HISTORY

OF PETROCHEMICAL INDUSTRY IN INDIA:

http://www.petrochemnext.com/webapp/portal/ForumsHome

The production

of petrochemicals in India began in the late fifties with the

setting up of small plants using non-petroleum feedstock.

Polychem Ltd. commissioned the first Polystyrene plant in 1958

which used coal based benzene. Union Carbide commissioned the

first LDPE plant in 1965 at Bombay, where production was based on

alcohol.

In the late

sixties, NOCIL commissioned a naptha based cracker with a

capacity of 60,000 tonnes per annum of ethylene. NOCIL began manufacturing ethylene

oxide (EO), ethylene glycol (EG), PVC and supplied ethylene to

PIL for manufacture of HDPE.

In 1973, Indian

Petrochemicals Corporation Ltd (IPCL), a company owned by the

Government of India, commissioned a naphtha-based aromatics plant

at Baroda, Gujarat to manufacture paraxylene, metaxylene and

dimethyl terepthalate (DMT).

In 1978-79, IPCL

commissioned a naptha cracker with a capacity of 130,000 tonnes

per annum of ethylene at Baroda to manufacture PP, LDPE, PBR,

linear alkyl benzene (LAB), SAN and acrylic fibre.

In 1978, ABS

Industries commissioned the first ABS plant in India. This plant

was subsequently taken over by Bayer Industries in 1997 and the

name was changed to Bayer ABS Ltd.

IPCL set up a

natural gas based ethylene cracker with a capacity of

300,000 tonnes per annum at Nagothane, Maharashtra in 1989-90.

Downstream capacities for manufacturing HDPE/LLDPE (swing plant),

PP, LDPE, MEG and PVC were also set up at this complex.

In 1992-93, Reliance

Industries Ltd (RIL) commissioned a 160,000 tonnes per annum

HDPE/LLDPE swing plant at Hazira, Gujarat.

In

1995, Supreme Petrochem Ltd. (SPL) commissioned a 66,000 tonnes

per annum HIPS/GPPS plant at Nagothane, Maharashtra. With

subsequent capacity expansions, the current capacity is 188,000

tonnes per annum.

In

1996-97, RIL commissioned a naphtha cracker at Hazira, with

capacity of 750,000 tonnes per annum of ethylene. RIL also

expanded the swing plant capacity to 400,000 tonnes per annum and

set up PP facility of 360,000 tonnes per annum.

In

1996-97, IPCL set up a 150,000 tonnes per annum PVC plant and a

chloralkali unit at Gandhar, Gujarat.

In

1999, IPCL set up a 160,000 tonnes per annum HDPE plant and a MEG

unit at Gandhar.

In

1999, RIL commissioned India's largest grassroots refinery at

Jamnagar, Gujarat and set up PP plants with total capacity of

600,000 tonnes per annum.

The

Gas Authority of India Ltd (GAIL), another public sector company,

commissioned a 300,000 tonnes per annum gas-based ethylene

cracker at Auraiya, Uttar Pradesh in 1999. GAIL also set up

downstream units of HDPE (100,000 tonnes per annum) and a swing

plant of HDPE/LLDPE (160,000 tonnes per annum).

In

February 2000, IPCL commissioned a gas-based ethylene cracker

with a capacity of 300,000 tonnes per annum at Gandhar, Gujarat.

In

May 2000, Haldia Petrochemicals Ltd (HPL) commissioned a 420,000

tonnes per annum naphtha cracker at Haldia, West Bengal. HPL also

set up downstream units of PP (210,000 tonnes per

annum), HDPE (200,000 tonnes per annum) and a HDPE/LLDPE swing

plant (225,000 tonnes per annum).

PVC

CHEMPLAST SANMAR

LIMITED PVC Division 15万トン増設計画

EDC自社生産検討

http://www.sanmargroup.com/chlpvcpro.htm

Commenced operations in May

1967 at Mettur, near Salem in Tamil Nadu with technology from

B.F. Goodrich, USA

Varied range of high

quality PVC Resin products with a wide range of end use

applications

Capacity: 60,000 MT

per annum

Manufacturer of 3

grades of Suspension Resins, 3 grades of Paste (Dispersion)

Resins, 2 grades of Copolymer Suspension Resins plus a

speciality Battery Separator Resin

The only manufacturer

of Battery Separator grade Resins (made with technical

know-how from ICI, UK) and Copolymer Suspension Resins in

India

The PVC business of

Chemplast Sanmar is integrated backwards i.e., it gets its

feedstock, industrial alcohol, from its alcohol plants at

Panruti, near Neyveli and from Krishnagiri, near Dharmapuri

and chlorine from its neighbouring chlor-alkali facility

It has the necessary

port-based infrastructure to import feedstock like ethylene

dichloride (EDC)

It has also recently

commissioned the Oxy Chlorination plant to increase

production of captive feedstock - EDC and projects to augment

Ethylene and Paste resin capacity are underway

It has a captive

power generation capacity of 10 MW in the PVC plant, meeting

100% of its requirements. The chlor-alkali plant also has 30

MW additional power generating capacity, with the option to

augment this capacity through wind mills

化学工業日報 2002/9/5

インドでPVC年産15万トン新設、ケムプラスト・サンマー 資金調達にメド

インドで大型の塩化ビニル樹脂(PVC)プラントの新設プロジェクトが前進してきた。年産15万トン規模のプロジェクトを検討しているケムプラスト・サンマーは、ドイツの投資家などから資金調達のめどを得ており、建設を予定しているタミール・ナドゥ州の環境関係当局の承認を経て具体化に向かう見通しだ。ケムプラスト・サンマーが現有するPVCの年産能力は6万トン。インドでは年率10%以上でPVCの需要が伸びており、同社では市場の高成長に対応して新設計画を検討してきた。

ケムプラスト・サンマーの計画では、インド最南部のタミール・ナドゥ州のカッダロールに建設する。年産能力は15万トン規模で、投資額は50億ルピーを予定している。

この計画については、ドイツのDEGなどからの資金調達のめどを得ている模様だ。ケムプラスト・サンマーはタミール・ナドゥ州の環境関係当局から承認を得るための各種の申請も済ませた。承認を得てプロジェクトは前進することになろう。

インドにおけるPVCの需要は79万トンとされる。インドの化学工業協会によれば、同国のPVC市場は今後数年で100万トンを超える見通しだ。需要の増大に対応してリライアンス・インダストリーズも15万トンの設備の新設を計画していると伝えられている。

ケムプラスト・サンマーは現在、6万トンのPVC工場を稼働している。原料のEDC(二塩化エチレン)は輸入に依存している。新設計画の15万トン規模の設備についてもEDCは外部調達に依存するものとみられ、今後のEDC需給動向に影響を与える要因になることも予想される。

2002/9/26 化学工業日報

印ケムプラスト・サンマー

EDC自社生産検討、塩ビの大型新設備向けに

塩化ビニル樹脂(PVC)の大型プラント建設計画を進めているインドのケムプラスト・サンマーは、原料である二塩化エチレン(EDC)の生産を検討し始めた模様だ。同社は現在、輸入したEDCを使って6万トンのPVC工場を稼働しており、新たに建設する15万トン規模の新設備についても外部調達に依存するものとみられていた。

EDCは中期的に不足が懸念されており、ケムプラスト・サンマーはこうした動向に対応するため自社生産の検討に入ったもの推定される。

ケムプラスト・サンマーの計画ではインド最南部のタミール・ナドゥ州のカッダロールに50億ルビーを投じてPVC工場を建設する。建設資金の調達のめども得ていると伝えられている。同社はタミールナドゥ州の環境関係当局承認のための各種申請手続きもすませた。

インドにおけるPVCの需要は79万トンとされる。今後数年で100万トンを上回る見通しで、ケムプラスト・サンマーは需要の増大に対応して新規プロジェクトの具体化に乗り出している。PVCプラントを新設するうえで原料のEDCの確保が最重要課題になっている。ケムプラスト・サンマーは現有の6万トンの設備向けには原料を輸入しており、新プラントについても外部調達に依存するものとみられていた。しかし長期的にみてEDCの不足が予想されることから、安定して原料を確保することが重要になる。ケムプラスト・サンマーがEDCの自社生産を検討するのも、こうした原料事情が背景にあると判断できよう。

DCM Shriram Consolidated

Ltd (DSCL)

is a Rupees 9.75

billion, public listed company,based in North India with a

core sector business

portfolio comprising fertilisers, chlor alkali, chemicals,

plastics, cement, textiles and sugar

PVC:

Commissioned: 1964 at Kota (Rajasthan)

PVC Resin Production: 34,000 MT/annum

Collaboration/Technology: Shin-Etsu Chemical Co. Ltd., Japan,

Kaneka, Japan

PVC Compounds

Production/ Capacity: Up to 12,000 MT/annum customised

production

Collaboration/Technology: Zeon Kasei Co. Ltd., Japan

DCW Limited

manufactures and

markets various home products including the production and

distribution of PVC resins, soda ash, caustic soda and the

extraction and distribution of refined iodised salt under the

brandname of `Captain Cook'. The company has its operating

division in Gujarat and Tamilnadu.

PS http://www.plastemart.com/plasticnew/interviews/polystyrene.asp

Supreme

Petrochem, the largest supplier

increased its capacity from 104 kt to 204 kt in 2000. BASF, one of

the global key players has acquired a

new 60kt plant at Dahej, Gujarat and thus has

entered the Indian Market.

The third Polystyrene producer viz. L G Polymers also has

similar capacity.

There is therefore almost 100% excess capacity. This would

certainly help in developing markets in the next few years.

It must be realised that although the growth of Polystyrene

during the last decade has been good, its consumption is only

about 5% of the total plastics consumption in India compared

to about 10% globally. The major driver of Polystyrene i.e.

consumer non durable like Food service ware will be dependent

on increased urbanisation and two income member families that

would enhance the consumption of fast food products. Infact

almost 40% of the global Polystyrene consumption is for Food

Service Ware. While its share, in India, is barely 13-14%.

Biaxially Oriented Polystyrene Sheet (BOPS), one of the most

interesting products that finds extensive usage in packing of

bakery products is not yet manufactured in India. There is a

significant scope for developing markets for Polystyrene. An

intensive application development effort by raw material

producers in collaboration with processors would be the key

factor that will play a major role in enhancing the market

size of Polystyrene.

化学工業日報 2002/10/21

BASF、インドでポリスチを増強

BASFはインドにおけるポリスチレン(PS)の年産能力を9万トンに増強した。インド国内の需要家のニーズに対応するのが狙いで、同社では輸入品を代替して市場におけるポジションを強固にできるとしている。

http://www.greaveslimited.com/

Greaves

Limited, is one of India's leading engineering companies.

It

manufactures a wide range of industrial products including

diesel engines, generating sets and gearboxes to meet the

requirement of core sectors. The company's core competencies

are in internal combustion engines, power transmission

systems and construction equipment. Greaves is the largest

manufacture of internal combustion engines in India. The

business operations of the Company are divided into Business

Groups strategically structured to ensure maximum focus on

each business area and yet retain a unique synergy in the

operations.

Greaves

supplies Acrylonitrile Butadiene

Styrene (ABS) and High Impact Polystyrene (HIPS) manufactured

at its state-of-the-art plant. Used extensively in the

manufacture of products which demand the use of high tensile,

high flexural and good impact resistant polymer, ABS has

excellent thermal resistance, good dimensional stability and

self-colourability. HIPS is a polymer that has excellent

processability and is extensively used by many industries.

Both polymers are available in a wide range of

grades-offering specific solutions to various customer

requirements.

Greaves

RPRL unit with its state-of-the-art plant for the manufacture

of Acrylonitrile Butadience Styrene (ABS), General Purpose

Poly styrene (GPPS), High Impact Polystyrene (HIPS) and

Styrene Acrylonitrile (SAN). The plant has a capacity to

produce 20,000 TPA of styrenic polymers and is located at Abu

Road, Rajsthan

Bayer ABS Ltd

In India, Bayer sees

particularly good opportunities in high-performance

engineering plastics, which are used widely in the automotive

and electronics industries. Complementing a Bayer project in

Thailand, Bayer Industries Ltd. took over 51 percent of

the shares of the Indian plastics manufacturer ABS Industries

Ltd. in

February 1997. The company has since been renamed Bayer ABS

Ltd. and is presently expanding the production capacity for

the plastics ABS and SAN at its plant in Baroda to about

50,000 tons per annum.

化学工業日報 2003/2/20

タターヒンダスタン合併、インドで総合肥料メーカー誕生へ

インドのタタ・ケミカルズとヒンダスタン・リバー・ケミカルズが合併することで合意した。新会社は肥料の総合メーカーに躍進する一方、ソーダ灰と誘導品のトリポリリン酸ソーダ(STPP)の統合効果も高い。これによって無機化学の大手がインドに誕生する。

2003/2/19 Financial Times

Merger between Hind Lever and Tata Chemicals in India.

Indian companies Tata Chemicals and Hind

Lever Chemicals (Unilever's 50% subsidiary) are about to merge

through a share exchange. Shareholders in Hind Lever will

receive 5 shares in Tata for every 2 shares they hold. The

merger should make Tata Chemicals one of the leading

fertilizers companies in India.

2003/5/14 Platts

New PET resin plant opens in India's

West Bengal state

India's South Asian Petrochem Ltd

Wednesday commissioned its 140,000 mt/yr bottle-grade polyethylene

terephthalate resin plant in

eastern West Bengal state. The bulk of the products from the

plant, reportedly the largest PET resin plant in southeast Asia,

would be exported, said a company spokesman.

The resin plant has its own power

plant to generate power for its own use. German-based Zimmer Ag

provided the technology for the plant, which is located in the

port town of Haldia. The PET resin plant is located close to Mitsubishi Chemical Corp's

350,000 mt/yr purified terephthalic acid plant.

The company would source the PTA--the primary chemical compound

used in the manufacture of PET bottles and films--from the

Japanese subsidiary, the source said. India's food and beverage

industry has stepped up the use of PET as their packaging

material.

Platts 2004/8/27

India's Chennai Petroleum to build 165,000+ mt/yr PP plant

India's refining major Chennai Petroleum Corp (CPC) is planning to set up a

polypropylene plant at its 950,000-mt/year petroleum refinery

complex in the southern Tamil Nadu state city of Chennai. The

plant capacity is a planned 165,000 mt/yr although company

chairman, M Ramachandran told Platts it was mulling building the

plant with larger capacity. "We will press ahead with the

project once a decision on the capacity is decided,"

Ramachandran added, at the sidelines of an industry function,

Friday.

Indian Oil Corp

owns the majority stake in CPC,

whose polypropylene project is in line with IOC's strategy to

foray into petrochemicals. In mid-August, IOC commissioned a

120,000-mt/yr linear alkyl benzene plant at its 13.70-mil mt/year

Koyali petroleum refinery in western Gujarat. IOC is also

building a 350,000-mt/year paraxylene and 553,000- mt/year

purified terephthalic acid production plants at Paniat in

northwestern Haryana state. The company has also decided to set

up an 800,000-mt/yr naphtha cracker facility in northwestern

Haryana state.

Platts 2005/8/31

Indian petchems importers

get tax break under Singapore-India FTA

Indian

petrochemical importers have been enjoying lower import taxes on

products from Singapore since Aug 1 following the signing of the

India-Singapore Comprehensive Economic Cooperation Agreement

(CECA) on Jun 29, industry sources said this week.

Under the CECA, an

estimated 75% of Singapore's domestic exports to India will have

tariffs eliminated or reduced over the next five years. Among the

sectors benefiting from the agreement include petrochemicals, electrical and electronics, and

pharmaceuticals, according to Singapore's Ministry of Trade and

Industry. The agreement stipulates that import taxes on Singapore

goods would either be immediately eliminated,

eliminated in phases, reduced in phases or excluded from any tax

concession.

Goods in the

immediate elimination category will have tariffs on them

completely eliminated from Aug 1, 2005. Notable petrochemical

products under this category include styrene and

butanol.

Goods under the

phased elimination category will see import tariffs cut by 10%

from now until Mar 31, 2006. In the second year, between Apr 1,

2006 and Mar 31, 2007, the tariff reduction will be increased by

15% to 25%. In the third year, import taxes would be halved; in

the fourth year, cut by 75% and in the fifth year ending Mar 31

2010, taxes would be completely eliminated. Petrochemicals which

fall under this category include dioctyl phthalate (DOP), dibutyl

phthalate (DBP), phthalic acid and phthalate plasticizers.

Goods under the

phased reduction category will see their tariffs cut by 50% over

the five years. In the first year until Mar 31, 2006, taxes would

be cut by 5%. In the second year, the cut would be increased to

10%, in the third year, up to 20%, in the fourth year a 35% cut

and in the fifth year ending Mar 31 2010, taxes would be halved.

Petrochemicals under this category include toluene, mixed

xylenes, ethylbenzene, cumene, ethylene glycol (ethanediol),

butanediol, acrylonitrile and isobutyl acetate.

Products totally

excluded from tax concession include acetic acid, 2-ethyl hexanol

and vinyl acetate, amongst others.

In the case of

toluene, Indian importers who were previously paying 5% import

duty on Singapore cargoes need only pay 4.75% this year.

"Although a 5% cut (in import taxes) in the first year is

small (worth $2-3/mt), it is a good start," said an

Indian-based importer who buys cargoes from Exxon Mobil. "I

will try to divert more of my imports to [sourcing from]

Singapore if possible," he noted.

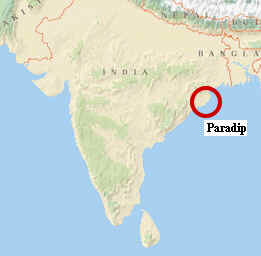

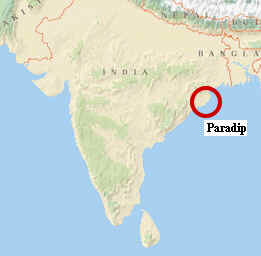

2005/9/19 Platts

India's IOC to detail

Paradip refinery, petchem project by Nov

State-run Indian Oil Corp (IOC) will submit a detailed

feasibility report for a 15-mil mt/yr petrochemical and

refinery project in Paradip by November 2005, a company source

said Monday. The study will be submitted to its board, and

approval of the project is expected be finalized in two months.

IOC has targeted a start-up date of 2010 for the plant, located

in the eastern state of Orissa.

Petrochemical production at the site will include paraxylene,

polypropylene and ethyl benzene, which will be entirely diverted

for styrene production. Actual production capacities have yet to

be finalized as the project is still in a preliminary planning

stage, the source said. In the second stage of the Paradip

project, IOC is planning to add a 1-mil mt/yr

naphtha cracker and downstream production which will include high-density

polyethylene, linear low density PE, incremental polypropylene as

well as monoethylene glycol.

Shell is said to be involved in the optimization of the

associated refinery's configuration. The refinery will have a

15-mil mt/yr crude distillation unit, a vacuum gasoil

hydrotreater, a coker and a fluid catalytic cracking unit. Works

are already in the pipeline to double the Panipat refinery from

6- to 12-mil mt/yr capacity by December 2005.

IOC is also looking at expanding its 6-mil mt/yr Haldia refinery capacity to 7.5-mil mt/yr. IOC's

total refining capacity will thus be boosted by 56% to 65-mil

mt/yr, from a current 41.5-mil mt/yr. IOC is India's largest

refiner and oil products retailer. Apart from seven refineries,

IOC has a majority stake in three other refineries.

Platts 2006/1/16

Chemplast approves

$100-mil 170 kt/yr PVC plant in south India

India's Chemplast Sanmar Ltd is to invest Rs4500-mil (US$100-mil)

in setting up a 170,000 mt/yr green field polyvinyl chloride

(PVC) plant at Cuddalore in Tamil Nadu, south India, the company

said. "The Board (Directors of the company) approved the

proposal to set up a green field 170,000 mt/yr PVC project at

Cuddalore at an investment of Rs 4500-mil,' Chemplast Sanmar told

the Bombay Stock Exchange in a statement issued Monday.

Chemplast had already received environmental clearance from the

federal government for setting up the new PVC Plant at Cuddalore.

The company initially planned to add 140,000 mt/yr capacity to

the the existing plant at Mettur, near Salem in Tamil Nadu, but

the Tamil Nadu provincial government opposed the setting up of

the plant on environmental concerns.

Chemplast Sanmar currently has a capacity of around 60,000 mt/yr PVC

resin at its

Mettur plant, using B F Goodrich technology from the US. It

manufactures a variety of high quality PVC resin products,

including battery separator resins, two grades of copolymer

resins, five grades of suspension resins and three grades of

paste (dispersion) resins.

The basic feedstock for its PVC plant, ethylene and chlorine,

come from its industrial alcohol plant at Panruti and its own

chloralkali facilities at Mettur and Karaikal, located in central

Tamil Nadu.

2006/2/16 betapharm

3i sells

betapharm to India based Dr. Reddy's Labs

http://www.betapharm.com/index.php?id=266

3i,

Europe's leading private equity and venture capital company has

sold German

generic pharmaceutical company betapharm Arzneimittel GmbH to Indian Dr. Reddy's

Laboratories Ltd. The

transaction volume is Euro 480m. The sale also includes the not

for profit beta institute.

Founded

in 1993, betapharm is the fourth-largest generics company in

Germany with a market share of about 3.5%. betapharm markets

high-quality generic drugs focussing on long-term therapy

products with high prescription rates. betapharm is the fastest

growing generics company over the past five years in the top 10

in Germany(1) with a track record of successful product launches.

betapharm's current portfolio comprises circa 145 active

ingredients in the market. Located in Augsburg, Germany,

betapharm currently employs circa 370 people including a sales

force of about 250.

3i

invested in betapharm in March 2004. Since then 3i has been

active in helping the company develop its business activities,

particularly in product sourcing. 3i also introduced Thomas

Nedtwig as a Chief Financial Officer and managed the succession

of Dr. Wolfgang Niedermaier as CEO when Peter Walter retired.

Bernie

Schuler, a partner in 3i's European buyouts business based in

Frankfurt, has led this transaction and has been on the board

managing the investment, from completion to exit. Commenting on

today's sale, he said: "3i has worked closely with

management in the past two years to position the business for

international growth and expansion. Today's sale to Dr. Reddy's

is an exciting logical step for betapharm's next phase of

development. Dr. Reddy's broader product range and high quality

production base at competitive cost levels will enable the

business to grow exponentially."

The

buyer, Dr. Reddy's Laboratories Limited, established in 1984, is an

emerging global pharmaceutical company with proven research

capabilities. The company is vertically integrated with a

presence across the pharmaceutical value chain. It produces

generic finished dosage forms, active pharmaceutical ingredients

and biotechnology products and markets them globally, with a

focus on India, U.S.A, Europe and Russia. Dr. Reddy's employs

over 6,500 people globally with headquarters in Hyderabad, India.

Dr.

Wolfgang Niedermaier, CEO of betapharm comments: "Dr.

Reddy`s impressive pipeline of generic and innovative products

and its high quality standards combined with competitive

manufacturing costs will help further develop our position in the

German market and offer an entry platform for the European

market. Its extensive and well recognised corporate social

responsibility activities perfectly fit with our successful

corporate philosophy and business model. We see Dr. Reddy`s as

our partner of choice to build a successful joint future and

continue betapharm`s growth and success story."

Commenting

on the strategic acquisition, G V Prasad, Vice-Chairman and CEO,

Dr. Reddy's Laboratories, said: "We are very excited with

our strategic investment in betapharm. betapharm with its

differentiated business model has all the key elements for

achieving success in a fast growing generics market in Germany.

We strongly believe that this strategic investment will generate

substantial opportunities for long-term value creation for both

companies."

Bear,

Stearns International Limited, New York, and Sal.Oppenheim,

Frankfurt, acted as financial advisors to 3i on this transaction

and Clifford Chance, Frankfurt, acted as external legal counsel

for 3i. Rothschild, London, acted as financial advisors and

Freshfields Bruckhaus Deringer, Munich, acted as external legal

counsel to Dr. Reddy's in this transaction.

betapharm http://www.betapharm.com/

betapharm

Arzneimittel GmbH was founded in Augsburg in 1993. The

pharmaceuticals company distributes reliably high-quality

generics (unpatented medicines) at affordable prices. With

around 150 active pharmaceutical ingredients, our medicines

cover all major illnesses, from common cold to serious

cardiovascular diseases. Today the company

employs a workforce of more than 350 people and in 2005

achieved a turnover of Euro186 million (NDC Insight, NPI).

2006/5/30 日本経済新聞

エチレンプラント インド最大施設建設 東洋エンジ 総受注額750億円

東洋エンジニアリングはインド大手機械メーカーのL&Tと共同で、国営インド石油(IOC)から石油化学の基礎材料となるエチレンの大型プラントを受注した。同国最大となる年産80万トンの設備で、2009年に完成、受注額は750億円で、東洋エンジグループの取り分は全体の6割にあたる約450億円にのぼる。今回の受注を機に、プラント建設が旺盛なインドでの事業拡大を目指す。

インド北西部のハリアナ洲パニパットに建設する。東洋エンジなどは設計、資機材調達、建設、試運転までを一括して請け負った。隣接の製油所などから調達するナフサを原料にエチレンを製造する設備で、このエチレンは汎用合成樹脂のポリエチレンやポリプロピレンなどの原料となる。IOCが計画している初めてのエチレンプラントで、石油を化学製品まで付加価値を上げて国内調達率を上げようとしている。

平成18年5月30日

東洋エンジニアリング

インド向け大型エチレン設備を日印のエンジ企業連合にて受注

東洋エンジニアリング株式会社(TEC、取締役社長

山田

豊)は、インドのエンジニアリング業界大手のL&T社と共同で、インド国営石油会社(IOCL)が、同国北西部ハリアナ州・パニパットに新設する、年産80万トンのエチレン製造設備をこの度受注いたしました。本プロジェクトは、隣接する同社パニパット製油所他からのナフサを原料に、インド最大かつ北インド初の大型エチレン製造設備を建設するもので、主に国内での需要に対応するものです。米国ABBルーマス社の技術をベースに、TECとL&Tは設計から工事/試運転までのEPC業務を一括請負で実施し、プラントの完成は2009年第3四半期を予定しています。TECは本プロジェクトに参画する現地法人Toyo Indiaと協力し、今後投資が期待されるインドの石油化学分野でも、積極的にビジネス展開を図ります。

<受注概要>

■客先 インド国営石油会社(IOCL: Indian Oil

Corporation Limited)

<本社:ムンバイ>

〜インド最大の売上高(約1兆5千億ルピー:2004年度)の企業〜

■受注者 TECとL&T(Larsen and Toubro Limited:ラルセン社) <本社:ムンバイ>

■対象設備 年産80万トンエチレン製造設備(原料はナフサ・ベース)

■建設地

インド、ハリアナ州パニパット(デリーから北西へ約125Km)

〜同社のパニパット製油所(原油処理能力・年間600万トン)の隣接地〜

■適用技術 米国ABBルーマス社(ABB Lummus Global Inc.)技術

■役務内容

設計、機器資材の調達および工事、試運転助成までの一括請負

■プラントの完成予想 2009年第3四半期

■受注の意義

* 本設備はインド最大かつ北インド初のエチレン製造設備であると共に、IOCLが建設する初のエチレンプラント。新設される本石油化学コンビナートでは、このエチレンを原料に高密度ポリエチレン、ポリプロピレン、モノエチレングリコール等の基礎化学品が生産される。

* TECとL&Tが共同で受注した初の大型プラントで、プロジェクト実施にはTECグループ(Global Toyoと呼称)の中核企業である現地エンジ会社のToyo Indiaが参画。

* 本件はTECの38件目の新設エチレンプラント実績で、36件目のインドでのプラント実績。

* 現在TECとToyo Indiaは、インドで2件の大型エネルギー関連(LNG/NGL)プロジェクトを実施している。

http://www.iocl.com/petrochem.aspx

IndianOil has

finalised a US$ 5.7 billion master plan on petrochemicals,

predominantly utilising the streams available from its

various refineries. As part of its forward integration

strategy, IndianOil is co-locating petrochemical plants with

its existing and proposed refineries. World-scale

petrochemicals plants with state-of-the-art technology have

been identified and are under various stages of

implementation. In addition, IndianOil is also exploring the

possibility of equity participation / acquisition of other

projects in India and abroad. These ventures are estimated to

have a capital investment requirement of about Rs. 25,0000 ?

Rs. 30,000 crore spread over the next eight years, to enable

IndianOil quickly emerge as a leading petrochemicals player

in the country.

Towards setting up of greenfield projects, IndianOil took the

first step by commissioning a LAB plant at Gujarat Refinery

in August 2004. IndianOil is also implementing an integrated

PX/PTA project PX/PTA project at Panipat Refinery, to be

commissioned in fiscal 2005. IndianOil is in an advanced

stage of setting up a Naphtha Cracker and downstream polymer

units at Panipat.

LAB (Linear Alkyl Benzene):

The year 2004-05 marked IndianOil's big-ticket entry into

petrochemicals with the commissioning of the country's

largest Linear Alkyl Benzene (LAB) plant at Gujarat Refinery

in August 2004. It is also the largest grassroots single

train Kerosene-to-LAB unit in the world, with an installed

capacity of 1,20,000 million tonnes per annum (MTPA).

Currently, two grades of LAB - high molecular weight and low

molecular weight - are being produced. The quality of the LAB

produced here has found wide acceptance in the domestic and

overseas markets.

Built at a cost of Rs. 1,248 crore and commissioned in a

record 24 months' time, the plant produces superior quality

LAB for manufacturing environment-friendly biodegradable

detergents, using state-of-the-art Detal technology from M/s

UOP, USA. The key raw materials for the plant, catering to

domestic as well as export market requirements meeting the

latest and most stringent quality standards, are Kerosene and

Benzene produced at Koyali Refinery.

PX/PTA (Paraxylene / Purified Terephthalic Acid):

The PX/PTA project marks IndianOil's major step towards

forward integration in the hydrocarbon value chain by

manufacturing Paraxylene (PX) from Naphtha and thereafter,

converting it into Purified Terephthalic Acid (PTA).

Currently under implementation at Panipat Refinery in

Haryana, the integrated Paraxylene/Purified Terephthallic

Acid (PX/PTA) complex is being built at a cost of Rs. 5,104

crore.

The PTA Plant will be

the single largest unit in India with a world-scale capacity

of 553,000 MTPA, achieving economy of scale. The process

package for the PTA plant was prepared by erstwhile M/s

Dupont, UK (now M/s. Invista) and that of the Paraxylene Unit

was prepared by M/s UOP, USA. M/s EIL and M/s Toyo

Engineering have been selected as the Project Management

Consultants (PMC) for executing the PTA and PX respectively.

The Paraxylene plant

is designed to process 500,000 MTPA of heart-cut Naphtha to

produce about 360,000 MTPA of PX. Naphtha will be sourced

from IndianOil's Panipat and Mathura refineries, for which

Naphtha splitter units are being set up at the respective

refineries. The PTA unit will produce 553,000 MTPA of

Purified Terephthalic Acid from Paraxylene. Technologically,

the plant will be one of the most advanced in the country.

IndianOil has

selected the latest and the most modern technology available

in this field to achieve economy of scale in the plants

scheduled for commissioning in 2006.

Naphtha Cracker:

The

Naphtha Cracker and downstream polymer units are being set up

at Panipat at a cost of Rs. 6,300 crore. An MoU has been

signed in June 2004 with the Government of Haryana, who are

providing fiscal incentives and concessions for the project.

Planned to be

completed by 2009, this project envisages setting up of a

Naphtha Cracker based on captive utilisation of Naphtha from

Panipat, Mathura and Koyali refineries of IndianOil. The

Naphtha Cracker complex envisages other downstream polymer

units utilising intermediates ethylene and propylene to be

generated from the Cracker.

The Naphtha Cracker

unit is designed to produce 800,000 tonnes per annum of

ethylene and 600,000 tonnes per annum of Propylene, based on

which other downstream polymer units are being designed to

produce Linear Low Density Polyethylene (LLDPE), High Density

Polyethylene (HDPE), Polypropylene (PP) and the speciality

chemical Mono Ethylene Glycol (MEG). The capacities of the

Naphtha Cracker and polymer units are kept at world-class

level, with the products ranging from commodity to niche

grades.

November 10, 2004

NOVA

Indian Oil

Corporation selects NOVA Chemicals' SCLAIRTECH technology for

LLDPE/HDPE Swing Unit Project at Panipat

NOVA

Chemicals Corporation today announced its proprietary

SCLAIRTECH technology has been selected by Indian Oil

Corporation Limited (IOCL) for a new linear-low

density/high-density polyethylene (LLDPE/HDPE) plant in

India.

With the

addition of the IOCL plant, NOVA Chemicals' SCLAIRTECH

technology will be utilized in manufacturing nearly half of

all polyethylene produced in India.

Scheduled

for completion in the third quarter of 2007, the facility is

designed to produce 350 kilotonnes (770 million pounds)

of polyethylene per year using NOVA Chemicals' SCLAIRTECH

solution-phase technology. The plant will be located in

Panipat, Haryana, approximately 100 kilometers north of New

Delhi. NOVA Chemicals and IOCL expect to sign a license

agreement for the plant, pending approval of the Indian

Ministry of Industry, before the end of 2004.

IndianOil

April 14, 2006

IndianOil

inks MOU with HSIDC for Petrochemical Hub at Panipat

http://www.iocl.com/displaynews.aspx?file_name=rel301&fol_name=releases

IndianOil

Corporation Ltd. (IndianOil), India's leading Fortune Global

500 company and Haryana State Industrial Development

Corporation (HSIDC) signed a Memorandum of Understanding

(MoU) at Chandigarh today for the creation of a special

purpose vehicle (SPV) for developing a petrochemical hub at

Panipat. The MoU was inked by Shri BM Bansal, Director

(Planning & Business Development), IndianOil and Shri

Rajeev Arora, Managing Director, HSIDC, in the presence of

Shri Bhupinder Singh Hooda, Hon'ble Chief Minister, Haryana

and Shri Sarthak Behuria, Chairman, IndianOil. The proposed

SPV will have equity from IndianOil, HSIDC and private

developers and shall be entrusted with the responsibility of

land acquisition, creation of the necessary infrastructure,

etc.

The MoU marks a major milestone of cooperation and progress

as envisaged in the MoU signed earlier on June 22, 2004 by IndianOil and the

Government of Haryana for setting up a mega petrochemicals

complex at Panipat. The project shall be based on naphtha as

feedstock and would comprise associated units and downstream

polymer/ chemical units such as dedicated HDPE (High Density

Polyethylene), Polypropylene and MEG (Mono Ethylene Glycol)

at an estimated investment of Rs 11,000 crore. Feasibility is

also being studied for setting up for the downstream projects

Polyethylene Terephthalate (PET) by utilizing a part of the

PTA (Purified Terephtnalic Acid) to be generated as

feedstock.

There is huge potential for downstream chemical and

petrochemical projects based on the various refinery streams

as feedstock. The feedstock available from IndianOil's

petrochemical projects can nurture various downstream

industries up such as Polyester Staple Fibre (PSF), Polyester

Filament Yarn (PFY), Partially Oriented Yarn (POY) and

Polyethylene Terephthatate (PET). PSF, PFY and POY are used

as ingredients for manufacturing textilea, mostlty polyester

oriented garments, carpets and other domestic products, for

this, a naphtha cracker along with polymer units is expected

to go on stream by 2009.

The project at Panipat, as envisaged by IndianOil would help

create a world class Petrochemical Hub, Which would cater to

the requirement of northern region as well as other regions.

While for IndianOil, this project is a cornerstone for

big-time entry into petrochemicals as a new growth area, for

the state of Haryana this project shall entail significant

industrial activity in the years to come.

HSIDC is acquiring 5,000 acres of land for setting up the

petrochemical hub with all the basic amenities such as

internal roads, drains, sewerage system, street light,

electricity effluent treatment plants, fire station,

commercial & housing facilities, including development of

civic infrastructure like schools, hospitals, parks, etc, the

corporation has already initiated acquisition proceedings for

1,000 acres of land for the first phase of the project. The

remaining 4,000 acres shall be acquired during the next two

years in a phased manner.

The petrochemical hub would require huge skilled and

unskilled manpower ranging from 10,000 to 20,000 during the

construction period, which may span over a decade or so. In

addition such magnitude of investment in downstream

industries will also open up major opportunities for

development in infrastructure and peripheral facilities in

the state leading to development of major vendors for supply

and contracts. It is estimated that infrastructure

development worth around Rs 2,000 crore shall be generated

through this project. With an investment of around Rs 15, 000

crore as above in petrochemicals and end products, the

downstream industries are likely to generate an annual

turnover of about Rs. 12, 500 crore.

June 22, 2004

IndianOil

IndianOil inks MoU

with Government of Haryana for Naphtha Cracker and Polymer

Complex at Panipat

http://www.iocl.com/displaynews.aspx?file_name=rel126&fol_name=releases

Indian Oil

Corporation Ltd., India's only 'Fortune Global 500' energy

major, and the Government of Haryana signed a Memorandum of

Understanding (MoU) here today, for setting up a Naphtha

Cracker and Polymer Complex at Panipat. Mr. N K Nayyar,

Director (Planning & Business Development), IndianOil,

and Mr. S C Chaudhary, Commissioner (Industries), Government

of Haryana, signed this MOU in the presence of the State

Chief Secretary, Mr. A N Mathur and other senior officials.

The MoU marks a major milestone of co-operation and progress

for setting up the above complex at Panipat at an estimated

cost of Rs. 6300 crore. The project is scheduled to be

completed by the second quarter of 2007. The project

envisages setting up of a Naphtha Cracker based on captive

utilisation of Naphtha from Panipat, Mathura and Koyali

refineries of IndianOil, besides other downstream polymer

units utilising the intermediate ethylene and propylene to be

generated from the Cracker. In order to ensure the economic

viability of the project, Government of Haryana, as part of

the MoU, has provided fiscal incentives and concessions.

IndianOil, with the full support of the State of Haryana, is

developing a world class petrochemicals hub at Panipat.

According to Mr. M S Ramachandran, Chairman, IndianOil, the

proposed Naptha Cracker complex will be a part of the

Corporation's overall integrated Refinery and Petrochemicals

Complex, which includes the PX/PTA and Panipat Refinery

expansion projects, which are currently underway. With a

combined investment of over Rs. 20,000 crore, the integrated

Refinery and Petrochemicals Complex is IndianOil's single

largest investment at any single location in the country.

While for IndianOil, this project is a cornerstone for entry

into petrochemicals and a new business line for growth, for

the State of Haryana however, this project shall lay the

foundation for creation of a world class petrochemicals hub,

which will engender significant industrial activity in the

coming years.

"The signing of the MoU marks a major milestone of

co-operation and progress bringing together IndianOil, --

India's largest business enterprise -- and the State of

Haryana, one of the most progressive states in the country

", said Mr. N K Nayyar, Director (Planning and Business

Development), IndianOil, on the occasion of the MoU.

2006/6/20 Indian Oil

IndianOil commissions

India's largest PTA plant at Panipat

India's leading Fortune 'Global 500' company- IndianOil has

commissioned the countrys largest Purified Terephthalic Acid

(PTA) plant at it's Panipat Refinery in Haryana.

The plant was inaugurated today by Chairman Mr. Sarthak Behuria

in presence of Director (Refineries), Mr. Jaspal Singh and

Director (Planning & Business Development), Mr. B M Bansal.

With the commissioning of this plant, IndianOil's vision of

becoming a major player in Petrochemicals business gets a big

leap forward.

The PTA plant at Panipat utilises the latest state of the art

T-10 technology of M/s Invista (earlier Dupont) producing PTA of

a far more superior quality than the one produced and marketed in

India and abroad. Moreover, it will be used as raw material for

the manufacturing of staple fibre, filament yarn, PET bottles,

polyester film, audio video tapes etc. for which the market is

growing at a fast pace.

Speaking on the occasion, IndianOil Chairman said "At

IndianOil, we have identified the petrochemicals business as one

of the prime drivers of future growth and to achieve this, we

have drawn up an ambitious Rs. 30,000 crore master plan. We are

using product streams from our existing refineries to achieve

better utilisation of the hydrocarbon value chain".

"Our master plan for the petrochemicals business involves

development of world-scale petrochemical hubs at Panipat in the

North and Paradip on the East Coast," he added.

Shri Jaspal Singh in his address said that the Px-PTA complex

set-up at a cost of approx. Rs.4600 Crore will produce 360,000 Tonnes of

para-Xylene per

annum which in-turn will produce 550,000 Tonnes of

PTA per annum.

Over 20,000 tonnes of Benzene will also be produced per annum as

a by-product from the complex. There is a flexibility of

marketing paraxylene also.

M/s L&T were the LSTK contractor who carried out the

engineering, procurement, construction besides providing

commissioning assistance for the plant. M/s Engineers India Ltd

(EIL) was the Project Management Consultant (PMC).

Mr. P Mukerji, DIR(PJ), EIL and Mr. M R Shankar, Exe. Vice

President, L&T, Executive Director, Panipat Refinery Shri C.

Manoharan were also present on the occasion.

Platts 2006/6/22

India's ONGC to break

ground on new petrochemical complex Friday

India's Oil and Natural Gas Corp Friday will launch construction

of a 1-mil

mt/year aromatics facility at Mangalore in southern Karnataka state.

Indian Prime Minister Manmohan Singh will fly down to the site to

lay a foundation stone to mark the occasion, a senior ONGC

official said Thursday.

Commissioning of the plant is scheduled for 2010, the official

said.

ONGC, in a tie-up with its subsidiary Mangalore Refinery and

Petrochemicals Ltd, has formed a new company -- Mangalore SEZ --

to build the facility at the Mangalore Special Economic Zone,

close to an oil refinery run by MRPL. MRPL is raising capacity at

that refinery to 15-mil mt/year from a current 9.69-mil mt/year

to provide naphtha for the petrochemical plant. ONGC, through

Mangalore SEZ, plans to invest Rupees 450-bil ($9.79-bil) to set

up the aromatics complex, a new petroleum refinery, a liquefied

natural gas terminal and a gas-based power generation facility.

The new refinery project would involve investment of Rupees

300-bil ($6.53-bil). ONGC has ordered a detailed feasibility

report for building the new 15-mil mt/year refinery that would be

built adjacent to MRPL's existing plant, ONGC has said.

The aromatics complex would involve investment of another Rupees

150-bil ($3.26-bil) and has also been approved by ONGC and MRPL

boards. ONGC has yet to determine investment needed to build the

LNG terminal and power plant. ONGC is India's largest exploration

and production firm, accounting for 80% of India's yearly crude

output of 33.50-mil mt.

Aug 08, 2006 The

Times of India

ONGC plans mega petrochem unit

Oil and Natural Gas Corporation Ltd.(ONGC)'s new petrochemicals

complex -- which will produce petrochemical building blocks

paraxylene and benzene -- is the first of its kind in the

southern peninsula, removing the freight handicap of southern

consumers.

It would also facilitate advancement of the petrochemical

industry, with broad-basing of the supply sources to the Indian

consumers.

The complex is the precursor of a chain of investments envisaged

in the Mangalore SEZ (M-SEZ).

A combined investment of around Rs 12,900 crore has already been

approved by ONGC for the Refinery Upgradation and Aromatics

(petrochemicals) complex.

This will become one of the largest PSU refinery investments at a

single location in the country. The complex will produce

paraxylene and benzene and the naphtha from the MRPL refinery

will be upgraded to paraxylene.

The feedstock is the heavy naphtha generated in the MRPL

refinery. The refinery already has two catalytic reformers and

one more new reformer of similar capacity will be installed in

the new complex.

Thus, around 1.6 million metric tonnes per annum (mmtpa) of heavy

naphtha will be the feedstock to produce 0.95

mmtpa of paraxylene and around 0.15 mmtpa of benzene, the rest being LPG,

gasoline pool feed and tail gas.

The oil major has also planned to add another petrochemicals

(olefins) complex, subsequently. This unit is the precursor of a

chain of investments in the Mangalore SEZ.

ONGC envisages investment of more than Rs 35,000 crore for

integrated operations in midstream and downstream like refining,

petrochemicals, power and LNG, in this M-SEZ, which is likely to

be the first Petroleum, Chemicals, Petrochemicals Investment

Region (PCPIR) of the country.

In this M-SEZ, support services like banking, insurance, etc.

will also be carried out, to make it self-contained. With

upgradation of MRPL, the new refinery configuration will enable

processing of higher proportion of low-cost sour and heavy crudes

leading to better margins.

India, constitutes just about 2 percent of the world

petrochemicals capacity. This is in sharp contrast to the 12

percent-plus growth rate which the country has set sights on,

calling for augmented supplies of energy products, including

petrochemicals.

The unit will bring some balance in the distribution of

petrochemical capacity.

As per estimates, the current paraxylene demand in India is more

than 2 million tonnes per annum (mmtpa) and is expected to grow

at more than 7 percent every year. The supply position is

estimated to lag this demand for quite a few years to come,

making for a comfortable market.

Platts 2006/8/14

India gives green light for ONGC move into petrochemicals

Indian energy minister M S Srinivasan has given a greenlight from

the government for state-owned Oil and Natural Gas Corp (ONGC) to

move ahead with plans to build petrochemicals units around the

country, Press Trust of India said Monday. Srinivasan was quoted

by the official news agency as saying ONGC would be allowed

"to set up petrochemical complexes wherever they have

refineries or have a natural gas source."

Earlier this month, ONGC's board of directors approved a plan for

to build a 1.1 million mt/year petrochemical

complex at Dahej. The cracker would produce

ethylene, propylene and derivative products HDPE, LLDPE, PP and

styrene butadiene rubber. The oil and gas producer also

plans to add petrochemicals

units to its 240,000 barrels/day Mangalore oil refinery.

"Worldwide, refineries are being converted into

refinery-cum-petrochemical complexes to gain from the high

margins on

petrochemicals," Srinivasan said in the comments published

Monday.

Srinivasan was quoted as saying the governmemnt was not ready to

allow ONGC to move into retail markets for petrol and diesel,

however. Domestic retailers Indian Oil Corp (IOC), Hindustan

Petroleum Corp Ltd (HPCL), Bharat Petroleum Corporation Ltd

(BPCL) and often sell such products at a loss into India's

subsidized markets, receiving government oil bonds in return.

"No such compensation mechanism is available to new players

in this business, including ONGC," the minister said.

Aug 8, 2006 Oil and

Natural Gas Corporation

ONGC Board approves

investment proposals Development of C-series in Mumbai offshore

(Rs. 3195 Crore) and Dahej Petrochemical Complex (Rs. 13600

Crore)

The Board of Oil and

Natural Gas Corporation Ltd. (ONGC), in its 158th meeting on 8th

August 2006 has approved investment proposals for (i) Development

of C-series in Mumbai offshore and (ii) Dahej Petrochemicals

Complex.

(ii) Dahej Petrochemicals

Complex

In pursuance of its ongoing business pursuits for value chain

integration, ONGC will be implementing a global scale

Petrochemicals complex comprising of 1.1 million

tonnes per annum of Ethylene capacity dual feed cracker, along

with associated units and polymer plants, to manufacture HDPE,

LLDPE, PP and Styrene Butadiene Rubber (SBR) at Dahej in Gujarat.

This Petrochemicals Complex will be integrated with ONGC's own

C2-C3 plant which is currently under execution (at Dahej) and

Naphtha as feedstock from ONGC's own operational units at Hazira

and Uran. The project is proposed to be implemented through a SPV

route, with ONGC having management control, holding 26% equity.

GSPC has

evinced interest to participate in the project as a joint venture

partner. With a projected Debt-Equity ratio of 2.55:1, ONGC's

anticipated equity investment (26%) would be around Rs. 992

Crore.

With assistance from Gujarat Government through participation of

its nominee GIDC as a co-promoter, ONGC's Petrochemicals Complex,

as the anchor industry, will come up in the Dahej Special

Economic Zone (D-SEZ). This would help in optimizing the project

cost and help development of various plastic processing

industries within SEZ to seize significant export market

potential.

This mega Petrochemicals Complex, with cracker of global capacity

and highest in the country so far, will involve investment of

around Rs. 13,600 Crore for its implementation, along with

downstream polymer plants. With its commissioning around

mid-2010, it will catalyze significant economic development in

western India and the country as well.

GSPC

GUJARAT STATE PETROLEUM CORPORATION LTD.

More

than 25 years ago, the Government of Gujarat conceived the

formation of a petrochemical company, that has today

metamorphosed into a large-scale energy organization,

excelling in a wide gamut of hydrocarbon activities.

Notwithstanding its limited role and the low key

infrastructure, the organization drew inspirations from the

exciting opportunities that the hydrocarbon sector offered in

the wake of liberalization of Indian economy. It gradually

began to expand its vision, widened the scope of its

activities and rechristened itself as Gujarat State Petroleum

Corporation in 1994, to enable smoother journey towards its

proactive vision.

2007/1/25 Foster Wheeler

Foster Wheeler Awarded

Contract for World-Scale Refinery and Petrochemicals Complex in

India

Foster Wheeler Ltd.

announced today that two subsidiaries in its Global Engineering

and Construction Group, Foster Wheeler Energy Limited and Foster

Wheeler India Private Limited, have been awarded services

contracts by Indian Oil Corporation Limited

(IOCL) for the Paradip

Refinery Project,

which is expected to be one of the largest integrated refinery

petrochemicals complexes in India. This world-scale facility,

comprising a new export refinery and petrochemicals complex, will

be built in Orissa State.

The terms of the

contracts were not disclosed, and the projects will be included

in the company's first-quarter 2007 bookings.

Foster Wheeler's scope

includes the front-end engineering design (FEED), preparation of

cost estimates and the overall project strategy, and supervision

of early works on site up to financial investment decision for

the refinery, which is expected in mid-2008.

The planned new refinery,

with a

crude processing capacity of 15 million tonnes per annum (TPA), will include a

fluidized catalytic cracking unit, an aromatics complex and a

polypropylene unit. The new complex will ultimately produce 700,000 TPA of

polypropylene,

1.2

million TPA of paraxylene, 600,000 TPA of

styrene monomer,

along with 10.5 million TPA of refined petroleum products. This

award also includes a detailed feasibility study for Phase 2 of

the development, the Paradip Naphtha Cracker

Project.

"Foster Wheeler is

very pleased to be awarded this strategically important

project," said Steve Davies, chairman and chief executive

officer, Foster Wheeler Energy Limited. "This award reflects

our in-depth expertise in refining and petrochemicals and in the

successful integration of refining and petrochemicals production.

We have been active in the Indian market for over seventy years

and it remains a very important market for Foster Wheeler. We

look forward to working with IOCL to deliver a high quality FEED

which meets or exceeds our client's expectations."

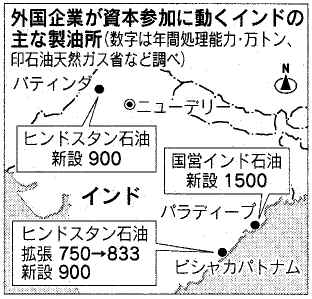

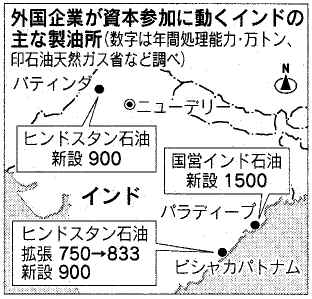

日本経済新聞 2007/1/30

インドで石油精製 サウジや仏企業 輸出拠点に活用も

サウジアラビアの国営石油会社やフランスのトタルなどが、インドの石油精製部門への進出に動いている。石油需要の拡大が見込めるインドに直接参入するだけでなく、将来は輸出拠点としても活用していく考え。インドでは製油所の新増設計画が相次いでおり、外国石油会社による資本参加、提携などが加速しそうだ。

インドの製油所への出資を巡って同国政府と交渉に入ったのは、サウジ国営サウジアラムコ。石油精製・販売最大手の国営インド石油(IOC)が東部オリッサ州パラディープに新設する大規模製油所(年間処理能力1500万トン)が対象だ。

国内2位のヒンドスタン石油(HPCL)のラール会長は、東部ビシャカパトナムに建設する製油所の株式を仏トタルなどに売却する考えを表明した。同会長は「トタルのデマレ会長と会い、数カ月以内に決着させたい」という。

一方、インド出身の鉄鋼王ラクシュミ・ミタル氏率いるミタル・グループは、HPCLが北西部バティンダに建設する製油所への資本参加を申し入れている。経済の高成長が続くインドは、2012年まで石油製品の需要が年4.5%のぺースで増える見込み。石油の一大消費地であるアジアと中東の中間にあり、付加価値の高い石油製品の輸出拠点としても有利とみられている。

海外各社は09年にも本格化する国内のガス開発事業への参入も視野に入れているようだ。

インドでは12年までに10カ所以上の製油所で新設・拡張工事が完成する予定。全体の処理能力は現在の1.6倍に拡大する。

Platts 2007/7/25

Indian investigators in S Korea for PVC anti-dumping probe

Indian government officials arrived in South Korea this week to

interview two of the country's leading PVC producers as part of

an investigation into allegations of anti-dumping of Korean PVC

in India, sources from these companies said Tuesday.

Officials from LG Chem and Hanwha Chemical said the two companies

were fully cooperating with the investigations. LG Chem has a

total PVC production capacity of 750,000 mt/year across South

Korea, while Hanwha Chemical's PVC production capacity is at

495,000 mt/year.

In June 2006, four Indian petrochemical companies petitioned

their government to begin an investigation into charges of

dumping of suspension-grade PVC by a number of foreign companies.

The four Indian companies are Indian Petrochemicals Corp. Ltd.,

DWC Limited, Chemplast Sanmar Ltd. and DCM Shriram Consolidated

Ltd. India's largest petrochemical producer Reliance Industries

also supported the petition.

A number of PVC companies/suppliers in Taiwan, China, Indonesia,

Japan, Korea, Malaysia, Thailand and the US were alleged to have

engaged in unfair trade practices.

ANTI-DUMPING DUTY UNLIKELY, SOURCES SAID

Some market sources said the anti-dumping investigation has

become slower this year due to tightness of supply in India.

Sources even said that some India PVC suppliers had to import

from northeast Asian producers to meet rising domestic demand.

Also, with China cutting export tax rebates on PVC has probably

increased the price of PVC from that country limiting its

attraction for Indian buyers.

Effective July 1, the Chinese government has reduced export tax

rebate on plastic resin and plastic products, including PVC, to

5% from the previous 11%. To make up for this, Chinese producers

will have to raise their PVC export prices.

"Considering this, there is no point in implementing the

anti-dumping duty now. PVC is not going to become cheaper than

before," said a market source in India.