexico of synthetic plastic emulsions.

Facilities in: Altamira, Tamaulipas (Mexico), Houston, Texas (US) and Mexico

City.

Installed capacity: 130 thousand tons.

About 400 employees.

Exports to around 35 countries.

About Jiangsu GPRO Group

Jiangsu GPRO Group Co., Ltd. is a large-scaled modern enterprise group

integrating R&D, production, sales and trading with advanced manufacturing

industries, real estate and modern services as core businesses. GPRO Group ranks

as one of the top 500 of China and one of the Excellent Chinese Private-owned

Enterprises. GPRO Group is at the leading position in, synthetic rubbers, fine

chemicals, additives for refineries and fuels as well as titanium dioxide and

the like.

2006/11/28 韓国の錦湖石油化学、南京でPO生産

南京の南京ケミカルパークで11月9日、「南京GPRO錦湖石化」のPO計画の建設がスタートした。

本年7月に韓国の錦湖石化と江蘇金浦集團 (Jiangsu GPRO Group)が50/50合弁会社設立の覚書を締結し、9月に契約を締結した。江蘇金浦集團は江蘇省南京市に本拠を置く化学会社で、従業員3,000人。プロピレンオキサイド、ポリエーテル、PP、ガソリン添加剤、潤滑油、酸化チタン等々を生産している。

同社は2005年に南京市に、同社40%/Sinopec揚子石化 60%のJV、揚子石化金浦橡膠(YPC-GPRO Rubber)を設立し、南京ケミカルパークにSBR プラントを建設中(第1期 100千トン、計画では第2期として+100千トン)

EmulsionThe emulsion plant is located in Altamira and has a capacity of 150,000 metric per year of Emulprene® and Insagum® synthetic rubber and Arlatex®, latex mainly directed to the tire, footwear, industrial rubber goods, adhesives and sealants, chewing gum, non-woven materials, paper coatings and textile industry.

Through the combination of three fundamental factors; excellence in quality, service and leading technology, INSA serves customers worldwide, demanding markets in America, Europe and Asia. Our plant is located in the industrial area next to the port of Altamira, Tamaulipas in Mexico and within easy driving distance to the USA border.Petrochemical Terminal

INSA was the first privately held company in Mexico to have its own Petrochemical Terminal.

Since 1991 these modern facilities, operated under rigorous safety and environmental conditions, allow for efficient and timely supply of our basic raw material from all over the world.

2011/9/28 ChemChina子会社の豪州Qenos、工場拡張で20億ドルの原料調達契約締結

Ted Baillieu (Premier of

Victoria) signs $2bn deal with Chinese

CHINESE plastics-maker Qenos has confirmed a full commitment to the expansion of

its Victorian facility by signing

a deal to take $2 billion in petrochemicals from Bass

Strait wells to feed its plant.

中国化工集団公司 (ChemChina)は2005年に、Orica と ExxonMobil から両社のJVの石油化学会社Qenos を買収した。

Orica は1997年に ICI が売却したICIオーストラリアが改称したもの。

Qenos は1999年10月に、Orica とKemcor(統合前のExxon Chemical とMobil Chemical の50/50 JV)が、両社の石油化学事業を統合して47/53で設立したJV。In 2008, Qenos became a subsidiary of China National Bluestar (Group) Co. Ltd, a joint venture between China National Chemical Corporation (ChemChina) and The Blackstone Group, a leading global alternative asset manager and provider of financial advisory services listed on the New York Stock Exchange.

2007年9月、ChemChina と投資会社のBlackstone Group は、スペシャルティケミカル分野でのグローバルリーダーをつくるための戦略的提携を発表した。Blackstone はChemChina の100%子会社のBluestarの20%を6億米ドルで取得、2人の役員を派遣する。

2007/9/17 Blackstone、藍星グループに出資

In Beijing last night, Victorian Premier Ted

Baillieu witnessed the signing of a declaration of commitment as part of the

signing ceremony for separate long-term contracts worth more than $2bn between

Qenos and suppliers

ExxonMobil Australia and BHP Billiton for

the Altona plastics plant. He said Victoria welcomed the confirmation of

Qenos to further its investment and expand its operations in Victoria and that

it sent a vote of confidence in the state's economy that would secure jobs at

the Qenos Altona plant well into the future.

Work has already begun on a $195 million plant

redevelopment.

Qenos was bought by the Chinese in 2008. It is a subsidiary of China National

Bluestar a joint venture between China National Chemical Corporation and US

private equity giant the Blackstone Group.

Qenos has extensive manufacturing facilities in Altona, Melbourne (Victoria) and Botany Bay, Sydney (New South Wales)

Qenos Melbourne

The Qenos Altona site covers 103 hectares, 15km west of Melbourne. It includes the registered office of Qenos as well as three plants – Olefins, Plastics and Resins. Olefins produces ethylene for the downstream plastics plants and for other manufacturers. Both Plastics and Resins plants manufacture High Density Polyethylene (HDPE), which is used in a wide range of markets including packaging, telecommunications and pipes for water conservation, irrigation, mining and energy.

Qenos Sydney

The Qenos Botany site covers 37 hectares in a major chemical and plastics manufacturing area located next to Botany Bay shipping terminal. The three major facilities at Botany – Olefines, Alkathene and Alkatuff – produce ethylene, low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE). The polyethylene produced is used across a range of industries and applications including consumer and industrial packaging, water conservation, waste management and agriculture.

Minmetals to buy copper miner Anvil for $1.3b

Minmetals Resources Ltd(中国国有資源大手の中国五鉱集団の五鉱能源)

has agreed to buy Africa-focused copper miner

Anvil Mining for $1.28

billion as the China government-controlled firm expands its global reach

and adds base metal reserves.

Minmetals' latest acquisition comes nearly five months after it

bowed out of a bidding war to buy Canadian copper miner Equinox Minerals

and underscores China's growing appetite to secure supplies of natural resources

to support the urbanization of its vast population.

Minmetals is offering C$8 a share, or a 39 percent premium, to Anvil's close on

Sept 29 in Toronto stock exchange. Anvil's depositary shares traded in Australia

surged 32 percent to A$7.67 on Sept 30.

"It has been very clear that Minmetals has a mandate to make mining investment

outside China," Andrew Driscoll, head of resource research at CLSA Ltd said.

Anvil said last month it had begun to review its strategic alternatives

including a sale, sending its shares higher.

September 29, 2011 Anvil

Anvil Mining Limited is pleased to announce that it has entered into a binding agreement with Minmetals Resources Limited pursuant to which Minmetals has agreed, subject to the terms of the Support Agreement, to make an offer to purchase all common shares of Anvil by way of a friendly take-over bid at a price of C$8.00 per share in cash.

Pursuant to Anvil’s previously announced strategic review process, Anvil received proposals from a number of potential parties expressing an interest in acquiring Anvil. After reviewing such proposals and consulting with its financial and legal advisors, Anvil’s Board of Directors has concluded that the Offer is in the best interest of shareholders, and the Board of Directors has unanimously determined to recommend to shareholders that they accept the Offer.

ーーー

Anvil

Miningはオーストラリアに本社を置く銅生産企業。アフリカのコンゴ民主共和国を中心に事業展開しており、同国における主要銅生産企業の1社。オーストラリアの主要証券取引所であるASX(オーストラリア証券取引所)及びカナダのTSX(トロント証券取引所)に上場している。

生産拠点はコンゴ民主共和国南東部に位置するカタンガ州であり、2002年より銅生産を行っている。主力はKinsevere銅鉱山。また同国の国営資源企業であるGécaminesとJV展開も行っている。ザンビアとコンゴ民主共和国の国境付近で探鉱プロジェクトの権益を所有しているが(Kapulo銅プロジェクト)、オーストラリアの同業Mawson

Westに権益65%を譲渡している(ファームアウト)。

Anvil Miningの年間銅生産量は約4万トン。

Dikulushi鉱山はコンゴ民主共和国南東部に位置するカタンガ州にある銅・銀鉱山。東部に隣接するザンビアとの国境近くであり、ムウェル湖近隣にある。

オーストラリアの資源企業Anvil Miningが所有。同社が最初に銅生産を開始した鉱山。

Dikulushi鉱山からは年間20000トン強の銅及び200万オンス強の銀を生産していたが、資源価格の急落、そしてキャッシュコストの急増により2008年末に操業を中断している世界金融危機と銅価格の下落により Dikulushi は2008年12月に待機状態に置かれ、Mutoshi HMSプラントは2008年11月に生産を停止した。Anvil社はMutoshiの探査に深い関心を持っており、Mutoshi ステージ2での溶媒抽出-電解採取 (SX-EX) プラント開発の妥当性を証明するため、掘削プログラムを2008年中に完了させた。

Anvil Mining operates in the Democratic Republic of Congo (DRC) in Central Africa. The Company has significant mine development and operating experience in the DRC. In 2010, the Company produced 16,538 tonnes of copper in concentrate form from its Kinsevere Stage I HMS(Heavy Media Separation 重液分離) plant. The Company expects to produce 36,000 to 38,000 tonnes of copper (as copper cathodes and copper in concentrates) for the full-year 2011.

The major focus of the Company is to complete the development and the construction of Kinsevere Stage II, a 60,000tpa of LME-grade copper cathode 銅陰極 project, in which Anvil Mining has a 95% indirect interest.

Anvil 95% - Mining Company Katanga (MCK) 5%

SINOPEC Pushes Forward S-MTO Projects

On Oct.10 2011, Sinopec Zhongyuan Petrochemical Company中原石化

started up its first S-MTO (standing for SINOPEC methanol-to-olefins

process) project in Puyang, Henan Province河南省濮陽市,

and produced on-spec ethylene and propylene products.

Zhongyuan Petrochemical invested RMB 1.5 billion in the project, which

including 600 kt/a methanol to 200kt/a olefin unit, a new 100kt/a

polypropylene (PP) unit and capacity expansion of an existing polyethylene

(PE) unit up to 260kt/a. Construction of the project was started in August

2010, PP unit and MTO unit reached mechanical completion in July and August

2011 respectively.

現状はエチレン180千トン、PE 200千トン(120千トン+80千トン)、PP 60千トン

The so called S-MTO process, employed by

the project was jointly developed by SINOPEC Shanghai Research Institute of

Petrochemical Technology (SRIPT), SINOPEC Engineering Incorporation (SEI)

and Beijing Yanshan Petrochemical Corp. A 100t/d MTO pilot unit was built in

2007 by Yanshan 燕山石化

and a 1.8Mt (methanol feed basis)/a S-MTO

process package was developed in 2008.

Methanol feedstock of this project is outsourced from local producer.

Zhongyuan Petrochemical and Henan Coal & Chemical Industry Group (HCCIG河南煤業化工集団)

Zhongyuan Dahua Chemical

According to the data from ASIACHEM Consulting, SINOPEC is currently push

forward three commercialized coal-to-olefin (CTO) projects, located in Hebi of Henan河南省鹤壁

市,

Huainan of Anhui安徽省淮南市 and

Bijie of Guizhou貴州省畢節市 respectively.

On Sep. 28, 2011, Sinopec started construction for its 600 Kt/a coal based polyolefin project in Zhijin County, Bijie, Guizhou Province. With investment of CNY 18 billion, first-phase 600 Kt/a coal based polyolefin project (300 kt/a PE and 300 kt/a PP) is predicted to complete construction and start up by 2014. In Oct. 2010, Sinopec and Guizhou Provincial Government signed a strategic cooperation agreement. Based on the agreement, Sinopec plans to invest CNY81.5bn in Guizhou to develop modern coal chemical industry, and explore oil & gas resources, and build refined oil pipelines and distribution network, as well as speed up the construction of a “coal-power-chemical integration project in the New Energy-Chemical Site of Bijie-Zhijin Cyclic Economy 循環経済New District. The CTO project is the first phase of this integration project. 畢節市織金県

This integration project includes the coal mine, power plant and coal chemical, total investment is RMB 61 billion. The first phase coal chemical project costs 18 billion, polyolefins capacity is 600 kt/a.

---

Another coal-based MTO project of 600kt/a olefin capacity will be developed and constructed by Anhui Zhong’an Combined Coal & Chemical Industry Company安徽中安聯合煤化工公司, a 50:50 JV between SINOPEC and Wanbei (North Anhui) Coal Power Group皖北煤電集団. Inauguration ceremony for the project was held in December 2010 and the start-up is scheduled by the end of 2013.

---

Also, a 1.8Mt(methanol

feed basis)/a coal-based MTO project is planned to be jointly invested by

SINOPEC and HCCIG(Henan Coal & Chemical Industry Group) in Baoshan Park of Hebi

City, Henan Province. The project will obtain methanol by purchasing a

600kt/a methanol unit currently under construction in the park and building

a new 1.2Mt/a mega size methanol plant. The data of startup is not disclosed

yet.