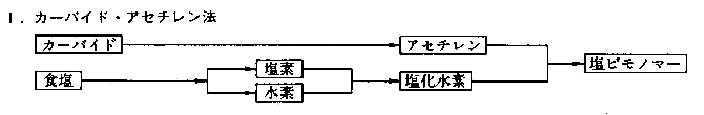

上記の旧式弱小ラインのほとんどはカーバイド・アセチレン法VCMによるものである。

中国政府は環境問題その他からこの設備を順次廃棄するよう指導している。

一部PVC設備は輸入VCMに切り替えるが、地方のPVC設備は廃棄される見込み。

上記記事ではカーバイド・アセチレン法PVCを150万トンとしている。

(化学経済 2000/11 臨時増刊)

2000年版「アジア化学工業白書」 各国のソーダ、塩ビ事業概況

中国

中国のPVC需要は堅調に推移しており,2000年も10%前後の成長が見込まれ,市場規模は400万トンに達する見通しである。この成長を支えているのは,主として純内需であり,パイプ,窓枠などの建築用硬質塩ビの伸びが著しい。他方,総需要の30%を占める製品再輸出のための需要は99年までは米国の好景気に支えられ堅調であったが,2000年上期は前年並みにとどまっている。

需要増に対応して滄州石化が99年第2四半期に23万トン増設,第3四半期には蘇州華蘇が10万トン新設,錦化集団が8万トン増設,99年末にLG

DAGUが5万トン増設,2000年第2四半期には江蘇蝙蝠集団が5万トンの新設をそれぞれ行っている。これにより,PVCの総能力はカーバイド・アセチレン法の150万トンと合わせ310万トンを超えることになった。

こうしたPVCの新増設があっても堅調な内需をカバーするに至らず,2000年も150万トンを上回る輸入が確実とみられている。

PVCの需要増に伴い,EDC・VCMの需要も増加しているが,構造的なエチレン不足などにより輸入が急増する傾向にある。VCMは98年から輸入が本格化し,99年は38万トンに達している。アセチレン法の生産を代替するための輸入は減少傾向にあるが,絶対需要の伸びから2000年のVCM輸入は40万トンを突破する見通し。また,EDC輸入も98年は8万トン規模であったが,99年は22万トン,2000年は30万トンを超える見通し。

今後のPVC新増設は,2000年後半に上海天原集団4万トン新設,斉魯石化5万トン増設,蘇州華蘇3万トン増設,2001年半ばにLG

DAGU6万トン増設が予定されている。

また,上海クロールアルカリ,滄州石化,福州石化などが30万トン規模のVCM・PVCプロジェクトを検討している。

カ性ソーダの99年内需は,化学繊維・レーヨン,紙パルプ,せっけん洗剤を中心に485万トンであった。輸出は上海クロールアルカリを中心に15万トンが見込まれている。多くの電解メーカーは内陸に立地しており,物理的に輸出用インフラが整っていない。今後の内需の伸びは年率数%の見通し。

中国のPVC産業の特徴

上記の旧式弱小ラインのほとんどはカーバイド・アセチレン法VCMによるものである。

中国政府は環境問題その他からこの設備を順次廃棄するよう指導している。

一部PVC設備は輸入VCMに切り替えるが、地方のPVC設備は廃棄される見込み。上記記事ではカーバイド・アセチレン法PVCを150万トンとしている。

Cangzhou Chemical

Industry (CCI; Cangzhou, China 河北省滄州) has selected Technip-Coflexip to provide

its vinyl chloride monomer (VCM) technology and the Chisso

process for a previously announced polyvinyl chloride (PVC)

plant, at Cangzhou, Hebei .

CCI plans to build units producing 400,000 m.t./year each of VCM and PVC. The plants will each be completed in

two, 200,000-m.t./year phases. The first is scheduled to come

online in 2004, and the second in 2006-07. They will double CCI’s PVC capacity.

Mitsui &

Co., which has a 25% stake in CCI, says it will supply ethylene dichloride

feedstock from Japan. China last year imported 1.8 million m.t.

of PVC compared with 1.45 million m.t. in 2000.

日刊通信化成品日報合成樹脂版 2000/7/14

滄州のVCM、PVC会社一体化

三井物産が出資している中国の滄州にあるVCM、PVC生産会社が、このほど合併、VCM/PVCの一貫生産会社となった。

同社はVCM年15万t、PVC15万tをそれぞれ別会社として生産してきたが、一本化することにより合理的生産体制がとれるということから、新鋭設備が稼働して1年になることを含めて合併したもの。出資比率は中国側75%、三井物産25%に変化はない。

*VCM製造会社:華井化工有限公司

PVC製造会社:滄井化工有限公司

化学工業日報 2002/7/11

ニチメンとチッソ,中国でPVC増強を受注

上海気破の10万トン分

建材中心に需要急拡大、新増設目白押し

ニチメンとチッソは、中国の上海気破化工股伶有限公司(上海クロールアルカリ)から、塩化ビニル樹脂(PVC)プラントの生産能力増強工事を受注した。現有年産25万トンのPVC設備を、2003年10月完成をめどに同35万トンに増強する工事の一部で、総事業費は250万米ドル。中国では、高い需要の伸びを背景に今後数年内の完成をめどとしたPVCの新増設計画が目白押しとなっており、ニチメンとチッソは今後もPVCプラントの受注に力を注ぐ。

本件の契約内容は、基本設計、技術供与(ライセンス)、機器供給などで、チッソはPVCの重合技術およびPVC中から原料の塩化ビニルモノマー(VCM)を取り除く脱モノマー塔の技術を提供、ニチメンは脱モノマー塔など機器調達を行う。設計はチッソの子会社であるチッソエンジニアリングが担当する。

チッソの脱モノマー塔は、世界中に50件以上ライセンスされており、今回の受注はその実績が評価されたもの。またチッソとニチメンによる中国でのPVC新増設工事の受注は、1993年の天津大沽化学の特殊塩ビ新設などに続き4件目となる。

中国では、住宅・ビル用の窓枠など建材向けを中心にPVCの需要が急拡大している。総需要は年間約500万トンで、現在約200万トンの輸入超過となっている。これを解消するため、国内化学メー力ーが今後2−3年の間に年産40万トン以上の新増設計画を4−5件計画しているほか、韓国のLG化学などの海外メーカーが、中国内における大規模な新増設を構想している。

2003/6/5 Asia Chemical

Weekly

Shanghai

Chlor-Alkali Chemical to form PVC joint venture in Ningxia

Shanghai

Chlor-Alkali Chemical (SCAC) plans to form a joint venture with

two Chinese companies to build a 100-120 000 tonne/year polyvinyl

chloride (PVC) plant in Ningchuan, Ningxia(寧夏) in western China, according to

a company source.

The two local

partners are Ningxia Ninghe National Chemicals Group Co, a

producer of calcium carbide, which will hold a 40% stake, and an

unnamed power company, which will hold 30%. SCAC will also own a

30% stake. The new company, which has yet to be formed, is to be

called Ningxia West PVC.

The project will use

the acetylene-based

route. Acetylene,

obtained by mixing calcium carbide with water, is used to react

with hydrogen chloride to produce vinyl chloride monomer (VCM),

which is then used to make PVC.

The investment is

estimated at slightly above Rmb900m ($108.7m/Euro92.7m). The

project will produce a corresponding amount of caustic soda,

chlorine and VCM.

The source said

Ningxia was chosen because of its coal reserves and competitive

electricity rates, which are one-third of the price charged in

Shanghai.

SCAC expects to use

mainly local technologies for the project, which is slated to

start up in H2 2005.

It was not immediately clear how the project would affect talks between SCAC and Tosoh for a PVC project in China. SCAC has been in talks with Tosoh for a PVC plant outside Shanghai that is set to start up after 2005.

《China Chemical Reporter》News (2003-07-16)

Shanghai Chlor-Alkali Invests in West Region PVC 寧夏

Ningxia Ninghe Minzhu Chemical Co.,

Ltd. has recently signed the "contract on the

Construction of Ningxia West Region PVC Co., Ltd." with Shanghai Chlor-Alkali Chemical

Co., Ltd. and Ningxia Yinglite Power (Group) Co., Ltd. The three

parties will make a joint investment to establish Ningxia West

Region PVC Co., Ltd. with a design capacity of 120 000 t/a PVC and 130

000 t/a calcium carbide.

The company will have a total investment of RMB930 million and a

registered capital of RMB279 million. Ninghe Minzhu will

subscribe RMB110 million, holding 40% of the equity and being the

biggest shareholder. Shanghai Chlor-Alkali and Yinglite Group

will each subscribe RMB83.84 million, each holding 30% of the

equity. Each party will make the investment in cash. The products

in Ninghe Minzhu and the products in West Region PVC Co., Ltd.

are highly complementary. Through the introduction of funds,

technologies and marketing experiences from the eastern region,

West Region PVC Co., Ltd. will become China's biggest PVC

producer using the calcium carbide process.

Asia Chemical Weekly 2003/8/15

Phase 2 of China's Ningxia PVC project would be started

Shareholders of a polyvinyl chloride (PVC) project in Ningxia, China, plan to pursue a second phase which would boost their total PVC capacity to 500 000 tonne/year.

Shanghai Chlor-Alkali Chemical (SCAC), Ningxia Yinglite Chemical(formerly Ningxia Ninghe National Chemicals Co) and Ningxia Yinglite Power are planning to build a 120 000 tonne/year PVC facility and a 100,000 tonne/year caustic soda plant in Shizuishan(石嘴山), Ningxia, as part of their first phase of the project.

Ninghe was renamed earlier last month because of a 51% stake acquisition by Yinglite Power last year. Yinglite Chemical is now a subsidiary of Yinglite Power. The shareholders have formed a new company, Ningxia West PVC, to operate the planned plant.

The second phase, estimated to cost Rmb6.4bn ($773.2m/Euro687.7m), is expected to include 380 000 tonne/year of PVC, at least 250 000 tonne/year of caustic soda and a power plant. Startup is targeted for 2008.

A source from the company said it would seek government approval for a proposal on the second phase later this year.

Meanwhile, engineering work has begun on the first phase, which is due to start up in H1 2005. It will employ local technology.

Both phases will be using the acetylene-based routes as Ningxia has coal reserves, from which calcium oxide and coke can be derived to make calcium carbide.

Shanghai Chlor-Alkali

Chemical reconsider Caojing's PVC project

Shanghai

Chlor-Alkali Chemical (SCAC) may decide against producing

polyvinyl chloride (PVC) at its complex in Caojing, Shanghai,

China, as originally planned, according to a company source.

The company is

considering whether to limit production to either ethylene

dichloride (EDC) or vinyl chloride monomer (VCM).

The source said the

company was certainly unlikely to produce PVC in Caojing for now

and was still deciding whether to produce 300 000 tonne/year of

EDC, along with 250 000 tonne/year of caustic soda and 200 000

tonne/year of chlorine at a proposed chloralkali unit in Caojing.

The alternative was to develop the chloralkali unit further

downstream to produce around 200 000 tonne/year of VCM as well.

If the company drops

the VCM and PVC units, the investment cost of the project would

be reduced from Rmb3.6bn ($435m/Euro372.9m) to Rmb1.8bn. Startup

is scheduled for H2 2005.

SCAC originally

wanted to produce 200 000 tonne/year of PVC.

2003/1/29 Financial

Times

Uhde starts work on

VCM plants.

In China, Shanghai Chlor

Alkali Chemical has

awarded a contract to Uhde to add 130,000 tonne/y of vinyl chloride

monomer (VCM) capacity

at its facility in Shanghai. Uhde has also won a contract from Sinopec Qilu

Petrochemical for a 400,000 tonne/y VCM plant and a 640,000

tonne/y ethylene dichloride facility in Zibo, Shangdong. In Iran, Uhde is adding 25,000

tonne/y of HDPE capacity at Arak Petrochemical's plant in Arak.

The projects should all be completed in 2004.

2003/6/19 Asia Chemical

Weekly

China's Yibin Tianyuan to expand Sichuan PVC by 120 kt/yr

China's Yibin Tianyuan Group Co (宜賓天原)plans to expand its 200 000

tonne/year polyvinyl chloride (PVC) plant in Yibin, Sichuan(四川), by 120 000 tonne/year at the end of this

year, according to a company source.

The company's caustic soda capacity will also be raised to 300

000 tonne/year from 180 000 tonne/year.

Tianyuan currently produces PVC via the calcium

carbide-based route.

2003-6-24 Asia

Chemical Weekly

Tianjin Dagu (天津大沽 ) starts

work on 200 000 tonne/year PVC

Tianjin Dagu Chemical has started construction work on a 200 000

tonne/year PVC plant in Tanggu, Tianjin, China, said a company

source.

The company aims to bring the Rmb815m (US$98.5m) project onstream

at the end of 2004. Tianjin Dagu is part of Tianjin Bohai

Chemical Industry

which also owns two PVC-producing affiliates - Tianjin Chemical

Plant and Tianjin LG Dagu

Chemical.

It was told last year that Tianjin Bohai plans to build a 660 000

tonne/year PVC plant in two stages, to boost its total production

to more than 1m tonne/year. Tianjin Dagu produces around 280 000

tonne/ year of PVC; Tianjin Chemical Plant owns a 120 000

tonne/year plant; and Tianjin LG Dagu recently expanded its plant

to 340 000 tonne/year from 240 000 tonne/year.

The source said plans to add more capacities are not firm. He did

not dismiss the possibility of Tianjin Dagu co-operating with LG

Chemical on other projects. LG is a partner in Tianjin LG Dagu.

The South Korean major is currently evaluating taking a stake in

a PVC project in Fujian, China.

The source added that sourcing feedstock for its future PVC

plants is one problem hindering its plans from moving ahead. Dow

Chemical was supposed to build a cracker in Tianjin, but its

plans seem to have stalled.

Tianjin Dagu plans to build ethylene storage tanks to accommodate

imported ethylene for its new 200 000 tonne/year PVC plant. It

hopes to complete building the tanks by end-2004. The company is

expected to use local PVC technology.

The company now produces 140 000 tonne/year of PVC via the

calcium carbide route, 40 000 tonne/year based on imported VCM,

and the balance 100 000 tonne/year at an integrated chlor-alkali,

ethylene dichloride and VCM complex.

Financial Times July 4,

2003

The first phase of Shenmu 100,000 tonnes/y PVC project started construction 陜西北部神木縣

Construction has started

of phase one of Shenmu's 100,000 tonnes/y polyvinyl chloride

project at Jinjie Industry Park. The first phase is funded with

RMB 200 M and will give an annual production capacity of 50,000 tonnes of

polyvinyl chloride, 40,000 tonnes of caustic soda, 40,000 tonne

of sodium hypochlorite, and 2000 tonnes of high purity

hydrochloric acid

with an expected production value of RMB 300 M. In the second

phase a 50,000 tonnes/y production line will be constructed with

a 100,000 tonne/y capacity.

2003-7-15 Asia Chemical

Weekly

China's Qinghai mulling PVC, methanol projects in Geermu

Qinghai Western Chemical

is planning a polyvinyl chloride (PVC), magnesium and methanol

project in Geermu, Qinghai, western China, a company source said.

The province has abundant natural-gas resources.

(Geermu, Qinghai=青海省格尓木)

The project has

attracted the interest of China International Trust and

Investment Corp (Citic), which took a majority 70% stake in

Western Chemical in March this year.

The source explained that the company would provide raw materials

for the project, and Citic the financial resources. The Chinese

government has approved the project.

Western Chemical and Citic plan to make use of natural gas to make

acetylene through partial oxidation. The acetylene will then be used to make

vinyl chloride monomer (VCM) and subsequently PVC. Synthetic gas

is produced in the process, which will be used to make methanol.

Chlorine

would be available from a nearby salt lake, 30-40 km from the project site, which

contains mainly magnesium chloride. Western Chemical has the

exclusive right to develop the lake.

Construction of the PVC plant is expected to start next year,

with the first phase due for completion in 2006 at a cost of

Rmb2bn ($241.6m /Euro211m). In this phase, the plant would produce 45

000 tonne/year of magnesium, 150 000 tonne/year of PVC, and 250

000 tonne/year of methanol.

The second phase, for which no startup date has been set, will

produce 75 000 tonne/year of magnesium, 200 000 tonne/ year of

PVC, and 250 000 tonne/year of methanol.

The source said a technology licensor for the gas-to-acetylene

unit has yet to be selected, but it is likely to be Sinopec. The

technology for the rest of the project has not been decided.

There has been increasing interest among Chinese companies in

gas-rich provinces to convert gas to acetylene. The two

conventional methods of PVC production are: the calcium carbide

route, which produces acetylene from the hydrolysis of calcium

carbide; and the ethylene route, which produces the

intermediates, ethylene dichloride and VCM. The former route,

which makes VCM from acetylene, is viewed as less

environmental-friendly.

Xinjiang Zhongtai Chemical is also considering using the

gas-to-acetylene route to produce PVC in Xinjiang.

A PVC consultant said the feasibility of using the

gas-to-acetylene route for PVC production depends very much on

the price of gas and electricity. He thinks that gas should be

priced below Rmb0.60/std m3 for the project to be competitive

with the other PVC-producing routes.

The source from Western Chemical said talks are under way with

gas and electricity suppliers. However, he is optimistic that the

project will be competitive, as he expects to secure a very good

price for gas at around Rmb0.50/std m3 on a long-term contract.

Agreements with the gas and power suppliers will be signed this

year.

《China Chemical Reporter》News (2003-07-16)

100 000 T/A PVC Project

Launched in Shaanxi 陜西省楡林

According to the

news disclosed by Shaanxi Investment Group Corporation, the 100

000 t/a PVC project located in Yulin of North Shaanxi with a

total investment of RMB1.15 billion has got the approval of the

provincial development planning commission. The construction will

start in Mizhi County in Yulin in early August this year.

The project has a capacity of 300 000 t/a PVC and occupies an

area of around 66 ha. The capacity of the first phase is 100 000 t/a PVC

and a matching 100 000 t/a ion membrane caustic soda unit will also be constructed.

Shaanxi Investment Group proposed the PVC project proposal in

December last year on the basis of in-depth market survey. The

purpose is to fully use the rich resources in Yulin such as

calcium carbide, rock salt and power to develop salt chemical

industry and accelerate the construction of North Shaanxi energy

and heavy chemical industry base. A project capital of RMB300

million has already been subscribed today.

PVC is a large-volume chemical raw material with the greatest

consumption in plastic processing. With the rapid development of

the national economy and the policy guide of "replacing wood

with plastics" and "replacing steel with

plastics", China has become one of the major PVC consumers

in the world. The domestic production falls far short of the

demand and the product market prospect is therefore extremely

bright.

《China Chemical Reporter》 2003-8-26

A 100 000 t/a PVC project in Shaanxi started construction

Shaanxi Yulin's 100 000t/a PVC project funded by RMB 1.15 billion started construction recently. The project is scheduled to produce PVC 300 000 t/a and in the first phase a production capacity of 100 000t/a PVC will be formed and a 100 000 t/a ion-membrane caustic soda unit will also be established.

中国でアセチレン法PVC工場建設

中国各紙の報道によると、最近中国ではアセチレン法によるPVC工場の建設が進んでいる。

上海クロルアルカリは最近、寧夏回族自治区で現地PVCメーカーとの間で合弁会社「寧夏西方塩ビ」を設立し、13万トンのカルシウムカーバイドと12万トンのアセチレン法PVC工場を建設することで合意した。上海クロルアルカリは30%を出資する。

豊富な原料と上海の1/3という安い電力料が同地を選んだ理由とされている。

陜西省楡林では8月に10万トンの電解と10万トンのアセチレン法PVCの建設が始まる。現地のカルシウムカーバイドや岩塩、電力を利用するもので、最終30万トンとする計画。

青海省格尓木でもアセチレン法塩ビ生産計画が進んでおり、来年建設開始の第1期では15万トン、第2期では20万トンの生産を計画している。

中国の旧式弱小ラインのほとんどはカーバイド・アセチレン法VCMによるもので、能力は合計150万トン程度とされている。中国政府は環境問題などからこれら設備の老朽更新を認めず、順次廃棄するよう指導していた。しかし内陸部ではVCM輸送が困難なため、アセチレン法が依然として中心となっている。

Asia Chemical Weekly 2003-8-12

Shenyang to produce 50 kt/yr of

paste PVC in two phases

Shenyang (瀋陽) Chemical Co plans to produce 50 000

tonne/year of paste-grade polyvinyl chloride (PVC) in two phases

in Shenyang, Liaoning (遼寧省), China, according to a company source.

Discussions are taking place with

potential foreign partners for the first phase of 30 000

tonne/year. Shenyang Chemical hopes to select one partner soon so

that construction work can start in September or October.

Construction would take about one year, the source said.

The company plans to build the plant

based on the acetylene route. It also plans to proceed with a

second phase of 20 000 tonne/year of paste-grade PVC which would

start up in 2005.

The source said the company would

buy either vinyl chlordie monomer (VCM) or ethylene dichloride

(EDC) and use the feedstock to expand its existing VCM plant to

support this phase. It currently uses the acetylene route to

produce 45

000 tonne/year of paste-grade PVC.

August 15, 2003

Financial Times

Singpu considers PVC production

Singpu Chemicals is investigating the

possibility of diversifying into the production of PVC from

caustic soda, aniline and chlorine in China. Capacity and startup

date are unknown, as the project is at a preliminary stage. The

company operates in the China Fine Chemical Industry Taixing Park

and produces 97,500

tonnes/y caustic soda and 30,000 tonnes/y aniline, despite having a

nameplate capacity of 43,000 tonnes/y. The company is undertaking

an initial public offering (IPO), from which it hopes to raise

S$13.7 M. This will be used to raise caustic soda capacity to

150,000 tonnes/y as well as maximising capacity at the aniline

plant.

Singpu Chemicals http://www.singpu.com

Our Company was incorporated in Singapore on 8 November 1990 as a private company limited by shares under the name of Panasia Investment Pte Ltd. We changed our name to Asiawide Chemicals Pte Ltd on 29 December 1995 and set up Singpu Chemcials Industries (Taixing) Co., Ltd. ("SCI") as our wholly-owned subsidiary in the PRC on 30 December 1995. On 29 July 2002, our Group acquired an 80% interest in Singpu Chemicals Industries (Yancheng) Co., Ltd.("YSC"), a joint venture company operating in the PRC, from our Parent Group. On 18 February 2003, we changed our name to Singpu Chemicals Pte Ltd. In August 2003, we are listed on the Mainboard of the SGX-ST and changed our name to Singpu Chemicals Ltd.

Strategically-located production facilities

Singpu Chemicals' two production plants with a total land area of approximately 313,000 sq m are strategically located in Taixing(泰興) City and Yancheng (塩城)City in the Jiangsu province(江蘇省).Jiangsu Province, being one of the most strategic locations for chemical manufacturing and distribution, is the one of the largest producer of aniline and the second largest producer of caustic soda in the PRC.

To further develop Jiangsu province as a hub for the chemical industry, the local provincial government established the China Fine Chemical Industry Taixing Park (previously known as "Taxing Economic Development Area") in 1991. Today, the industrial park has attracted internationally-renowned chemical companies such as Akzo Nobel Chemicals MCA (Taixing) Co., Ltd (a Fortune 500 Company), SNF (China) Flocculant Co., Ltd (a French water treatment agent manufacturer), and Noviant CMC (Taixing) Co., Ltd, with many more coming.

As the largest Chlor-alkali producer in the industrial park, we are well-placed to be the principal supplier of caustic soda and chlorine to the increasing number of large chemical producers setting up operations in the area.

Recognised as one of the market leaders in the chemical industry in Jiangsu province, we are the only Chlor-alkali producer licensed to operate a chemical jetty along the Yangtze River with a handling capacity of 5,000 tonnes of liquid chemicals, thus enabling optimal operational and cost efficiencies, and reliability in delivery.

Our track record in the PRC gives us a foothold in the rapidly growing PRC economy and affords us an edge over companies who are new entrants to the PRC market.

Asian Chemical News 2005/2/7-20

Singpu plans VCM and aniline units

SINGPU Chemicals submitted a feasibility study to the Chinese government last month on building a 200 000 tonne/year vinyl chloride monomer (VCM) unit and a 45 000 tonne/year aniline unit, and on doubling its caustic-soda production, said Chan Hian Siang, chief executive officer (ceo).

The company told ACN last year that it was conducting an internal feasibility study on diversifying into polyvinyl chloride (PVC) production from caustic soda, aniline and chlorine at its production site in China. Singpu produces 150 000 tonne/year of caustic soda and 45 000 tonne/year of aniline in the China Fine Chemical Industry Taixing Park in Taixing, Jiangsu.

As the investment cost of building a VCM unit and a PVC facility was too high, the company had decided to pursue PVC production later, said the ceo.

The company had also decided to pursue the VCM, aniline and caustic soda project in two phases, said Chan. In the first phase, it would build a 30 000 tonne/year aniline unit and increase its caustic-soda capacity by 100 000 tonne/year. The proposed aniline plant and the new caustic-soda capacity would come onstream by Q3 2005, he said.

In the project’s second phase, Singpu will increase the aniline and caustic-soda capacities by 15 000 tonne/year and 50 000 tonne/year, respectively. It would also build the proposed VCM unit in the second phase, which was due onstream in early 2007, said the ceo.

He added that the company would import ethylene to feed the proposed VCM unit.

The VCM unit would cost US$90m to build, said Chan, but he declined to elaborate on the cost of the proposed aniline unit and that of the caustic-soda expansion.

Singpu, which is listed on the Singapore Stock Exchange, currently sells aniline to Yantai Wanhua Polyurethanes, which is planning to build a 160 000 tonne/year methyl di-p-phenylene isocyanate (MDI) unit in Ningbo, Zhejiang. Wanhua now produces 80 000 tonne/year of MDI in Yantai, Shandong.