Iraq Economy

Britannica

Online

http://0-www.search.eb.com.library.uor.edu/eb/article-232273?tocId=232273

The manufacturing sector

developed rapidly after the mid-1970s, when government policy

shifted toward heavy industrialization and import substitution.

Iraq's program received assistance from many countries,

particularly from the former Soviet Union. The state

generally has controlled all heavy manufacturing, the oil sector,

power production, and the infrastructure, although private investment in

manufacturing was at times encouraged. Until 1980 most heavy

manufacturing was greatly subsidized and made little economic

sense, but it brought prestige for the Ba'th regime and later,

during the Iran-Iraq War, served as a basis for the country's

massive military buildup. Petrochemical and iron and steel plants

were built at Khawr al-Zubayr, and petrochemical production and

oil refining were greatly expanded both at Al-Basrah and at

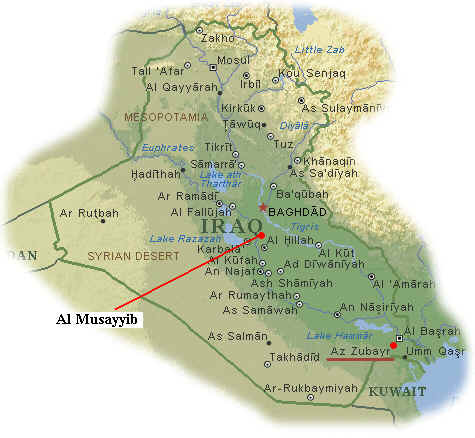

Al-Musayyib,

40 miles (65 km) south of Baghdad, which was designated as the

site of an enormous integrated industrial complex. In addition, a

wide range of industrial activities were started up, some of

which were boosted by the Iran-Iraq War, notably aluminum

smelting and the production of tractors, electrical goods,

telephone cables, and tires. Petrochemical products for export

also were expanded and diversified to include liquefied natural

gas, bitumen, detergents, and a range of fertilizers.

The combined results of the Iran-Iraq War, both Persian Gulf

wars, and, most of all, the UN embargo eroded Iraq's

manufacturing capacity. Within its first two years, the embargo

had cut manufacturing?which was already well below its highs of

the early 1980s?by more than half. After 1997, however, there was

an increase in manufacturing output, in both the public and the

private sectors, as replacement parts and government credit

became available. By the end of the decade, large numbers of

products long unavailable to consumers were once again on the

market, and almost all the factories that were operating before

the imposition of the embargo had resumed production, albeit at

somewhat lower levels.

イラクの石油産業 Platts Guide to Iraq's Oil Industry

With proven

reserves of 112-bil bbl and probable reserves of

214-bil bbl, Iraq has the

second largest crude reserves in the world after Saudi Arabia.

The infrastructure of the country's oil industry is however in a

lamentable state after suffering badly in the 1991 Gulf War.

More than a decade of UN sanctions have taken their toll on

Iraq's oil reservoirs, which contain the world's second biggest

oil reserves after Saudi Arabia.

Maintaining oil exports to feed its 23-mil people has presented

Iraq with a major challenge as oil wells, particularly in the

northern Kirkuk oil producing area, have suffered in the absence

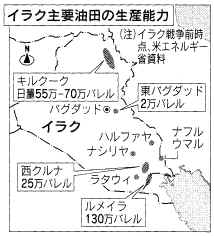

of badly needed spare parts. Production from the giant Kirkuk

oilfield, discovered in 1927 and containing 10-bil in reserves

and, from Rumaila in the south is in decline as the fields have

matured, making it vital for Iraq to revisit idle oilfields and

explore in the Western desert.

Iraq has put its proven oil reserves at 112-bil bbls, mostly in

southern Iraq, but senior deputy oil minister Taha Hmud said in

an interview in Baghdad May 23 that proven and probable oil

reserves could top 300-bil bbl if all unexplored acreage was

drilled.

Reserves

could top 300-bil barrels

But Iraq has been unable to expand its exploration

program in the past 20 years, first because of the 1980-88

Iran-Iraq war and later because of UN sanctions in place since

1990 after its invasion of Kuwait. "The figure we reached

and which is widely known, is that we could discover 214-bil bbl

of oil in addition to the present proven reserve. We are sure of

this figure as all available indications and scientific standards

say. This means that we will exceed the 300-bil bbl when all

Iraq's regions are explored," Hmud said.

But with recovery rates low -- around 15-20% of oil in place --

and funding limited despite the release by the UN of additional

funds for oil spare parts -- Iraq does not have modern recovery

techniques that would allow it to raise production without

damaging its reservoirs.

Yet it has no choice but to keep oil exports going under the UN's

humanitarian oil-for-food program, which allows Baghdad to sell

oil under UN supervision to buy food and medicines. Current

exports are running at around 2.2-mil b/d, according to Iraqi

officials since Iraq resumed oil sales after a one-month stoppage

to punish the US for its support of Israel. Despite the

sanctions, the US is the biggest single market for Iraqi crude

oil through indirect sales by traders who buy Iraqi crude oil and

sell it on.

Production

cannot be sustained

The latest available report by experts from oil services company

Saybolt International submitted to the UN in March 2000 said a

production level of 3-mil b/d of crude oil was achieved without

the technical resources to apply "good oil field

practises."

The report said that without prompt action, production would

continue to decline.

"The Iraqi oil industry continues to adopt high-risk

solutions in order to balance the production quantity/oil price

equation against the necessity to export crude oil, to produce

gas for domestic use and to refine products for transportation

and power generation.

Iraqi deputy oil minister Saddam Hassan, formerly head of the

crude oil marketing department SOMO, told a conference in Cairo

recently that Iraq's oil industry had been able to rise above the

difficulties caused by war damage and the shortage of spare parts

and modern technology.

Iraq has succeeded in raising its oil production from 1.5-mil b/d

in 1997 to around 3-mil b/d in the last two years. Energy

consumption had risen to around 32-mil tonnes of oil equivalent

from 26-mil tonnes of oil equivalent in 1997.

Iraq has plans to raise its oil production from around 3-mil b/d

currently to 6-mil b/d by 2010. Saybolt suggested in its report

that Iraq needed to adopt horizontal drilling techniques, 3D

seismic and reservoir simulation to raise recovery rates to

between 35 and 50%. It also suggested that to offset current

declines in production capacity in the longer term, new projects

to develop known reserves that remain unexploited should be

included.

Saybolt said that a sharp increase in production without

concurrent expenditure on spare parts and equipment had already

damaged oil-containing rocks and pipeline systems.

Unofficial

exports through Syria

This has not deterred Iraq from using a leaky old pipeline

running from northern Iraq to the Syrian Mediterranean port of

Banias to export some 200,000 b/d of crude oil outside of UN

control. Iraq and Syria have denied this practice, which traders

say started in 2001. Western diplomats say Iraq is also smuggling

crude oil through the Persian Gulf on "rust bucket"

vessels that do not meet international maritime standards while

truckloads of smuggled fuel oil cross into Turkey with their

contraband cargoes daily.

Iraq was producing 3.1-mil b/d of crude oil before its forces

invaded Kuwait in August 1990, making it the second biggest oil

exporter after Saudi Arabia within OPEC. Saudi Arabia made up the

bulk of the shortage on oil markets when Iraqi oil disappeared

from markets and prices shot up to $30/bbl.

Iraq is hoping to return to its pre-Gulf War production capacity

and has invited Russian and Chinese oil companies to help develop

its northern and southern oilfields, many of which have been

mothballed or have suffered water damage.

But implementation of these contracts will have to wait until

sanctions are lifted completely. The UN and Iraq are holding a

new round of talks in Vienna in early July to try to reach

agreement on the return of arms inspectors to Iraq to verify that

Iraqi President Saddam Hussein no longer possesses weapons of

mass destruction. This is a key condition to lifting sanctions.

Iraq, which also sits on 110-trillion cubic feet of natural gas,

is also hoping to be a major gas exporter but negotiations with

neighboring Turkey on building a gas pipeline have not reached a

conclusion.

April 15, 2003 Financial Times

Iraq has the resources to become oil/chemical giant.

The oil and petrochemical situation in Iraq is discussed, in

connection with the present war there. Oil production at 2 M

barrels/day is 33% less than it was before 1991.

Iraq has one chemical site still operating, including a 130,000 tonnes/y cracker, and plants for 60,000 tonnes/y of low density polyethylene (LDPE) and 30,000 tonnes/y high density polyethylene (HDPE). All these plants were operating at 20-30% of capacity before the war. 立地: Khor-al-Zubair

It is said that with suitable

capital investment, Iraq could make more oil and chemicals than

Saudi Arabia. European and British plant contractors and

machinery producers are seeking work from post-war Iraq, although

American aid is at present connected with companies in the USA.

http://www.geodesign.co.uk/iraq/iraq_why.htm

In the Arabian Gulf, Iraq has three tanker terminals: at Mina al-Bakr, Khor al-Amaya, and Khor al-Zubair.

Mina al-Bakr is Iraq's largest oil terminal, with four 400,000-bbl/d capacity berths capable of handling very large crude carriers (VLCCs). The terminal has a capacity as high as 1.2 MMBD.

Khor al-Amaya terminal could load 600,000 bbl/d. Upon full completion of repairs, Iraq projects Khor al-Amaya's capacity will rise to 1.2 MMBD.

Khor al-Zubair Iraq's third terminal, is linked to the Umm Qasr port by a 30-mile long canal. While Khor al-Zubair generally handles dry goods, it has the capability to service small quantities of liquefied petroleum gas (LPG) and refined products. Like Umm Qasr, Khor al-Zubair is being outfitted with crude loading capabilities.

AllBusiness 2005/5/9

IRAQ - The Petrochemical Sector.

http://www.allbusiness.com/periodicals/article/414801-1.html

Before the 1991 war,

Baghdad had impressive plans for its petrochemicals industry.

Baathist officials in 1995 said that, after the sanctions, Iraq

may become one of the world's largest exporters of

petrochemicals.

One of the targets for allied bombing in January 1991 was the 1.5m t/y

petrochemical complex at Al-Musayyib, in the centre, which was intended

to become an industrial zone matching those of Baiji to the north

or Khor Al-Zubair to the south. Technical teams have managed to

rehabilitate several of the damaged plants which now meet

domestic requirements for a range of plastics. But, as with oil

products, the quality has been questionable since most units were

only partly restored. Iraq has two main petrochemical complexes, one at Khor

Al-Zubair near Basra, called PC-1, and the other under

construction at Musayib, 60 km south of Baghdad called PC-2. Both owned and run by the State Enterprise

for Petrochemicals (SEP).

PC-1 - Khor Al Zubair - was badly damaged in the

previous war, by March 1991 leaving Iraq with no thermo-plastic

building blocks. It resumed limited operations in

February 1992.

The complex was mothballed on its completion in 1980 because of

the 1980-88 war with Iran. It went on stream in early 1989 to

produce: 130,000 t/y of ethane-based

ethylene; 110,000 t/y of ethylene dichloride; 60,000 t/y of LDPE;

30,000 t/y of HDPE; 66,000 t/y of vinyl chloride monomer (VCM);

and 60,000 t/y of PVC.

PC-2 - Musayib: Construction of this complex, in

central Iraq, had been postponed since the early 1980s because of

the war with Iran. Soon after Iran accepted the ceasefire in

August 1988, SEP went ahead with the project. A UK unit of

Bechtel was contracted as a technical consultant and did the

initial studies. The complex was nearly complete as the 1991 war

began. Allied bombing severely damaged

its units. It was brought on

stream partly in October 1992, with Iraqi engineers having done

the designs. Its ethylene unit was to have a 250,000 t/y capacity

compared to 420,000 t/y planned.

Musayib was being developed as an industrial centre, with West

Qurna field to provide crude oil, fuel and gas feedstocks. Under

pre-war plans, the first phase of PC-2 was to cost up to $2.5 bn

and was due to come on stream in the second half of 1991. It was

to have the following capacities:

250,000

t/y of ethylene, - 160,000 t/y of low-density polyethylene, -

55,000 t/y of ethylene glycol, - 20,000 t/y of ethylene oxide, -

100,000 t/y of polypropylene, - 70,000 t/y of butadiene, -

145,000 t/y of styrene monomer, - 80,000 t/y of polystyrene, -

80,000 t/y of styrene butadiene rubber (SBR) and polybutadiene

rubber, - 60,000 t/y of MTBE, - 15,000 t/y of butene-1, - 15,000

t/y of acrylonitrile butadiene styrene (ABS), and - 5,000 of

styrene acrylonitrile copolymer (SAC).

The complex was to have an aromatics plant with a nameplate

capacity of more than 115,000 t/y of benzene, 20,000 t/y of

toluene, plus a 100,000 t/y alkylation unit and a 30,000 t/y

catalytic condensation (polymer gasoline) unit.

In 1989 PC-2 was taken over by the Technical Corps for Special

Projects (Techcorps). It gave the main process contracts.

Construction contracts for all but three units went to the

following: Technip (France) for the polyethylene unit; Tecnimont

(Italy) for the polypropylene unit; a Japanese partnership of

Toyo Engineering (TEC) and Nichimen Corp. for the ABS, SAN and

butadiene units; TPL (Italy) for the ethylene glycol, ethylene

oxide, MTBE, alkylation and polymer gasoline units; CTIP (Italy)

for the butene unit; and Snamprogetti (Italy) for the aromatics

plant. The complex was to be equipped with advanced

instrumentation and computerised control systems supplied by

OAPEC's Bahrain-based Arab Engineering Systems & Control Co.

under a $25m technical aid contract with Techcorps.

OGN online.com 2003/11/24

Sector hope in Petchem plant launch

http://www.oilandgasnewsonline.com/bkArticlesF.asp?IssueID=290&Section=1480&Article=11860

Hopes are high that

private-sector investment will secure the future of Iraq's Khor

al-Zubair petrochemicals plant.

Engineers at the Khor al-Zubair petrochemicals

plant, about

40 kilometres south of Basra, are on the brink of a major

breakthrough. In late October, gas pressure at the plant reached

levels high enough to restart production of chlorine for the

first time since it was shut down just before the outbreak of war

in March.

The facility, built in the late 1970s by a US/German team of

Lummus and Thyssen Rheinstahl Technik, survived the war

unscathed, unlike much of the neighbouring industrial

infrastructure. Any plundering that did take place was mostly

limited to instrumentation and minor equipment. 'We managed to

secure the plant even before the British army arrived,' says

deputy plant manager Majid al-Faydh.

The plant - modest in scale by Gulf standards-has design capacity

of 130,000 tonnes a year (tpy) of ethylene and 90,000 tpy of low

and high-density polyethylene. It also produces significant

volumes of low-grade product for the local agricultural sector,

such as polyvinyl chloride (PVC), polythene sheeting, caustic

soda and sodium hydrochloride.

'We have finished drying the chlorine units and have partly

rehabilitated some of our utilities, such as the RO {reverse

osmosis} water plant, which we need for steam. I expect to

restart production of chlorine any day at a rate of about 50

tonnes a day. When we get more gas we also plan to restart

ethylene output,' says Al-Faydh.

The plant requires 80 million-85 million cubic feet a day of gas

feedstock. Some of this is siphoned off to fuel the complex's

four gas turbines, which have capacity to produce about 60 MW of

power. Only one of the turbines is operating at present. The US'

Bechtel, under its US Agency for International

Development (USAID) reconstruction contract, has brought in Dubai-based

Masaood John Brown to repair the units, which it originally

installed.

Improvements to the local grid have also assisted the plant's

restart. Supplies of about 15 MW have just come on stream to add

to the existing 10 MW produced by its one operable turbine. Once

the plant's powerhouse has been folly restored, the plan is to

put the surplus electricity back into Basra's domestic network.

So far, everything achieved at the plant has been done on a

shoestring. The State Company for Petrochemical Industries

(SCPI), which owns and operates the facility, has a minimal

budget of about $1 million. Yet, it has managed to sustain the

3,800-strong workforce and bring the plant to the brink of

restarting production with the bare minimum of help from the

Coalition Provisional Authority or USAID.

However, the plant's long-term future may depend on attracting

private investment.

日本経済新聞 2007/3/6

イラク新石油法 利権配分 交渉長期化も

油田持たぬスンニ派 「草案は外資利する」

シーア派・クルド系 権益維持へ制定急ぐ

混迷するイラクの政情を改善させるテコとして期待される新石油法の制定へ向け、各勢力の駆け引きが活発化してきた。主要な油田地帯を抱えるクルド系とイスラム教シーア派の合意で2月末に草案が閣議了承されたが、スンニ派は国民議会で修正を要求する見通し。イラク政府は5月末施行を目指すが審議が長引く可能性もあり、米国や政府の期待通り治安改善の切り札になるかは不透明だ。

スンニ派政党連合「イラクの調和」のドレイミ代表は2日、新石油法草案を検討する委員会を党内に設置すると述べた。同代表は新法草案に関し「良い点もあるが悪い点もある」と含みを持たせた発言を繰り返す。特に問題視しているのが、外国企業に最長40年の契約期間を認めている点。「外資に有利でイラクの国益にならない」と半分への短縮を求めるという。

イラクの原油生産量は現在日量200万バレル弱でピーク時の約半分。だが埋蔵量は約1150億バレルでサウジアラビア、イランに次ぎ世界3位。油田はクルド地方政府の治める北部3州とシーア派が多い南部に集中し、中部のスンニ派地域にはほとんどないとされる。

政府の草案では、石油収入を中央政府でいったん集約してから各地方に人口比に応じ分配するとしている。米紙ニューヨーク・タイムズは、草案承認直前の2月末「西部のスンニ派地区で大規模な石油・ガスの埋蔵が確認された」と報じ関係者の間で話題となった。ただ具体的な数字や根拠は明確でない。「持たざる地域」のスンニ派に石油収入を配分することにクルド、シーア派から不満の声が出る気配があり「法案成立へ両派を妥協させようとした米国の情報戦術」と見る向きもある。

クルド地方政府のサレハ報道官は2日「草案への異議はない」と歓迎の意向を表明した。クルド地区はイラク内では最も治安が安定しており、地方政府はノルウェーの石油会社など5社と独自に開発契約も結んでいる。

草案ではクルド側の主張していた地方政府が外資との交渉・契約権を握る項目が盛り込まれた。イラクでは新法施行後も当面はクルド地区に投資が集中する見通しで、経済的利益は大きい。クルド系治安部隊は2月から米軍・イラク軍が首都圏で始めた治安回復作戦への参加に同意し1800人を派遣したが、これは草案の主張を通す取引材料だったとの見方もある。

政府の中核を占めるシーア派も草案通遇へ根回しを積極的に進める。南部は武装勢力の活動が盛んで外資がすぐ進出できる状況ではないが「米国がシーア派のマリキ首相に10日のイラク安定化会議までに法案を提出するよう強く圧力をかけている」(地元記者)。ただ石油法とは別に議会で審議される予定の石油収入配分の割合に関する法律の草案は固まっていない。実利にかかわるだけに調整が遅れることへの懸念もある。

Iraq considering $2 bln

petrochemical plant

Iraq is considering building a $2 billion petrochemical plant and

could begin talks with potential international investors in the

project this year, the country's industry minister said on

Sunday.

"We are considering a completely new facility in the central

or northern parts of the country," Fawzi al-Hariri told

agencies on the sidelines of a conference in Dubai.

The plant would have an annual capacity of 1 million tones of

ethylene and derivatives, he said.

Hariri said on Wednesday that Royal Dutch Shell Plc and Dow

Chemical Co were in talks with the government to renovate and

expand a chemical plant in southern Iraq at a cost of up to $2.1

billion.

Oil majors are eager to gain access to Iraq's oil reserves, the

third-largest in the world, although security concerns mean the

companies are reluctant to put people on the ground.

Iraq, which produces most of its crude in the south of the

country, pumped 2.07 million barrels per day last month, making

it the Middle East's fifth-largest producer, according to a

survey this month.

The Associated Press September 2, 2007

Iraqi government officials and energy experts presented detailed plans for exploiting the wartorn country's vast petroleum wealth but admitted that the absence of a law regulating the industry is a bigger obstacle than security to attracting foreign investment.

Government officials at the three-day "Iraq Oil, Gas, Petrochemicals and Electricity Summit" held in Dubai tempered their grandiose projects for exploiting the country's massive oil reserves by admitting that the vital, but contentious, law still needed to be passed.

"Security is not stopping investors coming to Iraq, (it is because) they have no laws to protect their investment," Ali al-Dabbagh, the Iraqi government spokesman, told the Associated Press at the start of the conference.

After months of acrimonious debate, a new draft oil law will be discussed in parliament in the coming weeks, which al-Dabbagh hoped would be adopted by the end of the month.

"The majority of politicians are aware that we cannot go on without it," he said. "The oil law is the future of Iraq."

Despite being some of the largest in the world, Iraq's oil reserves are also some of the least exploited with the worst infrastructure - something Iraq is hoping foreign investors can change.

Talks have been held with Shell, Texaco and Dow Chemical companies on possible investments in various proposed projects, said Fawzi al-Hariri, Iraq's Minister of Industry and Minerals. He said the Saudi Basic Industries Corporation has also expressed interest.

Al-Hariri hoped that the negotiations would be concluded by the end of the year.

He described a plan for a US$120 million (Euro87.56 million) upgrade of a Basra petrochemical plant, that could be developed further with another US$1 billion (Euro0.75 billion).

"We are also considering a second, completely new facility, maybe in the north or central region," he told Dow Jones Newswires at the conference, putting the cost at over US$2 billion (Euro1.5 billion).

He said that the plant's final location would depend on the security situation.

Even more than new projects, however, it is the country's creaking oil infrastructure that has to be fixed, preferably with foreign investment, said Thamir Ghadban, chairman of Iraq Oil Commission.

Several times over the last three decades, complete overhauls were planned only to be shelved as the country was wracked by devastating wars and then U.N. sanctions.

"We think Iraq needs to bring up the oil production, but it also needs to go into oil exploration," Ghadban said, adding that the government plans to "convert 25 to 30 percent of probable reserves into proven reserves. "

If it succeeds, Iraq could raise production to 6 million of barrels of oil a day, up from an average of around 2 million barrels.

"Four million with national efforts and additional two million in cooperation with foreign oil companies," Ghadban said.

The country's former oil minister, Ibrahim Bahr al-Olom, called for additional domestic involvement in the sector as well, stressing the need for a "balance between national and foreign investment."

"Iraqis deserve a better standard of living," al-Olom said. "The only way they will get it, is by developing oil and gas resources."

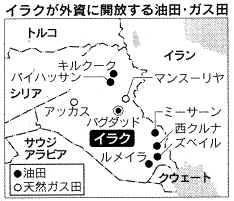

日本経済新聞 2008/7/1

イラク 8油田・ガス田、外資導入

13年に原油8割増産 日系4社など応札資格

イラクのシャハリスタニ石油相は30日、外資導入の対象となる油田と天然ガス田、計8ヶ所を発表した。イラクは世界第三位の石油埋蔵量を有する。戦後復興を急ぐ同国は外国石油会社への油田開放により原油生産能力を2022年に現在の8割増となる日量450万バレルに引き上げる計画。すでに日本企業4社を含む外資が応札資格を得ており、イラク参入をめぐる競争が本格化する。

外資導入による油田開発は03年のイラク戦争後初めて。対象となるのは北部の主要油田キルクークや南部の大油田ズベイル、ルメイラなど油田6カ所と、西部のアッカスなど天然ガス田2カ所。イラク石油省は事前審査で絞り込んだ41社を対象に09年3月までに入札を実施、落札企業と同年6月までに契約する。

イラク戦争で低迷した同国の原油生産量は同250万バレルまで回復。既存油田の老朽化した施設の設備改修で同50万バレルの短期的な上積みをめざしているが、さらに引き上げるためには新規油井の掘削など本格開発が不可欠だ。イラク政府は巨額の資金が必要となる開発促進のために外資導入に踏み切る。

油田やガス田の国有化など資源国が自国資源の国家管理を強める流れにある中で、未開発油田が多数残るイラクには世界中の石油会社が参入の機会を探っている。なかでも旧フセイン政権下で同国の石油開発から排除されてきた米英系石油会社は強い関心を示している。

イラク石油省は今回公表した長期開発とは別に油田改修で英蘭ロイヤル・ダッチ・シェルや米エクソンモービル、英BPなど外資6陣営と7月中にも契約する見通しだ。これらのメジャー(国際石油資本)が改修を請け負う油田は今回開放の対象となった油田と重複するケースが多く、入札でもこうした企業を軸に選考が進む可能性がある。

応札資格を持つ41社には、国際石油開発帝石ホールディングス、石油資源開発、新日本石油、三菱商事の日本4社が含まれている。

主要産油国の増産余力が乏しい中で、イラクの生産能力増強は原油価格高騰の要因となっている原油需給の緩和につながる可能性がある。ただ、外資導入による油田開発には、外国企業の開発への参加の枠組みや石油収入の分配などのルールを定めた基本法が必要。しかし、同法をめぐっては国内各派の対立で連邦議会での審議が停滞している。

Sep 01, 2008 (AsiaPulse via COMTEX)

IRAQ SIGNS FIRST

MAJOR OIL DEAL WITH CHINA

Iraq has signed its first major oil deal with a foreign company

since the fall of Saddam Hussein's regime, a spokesman for the

Iraqi Oil Ministry said Saturday.

The contract with the China National Petroleum

Corporation could

be worth up to US$3 billion and marks the first time in more than

35 years that Iraq has allowed a foreign oil company to do

business inside its borders.

The deal allows the CNPC to develop an oil field in

southern Iraq's Wasit province for about 20 years, Oil Ministry spokesman Assim

Jihad said.

Iraq's Cabinet must still approve the contract, but Jihad said

that would happen soon and work could start within a few months.

The Chinese company will provide technical advisers, oil workers

and equipment to develop al-Ahdab oil field, providing fuel for al- Zubaidiya

power plant in Wasit, southeast of Baghdad, bordering Iran, Jihad

said.

Once development begins, the field is expected to start producing

a preliminary amount of 25,000 barrels of oil a day and an estimated constant daily

amount of 125,000 barrels after three years, he said. `

Iraq

currently produces about 2.5 million barrels a day, 2 million of which are exported

daily, Jihad said. That is close to its status before the US-led

war that toppled Saddam in 2003, but below its levels prior to

the Persian Gulf War in 1991.

Iraqi Oil Minister Hussein Shahrestani said in July that he is

confident Iraq will be able to double its production in the next

five years.

As it did with other international companies, the Saddam regime

had a partnership contract with CNPC signed at the

end of the 1990s that entitled the company to share profits. The current contract, however,

will be only a "service

contract" under which CNPC is simply paid for its services, Jihad said.

He said Iraq has provided "security guarantees" for

CNPC, as it would for any other foreign company that will work in

Iraq's oil fields. Jihad called it a major and significant move

for Iraq.

Iraq sparked a scramble for lucrative oil contracts in June, when

Shahrestani opened bidding to 35 international companies for

long-term contracts to redevelop six oil fields. The Oil Ministry

continues to negotiate short-term, no-bid contracts with several

US and European oil companies, including Exxon Mobil Corp., Royal

Dutch Shell, Total SA, Chevron Corp. and BP.

Iraq has among the largest oil reserves in the world, with an

estimated 115 billion barrels, tying Iran for the No. 2 status

behind Saudi Arabia's 264 billion barrels, according to estimates

from the Energy Information Administration.

2008/8/29 CNN

バグダッド南方の油田開発で合意、調印 イラクと中国国営企業

イラク石油省高官は28日、同国と中国がイラクの首都バグダッド南方にあるアハダブ油田開発の合意文書に27日調印したと述べた。同油田の開発で 両国は、2003年の米軍事作戦の開始前に合意、調印していたが、戦時の影響で、政府間の承認が出来ない状態となっていた。

米軍事作戦で崩壊した旧フセイン政権時代の石油開発計画が復活したのはこれが初めて。中国側の参加企業は、国営の中国石油天然ガス集団 (CNPC)。旧フセイン政権は、国連による経済制裁を受けていたが、CNPCとの契約を強行していた。ただ、事業開始は国連制裁の解除後となっていた。

CNPCによる投資額の詳細は不明だが、イラク石油省高官は、30億米ドル(約3270億円)相当としている。アハダブ油田の原油の推定埋蔵量は数十億バレル。

イラクの原油生産量は現在、日量約250万バレルで、今年末までは最大300万バレルまで引き上げる計画。13年末までには450万バレルを目指している。

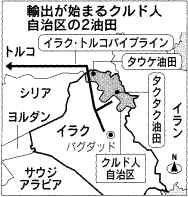

日本経済新聞 2009/5/16

来月からクルド自治区の原油輸出 イラク政府、歳入減少で妥協

イラクの北部三州で構成するクルド人自治区から初の原油輸出が6六月に始まる。原油の主権をめぐり対立してきた中央政府とクルド自治政府の間で妥協が成立、ノルウェーやカナダなどの石油会社が日量10万バレル程度の原油を中央政府が管理する既存パイプラインを使ってトルコの地中海岸の積み出し港に運ぶ。

イラク石油省は6月1日から自治区のタウケ油田で産出する原油を、イラクとトルコをつなぐ基幹パイプライン経由で輸出することを認めた。同月後半からは別の油田であるタクタク油田の原油輸出も認める。

Tawke油田はノルウェーのDNO International ASA が、Taq

Taq 油田はカナダのAddax Petroleum などの企業連合が開発する。中央政府はこれまで国家収入の9割を占める原油は中央政府が一元管理するとの立場から「自治政府が外国石油会社と交わした契約は違法」(シャハリスタニ石油相)と輸出を認めてこなかった。

中央政府と自治政府は今回、2油田で産出する原油の販売はイラク石油省傘下の国営石油会社(SOMO)が担当し、外国石油会社は自治政府と交わした開発契約(生産物分与契約)の比率に基づいて売却代金を受け取ることで合意したもよう。イラク側取り分をSOMOが管理する形を整えたことで妥協が成立したとみられる。

中央政府が一転してクルド産原油の輸出を認めた背景には、イラク全体の原油増産が計画通り進まないうえに原油価格の下落も加わり、歳入の減少に直面する中央政府の苦境がある。クルド産原油を加えて輸出を増やしたい思惑が働いたとみられる。

Iraq-Eni sign Zubair oil

deal

Iraq's oil ministry on Monday signed an initial deal with a

consortium led by Italy's Eni SpA to develop a prized southern

oil field, an agreement representing a key step forward in the

country's obstacle-strewn road to revamp its dilapidated oil

sector.

Eni,

the U.S.'s Occidental Petroleum Corp. and South Korea's KOGAS will develop the 4.1 billion

barrel Zubair field, with an eye to boosting output

from around 200,000 barrels per day to 1.1

million barrels a day within seven years.

Although the deal must still be approved by the Cabinet, Iraqi

Oil Minister Hussain al-Shahristani, hailed it as a significant

achievement at Monday's signing ceremony in Baghdad.

"Today, Iraq made a big leap on the way to develop its oil

industry," said al-Shahristani of the deal, which comes a

day before Iraq is to finalize an agreement with Britain's BP PLC

to develop the nation's largest oil field. "We are happy

with this progress and the achievement."

Shahristani also promised "more good news in the coming days

that will "put Iraq on the international oil map."

The Eni-led consortium will receive $2 per barrel of

crude produced. That's

less than half $4.80 per barrel they had bid in the licensing

round in held in June in Baghdad. The 20-year contract could be

extended by another five years.

Iraq's oil industry has been hampered by years of devastating

wars, crippling sanctions and sabotage attacks by insurgents

after the 2003 U.S.-led invasion, and continued violence has done

little to allay international companies' concerns about working

in the country.

The June licensing round in June -- the first such event in the

country in over 30 years -- fizzled, with a deal struck on only

one of the six oil and two gas fields on offer. Analysts

attributed the lackluster showing to unrealistic demands set by

Iraq, as well as low prices offered by the government at a time

when security remains tenuous.

Further undercutting development efforts is an impasse over

Iraq's oil law. The legislation, which would govern natural

resources and regulate foreign investment, has been stalled in

parliament since 2007. That has given international companies

little incentive to rush back into a country with the world's

third largest proven reserves of crude.

The signing of the Zubair deals come on the eve of the expected

signing Tuesday of a final deal with BP and its Chinese

partner, CNPC, to develop the 17.8 billion barrel Rumaila oil

field near the southern city of Basrah.

Rumaila, the Iraq's largest oil field, was the only deal struck

in the June licensing round. It would also be the second major

agreement reached by CNPC in Iraq after Saddam Hussein's regime

was toppled in 2003. Last year, CNPC signed a $3

billion deal to develop the al-Ahdab oil field in southern Iraq.

Daily production from Rumaila is at about 1 million barrels a

day. BP's targeted production for the oil field is 2.85 million

barrels a day within seven years.

The BP-CNPC consortium originally bid to receive $3.99 per barrel

produced, but later slashed the offer to the $2 per barrel

payment sought by the Iraqi Oil Ministry. The competing bid in

June was from a consortium led by U.S. giant Exxon Mobil, which

refused to amend its offer of $4.80 per barrel.

In the wake of the poor showing at the licensing round,

al-Shahristani announced last month that Iraq was revisiting the

bidding after three international oil consortiums revised their

offers and accepted Iraq's terms for developing two oil fields in

the south.

The Zubair field was one of those two fields, while the second is

the 8.6 billion barrel West Qurna Stage 1.

Three other international oil consortiums are competing to

develop that field after accepting Iraq's terms $1.9 per barrel

that were offered in the bidding round.

One is led by Russia's Lukoil and ConocoPhilips, another by Exxon

Mobil with Royal Dutch Shell and third is led by China's CNPC,

al-Shahritsnai annoucned.

The Lukoil-led consortium's targeted production is 1.5 million

barrels a day while the other consortium's targeted production is

2.1 million barrels a day. Lukoil consortium submitted an earlier

bid of $6.49 per barrel and the Exxon Mobil-led consortium was

asking for $4 per barrel.

The winner will be announced in the coming few days,

al-Shahristani said.

Iraq is also planning a second bidding round on December 11-12.

Forty-five international oil companies are set to bid for 10 oil

projects on offer.

Iraq's daily production ranges between 2.3 to 2.4 million barrels

a day and exports nearly 2 million barrels a day.

The overall fall in oil prices since last year has forced the

government to slash spending plans for this year from $79 billion

to $58.6 billion. The oil sector represents about 65 percent of

Iraq's gross domestic product and its revenues account for 95

percent of Iraq's earnings.