NPC's Annual Report 2001

http://www.nipc.net/npcg/2001/Special.html

Petrochemical Special Economic Zone

Lying on the northern coast of

the Persian Gulf, the Petrochemical Special Economic Zone, also

known as Petzone, is Iran’s

first specialized zone formed for the development of the country’s petrochemical industry. The zone expands

over an area of 2300 hectares in the southern town of Mahshahr in

the oil-and-gas rich province of Khuzestan. Being home to several

petrochemical facilities, namely Bandar Imam, Razi and Farabi,

Mahshahr is already the hub of Iran’s petrochemical industry. In the meantime,

9 great petrochemical and one centralized utility facilities are

being built in the Petzone. Once the petrochemical facilities are

on track, they will produce 5 million tonnes of various products

annually. The zone is divided into five sites. Situated in the

northern part of the zone, site No. 1, covering an area of 240

hectares is designated for the private sector light industries

and downstream petrochemical plants. Some parts of the site have

been set for administrative and civil services as well as

commercial centers.

Site No. 2, which expands over an area of 350 hectares, has been

allocated to both light and heavy industries. Olefin No. 7,

isocyanates and PVC projects will be built in this site. With an

area of 260 hectares, Site No. 3 will be home to heavy industries

projects. Site No. 4 is exclusively devoted to the NPC’s grassroots development projects. This

site covers an area of 200 hectares. Site No. 5 has been set

aside for warehouses, tank farms and heavy industries as well.

Petzone is located nearby the Bandar Imam’s port facilities. The port has 37 docks

with an annual loading and unloading capacity of 16 million

tonnes of cargo. Currently, the zone’s own dock, which has an annual capacity

of two million tonnes, is under construction for exporting liquid

petrochemicals.

So far, the zone has attracted over $3bn of investment for the

petrochemical projects while it potentially can attract over $5bn

of investment.

Projects being executed in the

Petzone are as follows: * Intermediate product

| Projects |

Products |

Capacity

1000T/Y |

MTBE

Owner: Petrochemical Industries Development Management

Co. (PIDMCO)

Ownership: NPC (100%)

Site: BIPC

Project starting date: 1997

Status: Completed |

MTBE |

500

|

1st PTA/PET

Owner: Shahid Toondguyan Petrochemical Co.

Ownership: NPC (100%)

Project starting date: 1997

Completion date: 2003 |

*PTA

Fiber-Grade PET

Bottle-Grade PET |

350

235

117

|

6th Olefin

Owner: Amir Kabir Petrochemical Co.

Ownership: NPC (84%), Social Security Organization (12%),

Others (4%)

Project starting date: 1998

Completion date: 2002-2003 |

*Ethylene

*Butene-1

*C4 Cut

Propylene

HDPE

LLDPE

Ethylene

Fuel oil

Butadiene Ext.

Pyrolysis Gasoline |

520

20

104

154

140

300

57

24

50

137

|

3rd

Aromatics

Owner: Bou Ali Sina Petrochemical Co.

Ownership: NPC (100%)

Project stating date: 1998

Completion date: 2003 |

Orthoxylene

Paraxylene

Benzene

Liquified Gas

Raffinate

Light Ends

Heavy Ends

Heavy Aromatics

C5 ’Cut |

30

400

180

39

199

350

500

23

21

|

Centaralized

utility plant

Owner: Fajr Petrochemical Co.

Ownership: NPC (100%)

Project starting date: 1998

Completion date: 2002 |

Electricity

Steam

Instrument air

Service air

Oxygen

Nitrogen

Service water

Potable water

D.M. water

Boiler Feed water |

585 MW

860 T/Hr

15,000 NM3/Hr

16,500 NM3/Hr

19,000 NM3/Hr

18,000 NM3/Hr

400 M3/Hr

250 M3/Hr

980 M3/Hr

4,680 M3/Hr

|

Engineering

Polymers

Owner: Khuzestan Petrochemical Co.

Ownership: NPC (100%)

Project starting date: 1998

Completion date: 2003 |

Polycarbonate

Solid epoxy resins

Liquid epoxy resins |

25

5

5

|

2nd PTA/PET

Owner: Shahid Toondguyan Petrochemical Co.

Ownership: NPC (100%)

Project starting date: 1999

Completion date: 2004 |

*PTA

PTA

Fiber-grade PET

Bottle-grade PET

Polyester Staple Fiber

Polyester Filament

|

350

10

132

132

65

65

|

3rd

Methanol

Owner: Fanavaran Petrochemical Co.

Ownership: NPC (100%)

Project starting date: 2000-2001

Completion date: 2003-2004 |

*Methanol

*CO

Methanol

Acetic Acid

CO |

1000

140

920

150

50

|

LDPE (7th

Olefin)

Owner: Laleh Petrochemical Co.

Ownership: Sabic Europe Petrochemical Ltd. (30%), Marun

(45%),

Pushineh Iran (25%) |

LDPE |

300

|

7th Olefin

Owner: Marun Petrochemical Co.

Ownership: NPC (100%)

Project starting date: 2000

Completion date: 2004 |

*Ethylene

*Propylene

*Pyrolysis Gasoline

*C2+

LDPE

PP

Ethylene

HDPE

MEG

DEG |

1,100

200

83

1,900

300

300

217

300

400

45

|

Isocyanates

Owner: Karun Petrochemical Co.

Ownership: NPC (40%), Chematur A.B. (30%), Hansa Chimie

(30%)

Project stating date: 2001

Completion date: 2004-2005 |

Toluene

diisocyanate (TDI)

Diphenylmethane diisocyanate (MDI)

*Carbonyl Di-chloride

*Anilyne

*Nitric Acid |

40

40

84

30

56

|

A polypropylene plant

contract is awarded to Tecnimont-Nargan

http://www.nipc.net/npcnews/news8and9/projects.html

The National Petrochemical

Company (NPC) awarded, on September 17, 2000, the contract

for a polypropylene (PP) plant of its 7th olefin facility to

Italy's Tecnimont SPA. The plant will be built in Bandar

Imam, Petrochemical Special Economic Zone (Petzone). The 300

Kt/a homopolymer/copolymer polypropylene plant will be based

on the Montel's technology.

The contract calls for the provision of license, basic

engineering, supply of equipment and technical assistance.

The plant will be fed by Marun (olefin no. 7) Complex's 1.1m

t/y ethylene cracker. Marun Petrochemical Company, which is

an NPC subsidiary will implement and

run the project.

Tecnimont's partner, Iran's Nargan will provide the detailed

engineering and those pieces of equipment that are

manufactured locally. The facility will be supplied within 24

months.

2003/5/21 Asia Chemical Weekly

Iran's NPC to start up engineering polymers project Q3 '03

Iran's National Petrochemical Co (NPC) expects to start up its

$198m (Euro170.1m) engineering polymers facility in the

Petrochemical Special Economic Zone in the third quarter of 2003

having already completed 93% of the project, according to the

NPC's latest news bulletin.

The facility, to be operated by NPC subsidiary Khuzestan

Petrochemical Co (KZPC), will produce 25 000 tonne/year of

polycarbonate (PC) epoxy resin, 5000 tonne/year of liquid epoxy

resin and 5000 tonne/year of solid epoxy resin.

Basic engineering for the project, which is wholly owned by NPC,

has been completed by German engineering company Salzgitter which

also supplied the technology.

Namvaran of Iran and Noyvallesina of Italy are the detailed

engineering & procurement contractors for the project.

The plant will consume 2.5m cubic metres/year of natural gas, 29

000 tonne/year of caustic soda, 1500 tonne/year of hydrochloric

acid (HCL), 9500 tonne/year of chlorine, 8000 tonne/year of

acetone, 27 000 tonne/year of phenol and 5000 tonne/year of

epichlorohydrin. Acetone, phenol and epichlorohydrin will be

imported while the remaining raw materials will be produced

domestically.

化学工業日報 2003/8/27

イランNPC、メタ100万トン設備が来月末稼働

イランNPC(国営石油化学会社)が建設を進めている年産100万トンのメタノール設備が、9月末に稼働する見通しとなった。このプロジェクトと連動するかたちで、同15万トンの酢酸設備の建設も進展しており、2004年末には完成・稼働する計画。NPCはまた、これに次ぐ世界最大規模のメタノール新設プロジェクトにも着手しており、2005年までに年産総能力は340万トンに拡大、世界市場での展開に弾みがつく見通しだ。

Platts 2004/3/10

Iran Pidek, German

Lurgi sign deal for Iran's No 2 methanol plant

Iranian

Petrochemical Industries Development and Engineering Co (Pidek)

and German Lurgi, signed a Eur160-mil ($196.54) deal for setting

up the second methanol project, the official Iranian news agency

reported Wednesday.

The plant, with a

daily production capacity of 5,000mt, is located at Pars Special

Energy Economic Zone in Assalouyeh at the Persian Gulf. South

Pars facilities and Mobin Petrochemical Co, affiliated to

state-owned National Petrochemical Co, will provide the feedstock

for methanol. The project is expected to take two years to

complete, IRNA said. The contract includes license, engineering,

procurement and technical support.

NPC's Zagros

Petrochemical Co is the plant operator. Once onstream, Zagros'

methanol production would rise to 10,000mt a day, together with

No 4 methanol unit. The No 4 plant has a 1.65-mil mt/yr capacity

and would come onstream January 2005. Iran's No 3 methanol plant,

with a 1-mil mt/yr capacity, would be operational in the near

future. Once all four projects are operational, Iran's methanol

output would be 3.4-mil mt/yr.

2003-10-23 ACW

Shell, Basell suspend Iran's

Olefins No8 for now

http://www.chemweekly.com/ReadNews.asp?NewsID=919&BigClassName=Companies&BigClassID=25&SmallClassID=43&SpecialID=24

Shell Chemicals and Basell have

withdrawn from the Olefins No 8 project in Iran for the time being because of a

disagreement over timing, according to Rein Willems, Shell's

executive vice president, business and procurement units.

However, Willems has stressed that the exit is not a done deal

and that the door to re-enter the project remains open for Shell

and Basell, who had originally considered taking a combined 50%

stake.

Willems said Iran's National Petrochemical Co (NPC) would pursue

the 1m tonne/year cracker project on its own for the time being

with the intention of bringing the facility onstream in 2006-07.

The project is located at Bandar Imam.

He said Shell and Basell both preferred to start up the project

in 2008-09 to avoid the added costs that would be incurred by

pursuing the project more rapidly.

One major driver behind NPC's desire to develop the country's

petrochemical industry rapidly is to boost overall economic

growth. Completion of a study into the project by the Western

producers had previously been delayed from end-2002 to Q1 2004.

Willems also says that Shell is due to make a final decision on

its joint venture cracker project in Pulau Bukom, Singapore, by

early 2005. If this schedule is met, building will begin some

time after the fourth quarter of that year, he added.

Shell and Sumitomo signed a letter of intent earlier this year to

pursue the project jointly.

This timetable would mean a startup of around 2008-09 for the

project, which would centre on a 1m tonne/year cracker.

Shell expects to move to the next stage of its Singapore project

feasibility study in Q1 of next year.

Willems also re-affirmed that Shell is examining the construction

of a worldscale monoethylene glycol (MEG) plant downstream of the

planned Singapore cracker.

He said the did not any more styrene or propylene oxide (PO) in

Singapore.

Ellba Eastern, a joint venture between Shell and BASF, brought

onstream a styrene monomer/PO (SMPO) plant on Jurong Island,

Singapore, in July 2002. It produces 550 000 tonne/year of

styrene and 250 000 tonne/year of PO.

In addition, an SMPO plant of similar capacities is part of

Shell's joint venture cracker project with CNOOC Petrochemicals

Investment in Guangdong, China. The Nanhai project is due to

start up at end-2005.

Shell is also understood to be keen on producing phenol

downstream of the planned Nanhai cracker.

Platts 2004/3/16

Iran's NPC to start up No 3

aromatics project by mid-2004

Iran's National Petrochemical Co has scheduled to commission its

No 3 aromatic complex in Bandar Imam Khomeini by July at the

latest, and start commercial operations by October, a company

source said Tuesday. NPC had initially scheduled to start up the

plant in January this year. According to the source, construction

at the No 3 site was already completed for 97%. When finished,

the complex would have the capacity to produce 400,000 mt/yr of

paraxylene, 180,000 mt/yr of benzene, as well as 30,000 mt/yr of

orthoxylene.

2004/04/12 東洋エンジニアリング/千代田化工建設

TEC・千代田連合、イランより2基目の大型肥料プラント受注

http://release.nikkei.co.jp/detail.cfm?relID=69384

東洋エンジニアリング株式会社(TEC、取締役社長 広瀬俊彦)、千代田化工建設株式会社(千代田、取締役社長 関誠夫)とイランのエンジニアリング会社ピーデック社(脚注)とのコンソーシャムは、三井物産株式会社の協力を得て、イラン国営石油化学会社(NPC)傘下のPIDMCO社から、バンダル・アサルイエ地区にて計画を進めている同社2基目の、アンモニア日産2,050トンと尿素日産3,250トンを生産する肥料プラントの、設計および機器資材一式の調達業務を随意契約にて受注いたしました。

本案件は、サウスパースガス田より生産される天然ガスを原料に世界最大級の肥料プラントを建設するものであり、現在TECをリーダーとする3社のコンソーシャムが建設している肥料プラントと同一の設備を隣接地に建設するものです。1基目の肥料プラント建設でのTEC・千代田・ピーデック3社コンソーシャムによるスムーズなプロジェクト遂行に対する客先の高い信頼と、国際協力銀行によるNPC向けの輸出金融適用及び日本貿易保険の貿易保険付保が受注に至った大きな要因です。

<受注概要>

■客先:PIDMCO(Petrochemical Industries

Development Management Company)

<イラン国営石油化学会社傘下の会社>

■建設地:イラン・イスラム共和国南部のバンダル・アサルイエ(Bandar Assaluyeh)地区

■対象設備:日産2,050トン・アンモニアと日産3,250トン・尿素の製造設備

<TECがアンモニア設備を、千代田が尿素(大粒尿素)設備を担当

ピーデックは両プラントの詳細設計、現地品の調達を担当>

■ライセンサー:

* アンモニア:英国・MWケロッグ社、

* 尿素:オランダ・スタミカーボン社、ベルギー・ハイドロファーティライザー社

■役務内容:基本設計、詳細設計、機器資材調達、テクニカルアシスタントサービスの一括請負

■プラントの完成:2006年を予定(注:建設は顧客が現地業者を使い遂行する)

■契約金額:約250億円

■ファイナンス:

今回の国際協力銀行(JBIC)によるイラン国営石油化学会社(NPC)向け輸出金融は、従来のようにイラン政府保証を求めず、イランの優良国営企業たるNPCに直接与信する画期的なもの。

■受注の意義:

* 1基目の肥料プラント建設での当コンソーシャムによるスムーズなプロジェクト遂行に対する客先の高い信頼性から、同規模の設備を入札無しで受注するに至ったこと。

* 今回の受注は海外大型プロジェクトにおけるTEC・千代田の協力関係上、3件目の実績となったこと。(イラン向け肥料2件とサハリン2LNG)

<脚注>

イラン・ピーデック社:イラン国営石油化学会社(NPC)のエンジニアリング会社で、コンソーシャムのイラン側パートナー。ピーデック(PIDEC)とは Petrochemical

Industries Design and Engineering Companyの略

2004/7/13 三井造船/三井化学

イランIPC社向け高密度ポリエチレン製造プラントの建設受注・契約調印について

三井造船株式会社(以下「三井造船」。社長:本山登雄)は、三井化学株式会社(以下「三井化学」。社長:中西宏幸)と共同で、三井物産株式会社の協力を得て、イランの National

Petrochemical Company(イラン国営石油公社、以下「NPC」。総裁

Mr.M.R.Nematzadeh)の傘下であるILAM Petrochemical Company(以下「IPC」。社長:Mr.D.F.Farahani)向け、高密度ポリエチレン製造プラントの建設を受注し、7月12日に契約を調印しました。

<契約の内容>

1.受注プラント: 高密度ポリエチレン(*)製造プラント 年産30万トン

*:包装材料、パイプ及び日用雑貨等の素材として利用される樹脂

2.建設地:イラン国イーラム州イーラム工業団地

3.プロセス:三井化学保有の高密度ポリエチレン製造技術

4.受注総額:約250億円

5.契約締結日:2004年7月12日

6.着工:2005年4月(予定)

7.完工:2007年12月(予定)

本契約は、NPCグループにとって、初めてのフルターンキーベース(**)の契約であり、欧州・韓国など海外の有力な競争先が商談に参加しましたが、高品質製品の製造に適し、世界各国に多くの技術供与実績を誇る三井化学の技術を、三井造船のポリオレフィンプラント建設に関わる数多くの実績や設計・調達・マネージメント能力が高く評価され、今回の受注に至りました。これにより、三井造船としての高密度ポリエチレン製造プラント建設の受注は、25件目になります。また、三井化学としての、当該技術供与は41系列目で、当該技術の世界合計生産能力は年産450万トン超となり、その存在感がさらに増すこととなります。

**:製造プラントの設計、機材調達、建設、試運転まで全て行った後に引渡しを行う契約形態。

プロジェクト遂行にあたって、三井化学は技術を供与し、三井造船は製造プラントの基本設計、機材の調達及び製造プラントの建設指導を行います。なお、三井造船はイラン国内の大手設計会社である

Energy Industries Engineering & Design Co.(以下「EIED」)とコンソーシアムを形成し,EIED社に対し、イラン国内の機材調達及び製造プラント建設工事を担当させます。

なお、本プロジェクトには、国際協力銀行による輸出金融の適用と日本貿易保険の貿易保険の付保を予定しています。

現在、イランでは、高密度ポリエチレンをはじめとし、石油化学分野の製造プラント建設が多数計画されており、三井造船は今回の受注を契機に、今後とも同国での受注活動を積極的に展開してまいります。一方、三井化学が保有するポリエチレン、ポリプロピレン製造プロセス技術は、世界的にも極めて高い水準にあると評価されており、今後とも全世界をターゲットに三井化学はライセンス活動を展開してまいります。

Platts 2004/10/21

SABIC-Iran cracker, integrated complex joint venture plan stalls

The proposed joint venture between Saudi Arabia Basic Industries

Corp and Iran's National Petrochemical Co, where SABIC was to

take a 50% stake in NPC's subsidiary Maroun Petrochemical Co, has

reached an impasse, confirmed SABIC's Vice Chairman and CEO,

Mohamed Al Mady, Wednesday. "The discussions with NPC have

not materialized," Al Mady said, addressing reporters at the

K 2004 plastics and rubber exhibition in Dusseldorf, Germany.

There is no guarantee that when SABIC enters into a discussion

with its potential partners or to make future investments, that

these will go smoothly, he said. In Iran, SABIC was assessing

three to four potential JV at one go, as the company was not able

to iron out several issues with NPC, it decided to put talks on

hold. "We will not take any decision unless it is beneficial

for us," he said, declining to elaborate the reasons why the

JV plans were shelved for the moment.

2006/4/27 Platts

Linde, Hyundai say no

financial loss from canceled Iran project

Germany's engineering company Linde and South Korea's Hyundai

Engineering and Construction Co have both confirmed the decision by

Iranian authorities to cancel foreign companies' role in Iran's

Olefin 11 project at

Pars Special Economic Zone, in favor of local contractors,

according to company sources this week.

Iran on Monday announced it was canceling contracts with Linde,

Hyundai and France's Technip totaling Eur960 million ($1.19

billion) for engineering work related to the construction of the

2.4 million mt/year ethylene cracker.

Of that amount, Linde and Hyundai had been awarded contracts

worth Eur404 million and Eur451 million respectively, while

Technip had been awarded the balance Eur105 million.

"It's true unfortunately, but there has been no financial

damage (to us) arising from it (the decision)," a source at

Linde said. "We have already been paid for the

pre-engineering work we have carried out so far," the source

said. "Olefin 11 was our biggest project in Iran, but we are

not dependent on Iran (alone)," the source added.

A source at Hyundai also said that there has been no financial

loss due to the canceled contract. "But we are concerned

that the aborted deal may damage the image of our company."

Technip declined to comment on this issue.

The Olefin 11 project would now be implemented by Iran's National

Petrochemical Company and domestic contractors with Eur260

million worth of savings, Asghar Ebrahimi-Asl, NPC's managing

director had said Monday. He added that the project's risk would

be reduced by awarding the contract to Iranian contractors.

Platts 2006/8/2

Venezuela's Pequiven signs information share agreement with Iran

Venezuela's state petrochemical company Pequiven has inked an

agreement with Iran's NPC to share information and specialists

from their respective petrochemical industries, a Pequiven

spokeswoman said on Wednesday.

Venezuela sent the first 16 Pequiven workers to Iran to work with

Iranian petrochemical specialists under the agreement, and the

workers met with Venezuelan president Hugo Chavez and Iranian

president Mahmud Ahmadineyad as they signed the agreement last

week.

Pequiven and Iran also expect to begin construction in September

on a technical school in Moron, Venezuela, that was outlined in a

previous agreement with Iran and will train Venezuelan

petrochemical workers, the spokeswoman said.

NPC will help train Pequiven's personnel to assist the company in

its effort to make Venezuela "a

worldwide petrochemical power" under its 2006-2012 business plan,

a Pequiven statement noted.

The deal to share information and specialists was signed in Iran

last week during a visit by Venezuelan President Hugo Chavez as

part of his two-week world tour. Also during Chavez's tour,

Pequiven agreed to study the purchase of potassium chloride from

a company in Belarus and Energy Minister Rafael Ramirez signed an

agreement for economic and technical cooperation on

petrochemical projects with Belarus.

November 26, 2006 Islamic

Republic News Agency

First private

petrochemical complex due to come on stream

| The

first private petrochemical unit in the country is due to

come on stream in Khuzestan provincial city of Mahshahr(Bandar

Imam Special Economical Zone ), head of board of

directors in Rejal Petrochemical Company told reporters

here on Saturday. Ali Mohammad Rejali said

in the first phase of the complex to be inaugurated next

week concurrent with the auspicious birth anniversary of

Imam Reza (A.S.), 90,000 tons of poly

propylene

is to be produced.

He added that

Isfahani investors have expended an amount of rls 950

billion for the complex and its development plan so far.

He stated during

the first stage of the complex development plan, the

production rate is expected to reach

160,000 tons.

It is also scheduled to produce propylene

gas from the natural "methanol" gas utilizing a

modern technology in the next steps.

The head of Rejal

Petrochemical Complex board of directors said the complex

was built in a 227,000-square-meter land out of which

some 127,000 square meters has been allocated for the

first phase of the complex.

During different

stages of the complex construction up to 1,200 working

forces were employed and by the time it goes into

operation it will be run by 180 people, he added.

Rejali stated

that due to the extensive uses of propylene in industries

such as textile, it also creates job opportunities and

for every ton of production a new job would be created.

The head of the

directing board said the complex license was purchased

from a German company and all the engineering work from

the beginning up to commissioning stage was done by

Iranian experts.

He referred to

breaking the ice in entrance of private sector to the

petrochemical industry as the main motivation in

investment in the complex under his management.

The head of Zarif

Mosavar Company's board of directors referred to

completion of production circle in the company and

supplying the needed raw material as the other incentives

for investment in Rejal Petrochemical Company.

This private

sector industrial manager reiterated that there was not

much expectation from the government but it paves the way

for the private sector to actively participate in

different fields.

He concluded that

the only way for the country's progress was to increase

production rate which is merely achieved through an

all-out participation and actual privatization process.

|

Platts

2007/1/25

Iran's

Parsphenol to start building new phe-ace plant this year

Iran's

Parsphenol, a privately owned company, is

aiming to start construction works on its planned 200,000 mt/year phenol-acetone plant by this year, Hossein

Yazdizadeh, president of Parsphenol said. Meanwhile, the

pre-commissioning and start-up of the company's phenol-acetone

plant was scheduled to be in 2010.

According to Yazdizadeh, Parsphenol had already completed a full

feasibility study for its phenol-acetone plant, which included

market analysis and technical evaluation. The total capital

investment in the plant was valued at around $250 million.

Yazdizadeh added that the bulk of Parsphenol's production would

be exported out of Iran, with specific focus on the Middle East

and other Asian countries.

Yazdizadeh explained that Parsphenol's concentration on the Asian

region stemmed from the fact that the main growth for bisphenol-A

(BPA), phenol's main derivative, would take place in Asia.

Research data from Parsphenol showed that in Asia, between the

time period 2007 to 2015, 340,000 mt/year of phenol capacity will

be added. However, average Asian phenol demand growth during the

same period, was expected to be around 400,000 mt/year. This left

a phenol shortfall of about 60,000 mt/year in Asia.

Parsphenol's slow progress on this project was also addressed by

Yazdizadeh. He pointed out that the most important reason for the

project's delay was tied in with Iran's National Petrochemical

Company (NPC) holdup in the construction of its "Olefin

12" plant in Assaluyeh. Parsphenol's propylene feedstock was

wholly provided by

NPC's "olefin 12" plant. Its benzene feedstock

would be obtained from NPC's fourth Aromatic (Borzouyeh) plant

also located in Assaluyeh.

Yazdizadeh added that Parsphenol was currently in the process of

selecting available and reputable companies as ita partner for

this project.

2007/4/11 Tehran Times

China eager to invest $2.7b in Olefin 12: NPC

National Petrochemical Company (NPC) Managing Director

Gholam-Hossein Nejabat here Tuesday said that China was keen to

make a 2.7 billion dollar investment in Olefin 12 plan in Iran.

Talking after an East Asia-Pacific states forum, he said the

Iranian and Chinese officials held new round of negotiations,

whose main topics revolved around a 2.7 billion dollar

investment in Olefin 12 plan and investment in downstream and

upstream oil projects in Iran. Nejabat said, “China is the first country the

Iranian party will pay a visit to hold official talks.”

According to the

NPC chief, the company’s output in the current Iranian

calendar year (started March 21, 2007) will reach 23 million

tons.

“To

this end, Iran’s presence in foreign countries

with the aim of doing marketing of petrochemical products plays a

determining role,” he added. The port of Hong Kong

was one of the world’s main markets for selling

petrochemical products, said the official, adding, “We plan to have a strong presence

in all fields related to trade and investment in the port.”

Nejabat said NPC

would welcome foreign investments in the petrochemical sector,

adding the company was determined to boost its economic

cooperation with foreign countries through improving relations

with Iranian ambassadors abroad.

He said Iran was holding talks with overseas enterprises on

implementation of petrochemical projects worth 9.4 billion

dollars. “Most of negotiations have resulted

in signing memoranda of understanding and establishing companies.

We are also active in every sector that has the capacity to

export technical and engineering services.”

The managing

director said scores of projects, including Arya Sassol

Petrochemical Complex with an annual one million ton ethylene

production capacity and Mehr Petrochemical Complex aiming to

produce heavy polyethylene, were under construction in

collaboration with investors from South Africa, Thailand, and

Japan.

“NPC

has also made investments in the Philippines and India; and has

outlined a host of plans to have a strong presence in Venezuela,

Oman, and Uzbekistan,” he revealed.

Shifting to the development of petrochemical industry in the

eastern, western, and central parts of the country, Nejabat

expressed hope the company would manage to build a complex in

each province as President Mahmud Ahmadinejad had already

ordered. “Iran accounts for 12 percent of

the Middle East’s petrochemical products and 0.7

percent of the world production,” said the deputy minister, adding, “The 20-year Outlook Plan has

targeted 34 percent share of the Middle East and 6.2 percent of

the international output.” The official said a 50 billion

dollar fund would be needed for achieving the objectives of the

Outlook Plan, adding, “We invest 12.5 billion dollars in

each Five-Year Economic Development Plan and the total investment

in the four plans amounts to 50 billion dollars.”

Pointing to the

parliament’s approval on removal of subsidies

on petrochemical products, Nejabat argued that the measure would

make the petrochemical market sound.

The Fourth Development Plan had allocated 12.5 billion dollars

for petrochemical projects, said the ranking official, adding the

projects were underway according to the Fourth Plan.

The NPC predicted that 35 petrochemical projects would come on

stream by the end of Iranian calendar year 1393 (March 20, 2015).

Iran is the second largest petrochemical producer in the Persian

Gulf littoral states, standing after Saudi Arabia, and will

retain its position until 2010.

The inauguration of the projects in question by 2015 will

considerably promote its status not only in the Persian Gulf

region, but in the world.

Apr14 2007

Iranians in China for oil

project

http://www.presstv.ir/detail.aspx?id=6055§ionid=351020103

Iran will send a

top-level delegation to China to continue talks with the Sinopec

Corp. over developing the Yadavaran Oilfield

in south Iran.

Experts from the Petroleum Engineering and Development Company

(PEDEC) and the head of legal affairs at the National Iranian Oil

Company (NIOC) will travel to China to continue talks, PEDEC's

managing director said.

Mehdi Bazargan noted that Iran and China have so far held several

rounds of negotiations over the field, which have brought views

closer. "However, it is premature to comment on the outcome

of the talks," he added.

Bazargan did not specify an exact date for the Iranians trip to

China.

Meanwhile, Iran's Oil Minister Kazem Vaziri-Hamaneh, on the

sideline of a Gas Exporting Countries Forum meeting in Qatar, has

said that Iran and China are close to a deal over the Yadavaran

Oilfield.

Also, Chen Tonghai, the president of the China Petroleum and

Chemical Corporation, known as Sinopec, has said the company is in

talks on providing engineering services to the Yadavaran field.

The state-owned Sinopec Group was not looking for an

equity stake in the Yadavaran field, but if a deal is reached it

would share profits from the field once it begins production, he

told reporters during a news conference in Hong Kong following

the release of the company's 2006 financial results.

"The negotiations (of an engineering contract) are underway,

but it's very complicated," Chen said.

Sinopec and NIOC signed a memorandum of understanding in October

2004, which allows the Chinese to buy $100b of oil and gas from

Iran over 25 years. It also covers the purchase of 150,000 bpd of

crude at the market rate.

The Yadavaran Oilfield is estimated to have 17 billion barrels of

reserves and production is to reach 300,000 bpd in two phases.

PEDEC is a subsidiary of the NIOC.

May 01, 2007 http://www.shana.ir

NPC CHIEF:Iran to Invest

Over $12bn in Petrochemical Sector

The managing director of National Petrochemical Company (NPC)

said Iran would make a 12.3 billion dollar investment in the

sector in the Fifth Five-Year Socioeconomic Development Plan

(2010-2015).

Gholam-Hossein Nejabat said his company would invest the huge sum

in 27 petrochemical projects during the Fifth Plan, out of which

9.2 billion dollars would be funded by hard currencies.

“The

investment helps the sector increase the petrochemical out by

33.7 million tons during the plan,” predicted the official.

Nejabat said 24 petrochemical projects with a 14.8 billion dollar

fund had been included in the Fourth Five-Year Development Plan

(2005-2010), with some becoming operational.

The NPC head said 13 petrochemical projects would come on stream

in the current year, adding three of them were ready for

inauguration.

2007/4/12 「イランで本年度

11計画が生産開始」

“At present, Iran

accounts for 12 percent of the Middle East’s petrochemical output, valued at

25 billion dollars, and the share will touch 34 percent by the

end of 20-year Outlook Plan, 2015,” said Nejabat.

“The

country’s world share is 0.9 percent,

which is predicted to reach 6.3 percent by 2015.

“According

to the Fifth Plan, Iran’s annual 55 million ton production

will soar to 158 million tons per annum.”

Petrochemical

products accounted for the highest share of non-oil goods Iran

exported in the past Iranian calendar year (March 21, 2006 to

March 20, 2007).

Totally 42.2 percent of the weight and 38.6 percent of the value

of exported non-oil products belonged to petrochemicals.

The country exported 14,236,800 tons of petrochemical products,

valued at 6.11 billion dollars, during the yearlong period,

showing 115.5 and 140.8 percent increases in terms of weight and

worth respectively when compared to those in their preceding

year.

According to the Customs Administration, gas liquids (propane,

butane), polyethylene, methanol, benzene, and different types of

tar were the main petrochemicals exported abroad as they

constituted 81 percent of the revenues fetched by petrochemical

products.

Iran's petrochemical products have been sold to more than 250

clients from 40 states.

Jul 2, 2007 Reuters

Iran, Venezuela in

"axis of unity" against U.S

The presidents of Iran and Venezuela launched construction of a

joint petrochemical plant on Monday, strengthening an "axis

of unity" between two oil-rich nations staunchly opposed to

the United States.

Venezuela's Hugo Chavez and Iran's Mahmoud Ahmadinejad, who both

often rail against Washington, also signed a series of other

deals to expand economic cooperation,

ranging from setting up a dairy factory in Venezuela to forming

an oil company.

"The two countries will united defeat the imperialism of

North America," a beaming Chavez told a news conference

during an official visit to the Islamic Republic, which the

United States has labeled part of an "axis of evil".

"When I come to Iran Washington gets upset," he said.

The two presidents -- whose countries are members of the OPEC oil

producing cartel -- earlier attended the ceremony to

start building a methanol facility with an annual capacity of

1.65 million tons on the Islamic Republic's Gulf coast.

"Iran and Venezuela -- the axis of unity," read one of

many official posters at the site near the port town of

Assalouyeh, showing the two leaders hugging each other and

shaking hands.

Ahmadinejad -- who came to power two years ago pledging to revive

the values of the 1979 Islamic revolution -- hailed the event as

a step towards boosting "brotherly" ties of the two

"revolutionary" nations. Iran is embroiled in a

worsening nuclear standoff with Western powers.

WESTERN "BARBARIANS"

Chavez, who last week pushed two U.S. oil giants out of his

country as part of his self-styled socialist revolution, said:

"This is the unity of the Persian Gulf and the Caribbean

Sea."

Iranian officials said a second methanol plant would be

set up in Venezuela.

Each would cost about $650 million to $700 million and take four years to complete.

Methanol is an alcohol which can be used as a solvent or an

element in fuel.

That would help Iran to access the Latin American market, while Venezuela would get closer to buyers

in India and Pakistan.

Chavez, who wants to forge an alliance of leftist states to

counter U.S. policies, arrived in Tehran on Saturday after

visiting Russia and Belarus.

In comments certain to please his hosts, who have often called on

the United States to leave Iraq, Chavez branded those invading

Iran's neighbor as "barbarians", drawing parallels with

the European colonization of Latin America centuries ago.

"Those who try to convince the world that in Iran there are

a bunch of barbarians are barbarians themselves."

Iran's hardline Kayhan daily said the two countries were riding

on a "global anti-imperialism wave."

But both also face economic challenges.

Iran sits atop the world's second-largest oil and gas reserves,

but U.S.-led efforts to isolate it over its nuclear ambitions are

hurting investment in the sector, analysts say.

The Islamic state rejects accusations it is seeking to build atom

bombs, saying it only aims to generate electricity.

Chavez last week forced U.S. oil majors from Venezuela, seizing

oilfields from Exxon Mobil and ConocoPhillips.

But economists caution his social spending, mainly paid for by

state oil company PDVSA, could run into trouble as Venezuela

battles to maintain oil output after the exit of the majors. The

opposition complain his anti-Americanism scares off investors.

日本経済新聞 2007/7/21

天然ガス供給 イラン、欧州ルート参加 印パとも輸出協議 孤立から脱出狙う

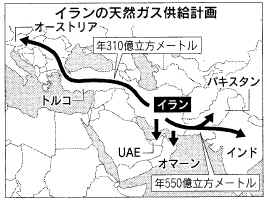

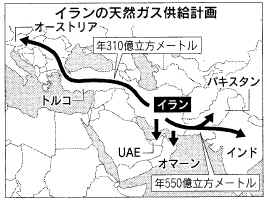

天然ガス埋蔵量で世界2位のイランが国際供給網の構築を急ぎ始めた。トルコ経由で欧州に通じるパイプラインヘの参加で基本合意したほか、7月末にもパキスタン、インドヘの輸出計画をまとめる。ウラン濃縮の継続で国連や米国の制裁を受けるなか、主要国とエネルギーで関係を深め、国際社会での孤立から抜け出す狙いだ。

イランのバジリハマネ石油相は14日、トルコ経由で欧州諸国にガスを供給するナブコパイプライン計画に参加することでトルコ政府と基本合意したと述べた。イランがトルクメニスタンから輸入しているガスの一部を再輸出する分も含めてナブコパイプラインに最大で年間310億立方メートルを供給する。イラン政府は詳細を8月までに発表する見通し。

ナブコパイプラインはトルコからブルガリアなどを経てオーストリアに至る全長3300キロメートルのガス供給ルートで、総工費は約63億ドル(約7700億円)。2011年の完成を目指している。トルコ企業が最近開発権を獲得したイラン南

部の南パルスガス田で生産するガスを流す計画とみられる。

最大で年間550億立方メートルのイラン産ガスをインド、パキスタンに輸出する全長2600キロメートルのパイプライン建設も実現間近だ。総工費は70億ドル前後。イラン石油公社高官によると、3カ国は7月末にもテヘランで石油相会議を開き、輸送料に上乗せする通過料での合意を目指す。

イランは近隣のアラブ首長国連邦(UAE)、オマーンともガス輸出で基本合意、価格など細部の詰めを進めている。イランはこれまで、主にトルコ向けに年間50億立メートル以上のガスを輸出してきた。だが約27兆立方メートルといわれる埋蔵量の大半は手つかず。輸出網を広げることで、石油輸出の伸び悩みを補う一方、主要国との関係強化を目指す考えだ。

欧州連合(EU)加盟国はガス輸入量の4割以上をロシアに頼り、調達先の多様化が安全保障上の重要課題だ。イランは欧州にガスを供給することで核開発問題での風当たりの緩和を期待。さらに核兵器保有国で親米のインド、パキスタンにイランの核開発への支持を求める。イランが外交を優位に進める武器として石油とともにガスを利用する方針なのに対し、トルコの米大使館は16日、「イランをガス供給元として信用しすぎるのは賢明ではない」との声明を出し、けん制した。

September

05, 2007 Jakarta Post

Pusri to build

plant in Iran

PT Pupuk

Sriwijaya (Pusri), the country's largest fertilizer producer, is

scheduled to sign an agreement with an Iranian petrochemical

company later this week to help bring to fruition its plan to

build a fertilizer plant in Iran.

Iranian

ambassador to Indonesia Behrouz Kamalvand said Tuesday that an

agreement would be signed between Pusri

and National Petrochemical Company International for the construction of

the plant, which will be located in Tehran and cost some US$600

million.

Mahmoud R.

Radboy, head of the Iranian embassy's economic section, said that

the two companies would have equal participating

interests

in the project

"It is

agreed that 50 percent of the production will

be dedicated to the Indonesian market and the rest will be sold

on the international market, although it is up to the companies

to decide which international markets they want to serve,"

Radboy said.

The gas supply

will come from the South Pars gas field, which holds 8 percent

of total world gas reserves, via a pipeline at a price of $1 per

million British thermal units (mmbtu).

"This lower

price is based on President Ahmadinejad's promise to build a

solid and good relationship with Indonesia," Radboy said.

Gas prices on

the global markets usually range between $3 and $5 per mmbtu.

The plant is

slated for completion in 2009.

Meanwhile,

regarding with Iran's offer to supply liquefied natural gas (LNG)

to the soon-to-be-built LNG-receiving terminal in Cilegon, West

Java, Mahmoud said the two governments were still discussing the

issue.

"We are

still also awaiting the Indonesian government's decision on

establishing a consortium for the project."

State power

utility PT PLN, which is the operator of the terminal, said

recently it would seek LNG supplies from Iran, after a previous

agreement for supplies from Qatar collapsed.

PLN director for

power generation Ali Herman Ibrahim has said the company will be

looking for some 4 million tons of LNG per year.

September 28th 2007

Venezuelanalysis.com

President of Iran Visits Venezuela and Signs Economic Agreements

The President of Iran, Mahmoud Ahmadinejad, arrived in Caracas

late Thursday night for a short meeting with Venezuelan President

Hugo Chavez. Both leaders emphasized the importance of unity and

cooperation in the "fight against U.S.Venezuela and Iran.

imperialism" and signed several more bilateral agreements to

build joint projects in Venezuela and Iran.

"The Venezuelan and Iranian people, and their leaders, have

great responsibilities in the world arena," said the Iranian

leader. "Together we can multiply our power and truly no one

will be able to defeat us," He assured that a "bright

future will belong to the revolutionary nations, and imperialism

has no other option but to respect our nations and their

sovereignty."

The Venezuelan president responded by calling the Iranian leader

a "great anti-imperialist fighter" and stated that his

visit to Venezuela was of "great importance."

The two leaders have made significant efforts in recent years to

strengthen union and cooperation between their countries. Both

countries are member of the Organization of Petroleum Exporting

Countries (OPEC), and are united in their opposition to the

government in Washington.

Since President Ahmadinejad was elected in 2005 the two leaders

have met on six occasions, both in Iran and in Venezuela, and

have signed economic and energy agreements that involve around

$17 billion. Most agreements have centered on building joint oil

and industrial projects, including petrochemicals, the auto

industry, and oil refineries.

On this occasion, the agreements they signed include the installation

of nine corn-processing plants in Venezuela with Iranian technology, part of

the new initiative of the Venezuelan government to increase the

production of corn and corn flour in the country. These plants

for processing corn will be placed in corn-producing regions and

run by the surrounding communities.

Another of the agreements is for the establishment of an industrial

complex for the production of auto parts in the central state of Carabobo.

The agreement was signed between the Iranian company Behsazin and

the Venezuelan Ministry of Communal Economy with the intention of

supplying national industry with nationally produced auto parts.

A third agreement has to do with the petrochemical industry and

allows for the construction of two plants for

the production of methane gas, one in Iran and

the other in Venezuela.

The Iranian President had to leave immediately after the meeting

but assured he would be visiting again soon. He apologized for

the short visit and promised a longer visit in the future. He

promised that Caracas and Tehran would remain in support of

"all the revolutionary countries in the world," and

mentioned Nicaragua, Cuba, and Bolivia, where he visited

immediately before his visit to Venezuela and signed agreements

with President Evo Morales.

"Together we will continue to support all the oppressed

nations and we will continue resisting imperialism until the

end," he declared.

Iranian authorities have said the support Chavez has given to the

"peaceful use of the nuclear energy" on the part of the

Iranian regime has been "very important" in the

struggle against international pressures. Chavez has said on many

occasions that all countries, including Venezuela, have the right

to develop nuclear technology for peaceful means.

In response to President Ahmadinejad's recent visit to New York

and to protests against him there, Chavez assured the Iranian

leader that he has Venezuela's support and admiration.

"Here we witnessed once again your great gift of

statesmanship, your dignity, your courage. We have all felt truly

proud to be your brothers and to share together the path of the

revolution, the path of dignity, the path of the struggle against

imperialism," he said.

In response to the University of Colombia President Lee

Bollinger's statement that the Iranian President is a

"small, cruel dictator," Chavez defended the Iranian

leader. "Instead of small, you are one of the biggest

anti-imperialist fighters of this change of era, said"

Chavez. He then congratulated Ahmadinejad for fighting for the

"justice that the people of the world desire."