トップページ

Gas Authority of India Ltd (GAIL)

概要

事業

Source: http://www.indiainfoline.com/comp/gail/gail.html

to boost PE capacity by 50 kt/yr by Mar

2003

GAIL

board okays 10 % stake in Haldia Petro

Gail Board Approves Marketing Alliance

With Haldia Petrochemicals

GAIL India forges alliance with Haldia

Petrochemicals

三井化学、インドのGAIL社向け「高密度ポリエチレン製造技術ライセンス」が発効

インドのGail、陝西省で石炭ーメタノールー石油化学 計画

India's Gail to increase ethylene

capacity to 450 kt/yr by Dec

GAIL to implement Rs. 5460 crore

Assam Gas Cracker Project 計画概要

INEOS wins

LL/HDPE Technology Licence contract in India

GAIL of India plans $2.3 billion petrochem plant in

Iran

2007/12 GAIL - RIL Sign MoU To Set Up

Petrochemical Plants globally

GAIL India plans petrochem project

in Colombia

概要

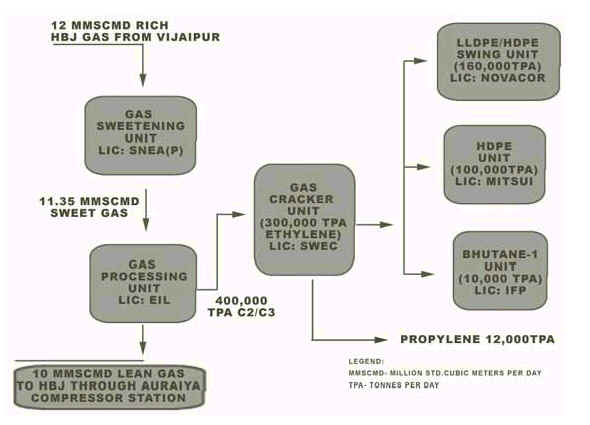

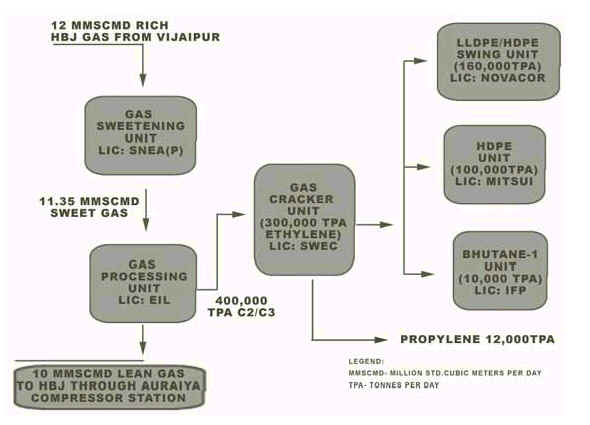

Gas Authority of India Ltd

(GAIL), is primarily engaged in transportation and wholesale

distribution of natural gas.

The company has also diversified into other integrated energy

and petrochemical activities.

事業

Petrochemicals is a major

area of GAIL's business activity. GAIL has set up a

world-scale Gas Cracker plant at Pata in Uttar Pradesh in

Northern India at an investment of Rs. 25 billion having a

design capacity to produce 300,000 TPA of ethylene (Expandable to

500,000 TPA). The Plant

was commissioned in March 1999. Downstream units include an HDPE production unit

of 100,000 TPA capacity

and an LLDPE/

HDPE Swing plant of 160,000 TPA capacity.

(Platts--17Apr2002)

India GAIL to boost PE capacity

by 50 kt/yr by Mar 2003

The Gas Authority of India

plans to boost the capacity of its polyethylene complex in

Auraiya by

about 50,000 mt/yr by

March 2003, a company source said Wednesday.

Financial Daily (India)

2002/7/24

GAIL board okays 10 pc stake in

Haldia Petro

THE board of Gas Authority of

India Ltd (GAIL) today approved a proposal to take a 10 per cent

equity stake in Haldia Petrochemicals Ltd. The approval is contingent on the

financial restructuring taking place. The investment will be

of the order of around Rs 200 crore.

GAIL's entry into HPL follows the breakdown of talks with

Indian Oil Corporation, which was set to acquire a 26 per

cent stake in the company.

Financial Times December 3, 2002

Gail Board Approves Marketing Alliance With Haldia Petrochemicals

(GAIL and HPL to enter into 4 commercial agreements for selling

their petrochemi

The board of directors of the

Gas Authority of India Ltd (GAIL) has approved a strategic

marketing alliance with Haldia Petrochemicals Ltd (HPL),

under which the 2 companies will enter into 4 commercial

agreements for selling their petrochemical products. GAIL and

HPL will enter into 3 separate long-term offtake agreements

for polypropylene, propylene and pentane.

2003/1/8 Asia Pulse

Businesswire via NewsEdge Corporation

GAIL INDIA FORGES ALLIANCE WITH HALDIA PETROCHEMICALS

State-owned gas firm GAIL

India (GAIL) Ltd said it has entered into a strategic

alliance with Kolkata-based Haldia Petrochemical Ltd for

marketing of petrochemical products.

Platts 2006/2/21

India's Gail to increase

ethylene capacity to 450 kt/yr by Dec

Gail (India) Ltd is to increase its ethylene manufacturing

capacity at the Pata plant in Uttar Pradesh to 450,000 mt/yr from the current 310,000 mt/yr by

December, investing around Rupee 7-bil, Gail chairman and

managing director Proshanto Banerjee said on the sidelines of an

industry conference Monday.

The state-run petrochemical company is augmenting its ethylene

capacity by increasing the number of cracker furnaces from four

to five, and is also setting up an additional

LLDPE/HDPE (Swing Plant) of 100,000 my/yr at the same petrochemical complex

to utilize the additional ethylene production.

(三井化学発表では既存エチレン300千トン、LL/HD 160千トン)

2005/1/25 三井化学

インド GAIL社向け高密度ポリエチレン製造技術ライセンスについて

http://release.nikkei.co.jp/detail.cfm?relID=91545&lindID=4

<技術ライセンスの概要>

1.ライセンス対象技術:当社保有の高密度ポリエチレン(*)製造技術

*:包装材料、パイプ及び日用雑貨等の素材として利用される樹脂

2.対象プラント:GAIL社高密度ポリエチレン製造No.2プラント(生産能力:10万トン/年)

3.プラント建設地:インド国 ウッタル・プラデシュ州 パタ

4.プラント完工:2006年中(予定)

<GAILの会社概要>

1.事業内容:ガス及び石化製品の製造販売

2.本社所在地:インド ニューデリー市

3.資本金:85億ルピー(約204億円)

4.売上(2003年度):1,200億ルピー(約2,880億円)

5.従業員数:約3,500名

6.石化工場立地:ウッタル・プラデシュ州 パタ

7.主要石化プラントの現有生産能力

ガスセパレーション 40万トン/年 エチレン 30万トン/年

HDPE(当社技術) 10万トン/年 HDPE/LLDPE 16万トン/年

2006/5/24 Gail 計画概要

GAIL

to implement Rs. 5460 crore Assam Gas Cracker Project

http://gail.nic.in/pressreleases/press050000167.htm

With the recent

approval of the Cabinet Committee on Economic Affairs (CCEA),

GAIL (India) Limited led Joint Venture Company (JVC) will

implement the Rs. 5460.61 crore Assam

Gas Cracker Project. The project to set-up an

integrated Petrochemical Complex at Lepetkata, District Dibrugarh

shall be implemented by a Joint Venture Company (JVC) to be

promoted by GAIL with 70% equity

participation. The remaining 30% equity will be shared equally

among OIL(Oil India Ltd), NRL(Numaligarh Refinery Ltd ) and Govt.

of Assam.

The project will be completed in 60 months from the date of

approval.

The

petrochemical complex will comprise of a cracker unit, downstream

polymer and integrated off-site/utilities plants. The complex has

been configured with a capacity of 220,000

tons per annum (TPA) of Ethylene and 60,000 tons per annum of

propylene with

Natural Gas and Naphtha as feed stock. The site has been

identified by the Govt. of Assam and necessary Environmental

clearance has been obtained.

The

existing LPG plant of GAIL at Lakwa will be modified to process

gas for recovery of ethane and higher hydrocarbon fraction which

will be transported to Lepetkata through a pipeline.

The

Products from the Petrochemical Complex shall be 220,000

Tons per annum (TPA) of HDPE/LLDPE, 60000 TPA of Polypropylene,

55000 TPA of Raw Pyrolysis Gasoline and 12,500 TPA of Fuel oil.

アッサム州はインド北東部に位置し、ブータンおよびバングラデシュと国境を接している。

アッサム州は天然自然に恵まれており、1901年にはインド初の石油精製所が州内ディグボイに設置された。ディグボイ精油所は、現在操業している石油精製所としては世界最古の部類に入る。

INEOS wins LL/HDPE Technology

Licence contract in India

220,000 tonnes LLDPE/ HDPE

The Assam Gas Cracker

Project has been approved by Cabinet Committee on Economic

Affairs in its meeting held on 18th April, 2006 under an

equity arrangement of GAIL (70%), OIL (10%), NRL (10%) and

Govt. of Assam (10%) with a project cost of Rs. 5460.61

crores in which capital subsidy is Rs.2138 Crores.

A Joint Venture agreement has been signed on 18.10.2006 and

the company 'Brahmaputra Cracker and

Polymer Limited'

was registered on 08.01.2007.

October 3, 2007 business-standard.com

GAIL plans $2.3 billion

petrochem plant in Iran

| At a time when

political and business relations between India and Iran

are under pressure, government-owned GAIL

India,

the country's largest transporter and marketer of gas,

plans to set up a mega $2.3

billion petrochemical plant in Iran. |

| |

| The Rs

16,047-crore company has appointed public sector

consultancy, Engineers India Ltd, to conduct feasibility

studies for the plant with a capacity of 3 million tonnes

a year that is likely to be set up near the gigantic South Pars

gas field in Iran. |

| |

| The largest

petrochemical plant to be set up by GAIL, the project

would have Reliance Industries Ltd

(RIL) and an Iranian government-owned company as

partners,

a senior GAIL official said. |

2008/10/31 GAIL

GAIL, IOCL ink MoU for cooperation in Petrochemicals

GAIL (India) Limited and Indian Oil Corporation Limited (IOCL)

today signed a Memorandum of Understanding (MoU) for cooperation

in the area of Petrochemicals to collaborate for exploring the

possibility of setting up of cracker complex

including downstream derivatives at Barauni.

GAIL shall assess the

prospect of natural gas availability from the

KG basin field

including the potentiality of the rich gas to be used as part of

the feedstock for the Project and work out the modality for

distribution of the same from KG basin field to the Project site.

GAIL will subsequently develop appropriate definitive agreement

for supply of the gas to the joint venture, once formed.

IndianOil shall assess the prospect of availability of off-gas and

naphtha not

only from Barauni refinery but also from other operating

refineries of IndianOil, to be used as predominant feedstock for

the said Project and work out the modality for positioning of the

same to the Project location. IndianOil will subsequently develop

appropriate definitive agreement(s) for supply of the feedstocks

to the joint venture, once formed

business-standard.com

The proposed chemical

plant will use 250,000 tonne of naphtha produced by IOC's

Barauni refinery and the natural gas that GAIL plans to bring

from eastern offshore and imported LNG through the planned

Jagdishpur-Haldia pipeline.

Project

structure and equity participation has not yet been decided.

"It could be a 50:50 joint venture between Gail and

IOC... it may also be a public-private partnership,"

Choubey said indicating that the alliance had room to induct

a strategic partner.

A 130-km

spur line from Gaya to Barauni would be laid to transport gas

to Barauni fertiliser plant, IOC's refinery and the proposed

petrochemical unit. Gail's Jagdishpur-Haldia pipeline would

transport gas found in eastern offshore.