2003.07.27 LG Chem

LG Chem, expands its PVC capacity

at Tianjin to 340,000 ton/year

LG Chem, Ltd., the largest chemical company in Korea, announced

today that it has raised its PVC capacity at its Tianjin LG Dagu

Chemical facility by 100,000 ton/year. A dedication ceremony took

place on the 25th of July in Tianjin City, China.

PVC (Poly Vinyl Chloride) is one of LG Chem's core petrochemical

products used in producing a wide range of plastic products

related to the building and construction sector as well as high

voltage electric cables, medical gloves, etc.

With the 100,000 ton expansion, Tianjin LG Dagu Chemical now has

a total PVC capacity of 340,000 ton/year. This is the 3rd

expansion LG Chem has made at its LG Dagu facility, which

initially started out with a PVC capacity of 100,000 ton/year.

"The Chinese market has a potential of further expansions in

PVC since its PVC supply is much lower than demand. LG Dagu's

expansion is in line with such circumstances," said Churl-Ho

Yoo, the Executive Vice President of LG Chem's Petrochemical

Business.

"For further growth in its PVC business, LG Chem has set

long term plans to increase its annual PVC capacity to 2.05

million tons (Korea 0.95 mil, China 1.1 mil) by 2010," Yoo

added. This is expected to elevate the company's position to the

3rd largest PVC producer in the global market.

LG Chem is now the 6th largest PVC producer in the world with a

total capacity of 1.13 million tons per year. (Korea 0.79 mil,

China 0.34 mil)

OVERVIEW OF LG CHEM

LG Chem, Ltd., is the leading chemical company in Korea in terms

of both size and performance. It is a vertically integrated

chemical company that manufactures a wide range of products from

petrochemical goods to high-value added plastics, floorings and

automotive parts. It also expands its chemical expertise to

high-tech materials for electronics and information technology

such as state-of-the-art rechargeable batteries and display

materials.

With annual sales of KRW 5.4 trillion (Yr 2002) and a global

workforce of approximately 10,000 employees, LG Chem plans to

realize positive progress towards sustainable growth by

consolidating its leadership in the domestic market and building

leader businesses outside of Korea.

Facts on LG DAGU

TIANJIN LG DAGU CHEMICAL CO. LTD. (www.lgdagu.com.cn)

| Location |

Tianjin, China |

| Establishment |

1998. 5. |

| Capital/ Ownership |

US$ 37.4million / 75%(LG

group 85%) |

| Capacity |

100,000 ton/year ('98.4)

150,000 ton/year ('99.10)

240,000 ton/year ('01.10)

340,000 ton/year ('03.7) |

PVC Demand/Supply in China

2002

|

2005

|

2010

|

Remarks

|

|

Demand

|

5,200

|

6,670

|

10,300

|

*LG

Chem's expansion plans are excluded |

Supply

|

3,333

|

4,690

|

4,690*

|

Shortage

|

1,867

|

1,980

|

5,610

|

World Top10 PVC producers -----------------(Unit: 1000 ton)

Rank

|

Company

|

Capacity

|

Nationality

|

Remarks

|

1

|

Shintech

|

3,108

|

Japan, U.S.

|

*Shin-etsu + Rovin |

2

|

FPC

|

2,826

|

Taiwan, U.S.

|

*FPC(Taiwan) 1.4 mil ton |

3

|

Oxy Vinyls

|

2,000

|

U.S.

|

*OxyChem + Geon |

4

|

EVC

|

1,405

|

EU

|

. |

5

|

Georgia

|

1,305

|

U.S.

|

. |

6

|

LG Chem

|

1,130

|

S. Korea

|

. |

7

|

Solvin

|

1,112

|

EU

|

*Solvay+BASF |

8

|

AtoFina

|

850

|

France

|

. |

9

|

Vinnolit

|

685

|

EU

|

. |

10

|

Westlake

|

635

|

U.S.

|

. |

Source: CMAI report/LG Chem

(2003)

2003.07.28 LG

Chem

LG Chem marks an

epoch in the Non-phosgene Polycarbonate Process

LG Chem, Ltd., the largest chemical company in Korea, announced

today that it has independently developed a new Non-phosgene

Polycarbonate Process using its own technology. With the

development of this new 'Condensed Non-phosgene Polycarbonate

Process', LG Chem has marked an epoch in the non-phosgene

polycarbonate process.

Polycarbonate is an engineering plastic widely used in optical

discs (CDs and DVDs), automotive and electrical applications,

housing components, industrial equipments and computers. This

diversity in usage comes from its unique properties of high

strength, heat resistance and excellent dimensional and color

stability.

The non-phosgene polycarbonate process is known to be an

environmentally friendly method compared to the conventional

interfacial polycarbonate preparation process, which uses

phosgene gas. This phosgene-free process lowers the production

cost by eliminating the need for extra care of the phosgene gas.

"Compared with the conventional phosgene process, the newly

developed process is likely to reduce investment costs by 70%.

For instance, the investment for a plant with a capacity of

60,000 metric ton per year can be significantly reduced to less

than USD 100 million from USD 250 million," said Jong-Kee

Yeo, the CTO and president of LG Chem. There

is also the added benefit of lower production costs by reducing

the plant operating cost.

Only a few companies, worldwide, have succeeded in developing the

environmentally friendly non-phosgene polycarbonate process. LG

Chem's Condensed Non-phosgene Polycarbonate Process has been

taken a step further by solving the problems of product quality

and long production time that other non-phosgene polycarbonate

processes have.

"The new process developed by LG Chem can reduce the total

production time by more than half and has enhanced the quality of

the resin itself in terms of transparency and color,"the CTO

added.

The Condensed Non-phosgene Polycarbonate Process is a result of

perseverance and countless hours invested in its development

since 1997. In addition, it is the outcome of LG Chem's

decade-long effort to develop environment-friendly processes

along with the Non-phosgene MDI (Methylene Diphenyl

Diiocyanate) process developed in 1995. The Condensed

Non-phosgene Polycarbonate Process is currently patent pending in

9 countries such as the U.S., Japan and Germany.

LG Chem is likely to see great benefit by exporting its highly

advanced non-phosgene MDI technology as well as its newly

developed non-phosgene polycarbonate technology. Furthermore, the

company said that it would also consider of forming a joint

venture with a foreign partner to pave the way towards overseas

expansion.

OVERVIEW OF LG CHEM

LG Chem, Ltd., is the leading chemical company in Korea in terms

of both size and performance. It is a vertically integrated

chemical company that manufactures a wide range of products from

petrochemical goods to high-value added plastics, floorings and

automotive parts. It also expands its chemical expertise to

high-tech materials for electronics and information technology

such as state-of-the-art rechargeable batteries and display

materials.

With annual sales of KRW 5.4 trillion (Yr 2002) and a global

workforce of approximately 10,000 employees, LG Chem plans to

realize positive progress towards sustainable growth by

consolidating its leadership in the domestic market and building

leader businesses outside of Korea.

Overview of the Polycarbonate market

Polycarbonate resins offer an exceptional combination of clarity

along with heat and impact resistance and also have very high

ductility and toughness over a wide temperature range. In the

1980’s, the demand for polycarbonate resins

increased very rapidly. In the year 2000, world polycarbonate

resin capacity reached 2.2 million metric tons. In East Asia, an

estimate of the average annual consumption between 2001 and 2005

is expected to be the fastest growing, averaging 12.5%.

Phosgene / Non-phosgene Polycarbonate process

There are two conventional polycarbonate processes: the

interfacial polymerization process and the melt

polymerization/solid-state polymerization process.

| 1) |

Interfacial

polymerization process (phosgene process) |

| |

The

interfacial polymerization is carried out in a solution

of bisphenol-A (BPA) and phosgene at the interface.

Although this process can easily produce high molecular

weight polycarbonate resins, it has disadvantages such as

the safety problem of handling highly toxic phosgene and

the large investment cost of dealing with the

environmental problems created by the process. |

| |

|

| 2) |

Melt

polymerization and Solid-state polymerization

process(non-phosgene process) |

| |

The melt

polymerization involves the reaction of diphenyl

carbonate (DPC) with bisphenol-A (BPA) to produce a low

molecular weight polycarbonate prepolymer at the melt

state. High molecular weight polycarbonate is synthesized

at the solid-state polymerization step.High temperature

and high vacuum equipments are required to handle highly

viscous

reactants, which lowers the quality of the resin in the

melt polymerization step. Long production time is

required at the solid-state polymerization process. |

| |

|

| LG Chem's Condensed Non-phosgene

Polycarbonate process |

| |

LG

Chem's Condensed Non-phosgene Polycarbonate Process cut

the production time of polycarbonate in half compared to

other non-phosgene processes. The melt-polymerization

process of trans-esterification between DPC and BPA is

designed to reduce the production time with excellent

prepolymer quality. Polycarbonate prepolymer is further

crystallized and polymerized to form polycarbonate in the

solid-state polymerization process by adopting a newly

designed single reactor. |

| |

|

Overview of MDI

(Methylene Diphenyl Diiocyanate)

MDI is a raw material for Polyurethane. Pure MDI is used for

casting elastomers and spandex fiber, thermoplastic elastomers.

Polymeric MDI is mostly used for insulating and automotive

materials. The global market size for MDI in the year 2000 was

2.4 million metric ton. Annual production of MDI in Korea is

130,000 metric ton.

The process for MDI production generally involves the use of

phosgene, a toxic substance.

However, in 1995, LG Chem succeeded in developing an

environmentally friendly and cost effective process that

eliminates the use of phosgene. This newly developed process was

introduced in the 'PEP Review', a research booklet published by

Stanford Research Institute (SRI), with 11 domestic and 3

international patents.

2004-1-22 Asia Chemical Weekly

S Korea LG International in Russian ethylene, refining jv

LG International Corp (LGI), the foreign investment arm of South

Korea's LG Group, said that has it formed a joint venture, the

Tatar-Korean Petrochemical Co (TKNK), with partners in Russia to

construct a refinery and petrochemical complex in Nizhnekamsk,

Republic of Tatarstan, Russian Federation.

The complex will produce 600 000 tonne/year of ethylene and have the capacity to refine 7m tonne/year of

oil, LGI said. It will also

include plants for the production and refinement of polymers, the

company said.

It did not provide further details on the financial or technical

details of the project. LGI said that it would continue to work

on this project and any other progress made on the business would

be announced as soon as possible.

The first meeting of the board of TKNK was held on 16 January and

full cash details on the project are still under development.

However, LGI confirmed that TKNK is seeking a $600m (Euro476.7m)

credit from a consortium of western banks to fund the first stage

of the refinery's construction.

Tatneft JSC owns 45.45% of the new company, while

Nizhnekamskneftekhim Inc has a 36.37% stake.

Svyazinvestneftekhim, an Ignatov & Co Group company that

holds shares in both Tatneft and Nizhnekamskneftekhim, and LGI both hold 9% stakes.

Platts 2004/6/30

LG expects Tatarstan oil/petchem project financing by year-end

South Korea's LG group expects to settle a financing plan by

December for a joint venture oil refinery and

petrochemicals project in

the republic of Tatarstan, sources at LG said Wednesday. A source

from LG's construction and engineering subsidiary said the

project's final scope and investment requirements would not be

finalized until the end of the year.

LG had signed preliminary agreements late last year with Russian

oil firm Tatneft, the Tatarstan government, and local refiner

Nignekamskneftekhim, according to local press reports. The

wordlscale refinery should be up and running in two years, the LG

source said, without offering a timetable for the petrochemicals

stage.

2004/9/22 Reuters

LG clinches $3bn Russian deal

http://edition.cnn.com/2004/BUSINESS/09/21/russia.lg.reut/

South Korea's LG International

Corp. and affiliate LG Construction Co. have clinched a $3

billion petrochemical plant deal with Russian oil firm Tatneft, LG

International said Wednesday.

The deal, which LG said was the biggest of its kind in Russia,

was struck during South Korean President Roh Moo-hyun's visit to

Moscow for talks with Kremlin chief Vladimir Putin.

The two leaders have been discussing energy issues, along with

North Korea and its nuclear plans.

The plant would have a daily refining capacity of 150,000 barrels

of oil and produce polyethylene and other petrochemical products,

LG International said in a statement.

Construction was scheduled to begin in 2005, it said.

Shares in LG International jumped 5.64 percent to 9,370 won

Wednesday morning, outperforming a 0.11 percent decline in the

broader benchmark stock index, after the deal was announced.

The deal followed an agreement on Monday between South Korea's

state-run Korea National Oil Corp. (KNOC) and Kazakhstan's state

oil firm KazMunaiGas on an upstream oil project in the oil-rich

Caspian Sea. Roh stopped by Astana en route to Russia.

South Korea, the world's fourth-biggest oil buyer, imports all of

its crude oil and natural gas needs, and is keen to diversify oil

and gas supplies away from the oil-rich but volatile Middle East

to others including Russia and Kazakhstan.

2004/9/22 Platts

Tatarstan sign $1.7-bil

petchem, refinery deal.

Tatarstan-Korean Petrochemical Co and South Korean LG have

signed a $1.7-bil agreement to construct a refinery in

Tatarstan. The agreement was signed in the presence of

Russian president Vladimir Putin and South Korean president

Roh Moo-Hyun in Moscow. The project is expected to be

expanded to include a petrochemical complex pushing the total

project cost to $3-bil. The first stage of the project

proposes construction of a 7-mil mt/yr (140,000 b/d) refinery

to handle heavy, high sulfur oil produced in Tatarstan and

Bashkortostan and is to start at the end of the year. The

second stage, at a cost of $1.2-bil, envisages a 600,000mt/yr

ethylene unit. The Tatarstan-Korean Petrochemical Co was set

up in January by Tatneft (45.45%),

Nizhnekamskneftekhim(36.37%), Tatarstan authorities (9.09%)

and South Korea's LG International (9.09%).

2004.09.23 LG International

LG International-LG E&C won a $3 billion project from

Tatarstan

http://www.lgicorp.com/eng/about/press_v.jsp?num=66¤t_page=1&gubun=D

■ Signed a $ 1.7 billion

contract for a phase I project and agreed on a 1.3 billion phase

II project, to build a petrochemical and oil refining complex.

■ The largest ever, paved

the way for entering the Russian plant market in the future.

LG International Corp., together with LG Engineering

&Construction, won a $ 3 billion project to build a

petrochemical and oil refining complex in Tatarstan. The project

is the largest ever in the history of Korea-Russia relations.

In the Moscow Kremlin on September 21, 2004, LG International

Corp. and the Republic of Tatarstan agreed to build a

petrochemical and refining complex through the two-stage project

worth $ 3 billion in total. Attended by presidents from Korea and

Russia, LG International Corp and the Tatarstan government signed

a $ 1.74 billion agreement for the construction of oil processing

facilities through the phase I project.

This $ 3 billion project is designed to build the petrochemical

and oil refining complex during the phase 1 and phase 2($1.3

billion) in the eastern area, about 1000 km away from Moscow in

Russia.

The project of TKNK(Tatarstan Korea Neftekhim), a joint venture

is the largest construction of petrochemical facilities in the

history of Russia. LG International and LG E&C participated

in the joint venture. LG International will finance the project

while LG E&C will carry out the designing, procurement and

construction (EPC turnkey) for the project.

The construction will be funded through project financing for the

first time since the financial crisis hit Russia. After the

construction and testing for about 4 years and 4 months from

2005, the complex will be operated in full swing.

After the completion of the project, Tatarstan will be capable of

refining150,000 barrels per day and producing petrochemical

products such as polyethylene and EPS. Accordingly, Tatarstan

will have the consolidated production facilities in refinery and

petrochemistry, which build a foundation for transforming its

industrial structure into high value added one.

LG International Corp. seized an opportunity to win the $

3billion plant construction project by participating in the

establishment of the joint venture, TKNK(Tatarstan Korea

Petrochemical Co) with Tatneft, NizheKamskNeftKim and

Svyazinvestmentholding Co., in a close cooperation with its

Moscow branch that gathered the related information at an early

stage. LG International will be responsible for project

financing, which is the largest contributor to wining the

project, and product marketing. In this way, it will oversee the

overall project execution.

Early this year, LG International won a contract for the

construction of a polypropylene plant in Oman using its joint

venture strategy for building a plant and securing the rights to

product sale. Using this creative strategy once again, LG

International Corp won the contract from Tatarstan. Accordingly,

it strengthens its reputation as a leading project organizer.

In 1997, with a 700 million petrochemical plant construction in

Qatar, the largest project at that time, LG International Corp.

and LG E&C started to enter the Middle East market in

earnest. In addition to the project to build the petrochemical

and refinery complex in Tatarstan, they are also preparing for

other projects. Thus, two companies show strong confidence in

making inroads into the Russian market, the largest oil producer.

For the project, financial assistance for feasibility study was

given by the Korea Plant Industries Association under the

sponsorship of the Ministry of Commerce, Industry and Energy.

With the help of the government’s strong support measure for export,

massive investment was made in the initial development stage and

it led to the successful singing of the contract for the project.

Platts 2004/2/12

Korea's LG Chem short lists three sites in China for EDC project

LG Chem, South Korea's largest chemical producer, has short

listed Tianjin(天津),

Guangdong(広東省), and

central China as three likely locations for a planned worldscale

EDC plant, a company official said Thursday.

The capacity of the plant was not disclosed, but sources close to

the company said it would be on the order of 300,000 mt/yr and the project

would entail an investment of $250-300 mil. Work on the unit is

expected to start in 2005. News of the site selection follows an

announcement last summer that LG Chem had opted not to build the

plant in Australia as originally planned because of high labor

costs and overheads.

2004/2/19 LG Chem

LG Chem develops new EP material applying nanotechnology

http://www.lgchem.com/press/releases/releases_view.jsp?idx=106

LG Chem, Ltd., the largest

chemical company in Korea, announced today that it has

successfully developed a new high barrier EP material named

HYPERIER® by applying

nanotechnology.

EP (Engineering Plastics) Engineering Plastics are high

performing plastics that are used as alternatives for metal

hardware. They are highly durable to heat and impact, which makes

it ideal for automobiles and electronic appliances components by

enabling them to be more lightweight and portable.

HYPERIER®, is unique in

terms of its high barrier capability of solvents, water, and gas,

which are important factors when used for automobile fuel tanks

and containers for food, cosmetics, pesticide, and so on.

The shortcomings of existing barrier materials lie in requiring

multi-layers due to low molding ability and weakness in water.

Moreover, high costs are unavoidable because of the expensive

Multi-layer molding equipments and high error rates.

However, by applying nanotechnology to its new EP material, LG

Chem has dramatically increased the barrier ability. Furthermore,

its single layer molding capability provides cost effectiveness

to processing companies by saving equipment and raw material

costs.

"The development of HYPERIER is the result of perseverance

and countless hours invested in its development since 2001. The

success has great significance in that it is the world's first

high barrier EP with the application of nanotechnology and that

it is based on our own technology" said Jong-Man Oh, the

Vice President of LG Chem's Engineering Plastics division.

LG Chem will soon commercialize its new EP material for cosmetic

containers in the 1H of 2004. Moreover, co-research projects with

car makers are currently in progress to apply HYPERIER®

for automobile fuel tanks in order

to secure the global KRWon 1 trillion/ year market.

"We will exert efforts to provide total solutions from the

designing stage to the processing techniques and material

developments. Our target is to become the No. 1 company in

barrier materials by securing 30% of the global market by

2008," Oh added.

Patents related to the company's new nanotechnology based EP

barrier material are currently patent pending in China, Europe,

Japan, Korea, U.S. Taiwan, etc.

HYPERIER® is a compound

word of HYPER and BARRIER. By using nano size barrier particles,

the permeation of solvents, water, and gas is dramatically

reduced. Moreover, due to its high processing capability,

HYPERIER® can be used for

containers of various products.

2004/7/14 LG Chem

LG Chem becomes a global NPG producer through expansion

http://www.lgchem.com/press/releases/releases_view.jsp?idx=110

LG Chem, Ltd., the largest

chemical company in Korea, announced today that it would expand

its NPG (Neopentyl Glycol) capacity by 20,000 tonne to 50,000

tonne/year by 2005. Such an increase will position the company as

the No.3 global producer and the No.1 producer in Asia.

NPG is the raw material for alkyd resin, unsaturated resin and

powder resin. Such resins are used in paints for construction

materials, electronic appliances, automobiles. Moreover, it is

well known as an environment-friendly product.

Due to its high processability, water resistancy, and weather

resistancy, the global demand for NPG has dramatically increased

to a market size of KRW 600 billion. An estimated annual growth

of 6% is expected. However, the high technology required for the

production has been acting as a major obstacle in entering the

market.

LG Chem first entered the NPG business in 1998 by becoming the

world's 4th company to develop its own NPG production technology.

"The development of our own technology was the result of

perseverance and countless hours invested in its development

since 1995," said SangYoun Lee, the General Manager of LG

Chem's Acrylate & E-Chemicals' planning department.

For the NPG expansion of 20,000 tonne/year, a capital injection

of KRW 20 billion will be made at its facility located at Yeosu,

Korea. In addition, a new technology, with advanced reaction

efficiency and yield rate by 30% and an energy saving rate of

50%, will be applied for the expansion.

"We have made a breakthrough by dramatically improving our

technology. The capacity expansion with the application of our

new technology is expected to provide an increase in export by

more than USD 30 million," Lee added.

Korea currently has a NPG market of KRW 30 billion, where LG Chem

is the sole producer. Moreover, the NPG market in China is

forecasted to increase from its current KRW 150 billion to KRW

300 billion by 2008.

"Though advanced technology and enhanced capacity, we are

planning to initiate aggressive marketing and solidify our

position in the global market. As for our goal by 2006, we are

aiming to capture a 15% global market share and a 25% market

share in China," the General Manager said.

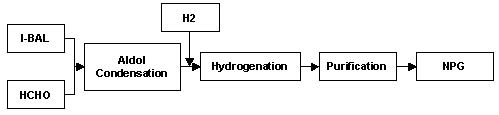

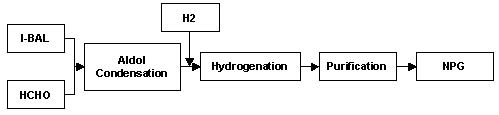

NPG Production Process

Global NPG Producers

| Rank |

Company |

Capacity

(1,000 tonne) |

Ratio |

1

|

BASF

|

135

|

36%

|

2

|

Eastman

|

87

|

23%

|

3

|

MGC

|

35

|

9%

|

4

|

LG Chem

|

30

|

8%

|

-

|

Others

|

89

|

24%

|

Total

|

376

|

100%

|

2005/7/27 LG Chem

LG Chem to Expand Acrylic Acid Plant in Yeosu

LG Chem, Ltd., the largest chemical company in Korea, announced

its plans to add a fourth acrylic acid plant in Yeosu by the end

of 2007. The new plant will produce 80,000 mt/yr of

crude acrylic acid.

Through the new investment, LG Chem will have a total of 4

acrylic acid plants with a total production capacity of 240,000 mt/yr.

Acrylic acid, which is the raw material for acrylates, is a

monomer widely used in over 3,000 products such as SAP (Super

Absorbent Polymer), coating, adhesives, etc.

The existing three plants are situated in Naju and Yeosu. In

these plants, the company uses Japan's Nippon Shokubai

technology. However, LG Chem developed its own oxidation catalyst

in 1998 and the catalyst has been applied ever since.

The new investment is particularly noteworthy, as LG Chem will be

using

its own developed production technology. LG Chem's new process is an

enhanced technology that improves the production efficiency and

stability through a new reaction system and innovative

purification technique.

Other than LG Chem, only three major chemical companies such as

Nippon Shokubai Co. Ltd., BASF and Mitsubishi Chemical Corp. have

their own technology to produce acrylic acid.

The main reason behind the expansion is to meet the growing

demand in China. The company expects that the demand in China

will maintain an average growth of 13% per year throughout the

end of 2010. Another reason is that the company plans to maintain

its position as the leader of acrylates in the Korean and Asian

market.

The global market for acrylates is increasing at 4% annually

whereas the Korean market is steadily growing at over 5% per

year. In the Korean market, the automobile and ship building

industry has been the driving force for the increase in demand

for acrylates.

"As the new plant will adopt the most advanced process and

technology, it will reinforce the competitiveness of the acrylate

business of LG Chem," said Jeong O Kim, Vice President of

the Acrylates Division.

The company expects to generate annual sales of KRWon 110 billion

from the new plant. In addition, the company is currently

studying the possibilities of establishing another 160,000 mt/yr

acrylic acid plant in China to build a leading position in the

fast growing market.

Overall, LG Chem has decided to nurture the acrylate business as

one of the company's strategic products.

Overview of LG Chem

LG Chem, Ltd., is the leading chemical company in Korea in terms

of both size and performance. It is a vertically integrated

chemical company that manufactures a wide range of products from

petrochemical goods to high value added plastics and high

performance industrial materials. It also extends its chemical

expertise to high-tech materials for electronics and information

technology such as state-of-the-art rechargeable batteries and

display materials.

2004 Acrylic Acid Producers in terms of capacity Unit: KMT

| Rank |

Company |

Capacity |

License |

1

|

BASF

(Germany)

|

750

|

Own

Technology

|

2

|

R&H

(U.S.A)

|

575

|

Japan

|

3

|

DOW

(U.S.A)

|

516

|

Japan

|

4

|

NSCL

(Japan)

|

450

|

Own

Technology

|

7

|

LG Chem (Korea)

|

160

|

Japan

|

* LG

Chem’s new plant will apply its own

technology.

Acrylic Acid Supply and Demand Unit: KMT

| Category |

2004 |

2008 |

2010 |

CAGR

('04~'10) |

| Capa |

Demand |

Capa |

Demand |

Capa |

Demand |

Global

|

3,617

|

3,333

|

4,351

|

3,834

|

4,491

|

4,143

|

4%

|

China

|

165

|

463

|

645

|

745

|

645

|

937

|

13%

|

Korea

|

160

|

130

|

160

|

151

|

160

|

180

|

5%

|

* Source: Tecnon (2004),

LG Chem

2005/8/31 LG Chem

LG Chem Develops New

Production Method for LCD Color Filters

http://www.lgchem.com/press/releases/releases_view.jsp?idx=130

LG Chem, Ltd., the

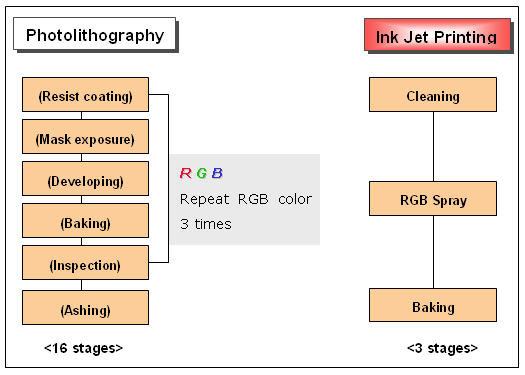

largest chemical company in Korea, announced today that it

developed its own production method to produce color filters, a

key component for LCDs. Also the new development is a departure

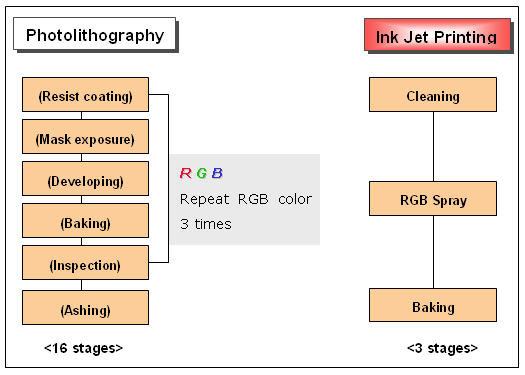

from the previous 'photolithography

method'.

A color filter is a key component, which sharpens the color of

LCDs. It also accounts for 20% of the manufacturing cost of the

LCDs.

The new production method enables LG Chem to simplify the

manufacturing process and saves manufacturing cost and time by

reducing its production stages from 16 to 3 steps.

The new process is an 'Ink Jet Printing Process' which prints ink on the surface

of the LCD glass plate. It is a process that can be described as

printing paper on an ink jet color printer.

The 'Ink Jet Printing Process' is considered as a 'Holy Grail'

process for color filter manufacturing. LCD panel companies have

been craving to develop this process to compete against the PDP (プラズマディスプレイ) manufacturers in price. In

addition, LCD equipment manufacturers have also been longing to

develop this process.

LG Chem was the first in Korea to ever develop this new

production method and it is expected to provide LCD manufacturers

a competitive edge over PDP manufacturers. Currently, LCD TVs are

priced higher than PDPs in the market. This will be an

opportunity to popularize LCD TVs.

Also, with the 'Ink Jet Printing Process', LG Chem will be able

to save more than 50% on its manufacturing cost.

"In the display industry, Korea has been dependent on raw

materials and manufacturing processes from Japan, however, this

new development will make it unnecessary for us to rely on

imports for LCD raw materials and manufacturing process,"

said Jong-Kee Yeo, President and CTO of LG Chem.

"Not only did LG Chem develop its own development method but

also it developed its own technology to produce the raw

materials. This will significantly enhance the domestic LCD

manufacturers to gain more market share in the global

market," the CTO added.

Editor's Note

Overview of LG Chem

LG Chem, Ltd., is the leading chemical company in Korea in terms

of both size and performance. It is a vertically integrated

chemical company that manufactures a wide range of products from

petrochemical goods to high value added plastics and high

performance industrial materials. It also extends its chemical

expertise to high-tech materials for electronics and information

technology such as state-of-the-art rechargeable batteries and

display materials.

Comparison between the previous and new method

The new production method greatly reduces manufacturing cost and

time, making the previous 16 development stages into 3.

September 06, 2005 Dow

LG-DOW Proceeds with

Project for Second Polycarbonate Train

Start-up Will Bring 65,000 Metric Tons to Korea and Broader

Pacific Markets

http://news.dow.com/dow_news/prodbus/2005/20050906a.htm

LG DOW

Polycarbonate Ltd. (LG-DOW),

a 50/50 joint venture between The Dow Chemical Company and LG

Chem, Ltd., today announced the next steps in a plan to build its second

polycarbonate train in Yeosu, Korea.

"Basic engineering work for the second polycarbonate train

is already completed, paving the way for us to initiate the

construction process," said Mark Remmert, LG-DOW President

and one of two representative directors for the JV. "We have

also appointed a full-time project manager to take us through

detailed engineering to a fully operational train."

"Just as LG-DOW's first polycarbonate train helped supply

the region's high demand for polycarbonate resins, the planned

second train will serve an equally critical role in fulfilling

our customers' expectations and sustain our mutual growth,"

added Mr. DH Jun, Executive Vice President and the other

representative director of the JV.

LG-DOW's second polycarbonate train has a planned nameplate

capacity of 65,000 metric tons (143 million pounds), which is

designated to supply Korea and other markets in Asia Pacific.

Assuming that all milestones are achieved, it could be fully

operational in less time than the industry average of two years.

This would be made possible in part because critical

infrastructure for a second train was included in the

construction of the joint venture's first polycarbonate train,

which began in July 2001.

The project management team, led by newly appointed project team

leader Julian Schoenborn, will be responsible for developing a

formal timeline for start-up. He will also be responsible for

cost estimations, contractor selection, construction management

and future start-up of LG-DOW Train II.

"LG-DOW brings proven polycarbonate technology to Asia, and

the benefits associated with global CALIBRETM Polycarbonate Resins. With the

combined knowledge and experience of two global plastic leaders,

LG-DOW is ideally positioned to continue meeting the needs of

global customers while leveraging local logistics capabilities to

meet 'just-in-time' demands of a diverse customer base,"

Remmert said.

Polycarbonate resins are high-performance resins offering an

exceptional combination of clarity together with heat and impact

resistance. Precise control of molecular architecture, a result

of Dow's proprietary production process, gives the polycarbonate

resins very high ductility and toughness over a wide temperature

range. Polycarbonate resins are used in the manufacture of a

variety of products, including compact discs, mobile phones,

notebook computers, computer monitor housings, water bottles,

vehicle headlamps, and construction materials.

About LG DOW Polycarbonate Ltd.

A 50/50 joint venture between The Dow Chemical Company (Dow) and

LG Chem, Ltd. LG- DOW is among the largest petrochemical

investments in Korea. LG-DOW commenced operations on July 1,

2001, when it started its first 65,000 MTA plant in Yeosu, Korea,

assuming the market franchise for CALIBRE Polycarbonate resins

from The Dow Chemical Company. The primary business of LG-DOW is

the manufacture and supply of CALIBRE Polycarbonate resins to

customers in Asia Pacific.

LG DOW Polycarbonate Ltd. continues to effectively serve

customers, and satisfy growing needs in the Asia Pacific

engineering plastics market by matching the strengths of global

plastics leaders, Dow and LG. For further information on LG-DOW,

visit www.lg-dow.com.

2005/9/28 LG Chem

LG Chem Plans to Commercialize Portable Fuel Cell

http://www.lgchem.com/press/releases/releases_view.jsp?idx=131

LG Chem, Ltd., the

largest chemical company in Korea, announced today that it has

completed its development of portable fuel cells and plans to

commercialize the product within this year. Methanol fuel will be used to power the fuel

cells.

The durability of LG Chem's fuel cells lasts for more than 4,000

hours, which is 8 times longer than products developed by its

competitors.

LG Chem's portable fuel cells are a micro miniaturized product,

which is less than 1 liter in the core volume and weighs less

than 1 kg. It's easy to carry and can be used to power laptops

and other electronic equipment through long periods of time by

exchanging cartridges that contain methanol fuel.

1 fuel cell cartridge (200cc capacity) can power a 25W laptop for

more than 10 hours.

LG Chem's newly developed fuel cell system produces 25W of power,

which is the world's largest power output among its kind. In

particular, power hungry devices such as PMP (Portable Multimedia

Player); DMB (Digital Multimedia Broadcasting) phones and laptops

can be powered by using a USB port.

As the power demand for electronic devices such as laptops and

cell phones increases, LG Chem plans to further develop various

fuel cells which can generate power ranging from 5W to 50W. The

company expects to apply the 50W fuel cell to high performance

laptops and electronic components; moreover, it hopes to broaden

its usage to other devices.

"Developing a fuel cell which has a long durability and

reliability is a great opportunity for LG Chem to outpace its

competitors and gain a strong presence in the global

market," said Jong-Kee Yeo, President and CTO of LG Chem.

"Once the global codes and standards for portable fuel cells

are prepared within the end of this year, the company will soon

start commercialization by meeting growing demands in areas such

as laptops and cell phones. Moreover, it will be applied in areas

such as portable electronic devices for the military" the

CTO added.

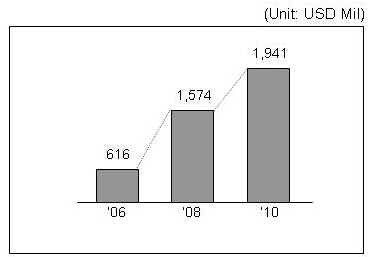

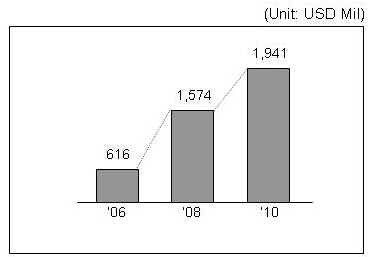

In addition, the global demand for portable fuel cells in 2006 is

estimated to reach USD 600 million. The market is expected to

reach USD 1.9 billion with a high growth rate of 28.3%/yr by

2010.

| Editor's

Note |

| Overview

of LG Chem |

| |

LG Chem, Ltd.,

is the leading chemical company in Korea in terms of both

size and performance. It is a vertically integrated

chemical company that manufactures a wide range of

products from petrochemical goods to high value added

plastics and high performance industrial materials. It

also extends its chemical expertise to high-tech

materials for electronics and information technology such

as state-of-the-art rechargeable batteries and display

materials. |

| |

|

| Fuel

Cell |

| |

Fuel cell is a

mechanism, which transform chemical energy such as

hydrogen and methanol into electric energy. Unlike

batteries, which require recharging, fuel cells can

continuously produce electricity under the condition that

fuel is constantly supplied. It is also environment

friendly and is considered the next generation of energy.

|

| |

|

| Development

Trend of Portable Fuel Cell |

| |

A portable fuel

cell can be largely classified into methanol fuel cell

and a hydrogen macromolecule fuel cell that requires a

miniature reformer.

The hydrogen macromolecule fuel is not adequate to be

applied on mobile IT devices since it requires a macro

reformer or a hydrogen storage container to generate

power. On the other hand, the DMFC (Direct Methanol Fuel

Cell) can contain higher levels of energy and uses less

dangerous methanol to generate power; therefore, the DMFC

is widely being developed over the hydrogen macromolecule

fuel cell.

LG Chem developed the DMFC. |

| |

|

| Direct

Methanol Fuel Cell |

| |

Methanol fuel

cells generate electric power by mixing methanol with air

(oxygen); therefore, it does not require a macro

reformer. It's also much more portable than hydrogen

macromolecule fuel cells. Moreover, methanol fuel cells

are less dangerous than hydrogen macromolecule fuel cells

as it generates power under 100°C. In addition, methanol fuel

cells contain 4,759 Wh/L of energy density, which is much

higher than the energy density of rechargeable batteries

(450 Wh/L).

|

| |

|

| Global

Market for Portable Fuel Cell |

| |

|

| |

* Source: Fuel

Cells for Portable Power, Darnell for US Fuel Cell

Council, 2003 |

2005/10/4 LG Chem

LG Chem Launches HI-MACS

Manufacturing Facility in U.S.A.

http://www.lgchem.com/press/releases/releases_view.jsp?idx=132

10.04.2005

LG Chem, Ltd., the

largest chemical company in Korea, announced today that it will

open its first U.S manufacturing facility, LG Chem Industrial

Materials Inc. (LG

CIM), in Gordon County, Georgia. LG Chem will commemorate the

grand opening of the facility on 3rd October 2005.

The new facility will produce LG HI-MACS, which is an artificial acrylic

solid surface,

mainly applied to bathroom and kitchen counter tops.

The company invested a total of USD 40 million into the facility.

The specification of the HI-MACS, which LG CIM will start to

produce, is 760mm(width) x 3680mm(length) and the thickness will

range from 6mm to 12mm. The annual production capacity will be

300,000 sheets.

Georgia was strategically selected as the most suitable location

due to its stable supply of raw materials, low labor cost, and

fast delivery. Other advantageous are logistics, and reduction in

import tax. Furthermore, the enthusiasm and support from the

State of Georgia was one of the major attractions for the

investment.

"Not only will the project hold a great significance for our

company but also it will be beneficial to the State of Georgia as

well. This is truly a win-win situation," said President and

CEO of LG Chem, No Ki-Ho, during his commemoration speech on 3rd

October 2005.

"This marks a great significance for LG Chem as it will be

the first manufacturing facility in the North America,"

added the CEO.

Overall, the global markets size for acrylic solid surface in

2004 was KRW 1.2 trillion. Out of the total global market size,

LG Chem's market share was 14% and the company plans to increase

its market share to 20% by 2008.

LG Chem will be the first chemical company in Korea to launch a

manufacturing facility in North America.

Editor's Note

Overview of LG Chem

LG Chem, Ltd., is the leading chemical company in Korea in terms

of both size and performance. It is a vertically integrated

chemical company that manufactures a wide range of products from

petrochemical goods to high value added plastics and high

performance industrial materials. It also extends its chemical

expertise to high-tech materials for electronics and information

technology such as state-of-the-art rechargeable batteries and

display materials.

Platts 2006/9/6

S Korea's LG may scrap

80,000 mt/year PVC line in efficiency move

South Korea's LG Chem has

been considering scrapping an 80,000 mt/year polyvinyl chloride

line in the company's Yeosu complex during November or December

this year in an effort to improve production efficiency, a

company source said Wednesday.

The company will

make a final decision by the end of October. But the source said

he was "99% certain" that the company will scrap the

line. "It will be more efficient to scrap the line and run

[the rest of] the plant at the full capacity," the company

source said. If the move goes forward, LG's PVC production

capacity at Yeosu would be slashed to 470,000 mt/year.

PVC producers have

been suffering from negative margins amid high ethylene feedstock

prices as they have not been able to pass on cost pressure to

their PVC products amid intensifying competition with

carbide-based PVC.

The carbide-based

PVC prices are typically Yuan 200-300/mt lower than

ethylene-based PVC.

2006/9/8 Asia Puls

LG Chem expands production facilities in China

LG Chem Ltd., South Korea's largest producer of chemicals, has

increased its production facilities for two chemicals products in

China, a move designed to tap the quickly expanding Chinese

market, the company said Friday.

LG Chem held a ceremony Thursday in its factory in Ningbo,

China's southeastern coastal province of Zhejiang, to mark the

addition of facilities there to produce 150,000 tons of

acrylonitrile butadiene styrene (ABS) annually, it said.

The addition catapulted LG Chem's ABS production capacity to the

world's largest level of 1 million tons, comprising 450,000 tons

from its Chinese unit, Ningbo LG-Yongxing Chemical Co., Ltd., and

550,000 tons from its South Korean factory in Yeosu, 455

kilometers southwest of Seoul.

(正しくは中国48万トン、韓国56万トンで、計104万トン)

ABS is

thermoplastic used to produce a number of products such as

electric devices, electronics goods and auto body parts.

"China's annual ABS demand amounts to 3.1 million tons and

this is expected to expand over 8 percent every year," the

company said in a statement. "We look forward to tapping the

Chinese market further, since about 60 percent of ABS consumed in

the market is imported."

LG Chem is the global leader in ABS production with a 15-percent

market share.

On the same day, LG Chem also launched operations at Ningbo LG-Yongxing

Latex Co.,

next to the ABS factory, to produce 70,000 tons of

styrene-butadiene latex (SBL) annually. SBL is a synthetic

plastic in liquid form that is widely used in paper coating and

as a textile adhesive.

LG Chem's SBL production capacity rose to a combined 150,000

tons, including 80,000 tons from its Yeosu factory, the company said.

LG Chem has been operating a holding company in China since last

year as it aims to become one of the top five chemical

manufacturers on the Chinese mainland by 2008. The holding

company supervises the operations of its 10 manufacturing

facilities and over a dozen offices in China. In 2008, LG Chem is

targeting US$4.5 billion in sales from China.

British Plastics &

Rubber October 30, 2006

LG bids for supremacy in polypropylene

LG International is to start selling polypropylene in Britain as

its new plant in Oman comes on stream. The company will take 250,000 -

300,000 tonnes per year of the 340,000 tonnes capacity of the Oman Polypropylene

plant -

a 20:80 joint venture between LGI and the Oman Oil company - and

plans to sell 100,000 tonnes of this into European markets. Its

target is to sell 20,000 tonnes of homopolymer in the UK within

two years at 'competitive prices' and to become the largest

stockist of PP homopolymer in the country.

LG's Luban material is made to a Novolen gas-phase technology

licence from Novolen Technology Holdings, a joint venture company

owned 80 per cent by ABB and 20 per cent by Equistar. Initial

grades will be for the injection moulding, BOPP (fibre),

extrusion, thermoforming and film sectors. Products will be

offered in a range of melt flow indices to suit specific

applications including household appliances, furniture, closures,

thin-walled packaging, tape yarns, monofilaments, strapping,

non-woven spunbonded, OPP and cast films.

All the materials will be held in stock in the UK ready for

delivery within 48 hours in bulk loads or 1・25 tonne pallet lots of 25 kg

bags. Europe-wide technical support is already in place.

Platts 2006/11/15

S Korea's LG

Petrochemical to become propylene exporter in 2007

South Korea's LG

Petrochemical is set to become a net exporter of propylene from

2007, following the completion of its olefins conversion unit at

Yeosu in September this year, company sources said Tuesday. The

OCU is able to produce 80,000 mt/year of propylene.

LGPC imported 50,000-60,000 mt of propylene in 2006. From 2007,

it plans to sell about 30,000mt of propylene through term

contracts and in the spot market. Its term contracts will be

based on spot prices published by Platts (FOB Korea) and ICIS

(CFR Northeast Asia). Other price formula details would differ

from contract to contract.

May.31,2007 english.chosun.com

LG Opens LCD Cluster in

Poland

LG has established a

bridgehead in Poland to further advance into the European market,

with a one-stop manufacturing cluster for LCD components and

televisions that opened on Wednesday.

Key components for the

cluster in Poland will come from Korea. LG plans to assemble and

produce LCD components and finished TV sets at the cluster for

distribution in Europe, the world's largest LCD TV market.

LG held a dedication

ceremony for the LG Poland LCD Cluster near the city of Wroclaw

in the southern part of the Central European country.

Four LG Group affiliate

facilities are operating in the cluster -- LG Electronics' finished TV set assembly line, LG.Phillips' LCD module assembly plant, LG Chem's polarizer plant and LG Innotek's inverter and power module

manufacturing plant.

The W500 billion

(US$1=W931), 1.5 million-sq.m cluster is LG's third largest

manufacturing base after the Paju Display Cluster measuring 4.4

million sq.m and the Nanjing Display Cluster measuring 2.04

million sq.m. LG plans to produce 2.4 million LCD units annually

at the Poland site.

"With demand for LCD

TVs expected to increase rapidly in the European region, the

Poland cluster will play a key role in LG's entering

Europe," Koo Bon-moo, chairman and CEO of LG Group, said

before the ceremony.

LG chose the site in

Poland since the Wroclaw area is a nexus of transportation links,

including highways and air routes. That makes Poland an ideal

launching pad for entry into Europe.

This year Europeans are

expected to buy 27 million LCD TVs, or 37 percent of the global

LCD TV market. LG considers Poland an attractive market with a

population of more than 38 million and US$13,000 in consuming

power per capita.

LG Electronics also

opened a side-by-side refrigerator assembly plant with an annual

capacity of 300,000 units in Poland. The company aims to take on

Western home-appliance makers like Bosch, Electrolux and

Whirlpool.

At the end of this year,

LG Electronics plans to add an air-conditioner assembly line in

the Poland cluster and develop it into a base for supplying

high-end home appliances in Europe.

LG.Phillips LCD plans to

supply LCD modules produced in the Poland cluster to global TV

makers located in Eastern Europe. Several LCD TV makers have

assembly plants in the region, including a Phillips plant in

Hungary, Panasonic and Tatung plants in the Czech Republic, and a

TCL-Thomson Electronics plant in Poland.

The Poland cluster will

help LG quickly supply LCD modules to the European market and

offer more services to local customers, such as technology

solutions.

Japan's

Toshiba, which holds a 19.9 percent stake in the Poland

subsidiary of LG.Phillips LCD, is now building an LCD TV plant

in the area which should begin operating in August. Toshiba is

expected to become a major buyer from LG.

Nam Yong, vice chairman

and CEO of LG Electronics, said, "By connecting the Poland

cluster with the Paju cluster in Korea and the Nanjing cluster in

China, we are going to enhance our competitiveness through

collaboration and division of labor."

Jul 05, 2007 Thomson Financial via COMTEX

SKorea's LG

Chemical to merge with LG Petrochemical to boost synergy

South Korea's largest chemical company LG Chemical Ltd said

Thursday its board has approved a plan to merge with LG

Petrochemical Co Ltd in a move aimed at boosting operational

synergies between the two.

"The two companies agreed to merge in a bid to actively

respond to changes in the business environment domestically and

overseas, to boost efficiency and maximize synergies and to grow

into a global petrochemical company," LG Chemical said in a

regulatory filing.

The merger will also boost LG Chemical's bargaining power for

purchasing raw materials as well as lowering its debt ratio.

LG Chemical already holds 40 percent of LG Petrochemical as of end-2006.

LG Petrochemical shareholders will receive 0.48 LG Chemical share

for every LG Petrochemical share, with the merged entity

scheduled to be launched in November, the company said.

Following the merger, LG Chemical said it will have an annual

ethylene production capacity of 1.66 million tons, placing it as

the second largest domestic producer and fifth in the Asian

region.

At 11:58 am, LG Chemical was down 1,300 won or 1.48 percent at

86,700 won, while LG Petrochemical was up 600 won or 1.45 percent

at 41,950 won.

2009/3/11 トステム

トステムとLG化学が新合弁会社を設立

住生活グループのトステム株式会社(本社:東京都江東区、社長:小川康彦、以下トステム)と韓国LGグループの株式会社LG化学(LG

Chem. Ltd.、本社:大韓民国ソウル市、CEO:金磐石[キムバンソク]、以下LG化学)は、韓国ソウル市にアルミ建材および産業用アルミニウム製品の供給拠点となる合弁会社「LG−TOSTEM

BM Co., Ltd. ※(以下LG−TOSTEM)」(設立日:2009年4月予定)を設立することに合意し、本日、新会社設立に関する「合弁会社契約書」を締結しました。

「LG−TOSTEM」は、トステムのアルミ建材の製造技術と、LG化学の樹脂サッシ等産業建材の販売力を融合させ、近年建物の高層化など、アルミサッシ需要が高まる韓国における販売拡大を目指します。

LG 化学は、2009年4月1日に3つの事業分野(石油化学、情報電子素材、産業材)のうち産業材事業部門を分社化し、新しく「LG

Hausys(LGハウシス)Co., Ltd(以下LG Hausys)」を設立します(本件は2008年12月発表済み)。「LG−TOSTEM」は、新会社「LG

Hausys」の子会社として、アルミ建材、産業用アルミニウム製品などを韓国の市場に供給していきます。

■「LG−TOSTEM」設立の経緯、目的

韓国では建物の高層化などにより、近年アルミサッシの需要が高まりつつあります。

そうした中、LG化学は今後の市場を見据えアルミサッシの製造・販売強化を検討しており、一方トステムは、海外販売戦略の一環として、韓国市場でのパートナーを求めていました。そこで両社の思いが一致し検討した結果、合弁会社設立の運びとなりました。

■「LG−TOSTEM」今後の展開について

LGグループの中核会社であるLG化学と、日本のアルミサッシ市場でシェアNo.1のトステムは、この新会社設立により、2012年に1,200億ウォン(120億円)※の売上を目指します。

※為替レート 1ウォン=0.1円で計算

また、新会社のコスト競争力、新商品開発力を活かし、韓国市場だけではなく将来的には海外市場にも展開していきたいと考えております。

■「LG−TOSTEM」の主な取扱い商品について

アルミ建材や産業用アルミニウム製品などの製造・販売を行なっていきます。

<今後の体制について>

(1)トステムとLG化学で合弁会社「LG−TOSTEM」の設立を合意(2009年3月)

(2)LG化学の産業材事業部門を分社化し「LG

Hausys」を設立(2009年4月1日)

(3)「LG Hausys」の子会社として「LG−TOSTEM」の事業開始時(2009年4月以降)

【新会社の概要】

会社名:LG−TOSTEM BM Co., Ltd.(4月設立時の社名予定)

所在地:大韓民国ソウル市

設 立:2009年4月(予定)

資本金:60億ウォン

出資比率:LG化学 51%、トステム 49%

従業員数:25名(設立時)

事業内容:アルミ建材および産業用アルミニウム製品の製造、販売