トップページ

BPケミカルズ(BP Chemicals) Standard

Oil と BP

BP Refining & Petrochemicals

GmbH

1999年1月 英国系石油メジャーのBP社と米国系石油会社のアモコ社との合併

→ BPアモコとして発足2000年4月 ARCOを買収して社名をBPに戻した。

Shanghai Secco Petrochemical

BP Refining &

Petrochemicals GmbH (2003/9/1 Veba Oil

Refining and Petrochemicals を改称)

|

| frequently asked

question Are

you really changing the name of British Petroleum to Beyond Petroleum ?

This

question was answered by Sir John Browne, BP’s CEO, in 2000.

http://www.bp.com/faqs/faqs_answer.asp?id=47

No, of course not. The words 'Beyond Petroleum' are

'a kicker' - the pay-off line in the current

advertising campaign that sums up how the company has

changed as a consequence of recent mergers and

acquisitions and how it will change further in the

future as we expand into new areas beyond our

traditional business of finding and selling oil and

oil-related products.

|

BP AMOCO

(ARCO)

ARCO Polypropylene, LLC

BP Slashes U.S. Polypropylene

Capacity

BP Asian JVs to add 1.05-mil

mt/yr PTA capacity by Q1 '03

Samsung General Chemicals sold PTA Unit to

Samsung Petrochemical

Samsung Petrochemical Company (SPC)

Biyang Chemical PTA Project to Be Put in

Production in May

BP Studies PTA

Expansion in China

China American Petrochemical to become

top PTA producer

BP Strengthens Asian PTA Presence

BP to close Wilton polyethylene plant

E.ON

will hand over Veba Oel to BP BP

Refining & Petrochemicals GmbH

2002/10 Indonesian PE joint

venture PT Peni for sale: BP

→ 2003/3 Consortium to buy Indonesia's PENI

2003/3 BP Planning New World-Scale PTA Plant In

Belgium

2004/2 BP、Sinopec株を売却

2004/2 BP Licenses Innovene

Technology For Sasol Polymers Polypropylene Expansion

2004/3 Sinopec and BP Invest In Acetic Acid

Project

2005/3 BP

and Sinopec to Sign a Joint Venture Contract for their Nanjing

Acetic Acid Plant

2004/4 BP Plans Sale of LAO/PAO

Business Under New 'Twin-Track' Strategy

BP Plans To Sell Over 50% Of

Petrochemicals Business And Prepares For IPO

BP chemicals spin-off to include

Grangemouth, Lavera refineries

BP focuses on seven

core products -purified terephthalic acid

(PTA), paraxylene (PX), acetic acid,(残す)

acrylonitrile,

ethylene, high-density polyethylene (HDPE) and

polypropylene (PP)(売却) |

2004/5 BP Steps Up Investment In

China

2005/4 BP revised the capacity of No2 PTA project

in Zhuhai

2004/11 NOVA Chemicals announces intent to form

European Styrenics Joint Venture with BP

2004/11 BP、ギ酸、プロピオン酸、アセトンから撤退

2004/11 BP、NOVAとの提携でLLDPE生産性アップ

2004/12 BP to Close U.S. Linear

Alpha Olefin Production Capacity

2005/3 BP Announces New Identity for

Petrochemicals Company Innovene

2005/5 BP and NOVA Chemicals sign binding

agreements for European Styrenics JV:NOVA Innovene

2005/6 Innovene and Delta Oil Agree To

Explore Major Petrochemical Investment in Saudi Arabia

2005/7

Shanghai Secco Olefins JV to Stay

with BP After Innovene Spin-Off

2005/9

BP chemical unit Innovene sets $1

billion IPO

2005/9

BP Confirms Plans for Second

Zhuhai PTA Plant

2005/10 BP Agrees Sale of Petrochemicals

Business to INEOS for $9 Billion

2005/10 BP、Sinopec と提携交渉

2005/11 Sinopec and BP

Celebrate the Establishment of Nanjing Acetic Acid JV

Acetic acid projects in Nanjing:

BP vs. Celanese

2006/3 BP, Innovene 売却に伴い改組

2006/4 BP Expanding

European PTA and Paraxylene Production

2006/4 Kuwait, BP mull refining,

petrochemical JV's in S China

2006/5 BP got final approval for PTA project in

Zhuhai

Technip

Awarded Contract by BP Zhuhai

BP starts

construction of 900 kt/year PTA unit in Zhuhai, China

2006/6 BP and DuPont

Announce Partnership to Develop Advanced Biofuels

2006/7 BP to Market Share

of SPC in Korea

2006/7 幻のBP-Shell合併案

2007/5 事故に関するCSB報告

BP Agrees

Major Exploration and Production Deal with Libya

2007/6 BP、ロシアのガス田 ガスプロムに売却

BP, ABF

and DuPont Unveil $400 Million Investment in UK Biofuels

BP、D1オイルズ、バイオディーゼル原料ヤトロファ栽培のJV

設立

2007/8 BP

Formalizes Coal-Bed Methane Plans

2008/1 INEOS to buy Vinyl Acetate Monomer

and Ethyl Acetate businesses from BP

BP Reinforces its

Commitment to China

2008/9 BP and AAR Move to Resolve

Joint-Venture Dispute

2009/4 BP shutting

600,000 mt/year of US PX production

2010/7 BP

Signs North America and Egypt Asset Deals with Apache

2010/9 BP to Sell Malaysian Ethylene and

Polyethylene Interests to Petronas

2010/11 BP Agrees to Sell its Interests in

Pan American Energy to Bridas Corporation

2011/11

BP's sale

of interest in Pan-American Energy to Bridas Corporation canceled

2011/1 BP、ロシアのRosneft と戦略的提携

2011/5 BP、ロシア石油最大手ロスネフチとの提携白紙に

2011/2 BP and Reliance

Industries Announce Transformational Partnership in India

2011/8

BP

and Reliance Commence Strategic Alliance for India

2011/4 BP Agrees Sale of Arco Aluminum

2011/8

BP and JBF Group Agree to Build New Co-Located PET Facility in Geel, Belgium

2011/9

BP to Expand Activities

in Biofuels, Buying Out Remaining Shares in Brazil's Tropical Bioenergia S.A.

BP Announces Acquisition of

Additional Shares in Brazilian Sugar and Ethanol Producer CNAA

2011/10

BP and Partners Investing £10 Billion

in UK Oil and Gas Projects

2012/2 BP

Agrees to Sell Kansas Gas Production and Processing Asset

2012/3

BP Enters the Utica/Point Pleasant Shale in Ohio

2012/5 BP wins delay of Gulf

spill trial until 2013

2012/6

BP Notifies Partners

of its Intention to Pursue a Potential Sale of its Interest in TNK-BP

BP Announces Sale of

Interests in the UK North Sea to Mitsui

BP To Sell Jonah Gas

Operations in Wyoming, U.S.

2012/7 BP

licenses latest generation PTA Technolgy to JBF Petrochemicals

BP Begins Next

Stage in TNK-BP Sale Process

2012/9 BP to Sell Non-Strategic US Gulf Of Mexico

Assets to Plains Exploration and Production Company

BP AMOCO (Associated Press, April 13, 2000)

History: BP's

predecessors include Burmah Oil and Anglo-Persian Oil. Anglo

had the first oil strike in the Middle East in 1908; the

British government bought 51 percent in 1914, eventually

selling its interest in 1987.

British

Petroleum completed its $55 billion acquisition of Amoco on

Dec. 31, 1998,

creating Britain's biggest company and the third largest oil

company in the world.

In April 2000, the U.S. Federal Trade Commission

"unanimously approved BP Amoco PLC's $27.6 billion

purchase of Atlantic Richfield Co. after the company agreed to sell

Arco's Alaskan large oil holdings.

BP Amoco PE Europe Asia

BP

Supplying polyethylene to the world

The BP Polyethylene Business is a leading producer of

polyethylene, with a full range of low density polyethylene

(LDPE), linear low density polyethylene (LLDPE) and high

density polyethylene (HDPE) products for the packaging,

agricultural, consumer goods and construction sectors. We are

also major licensors of cutting edge process and catalyst

technologies to the global polyethylene market.

The Polyethylene Business is one of the largest business

units in BP's Chemicals stream, with access to over 1.9

million tonnes per annum of polyethylene capacity.

Innovex LLDPE film products

The business

supplies the film market sectors with Innovex linear low

density resins based on both butene (C4) and higher alpha

olefin (C6) comonomers.

Novex LDPE film and

coating products

Novex low

density resins include a comprehensive range of

homopolymer and copolymer grades, additive packages and

natural masterbatches.

Innovene Advanced

gas phase technology

The Innovene gas

phase manufacturing process has been licensed worldwide,

and almost 40 licensees currently use this

ground-breaking technology.

Rigidex HDPE

Moulding Products

Rigidex HDPE is

used many sectors of the packaging industry, with

products for applications as diverse as small bottles,

large drums and tanks, crates, pails, bottle caps, toys,

technical parts and fibres.

Rigidex Pipe

products

Rigidex HDPE and

MDPE products supply the utility services and

distribution industries. The main applications are in

pressure and non-pressure piping systems, the coating of

steel pipes with polyethylene, and the production of

ducting to carry cables.

Wire & Cable Resins

and compounds

Resins and

compounds based on LDPE, LLDPE and HDPE, manufactured

mainly at Cologne, Germany are supplied to the wire and

cable market.

Strength in Depth -

global reach

Our plants based at Grangemouth in Scotland, Lavera in

France, and Cologne in Germany produce high density and

linear low density polyethylene for the film, coating,

moulding, pipe, masterbatch and wire and cable markets. BP

has three joint ventures producing polyethylene in the Asia

Pacific region; PT Peni in Indonesia; PEMSB in

Malaysia and Bataan Polyethylene Corporation in the

Philippines.

BP Amoco

Europe

BP Amoco produces olefins at two

manufacturing sites in Europe, Grangemouth in Scotland and Lavera in France. The sites have a combined

ethylene cracking capacity of approximately 1.3 million tonnes

per annum. Olefins produced at these two sites are used to supply

BP Amoco derivatives, along with various external customers and

joint venture partners in Europe and East Asia.

Two former Amoco sites located at Feluy and Geel in Belgium have recently been integrated

into the business. Feluy is a net consumer of 315,000 tonnes of

ethylene per annum, whilst Geel consumes 480,000 tonnes of

propylene. The Baglan Bay plant in Wales is also a consumer of

ethylene and propylene for the production of isopropanol, ethanol

and vinyl acetate monomer.

Our European sales office,

located at Sunbury-on-Thames near Heathrow, services the UK,

France, Germany and Benelux. The BP Amoco Olefins European

headquarters is also located in Sunbury-on-Thames.

Marl

Marl

Grangemouth in Scotland:

At the heart of the

Grangemouth site are two crackers. These produce feed

materials used by derivatives including the PP3

(polypropylene), PEX, Innovex and Rigidex (polyethylene)

plants. These plants produce various grades of low and

high-density polyethylene used in the manufacture of

thousands of everyday items ranging from stretch wrap and

fruit bags to gas pipes and plastic bottles. Raw materials

for both crackers come directly from the North Sea's Forties

pipeline system.

The Grangemouth Unit 4 (G4)

can crack 250,000

tonnes of ethylene per

annum from both gas and light distillate feedstocks. The

Kinneil Grangemouth (KG) unit is a gas cracker using mainly

propane and butane as its raw materials. It has a capacity of

450,000

tonnes of ethylene per

year. An effluent treatment plant that treats wastewater from

both KG and G4 is one of KG's key features. This has

radically improved effluent quality and is a testament to BP

Amoco's commitment to environmental improvement. Any further

waste products from both plants are ultimately recycled or

used as fuel. Nothing is wasted.

The two units produce 700KTe

of ethylene per annum between them, although this capacity

will increase to more than 1,000KTe per annum by 2001.

Lavéra

Olefins at Lavéra are manufactured indirectly by BP

Amoco through Naphtachimie, a 50:50 joint venture

with Elf Atochem.

Naphtachimie's Cracker 4 produces 700,000 tonnes

ethylene, 500,000 tonnes

propylene and 120,000 tonnes of Butadiene per annum. BP Amoco

uses 50% of this output to supply derivative plants such as

Appryl (Polypropylene) and Oxochimie (Oxo-alchohols) and

third party customers.

Feluy, Belgium

The

BP Amoco Chemicals Feluy plant, located just south of

Brussels in Belgium, is the largest western European producer

of linear alpha olefins (LAOs) and the largest European

producer of polyalphaolefins (PAOs). To meet the requirements

of the industry, production capacity of LAOs is now

300,000 tonnes per annum. PAO

production capacity on the site is 55,000 tonnes.

Geel, Belgium

BP Amoco

Chemicals facility in Geel, Belgium is located on a 115

hectare site, 45 km east of Antwerp.

The

plant's operations can be divided into two main streams. The

commodity and speciality stream manufactures 900,000

tonnes of purified terephthalic acid (PTA) and 130,000 tonnes

of purified isophthalic acid (PIA) per annum.

These are used in polyester fibres, films and packaging

resins, as well as in coatings and glass reinforced plastic

resins. A 450,000 ton paraxylene plant on the site provides

the raw material for the PTA. The polymer stream manufactures

500,000

tonnes per annum of polypropylene resins for use in

fabrics, fibres and moulded plastics, for which the site

consumes 480,000 tonnes of propylene per annum.

Marl in Germany

BP Amoco Chemicals Marl in

Germany consumes 100,000 tonnes of ethylene and 300,000

tonnes of benzene per annum. The plant manufactures styrene, polystyrene

(PS) and expandable polystyrene (EPS). The acquisition of the Marl facility

in 1997 has made BP Amoco Chemicals the second largest

supplier of PS and EPS in Europe.

Baglan Bay

BP Amoco Chemicals Baglan Bay

plant is located in Port Talbot, 13 kilometers east of

Swansea on the south coast of Wales. It is one of the

company's three major petrochemical production centres in the

UK. The 1000 acre site manufactures ethanol, vinyl acetate

monomer (VAM) and isopropanol (IPA) from ethylene and propylene

feedstock.

Asia

BP Amoco's Olefins business in

Asia is run from three offices based at Kuala Lumpur in Malaysia,

Jakarta in Indonesia and Singapore.

The strategic function of BP Amoco Olefins operations in Asia is

to source and supply competitively advantaged olefins to our

Joint Venture polymer manufacturing assets in the Asia Pacific

region. We supply approximately 140,000 tonnes of ethylene to our

joint venture polyethylene plants in Merak, Indonesia and Bataan,

Philippines. A further 250,000 tonnes of propylene are supplied

to our joint venture site at Balongan, Indonesia and to other

third party customers.

Ethylene

BP Amoco has a 51% share in

the PT Petrokimia Nusantara Interindo (PT PENI) polyethylene plant in Merak,

Indonesia. Other joint venture partners include PT Arseto

Petrokimia (24%), Mitsui and Co Ltd (12.5%) and Sumitomo

Corporation (12.5%).

*PT Peni for sale: BP

The plant manufactures 450,000 tonnes per annum of Linear Low

Density Polyethylene (LLDPE), and High Density Polyethylene

(HDPE) using BP Amoco's Innovene technology.

In the Philippines, BP Amoco owns a 38% share in the Bataan Polyethylene

Corporation (BPC)

plant at Bataan. Other joint venture partners include

Petronas and Sumitomo Corporation. Plant capacity will be

250,000 tonnes per annum of LLDPE and HDPE when operations

commence in mid 2000.

*Bataan PE for sale: BP

BP Amoco also has a 60% share in Polyethylene Malaysia (PEMSB) and a 15% share in Ethylene Malaysia (EMSB) at Kertih.

Propylene

BP Amoco has a 10% share of PT Polytama Propindo (PTPP) polypropylene in Balongan. The

plant produces 180,000 tonnes per annum of polypropylene, based

on Himont technology.

The Olefins Asia business is responsible for marketing all

propylene (approximately 210,000 tonnes per annum) produced at

the Pertamina

refinery at Balongan in Indonesia. Olefins Asia also manages the propylene

pipeline supply operation between the refinery and the Polytama

site.

*Polytama

Propindo was established

as a joint venture between Tirtamas Majutama with 80% stake,

BP Chemicals owns 10% share and Japan’s Nissho Iwai owns the rest 10%.

Tirtamas Majutama had agreed to hand over its assets in

the multibillion dollar project to Indonesian Bank

Restructuring Agency(IBRA).

Tuban

Petro will then control 59.5 % of

the shares in PT Trans Pacific, 80 % of PT Polytama Propindo,

50 % of PT Petro Oxo Nusantara, and 50 % of PT Pacific

Fibretama.

2000/12/19 Solvay

Major activity exchange between Solvay and BP

http://www.solvay-polyolefins-europe.com/News/news/press/pr2000/pr001219.htm

SOLVAY announced that it signed with BP a Memorandum of

Understanding aimed at strengthening its portfolio. The

agreement would lead to SOLVAY's transfer of its polypropylene

(PP) business to BP and to BP's transfer of its engineering

polymers business to SOLVAY. SOLVAY would also form joint ventures

with BP in high density polyethylene (HDPE) in Europe and the

Americas.

In Europe, the two companies

would combine their European high-density polyethylene (HDPE)

businesses into a 50-50 joint venture.

→BP Solvay Polyethylene Europe

In the US, the agreement would lead to SOLVAY and BP creating

a 51-49 joint venture for SOLVAY's current HDPE business.

→BP Solvay

Polyethylene North America

↓

Solvay sells its stake in BP Solvay

Polyethelene joint ventures to BP

BP Solvay Polyethylene

North America

(Solvay holds a 51

percent stake and BP owns the remainder.)

BP Solvay Polyethylene North

America is one of the global marketplace's most exciting new

companies. A joint venture between British Petroleum (BP) and

Solvay S.A., our combined roots in the chemical business go

back almost 140 years.

Annually BP Solvay Polyethylene produces 1.8 billion pounds of

Fortiflex high-density polyethylene (HDPE) at its production facilities in Deer

Park, TX.

(2001/11/1 release) http://www.bpsolvaype.com/Press.html#21

Solvay's

agreement with BP enters into force

BP completes deal to strengthen core

polymers businesses

Solvay’s agreement with BP enters into force

・Strengthening of

Solvay’s position in

high-margin Specialty Polymers

・Birth of "BP

SOLVAY POLYETHYLENE" joint ventures

- The acquisition by

Solvay of BP’s engineering

polymers business.

- The setting up of two joint ventures

in high density polyethylene ("HDPE"), which together are one of the

leading players worldwide, with a total turnover of

approx. EUR 2.0 billion.

Joint ventures in Europe (50/50) and in the USA

(51/49) have been

created under the new name "BP Solvay

polyethylene".

- And the divestment of

Solvay’s Polypropylene

(PP) activities where

it was not amongst the global leaders (ranked 12th with

annual sales of EUR 500 million).

BP completes deal to

strengthen core polymers businesses

As result of the deal, BP has added

Solvay’s global

polypropylene business to its existing business and the two companies have

combined their high-density polyethylene (HDPE)

businesses into two joint ventures. BP has also

transferred its non-core engineering polymers business to

Solvay.

2003/7/9 Dow Jones

Business News

Solvay, BP JV Restructures US

Production Facilities

Belgian chemical and

pharmaceuticals company Solvay SA (B.SOL) Wednesday said

that its U.S. joint venture with BP PLC - BP Solvay

Polyethylene North America - will discontinue production of 260 million pounds

of high density polyethylene (HDPE) capacity from three

small-capacity lines at its Deer Park, Texas manufacturing site at the end of

July. The capacity being removed from the Deer Park site

is being replaced by production from a new 700 million

pound HDPE slurry loop plant at Cedar Bayou, Texas, in

which BP Solvay Polyethylene owns a 50% interest.

The recent, successful startup of the new Cedar Bayou,

Texas HDPE plant, jointly owned by BP Solvay

Polyethylene North America and Chevron Phillips Chemical

Company L.P, enables

BP Solvay Polyethylene to improve the overall economics

and efficiency of its operations.

ARCO

Polypropylene, LLC

(BP

18 April 2000 )

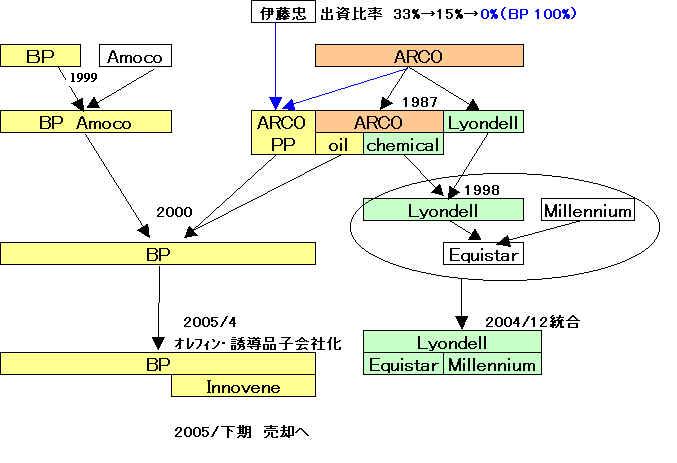

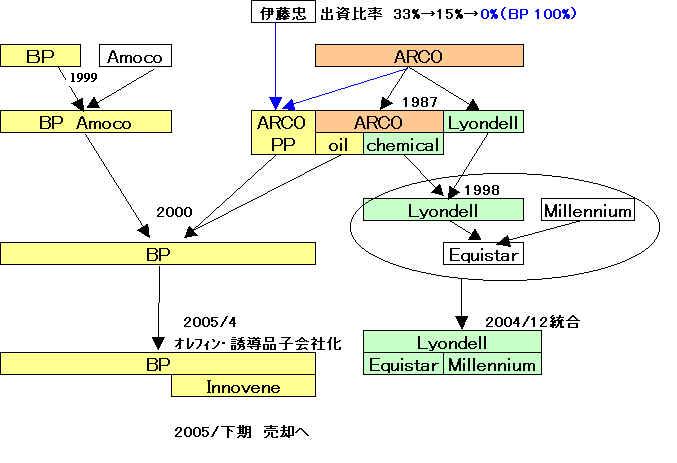

BP Amoco

combination with ARCO expands BP Amoco's Polypropylene capacity

BP Amoco

announced today that, as a result of its combination with

ARCO, the company will assume two thirds ownership in ARCO

Polypropylene, LLC, a

joint venture between ARCO and the Itochu Corporation of

Japan.

The joint

venture consists of a recently constructed 200,000 tonne per year

polypropylene plant in

Carson, California.

→ 伊藤忠15%に

→ BP 100%に (伊藤忠はアジア、南米のSales agent)

Chemical Week Apr

03, 2002

BP

Slashes U.S. Polypropylene Capacity

BP says it will

permanently close about 32% of its North American

polypropylene (PP) capacity. The company will shutter two

unitsーa

261,000-m.t./year plant at Bayport, TX and a

205,000-m.t./year unit at Chocolate Bayou, TX. BP idled the

Chocolate Bayou unit late last year, citing weak demand and

poor margins. The Bayport plant will be closed by June.

The closures

will leave the company with PP capacity of 625,000 m.t./year

at Chocolate Bayou, and 386,000 m.t./year at Deer Park, TX.

BP obtained the Deer Park plant as part of a swap deal with

Solvay Polymers. BP also has about 180,000 m.t./year of PP

production at a joint venture with Itochu at Carson, CA,

obtained in its 2000 acquisition of Atlantic Richfield.

Platts 2002/10/25

Indonesian PE joint venture PT Peni for sale: BP

Indonesian

polyethylene joint venture PT Peni is to be sold after

shareholders (BP 75%, Mitsui Corp 12.5% and Sumitomo Corp

12.5%) decided that the verticle integration needed to

improve the JV's profitability would be best achieved under

new leadership, a BP spokesperson said Friday.

BP had

also agreed in-principle to sell its 39% share in a PE JV in

the Philippines, Bataan Polyethylene, because of poor

returns.

27th March 2003 BP

BP Planning New

World-Scale PTA Plant In Belgium

http://62.58.106.148/downloadable_files/2003-03-26_PTA4_pb_eng_v6.doc

BP announced today that it has begun detailed engineering

design for the construction of a new world-scale purified

terephthalic acid (PTA) production plant at its Geel

petrochemicals site in Belgium.

The plans envisage construction of a 700,000 tonnes a year

PTA plant at Geel.

BP is a world

leader in the production of PTA, with worldwide production

capacity of some 6 million tonnes a year. In addition to

European PTA production at Geel, BP also produces PTA from

plants in the USA, Brazil, Korea, Indonesia, Malaysia and Taiwan. BP's latest PTA

production site, the 350,000 tonnes a year

Zhuhai (珠海) joint venture in southern China, was

successfully commissioned in January 2003. (BP Zhuhai Chemical Company Limited)

Asian Oil & Gas

2000/11/1

中国JV完成

PTA to the

fore in BP ventures

The official

groundbreaking for a world-scale purified terephthalic acid

(PTA) plant took place in Zhuhai, one of China's special

economic zones, in November. Targeted for completion in

December 2002, the $408 million complex will be owned and

operated by the Amoco Zhuhai Chemical Company, a three-year-old

joint venture between BP (80%), the Fuhua Group, a

subsidiary of the Port Enterprise Group (15%) and the China

National Chemical Fibre Company (5%).

July 30, 2002

China American Petrochemical to become top PTA producer

http://www.taiwanheadlines.gov.tw/20020730/20020730b6.html

China American Petrochemical Co. (CAPCO) will become the

world's top supplier of pure terephthalic acid (PTA) after

its sixth PTA plant starts production in early 2003.

CAPCO is

a joint venture of BP-AMOCO, which has a 50 percent stake,

and Taiwan's state-run Chinese Petroleum Corp., which holds

25 percent.

21 August 2001

BP to close Wilton polyethylene plant

http://www.bpchemicals.com/polyethylene/news/business_news/210801.html

BP announced

today that it will close its low density polyethylene (LDPE)

manufacturing operations at Wilton on Teesside. The company

cited difficult market conditions as the reason for closing

the 100,000 tonne a year plant.

The Wilton plant, built in 1973, uses high-pressure autoclave

technology to manufacture low-density polyethylene for use by

customers in a wide range of products such as film

applications. BP acquired the plant from ICI in

1982.

2005/10/7 BP

BP Agrees Sale of

Petrochemicals Business to INEOS for $9 Billion

http://www.bp.com/extendedgenericarticle.do?categoryId=2012968&contentId=7010538

BP today announced that

it is to sell Innovene, its olefins,

derivatives and refining group, to UK-based INEOS. The $9 billion cash sale, subject

to regulatory approvals, includes all Innovene's manufacturing

sites, markets and technologies. The sale is expected to be

concluded early in 2006 at which time payment will be received by

BP.

Innovene is the 100 per cent BP-owned group created in April

2005. It has 8,000 staff, manufacturing facilities in seven

countries in North America and Europe; $18 billion revenues in

2004; $13 billion of gross assets; $9.9 billion of net assets;

pre-tax profits (Jan-Jun 2005) of $0.7 billion; 18 million tonnes

of annual petrochemicals capacity and 412,000 barrels per day of

crude oil refining capacity.

Notes to editors:

BP announced the separation of its olefins and derivatives

business in April 2004. It then added two refineries

(Grangemouth, UK, and Lavera, France) to the business in November

2004, and created the 100% BP-owned Innovene subsidiary in April

2005.

BP is the world's second largest integrated oil and gas company,

operating in more than 100 countries with over 100,000 staff and

turnover of $285 billion.

INEOS is a leading global manufacturer of speciality

petrochemicals and comprises 10 business units each with a major

chemical company heritage. Its production network spans 46

manufacturing facilities in 14 countries.

Innovene assets included in sale agreement:

North

America

Chocolate Bayou, Texas

Texas City (chems), Texas

Hobbs Gas Fractionation Facility, Texas

Battlefield (ex-Deer Park), Texas

Green Lake, Texas

Carson (chems), California

Lima, Ohio

Whiting (chems), Indiana

Joffre, Canada |

|

Europe

Grangemouth (chems/refinery), UK

Lavera (chems/refinery), France

Sarralbe, France

Feluy, Belgium

Geel (polypropylene), Belgium

Lillo, Belgium

Koln (excluding ethylene oxide), Germany

Marl, Germany

Rosignano, Italy

The NOVA Innovene joint venture |

2006/5/3 Asia Chemical

Weekly

BP got final approval for

PTA project in Zhuhai

BP Zhuhai Chemical Co.

(BP Zhuhai), an 85:15 jv between BP and FuHua Group, has got the

final approval from NDRC for its 900 000t/y PTA project in

Zhuhai, Guangdong Province.

This is BP's second

PTA project in Zhuhai. With total investment is RMB 3.02 billion

(USD 377 million), the project is expected to start up by the end

of 2007.

PX feedstock will be sourced from Sinopec Maoming Petrochemical

who is building a 600 000t/y PX plant in Maoming, Guangdong

Province, and it should be operational from 2007.

Acetic acid will be secured from the jvs of BP and Sinopec both

in Chongqing and in Nanjing.

Yangtze River

Acetyls Co (Yaraco) - a jv of BP and Sinopec - has 350 000

tonne/year acetic acid capacity in Chongqing; BP YPC Acetyls Co

-another jv of BP and Sinopec - is building a 500 000 t/y acetic

acid project in Nanjing, Jiangsu Province.

In Feb. 2006, the SEPA

ordered checks on 127 petrochemical projects in terms of

potential risks of chemical pollution. BP Zhuhai 900 000t/yPTA

project was involved while it did not be impacted by the

environment issue.

Currently, BP Zhuhai

operates a 350 000t/y PTA plant in Zhuhai.

BP Zhuhai Chemical Co. Ltd. (BPZ), a chemical

producer of Purified Teraphthalic Acid (PTA), is located

in Zhuhai, Guangdong province of China. Zhuhai is located

adjacent to Macau and approximately 35 km across the

mouth of the Pearl River from Hong Kong.

BPZ is the first Sino-foreign joint venture producing and

selling PTA product in China. This joint venture is 85%

BP and 15% Fu Hua Group. It has started up the initial

operation activities in January 2003 and its annual

production capacity is 350,000 tons. BPZ's producing capacity is capable

of reaching 500,000 tons per year.

Based on the successful launch of the first phase, BPZ

will continue to seek the support from the Chinese

government in growing its world-class PTA manufacturing

facility. |

2006/5/29 China

Chemical Reporter

Technip Awarded Contract by BP Zhuhai

Technip announced on May 10th, 2006 that it has been awarded

by BP Zhuhai Chemical Company Limited, a joint venture

between BP and Zhuhai Fuhua Group, a services contract for

the development of a new world-scale PTA (purified

terephthalic acid) plant at their site in Guangdong Province.

The contract, which covers the management of the development,

will be executed by a team integrated with the client.

Technip's operations and engineering center in Rome (Italy)

has responsibility to execute the contract, which falls

within the framework of the on-going alliance between BP and

Technip in the PTA domain.

The new plant, with a capacity of 900 000 t/a, will be the

first to employ BP's latest technology and is expected to

come on stream at the end of 2007 to meet China's growing

demand for PTA.

Platts

2006/6/26

BP starts construction of 900 kt/year PTA unit in Zhuhai,

China

BP held a ground breaking ceremony to herald the construction

of its new purified terephthalic acid plant in Zhuhai, China

on Friday. The new unit will be an expansion of BP Zhuhai, an

existing joint venture between BP and Fu Hua Group, said a

company source Monday.

When commissioned at the end of 2007, it will be the world's

largest single train PTA unit with a capacity of 900,000

mt/year, and will bring the combined capacity from the

company's Zhuhai site to 1.4 million mt/year, the source

said.

2006/7/18 Asia

Chemical Weekly

BP starts construction for its No.2 PTA plant in Zhuhai

On July 17, BP starts construction for its No.2 PTA project

in Zhuhai, Guangdong Procince.

The new 900 000 tonne/year PTA plant is operated by BP Zhuhai

Chemical Co. (BP Zhuhai), an 85:15 jv between BP and FuHua

Group.

With total investment of RMB 3.02 billion (USD 377 million),

the project will use BP's latest state-of-art technology.

According to BP, this plant will be the largest and most

efficient PTA project in China.

Compared to traditional PTA technology, BP's technology use

in Zhuhai, will reduce green-house gas emissions by 65%,

liquid waste discharges by 75% and solid process waste by

40%. In Feb. 2006, the SEPA ordered checks on 127

petrochemical projects in terms of potential risks of

chemical pollution. BP Zhuhai project was involved while it

did not be impacted by the environment issue.

The PX feedstock will be sourced from the under-building 600

000 tonne/year PX project of Sinopec Maoming Petrochemical,

which is expected to start up in 2007. Acetic acid will be

secured from two jvs of BP and Sinopec -- Yangtze River

Acetyls Co and BP YPC Acetyls Co.

Yangtze River Acetyls Co (Yaraco) has 350 000 tonne/year

acetic acid capacity in Chongqing; while BP YPC Acetyls Co is

building a 500 000 t/y acetic acid project in Nanjing,

Jiangsu Province.

The plant is expected to be commissioned by the end of 2007

and will bring the combined PTA capacity of BP in Zhuhai site

to 1.4 million tonne per year.

2001/7/16 Alexanders Gas & Oil

Connection

E.ON will hand

over Veba Oel to BP

German energy

and special chemicals company E.ON and UK oil company British

Petroleum agreed to swap a couple of their German oil and gas

businesses, the chairmen of the two companies told. Under the

terms of a contract signed, E.ON will hand over its

petroleum subsidiary, Veba Oel, to BP. The deal also means that

Veba Oel's subsidiary, Aral, Germany's largest gasoline station

chain, will also pass into British hands. In return, E.ON will

acquire Gelsenberg from BP.

Gelsenberg holds 25.5 % of Ruhrgas, Germany's leading gas

distributor. The two linked transactions carry important

strategic implications for both companies, said E.ON Chairman

Ulrich Hartmann at the press conference held together with BP

Group CEO John Browne. Both for E.ON and for Veba Oel, BP not

only represented a partner of the highest order, said Mr.

Hartmann.

The petroleum giant was also the only partner with whom such a

deal of this strategic quality could have been cut. It provided

the Duesseldorf-based company with a unique opportunity to sell

Veba Oel while refocusing E.ON's energy activities by a novel

growth step in its core natural gas business, he said.

Veba Oel,

sources in Duesseldorf say, will become BP's most significant

subsidiary in Germany. The transaction provided BP with the

opportunity to improve its market position in Germany in one fell

swoop by acquiring the largest and, at the same time, a highly

efficient gasoline station chain in the world's third-largest

economy. Mr. Browne called the deal a fortuitous meeting of

interests.

Its new ownership of Aral gives BP 25 % of the retail market in

Germany and puts it clearly in a leading position. It also gives

it some 15 % of the European market. Mr. Browne confirmed that it

was BP's intention to group all its gasoline retail activities in

Germany under the Aral banner.

On the other hand, Aral service stations abroad, in Poland or

Austria for example, will fly the BP flag. More important even

than market share, however, will be the high level of efficiency

that can now be achieved in Germany, said Mr. Browne. With the

acquisition of Veba Oel, BP expects annual synergism and savings

of at least $ 200 mm. The merger will also mean that around 1,500

of more than 40,000 jobs in total will disappear.

Both companies

believe that the German Federal Cartel Office in Bonn will be

responsible for reviewing the gas-related aspects of the deal.

The EU Commission in Brussels will be responsible for checking

any competition questions relating to BP's acquisition of Aral's

gasoline stations.

Ulf Boege, president of the German Federal Cartel Office, has

expressed concern about concentration in German gasoline

retailing, pointing out that the two largest players,

Shell/RWE/DEA, on the one hand, and BP/Aral, on the other, could

now together represent more other than 50 % of the total gasoline

retail market.

Financial Times 2006/7/26

Sutherland wins BP power play

Peter Sutherland, chairman of BP, yesterday stamped

his authority over the energy group by forcing Lord Browne, its

widely admired chief executive, to announce he would retire at

the end of 2008.

However, even as the company was trying to draw a line

under the row, lingering tensions between the two camps

resurfaced, particularly over a now-abandoned

plan for BP to pursue a merger with Royal Dutch Shell,

the company's European rival.

People close to Mr Sutherland and Lord Browne denied

that the idea - resisted by the chairman and other board members

- fuelled tension between the two.

The move, described earlier this week by sources close

to Lord Browne as a "significant potential merger", was

yesterday officially dismissed as nothing

more than "scenario planning".