2012/10/17 日揮

当社サウジアラビア法人がエチレン設備増設プロジェクトを受注

日揮は、当社のサウジアラビア法人であるJGCガルフ・インターナショナル社が、サウジアラビア国営石油会社(サウジアラムコ社)と住友化学(株)がサウジアラビアで推進する、ラービグ第2期計画向けエチレン製造設備の増設プロジェクトを受注しましたので、お知らせします。

プロジェクトの詳細は以下の通りです。

1. 顧客名: 住友化学株式会社

サウジアラビア国営石油会社(Saudi Arabian Oil Company)

(通称: サウジアラムコ社 - Saudi Aramco)

2. 受注者名: JGCガルフ・インターナショナル社

(JGC Gulf International Co., Ltd: 日揮100%出資のサウジアラビア法人)

3. 建設地: サウジアラビア王国ラービグ地区

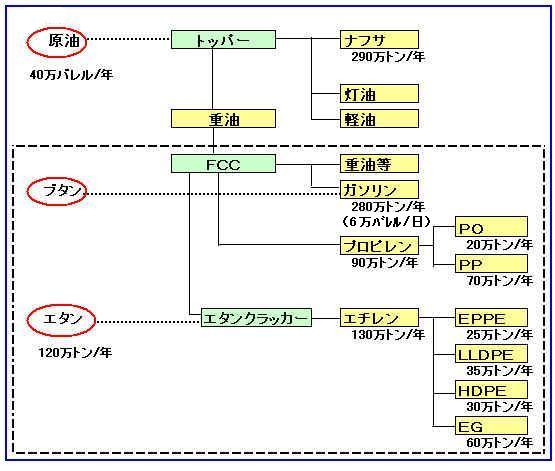

4. 契約内容: エチレン製造設備増設(年産30万トン)に係る設計、機材調達、建設工事(EPC)役務

5. 契約形式: ランプサム(一括請負)契約

6. 受注金額: 非公表

7. 納期: 2015年

8. プロジェクトの概要:

石油化学製品の世界的な需要の高まりを受け、サウジアラムコ社と住友化学株式会社の合弁会社であるラービグ・リファイニング・アンド・ペトロケミカル・カンパニーは、サウジアラビアのラービグ工業地帯で石油精製・石油化学コンプレックス事業(ラービグ第1期計画)を運営し、これに続いてサウジラムコ社と住友化学は、ラービグ第1期計画の大規模拡張計画(ラービグ第2期計画)を進めております。

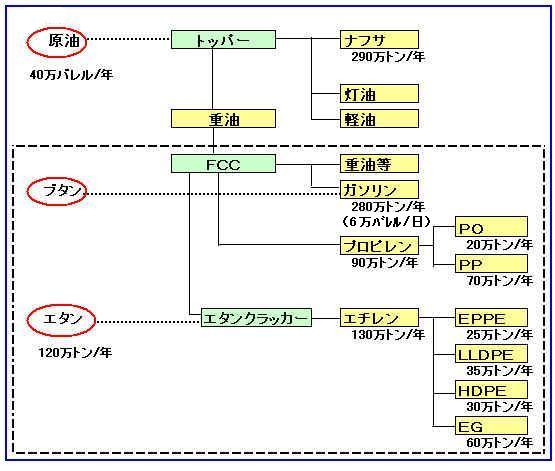

今般、JGCガルフ・インターナショナル社が受注したエチレン製造設備増設プロジェクトは、日揮が2008年に建設した第1期計画のエチレン製造装置(年産130万トン)を年産160万トンに拡大するための設備を増設するものであり、ラービグ第2期計画の中核装置の一つとして、その下流には多数の化学品製造設備が連なる非常に重要度の高い設備となります。

さらに、住友化学株式会社とサウジアラムコ社の最重要プロジェクトであるラービグ第2期計画に対し、事業化調査に係るプロジェクト・マネジメント・サービス業務に引き続き、日揮グループが参画できることは大変光栄なことであり、価値あることと考えております。

サウジアラビアは、近年自国の産業多角化と自国民の雇用促進政策を積極的に推進しています。このような中、当社は2008年に同業他社に先駆けて同国にEPC(設計:

Engineering、調達: Procurement、建設: Construction)子会社としてJGCガルフ・インターナショナル社を設立し、これまで現地のニーズに対応しながら着実に実績を重ねてきました。

本プロジェクトの入札においては、顧客はEPC役務を一貫して遂行できるサウジアラビア国内(IK (Inside of Kingdom) EPC)企業が参画することを強く望んでいました。今回の受注は、JGCガルフ・インターナショナル社の現地での実績とプロジェクト遂行能力、さらに価格競争力が高く評価されたものと考えております。

また、JGCガルフ・インターナショナル社が現地で一貫してプロジェクトを遂行していくことは、正にサウジアラビアの国家戦略と当社の企業戦略とが合致したものであり、両者にとって大変意義深いプロジェクトとなります。

当社は現在、中期経営計画「NEW HORIZON2015」において、海外EPC子会社の強化・拡大を推進しており、本プロジェクトの遂行を通して、JGCガルフ・インターナショナル社のプロジェクト遂行能力のさらなる向上を図って行く予定です。

2012/12/20 Arabian Supply Chain

Rabigh Petrochemical Logistics opens new Saudi facility

Rabigh Petrochemical Logistics (RPL) announced the

opening of its new regional warehouse in Rabigh last week.

The new warehouse is located at Rabigh Plus Tech Park

in Rabigh (RPTP). The opening ceremony was attended by top officials of

PetroRabigh, various clients in RPTP, as well as executives from Almajdouie and

the Sumitomo Warehouse Co. management team.

Rabigh PlusTech

ParkはSaudi Aramcoと住友化学がスポンサーとなって PetroRabigh

に建設するプラスチック加工団地で、面積は240ヘクタール(うち70ヘクタールは用役、物流、共通施設用地)。

The total area for RPL is 30,000sq.m. with an

area of 13,000sq.m. covered warehouse built with storage space and 300sq.m.

temperature controlled warehouse. In addition, there is also around 5,000sq.m.

of open sky storage and two container docking stations. The warehouse is made

with world class safety and security standards which ensure handling of the

products with great care. Presently, RPL annually handles 1.6 million tonnes of

materials inside PRC warehouse, of which, 8% to 12% is expected to be handled in

RPTP. Aside from this new warehouse, RPL is also operating its existing

warehouse facility in Riyadh.

This investment demonstrates RPL’s commitment to offer broad and innovative

logistics solutions to its long term strategic customers. With this new setup,

RPL is looking forward to provide total logistics solutions to its major client

PetroRabigh, as well as other potential customers in RPTP.

RPL has already started working with other major RPTP tenants like ASTRA(Arab

Supply and Trading Co.), SPCS (Sumitomo Chemical Polymer

Compounds Saudi Arabia) and AJMC (Arabian Japanese Membrane Company).

サウジアラビアでは住友化学 55%、東洋インキ 45%出資で

Sumika Polymer

Compound Saudi Arabia

を設立し、PetroRabighプラントに隣接するRabigh Conversion Industrial Park (Rabigh

Plus Tech Parkと改称)で年産10,000トンののPPコンパウンド設備を建設する。

アジア、アフリカ、欧州等の市場に向けて、原料から一貫した生産体制を構築する。

2008/6/27 住友化学、サウジでPPコンパウンドを生産

AJMC

社名 :Arabian

Japanese Membrane Company, LLC

出資者:Arabian

Company for Water & Power Development 49%

東洋紡 36.1%

伊藤忠 14.9%

場所

:ラービグ

設立 :2010/3

事業 :海水淡水化用逆浸透膜エレメントの製造・販売

2013-12-15

PetroRabigh

1)従来、石油製品はAramco、石油化学は住化が担当していたが、半々に変更

2)石油化学の販売マージンを1/3カット、石油製品(赤字)についてはマージンをゼロに。

3)2013/4に遡及、5年後見直し

これにより2013年(9ヶ月)で267百万ドル改善の予想。

PetroRabigh's earnings have been hit hard

this year by maintenance at some of its facilities, pressure on profit

margins, power cuts and an outage of its ethane cracker due to a water leak.

|

Rabigh Refining and Petrochemical

Company (Petro Rabigh) announces the signing of an agreement with the Founding

Shareholders, Saudi Aramco Company and Sumitomo Chemical Company, that enhances

its business and financial performance.

Rabigh Refining and Petrochemical Company (Petro

Rabigh) announces that on Thursday, December 12th, 2013 the Company signed an

agreement with the Founding Shareholders, Saudi Aramco Company and Sumitomo

Chemical Company, that enhances its business and financial performance.

Per the agreement, Saudi Aramco Company

supplies Petro Rabigh with 50 million cubic feet, or its equivalent, of methane

gas per the local market price, until the completion of the main gas network in

Rabigh area and the allocation of the required amount of gas to Petro Rabigh

through the appropriate regulatory authorities in the Kingdom.

In addition, the Founding Shareholders shall

equally handle international marketing of Petro Rabigh’s

products.

* Previously, Saudi Aramco marketed refined

products for PetroRabigh while Sumitomo Chemical handled chemicals.

Further, they are committed to reducing

marketing commission by about one-third of current rates.

Also, the marketing commission for Petro Rabigh ’s refined

products has been cancelled.

This Agreement shall take effect

retroactively as of April of this year, 2013.

The agreement is likely to have a positive impact on the Company's revenues by

approximately one billion Saudi Riyals(* $267 million) this year and one billion

three hundred million Saudi Riyals per year in the coming years per the current

outlook of prices and production levels.

The agreement will be reviewed and evaluated

by all parties after five (5) years from the date.

-----------

April 01, 2014 Bloomberg News

Aramco Trading Starts Selling Petro Rabigh

Chemical Products 上記参照

Saudi Aramco Products Trading Co., the fuel

marketing unit of Saudi Arabia’s state oil producer, started selling products of

an affiliated petrochemicals maker.

Aramco Trading will sell products including polypropylene and polyethylene made

by Rabigh Refining & Petrochemicals Co., according to a statement on the state

oil company’s website today. The company began physical deliveries of the first

chemical products today, it said.

Saudi Arabian Oil Co., the world’s largest oil exporter, owns all of the

marketing unit and 37.5 percent of the refinery, known as Petro Rabigh. Sumitomo

Chemical Co. holds an equal share in Petro Rabigh, with the remainder traded on

the stock market. The partners will sell equal amounts of Petro Rabigh’s

products, according to a Petro Rabigh statement today.

Persian Gulf oil producers such as Saudi Arabia are boosting chemical output to

diversify their economies away from reliance on crude sales for revenue by

selling finished products like transport fuels and plastics. Aramco and Sumitomo

plan to expand the Petro Rabigh plant and Aramco is building additional chemical

capacity at Jubail on the Gulf.

2014/1/1 Petro

Rabigh

Append Announcement from Rabigh Refining

and Petrochemical Company (Petro Rabigh) Regarding the Start of Terminating the

Services of Rabigh Arabian Water & Electricity Company (RAWEC)

With reference to the announcement of Petro

Rabigh on September 18th, 2013 regarding the start of terminating the services

of Rabigh Arabian Water & Electricity Company (RAWEC),

Petro Rabigh announces that yesterday, Tuesday, December 31st, 2013 it reached a

preliminary agreement for a comprehensive settlement with Rabigh Arabian Water &

Electricity Company (RAWEC), the main supplier of power and utilities for the

Company.

PetroRabigはRAWECの停電事故でしばしば操業を停止、大損害を出しており、契約停止を通告していた。

なお、これまではRAWECからのみ、電力を受けていたが、昨年の停電のあと、全国電力網に接続、仮にRAWECが停電してもPetroRabighは影響を受けない体制に変更したという。

The settlement agreement includes a financial

package of more than 1 billion Saudi Riyals which

RAWEC is committed to fund, and which is distributed as follows:

750 million Saudi Riyals in cash upon signing the

final agreement,

190 million Saudi Riyals as reduction in the value

of future rate throughout the remaining period of the concession contract of

Build, Operate and Own (BOO),

and approximately 250 million Saudi Riyals as

capital investment to improve the reliability of the utilities supply network.

1SARは0.2666米ドル

Until the execution of the final settlement

agreement, Petro Rabigh, under this preliminary agreement, will suspend for 3

months the previous notification that was sent to RAWEC on Wednesday, September

18th, 2013 where Petro Rabigh expressed its desire to terminate the agreement of

power and water supplies with RAWEC. However, this preliminary agreement

provides a promising opportunity to settle this issue for the interest of both

parties.

May 14, 2014

Reuters

Saudi Aramco, Sumitomo face higher costs for

petrochemical plant expansion

The

expansion of a petrochemicals complex in Saudi Arabia owned by Saudi Aramco

and Sumitomo Chemical is now expected to cost 32 billion riyals ($8.5

billion), higher than previously estimated, the joint-venture said on

Wednesday.

The expansion plan, which aims to

increase output from the plant as well as introduce higher-margin products,

was originally estimated to cost around $7 billion.

But in a stock exchange filing

on Wednesday, PetroRabigh said: "Total investment in the project is around

32 billion riyals according to current forecasts."

The statement did not give any

reason for the change in price, but said the project - situated on Saudi

Arabia's Red Sea coast - was still due to come online during 2016.

A company spokesman declined to

provide further information.

The joint-venture, known as

PetroRabigh, has had a number of setbacks because of maintenance issues in

2013 at its existing facility including power cuts and an outage at its

ethane cracker.

A new marketing deal with its

parent firms in December has helped alleviate the pressure on profits from

the maintenance problems. Both Aramco and Sumitomo have also made firm

commitments to the expansion project, known as Rabigh II, since giving it

the final go-ahead in 2012.

Under the plan, an existing

ethane cracker will be expanded and a new aromatics complex built that will

make higher-value petrochemical products and have a capacity of 1.72 million

tonnes per year.

PetroRabigh's existing plant can

produce an annual 18 million tonnes of refined products and 2.4 million

tonnes of petrochemical products.

Rabigh II will produce ethylene

propylene rubber (EPR), thermoplastic polyolefin (TPO), methyl methacrylate

(MMA) monomer, polymethyl methacrylate (PMMA) among other products.

To fund construction of Rabigh

II, both Sumitomo and Aramco will put in around 100 billion yen, with the

rest coming from project financing, Sumitomo Chemical President Masakazu

Tokura told reporters in November. (Reporting by Reem Shamseddine; Editing

by David French and Jane Merriman)

September 10, 2014 Reuters

Saudi's PetroRabigh seeks funding

for $8.5bn petchems project

Saudi Arabia's

PetroRabigh said on Wednesday its founding shareholders

had formally invited banks to provide financing for the

SR32 billion ($8.5 billion) expansion of its

petrochemicals complex in the kingdom.

No figures for how much

cash would be raised by PetroRabigh - a joint venture

between Saudi Aramco and Sumitomo Chemical - were given

in the statement.

However, Sumitomo

President Masakazu Tokura said last November that both

companies would each put in 100 billion yen ($975

million), with the rest of the funds coming from project

financing.

The requests for

proposals were issued by the parent firms to local and

international banks on Tuesday, with financing of the

expansion to be split between conventional loans and

sharia-compliant facilities, the bourse filing said.

PetroRabigh's

existing plant can produce an annual 18 million tonnes

of refined products and 2.4 million tonnes of

petrochemical products.

The new facility,

known as Rabigh II, is to

be built as an expansion of PetroRabigh's existing

petrochemical plant, increasing output and introducing

higher-margin products.

The project, located

on Saudi Arabia's Red Sea coast, received a formal

go-ahead from the parent firms in 2012; PetroRabigh has

said previously it is due to come online in 2016,

despite a string of maintenance problems at the existing

facility.

Rabigh II will

produce ethylene propylene rubber, thermoplastic

polyolefin, methyl methacrylate monomer and polymethyl

methacrylate among other products.

The ownership of

Rabigh II will be transferred to PetroRabigh from the

parents in the fourth quarter of this year, the joint

venture firm said last month, although Aramco and

Sumitomo would continue to guarantee the debt raised to

build the scheme.

2015 年3 月17 日 住友化学

2012/5/28 住友化学、サウジ・アラムコとの「ラービグ第2期計画」実施

ペトロ・ラービグ社のラービグ第2 期計画に関するプロジェクト・ファイナンス契約調印について

住友化学とサウジアラビアン・オイル・カンパニー(サウジ・アラムコ社)が主要株主として出資しているラービグ・リファイニング・アンド・ペトロケミカル・カンパニー(ペトロ・ラービグ社)は、既存の石油精製・石油化学統合コンプレックスの拡張計画(第2期計画)に関し、このほど銀行団との間で、融資契約上のプロジェクト・コスト約81億米ドル※1の6割強にあたる約52億米ドル※2のプロジェクト・ファイナンス契約を締結いたしました。

本プロジェクト・ファイナンスは、政府系金融機関である日本の国際協力銀行(JBIC)とサウジアラビアのパブリック・インベストメント・ファンド(PIF)を中心に、両国および欧米の金融機関19行をメンバーとする幹事銀行団から、ペトロ・ラービグ社が融資を受けるものです。JBICからは約20億米ドル、PIFからは13億米ドルの融資を受けます。また、本プロジェクト・ファイナンス組成にあたっては、三井住友銀行およびサウジ・ブリティッシュ・バンクをファイナンシャル・アドバイザーに起用いたしました。

ペトロ・ラービグ社は、第2期計画において、新たに確保する30百万立方フィート/日のエタンと、約3百万トン/年のナフサを主原料に、エタンクラッカーの増設や芳香族プラントの新設を通して、付加価値の高いさまざまな石油化学製品を生産いたします。本計画では、住友化学や他社の最新鋭の技術を導入し、既存の第1期計画との相乗効果を追求するとともにサウジアラビアにおけるさらなる雇用創出と産業多様化にも貢献してまいります。

なお、本計画の設備につきましては、2016年前半から順次稼動させていく予定です。

※1 建設期間中の金利など、設計・調達・建設(EPC)以外のコストを含む。

※2 一部サウジリヤル建て融資を含む。

----

2015/3/18 日経

住友化、サウジ合弁会社から1500億円を回収 3月末

住友化学は17日、サウジアラビアの石油化学合弁会社、ペトロ・ラービグから約1500億円の現金を3月末をメドに回収すると発表した。同社の設備拡張に伴い、住友化が立て替えていた。回収する現金は、2014年3月期末で1兆700億円に達していた有利子負債の削減に充てる。

ラービグ社はサウジ国営石油会社のサウジアラムコとの合弁会社で、住友化の持ち分法適用会社に当たる。ラービグ社がプロジェクトファイナンスで約52億ドル(6290億円)を調達し、住友化に立て替え金を返す。

ラービグ社は16年稼働予定の第2期拡張計画に際し、プロジェクトファイナンスまでのつなぎ資金として住友化とサウジアラムコに投資資金を立て替えてもらっていた。

住友化は回収資金を借入金の返済に回し、財務体質の改善につなげる。過去10年間、ラービグ社への出資などで有利子負債が急速に増え、14年3月期末まで4期連続で1兆円を超える状態が続いていた。今期末は9800億円、来期末は9千億円未満に減らす目標を掲げており、達成に向けて弾みが付きそうだ。

2015/7/1 Gulf News

Saudi’s PetroRabigh says paying 0.5 riyals/share dividend for FY 2014

Saudi Arabia’s PetroRabigh will pay a cash dividend of 0.5 riyals ($0.13) per

share for the full year of 2014, it said in a bourse filing on Wednesday.

This is the first time PetroRabigh is paying a dividend since at least 2010,

according to Thomson Reuters data.

Dec 31, 2015

Reuters

別途、サウジ政府、石化原料大幅値上げ (2016/1/4 ブログ)

PetroRabigh says Phase II delays raise cost

and capital needs

* Building work to finish

now in Sept 2016

* Total cost now 31 bln riyals, up 1 bln riyals

* Rights issue size raised to 9.26 bln riyals

The completion of PetroRabigh's

Phase II expansion will be delayed by nine months,

raising the cost and forcing the Saudia Arabian petrochemical producer and

refiner to seek more cash from shareholders, it said on Thursday.

The delay to September 2016 is

the latest issue to hit the project, which will let the company manufacture

higher margin products but has faced a number of uncertainties since it was

proposed in 2009, mostly over the cost of the huge expansion.

The total cost will now be

31 billion riyals ($8.3 billion), 1 billion riyals

more than the previous figure, according to a bourse filing from the

firm, which is a joint venture between Saudi Aramco and Sumitomo Chemical.

(1リアル =0.26662米ドル)

PetroRabigh blamed the increase

on "the failure of the key contractors of the project to meet the planned

implementation schedule", without elaborating.

The delay also means that a

planned rights issue to support the funding costs will need to rise

to 9.26 billion riyals, 2.24 billion riyals more than initially

announced in April, the company said in a separate bourse filing.

PetroRabigh has already signed

loans worth 19.4 billion riyals to finance the project, with a significant

chunk coming from the Japan Bank for International Cooperation and the

state-owned Public Investment Fund.

| |

当初 |

今回 |

差異 |

|

億SAR |

億ドル |

億SAR |

億ドル |

億SAR |

億ドル |

|

建設費 |

300 |

(80.0) |

310 |

(82.7) |

10 |

(2.7) |

|

ローン |

194 |

(51.7) |

194 |

(51.7) |

ー |

ー |

|

増資 |

70 |

(18.7) |

92.6 |

(24.7) |

22.4 |

(6.0) |

Under the project, known Rabigh

II, an existing ethane cracker will be expanded and a new aromatics complex

will be built which will process more than 2.7 million tonnes of naphtha a

year to make higher-value petrochemical products.

The ethane cracker expansion is

now due to be completed in the first quarter of 2016, PetroRabigh said.

PetroRabigh's existing plant can

produce an annual 18 million tonnes of refined products and 2.4 million

tonnes of petrochemicals.

The company said it will start

gradually operating units of the expansion from the beginning of the second

half of 2016. In March, it was announced the expanded facility was expected

to start production in the first half of 2016.

別途、サウジ政府、石化原料大幅値上げ (2016/1/4 ブログ)

石油化学原料も12月29日から大幅に値上げされた。

メタンの価格はこれまでの100万BTU当たり75セントから1ドル25セントに、エタンは75セントから1ドル75セントに引き上げられる。

(米国の最新のエタン価格は100万BTU当たり2ドル24セント)

これを受け、サウジの石化各社は影響額予想を発表した。

|

SABIC |

5%のコストアップ |

|

Saudi Arabia Fertilizers Co (SAFCO) |

8%のコストアップ |

|

Yanbu National Petrochemical Co (Yansab) |

6.5%のコストアップ |

|

National Industrialisation Co (Tasnee) |

190百万リアル (51百万ドル) |

|

Saudi Cement Co |

68百万リアル (18百万ドル) |

|

Petro Rabigh |

300百万リアル (80百万ドル) |

2016/4/21

Saudi's Petrorabigh starts expanded ethane

cracker

Saudi Arabia's PetroRabigh has started

full operations at its expanded ethane cracker, it said on Thursday (2016/4/21).

The expansion will increase ethane processing capacity from 95

million standard cubic feet per day (scfd) to 125 million scfd; boosting

capacity to 1.6 mln tonnes per year (from 1.3 mln tonnes).

The start of the expanded ethane cracker will increase the company's revenue by

an estimated 750 million riyals ($200 million) for 2016 and depending on the

feedstock availability, the firm said in a bourse statement.

2017/3/16

KAEC, Petro Rabigh launch Saudi Sustainable

Development Association

King Abdullah Economic City (KAEC), a

special economic zone on Saudi Arabia's Red Sea coast, and Petro Rabigh, a

joint venture between Saudi Aramco and Japan's Sumitomo Chemical, have

launched the Saudi Sustainable Development Association, said a report.

The association is an innovative, pioneering initiative to combine the

resources of national corporations and channel them efficiently toward

better economic and social development in the kingdom in general, and in the

Rabigh area in particular, added the Saudi Gazette report.

Announced in a special ceremony at KAEC, this initiative is the first of its

kind in the kingdom, creating a partnership among corporations and

institutions in the private sector in the field of

social responsibility and sustainable development.

The announcement ceremony was attended by Ayman Al Mubaireek, deputy

governor of Rabigh, and more than 30 representatives of government agencies

and senior corporate officials.

In addition to KAEC and Petro Rabigh, the consortium includes the

Cooperative Insurance Company (Tawuniya,) the International Medical Center,

DHL, SANKYU, Saudi Arabia, FAL Holding, RAWEC, Al-Tamimi and Co., GEMS –

Global Environmental Management Services – and Arabian Pipes.

Bassam A Al Bokhari, vice president of industrial relations at Petro Rabigh

and chairman of the Association Board, said the partnership will unite the

efforts that national corporations make towards enhancing corporate social

responsibility and promoting sustained development that meets the area’s

basic needs.

He also said that this will constitute added value in the long run, and

contribute to the kingdom’s Vision 2030 by giving the private sector the

opportunity to participate in development, added the report.

2017/8/29 日本経済新聞

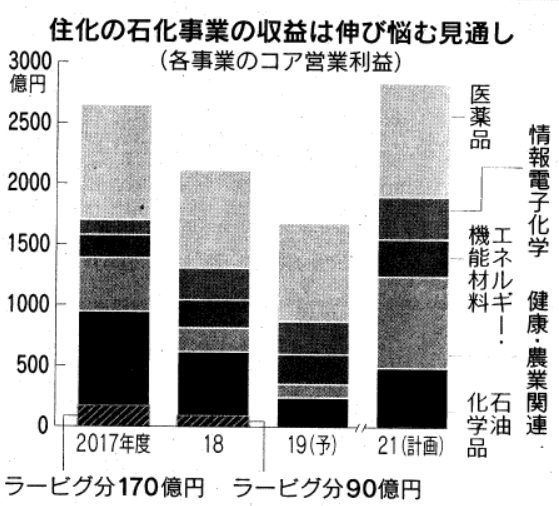

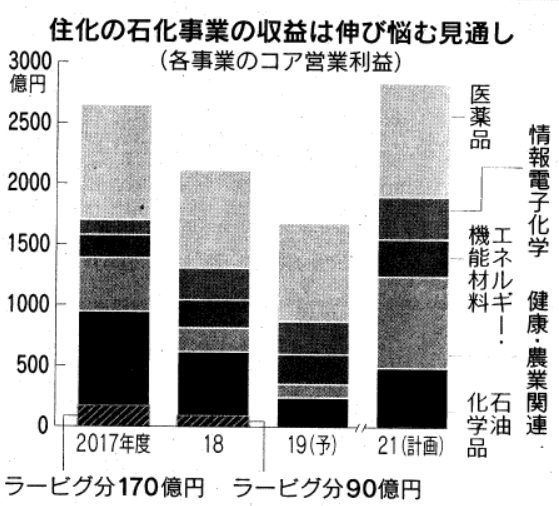

住友化 サウジ事業の持ち分法利益 来期以降、200億円超に

住友化学がサウジアラビアで手掛ける石油化学コンビナート「ペトロ・ラービグ」が収益貢献し始める。十倉雅和社長は2019年3月期以降、ラービグの稼働安定により住友化が200億円以上の持ち分法投資利益を得られるとの見通しを示した。前期実績は4億円だった。需要が急拡大する有機EL部材の増産を検討していることも明らかにした。

ラービグはサウジ国営石油会社サウジアラムコとの合弁事業。住友化は37.5%出資し、持ち分法適用会社にあたる。春先までは電源ケ一ブル切断などの人為的ミスが相次ぎ低稼働が続いたが、足元では稼働が安定。ラービグの2017年4〜6月期純利益は3億1600万リヤド(約90億円)と前年同期の3倍強に増えた。

十倉社長は「(ラービグ単体で)月50億円の利益は稼げる実力を持つ」と指摘。住友化にとって年225億円の持ち分法投資利益を得られる計算だ。「ラービグはリスク要因ではなく収益への追い風」になるという。遅れていた2期工事もこのほど完成し、「2019年からフル稼働を見込む」と話した。

高付加価値製品については積極投資を続ける。韓国で生産する有機EL向けフィルム型タッチパネルは設備増強中だが、近く追加投資を検討する。

2018/1/7 Petro Rabigh

Announcement From Rabigh

Refining and Petrochemical Company (Petro Rabigh) Regarding The

Latest Developments in the Rabigh (Phase II) Project

With reference to the announcement from Rabigh Refining &

Petrochemical Co. (Petro Rabigh) on September 29, 2016

concerning the latest developments in the Rabigh (Phase II)

Project, the company announces that it has achieved on-spec

production at 10 of the Projects total of 12 units. The

remaining two units will start up in the first quarter of 2018.

Upon completion of all Phase II plants, both phases I and II

will be integrated operationally within the Petro Rabigh

industrial complex.

By the end of December 2017, the company achieved on-spec

production at the units for Cumene,

Phenol, Methyl tert-butyl ether (MTBE)/Isobutylene, Metathesis,

Methyl Methacrylate (MMA), Naphtha Reformer, Poly Methyl

Methacrylate (PMMA), Low Density Polyethylene/ (LDPE), Thermo

Plastic Olefin (TPO) and Nylon 6 (Polyamide 6).

Production is expected to start at the

Aromatics and EPR (Ethylene Propylene Rubber = EPDM)

units in the first quarter of 2018 as previously scheduled.

Financial Impact of the above will be part of the company

financial results starting the first quarter of current year, as

it cannot be currently estimated.

第1期

2018/5/16 日経

住友化学、ペトロラービグに追加出資

住友化学は15日、サウジアラビアで石油化学コンビナートを運営する関連会社

PetroRabighに約1000億円を追加出資すると明らかにした。2017年に完了した拡張工事の投資資金をまかなうもの。共同出資している国営会社サウジアラムコなども出資に応じるため、株式の保有比率は37.5%で変わらない見通しだ。

PetroRabighが実施する約30億ドル(約3300億円)分の新株発行の一部を引き受ける。

PetroRabighは第二期計画のコストを賄うため、2015年4月13日の臨時株主総会で増資を提案している。

その時の想定金額は70.35億リアル(18.76億ドル)で、必要な承認手続きを得ることを条件にしており、株数と価格は追って決めるとしている。

最終決定時点の株主に割り当てるとしている。

2016年12月にHSBC Capitalを財務コンサルタントに選んだとの発表があった。

その後は進展なしとの発表のみで、2018/2/1にも進展なしとの発表があった。

日経記事では30億ドルの増資となっており、建設費アップで増やしたと思われる。一般公募でなく、現株主への割り当てということは発表と同じ。

Feb 28, 2019

Petro Rabigh Selects Jacobs for Fuel Oil

Upgrade Project in Saudi Arabia

Jacobs has received a contract

from Rabigh Refining & Petrochemical Company (Petro Rabigh) to

provide FEED and Project Management Consultancy (PMC) services

on the company's fuel oil upgrade project

– Bottom of the Barrel. Located in Rabigh,

Saudi Arabia, Bottom of the

Barrel is an upgrade project which converts oil residue streams

from the crude distillation process into more profitable

products.

In today's market, there is

increased demand for transportation fuels,

primarily diesel and low-sulfur bunker fuel oil, as well as

decreased demand for residual fuel oil.

This shift, combined with the lowering

sulfur limits worldwide, makes maximizing conversion

critical. Jacobs is projected to employ 150 full time employees

while delivering pre-front end engineering design, FEED and

project management over a two-year period.

"Through this oil upgrade

project, we are supporting Petro Rabigh with a unique

opportunity in the market to meet growing demands for

transportation fuels," said Jacobs Energy, Chemical and

Resources Senior Vice President and General Manager EMEA David

Zelinski. "The implementation will yield value-added products

for use across Saudi Arabia, as

well as export to global markets."

Petro Rabigh, a refining and

petrochemicals plant on the west coast of

Saudi Arabia, is a joint

venture between Saudi Aramco and Sumitomo Chemical. The company

produces refined products and petrochemicals that are used in

end products such as plastics, detergents, lubricants, resins,

coolants, anti-freeze, paint, carpets, rope, clothing, shampoo,

auto interiors, epoxy glue, insulation, film, fibers, household

appliances, packaging, candles, pipes and many other

applications.

Jacobs leads the global

professional services sector delivering solutions for a more

connected, sustainable world. With $15

billion in fiscal 2018 revenue and a talent force of more

than 80,000, Jacobs provides a full spectrum of services

including scientific, technical, professional and construction-

and program-management for business, industrial, commercial,

government and infrastructure sectors.

2019/11/30 日経

2兆円プラント 住友化学の誤算

石化製品の供給過剰・設備費が膨張

サウジで第2期運転開始も… 早期の収益貢献揺らぐ

住友化学が社運をかけてサウジアラビアで進めてきた世界最大級の石油化学コンビナート計画に懸念が浮上している。1兆円を投じた第2期の商業運転が11月から始まった。だが、設備費の膨張など運営面の誤算に加え、世界的な供給過剰で石化製品の市況が悪化。中東の割安な原料を生かし、早期に収益貢献させるシナリオは揺らぐ。稼ぐ力を増したうえで農薬など高付加価値品にシフトし、競争力を高める戦略にも影響しそうだ。

紅海を望むサウジ西部の石化コンビナート「ペトロ・ラービグ」。10月末、第2期の新設備の試験運転を予定通り終了したと発表した。住化の関係者は「スムーズに立ち上がった」と胸をなで下ろす。

ラービグ計画はサウジ国営石油会社、サウジアラムコと住化の合弁事業だ。第1〜2期の総事業費は2兆円に及ぶ巨大プロジェクトで、住化の投資額は2600億円に達する見通し。2期の設備ではアクリル樹脂原料のMMAや合成ゴムなどを生産する。

ラービグ計画は住化にとって特別な意味を持つ。2003年に三井化学との経営統合交渉が破談になったのち、当時の社長だった故・米倉弘昌氏が社運をかけ推進した。汎用的な石化製品は国内では投資を見切り、競争力のある海外でつくるという国内の総合化学大手でも大胆な決断だった。

第1期の商業運転を開始したのは09年。最大の強みと期待したのは原料の割安さだった。原料に使う天然ガス、エタンは原油由来のナフサ(粗製ガソリン)と比べ5分の1程度の価格で調達できる。これを武器に、商業運転の直前には「第1期段階で年500億円の利益貢献がある」と想定した。

しかし、ここからが重なる。まずは第1期の商業運転で設備トラブルが頻発したこと。従業員の技能不足が原因だった。これを受け、住化は安定操業に向け事業費を積み上げた。当初は約1兆5千億円と見積もった総事業費は2兆円に膨らみ、原料費の安さを相殺するように設備費が膨らんだ。

商業運転前には想定できなかった世界的な石化製品の供給過剰も起きた。2010年代前半から北米でシェールガス由来のプラントの新増設が相次いだ。直近は中国でも大型プラント建設が進行し「これまでにない規模の供給過多」(経済産業省)となりつつある。

米中貿易戦争を受けた世界景気の減速も石化製品の市況を悪化させている。MMAの足元の国際価格(アジア地域)は1トンあたり1600ドル弱で、18年夏から4割も下落した。

足元は中東の地政学リスクも高まる。9月中旬にはサウジ中部にある石油施設が無人機で攻撃され、ラービグ向けの原油や天然ガスの原料供給が一時、1〜2割縮小する事件も起きた。

「(ラ一ビグ計画の今後については)収益性を慎重に見極めないといけない」(住化の岩田圭一社長)。度重なる誤算で収益貢献への期待は縮小している。17年度に170億円だったラービグからの収益(コア営業利益ベース)は18年度に90億円に目減りした。見通しを公表していない19年度以降も収益拡大は難しいとの見方が少なくない。「年500億円」とした当初想定は遠い。

野村証券の岡崎茂樹氏は「競争力の高い原料があるサウジで汎用品をつくるという戦略自体は正しかった」としつつ「シェール革命の到来など当初想定していなかった市場構造の変化がラービグの逆風になった」と現状を総括する。

ラービグでの誤算は住化の構造改革にも影響を及ぼす。住化はラービグで生産される石化製品の販売、配当収入などからもキャッシュを捻出。これを農薬事業や、有機ELパネル向けなど電子材料事業に振り向けて成長する計画だった。ラービグは将来の成長戦略の重荷にもなりかねない。

世界の化学業界では、より高付加価値品にシフトする流れが加速している。国内でも三菱ケミカルホールディングスが18日、田辺三菱製薬を約4900億円で完全子会社化すると発表。昭和電工が、先端材料に強い日立化成の買収に動いていることも明らかになった。

ラービグ計画でかつて先進性を示した住化にとっては正念場となる。

2021/9/29

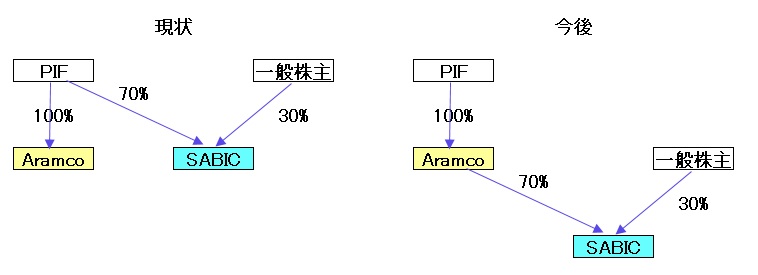

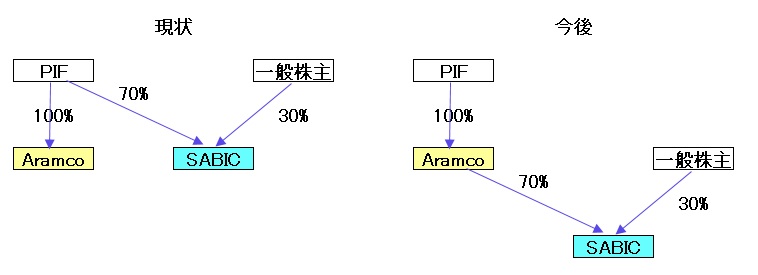

SaudiAramco、PetroRabigh の石油化学製品の自社枠の販売権をSABICに移管

SaudiAramcoと住友化学のJVのPetro Rabigh

は9月29日、SaudiAramcoとSABICとの間で新しい契約を締結した。

現在、PetroRabighの製品のうち、石油化学製品は半分を住友化学、半分をSauduAramcoが販売しているが、10月1日からSaudiAramco販売分をSABICが販売するというもの。

サプライチェーンの効率を高め、石油化学業界での競争力を高めるためとしている。

Rabighの石油化学製品の半分について、従来 Aramco が販売していた分を子会社で石油化学専業のSABICに任せるもので、経緯は下記の通り。

PetroRabighは製造会社で、製造した製品の販売は、当初は、石油製品はAramco、石油化学製品は住友化学が担当していた。

2013年12月に下記の発表があった。

1) 従来、石油製品はAramco、石油化学は住化が担当していたが、石油化学製品について両社半々に変更する。

2) 石油化学の販売マージンを1/3カット、石油製品(赤字)についてはマージンをゼロに。

3) 2013/4に遡及、5年後見直し

Aramcoは2016年4月1日にLANXESS と折半出資の合成ゴム JV のARLANXEO

を設立したが、2018年12月末にこれを100%子会社とした。

PetroRabighでは2018年3月28日に第二期計画のEPDM

が稼働したが、ARLANXEO への販売はAramcoが行っている。

2019/1/1

Saudi Aramcoと LANXESS のJV のARLANXEO、Aramco 100%に

Saudi Aramcoは2019年3月27日、SABICの株式の70%を政府系ファンドのPublic Investment Fund (PIF)

から691億ドルで買い取ることで正式に合意したと発表した。

SABICの残り30%はSaudi Stock Exchange(Tadawul

)に上場されているが、これはそのままとなる。

2019/3/30 Saudi

Aramco、SABIC株式の70%を取得

2022/12/25 Saudi Top Trading Co.

Saudi Top Trading, Petro Rabigh sign MoU to establish SAR 100 mln factory

Nomu-listed Saudi Top Trading Co. announced that one of its factories, Saudi Top

Plastic factory, signed on Dec. 13 a memorandum of understanding (MoU) with

Rabigh Refining and Petrochemical Co. (Petro Rabigh), according to a statement

to Tadawul.

The MoU is to establish a factory with a total construction value of about SAR

100 million in two phases, the first with a value of nearly SAR 60 million and

the second phase of approximately SAR 40 million.

The new factory will be established on an area of 34,000 square meters, and for

a period of 30 years, to produce 50,000 tons annually of

polymer compounds, rubber, and industrial waxes in Rabigh Plastic

Technology Complex.

It pointed out that the supply of polymer scrap materials, rubber, and

industrial wax for the new factory will be from Petro Rabigh.

The 12-month MoU started from signing date, Saudi Top Trading stated, noting

that there are no related parties.

The financial impact of this project will be determined later upon the

completion of all agreements related to this MoU, it stated.

May 26, 2023

Petro Rabigh refinery to feed

proposed needle coke, graphite complex PetroRabighの重油残渣から製鋼用黒煙電極材料製造

Privately held TAQAT Development Co. has let

a contract to Chevron Lummus Global (CLG) to deliver technology licensing and

engineering services for a proposed grassroots complex that will

produce needle coke and synthetic graphite from feedstock supplied by the

400,000-b/d refinery and chemicals complex operated by Rabigh Refining &

Petrochemical Co. (Petro Rabigh)—a 50-50 joint venture of Saudi Aramco and

Sumitomo Chemical Co.—in the port city of Rabigh, Saudi Arabia, along the Red

Sea.

|

TAQAT Development Company is a start-up private company (of

ex-family business owners) incorporated in Saudi Arabia and

registered under commercial registration number 2051048776.

The Company, with a seasoned technical and professional leadership,

will be developing a synthetic graphite

cluster in Saudi Arabia. The cluster will include a Needle

Coke plant (Needle coke is a precursor for the graphite project) to

be developed inside the facility of Rabigh Refinery & Petrochemical

Company (PRC).

Rabigh Refinery & Petrochemical will supply the scares Decant

Oil feedstock. In addition, the cluster will include a Graphite

plant that will be most probably co-located next to KSA proposed

Electric Vehicle (EV) plant.

TAQAT enjoys very strong

Government support since the proposed EV plant is supported by the

Public Investments Fund (PIF) and the Saudi Government Industry

Clusters, which is targeting to develop a world-class automotive

industry to be a major regional player supplying the MENA market

strong growth demand. TAQAT will be leading regional

quasi-government entities to develop the subject needle coke and

battery anode project.

Further, TAQAT is supported by

the Ministry of Energy, and the Ministry of Industry, to fast track

the subject project to mee target production dates. The supply of

the scarce feedstock from Petro Rabigh Refinery was culminated by

officially signing the binding MOU between TAQAT and PRC in December

2020. |

As part of the contract, CLG will license the

proposed 75,000-tonne/year (tpy) complex its proprietary two-step coking process

to enable conversion of lower-value, heavy oil residue

streams from Petro Rabigh’s refinery that would otherwise be used as fuel

oil into high-quality needle

coke, which in turn will be used to produce synthetic graphite, the

service provider said on May 25.

needle

coke : 製鋼用黒鉛電極原料

Alongside technology licensing, CLG’s scope

of work under the contract also covers basic design, pilot plant testing, as

well as other unidentified engineering and operations support for the project.

The service provider revealed neither the

value nor duration of the license and engineering contract, which was initially

signed on Feb. 14, 2023, according to a recent post by TAQAT to one of its

official social media accounts.

According to TAQAT’s website, the proposed

complex—or cluster—will consist of two separate installations, including a plant

to be developed inside Petro Rabigh’s refinery that will use the refiner’s

supply of slurry-decant oil feedstock to produce needle coke.

The planned cluster also is to include

construction of a separate plant that will use the precursor needle coke for

production of graphite anode for electric vehicle (EV) and energy storage-system

batteries, TAQAT said.

While TAQAT confirmed via its website the

December 2020 signing of its agreement with Petro Rabigh’s refinery for the

needle coke plant’s development and associated feedstock supply, the company

recently formed a joint venture with Novonix Ltd.—a Canadian-based battery

technology developer and manufacturer—to develop a 30,000-tpy graphite anode

materials plant in Saudia Arabia that would receive precursor needle coke, at

least in part, from the proposed Petro Rabigh plant, according to a Mar. 30,

2023, release from Novonix.

TAQAT said its proposed needle coke-graphite

anode project is supported by investments of the government of Saudi Arabia

under its Vision 2030 goals, which aim to have EVs account for 30% of all

on-road, in-kingdom vehicles by 2030.

The TAQAT (60%)-Novonix (40%) JV’s proposed

graphite anode plant—plans for which must be finalized by end-March 2024 per

terms of the agreement—would directly support a localized supply chain for the

EV sector, the companies said.

Petro Rabigh has yet to directly disclose any

official details to global media outlets regarding its role in the proposed

specialty complex.

ーーーーーーーーーーーーーーーーーー

May 25, 2023

Chevron Lummus Global LLC (CLG) announced a

recent contract award from TAQAT Development Company for a new 75,000 TPA

needle coke/synthetic graphite complex in Rabigh, Saudi Arabia. Under the

agreement, Chevron Lummus Global will provide pilot plant testing,

licensing, basic design, and additional engineering and operations support.

The feedstock will be supplied by Rabigh Refining & Petrochemical Company

(Petro Rabigh).The grassroots

complex will utilize CLG's two-step coking process to convert feedstock

streams, which would otherwise be used as fuel oil, into high-quality needle

coke, and synthetic graphite. This process helps to reduce environmental

impact by repurposing feedstock streams that would otherwise be considered

lower-value or waste materials into valuable products, contributing to a

more sustainable approach to resource utilization.

CLG's proprietary technology is the

result of decades of continual refinement and accumulated data from over 60

unit designs and commercial installations. It has proven to be a superior

option for converting heavy feedstocks into in-demand products like needle

coke and synthetic graphite. This contract award highlights CLG's expertise

and leadership in the field of advanced carbon products.

About TAQAT

TAQAT Development Company is a leading Saudi Arabian energy company, The

company is a leader and innovator in the global energy market, and a key

contributor to the economic growth and development of the MENA region. TAQAT

is constantly seeking out new opportunities to invest in and develop

solutions to meet the region's emerging technology energy needs. TAQAT is

commercializing a wide range of energy products and services, including

high-quality petroleum coke and renewable energy solutions. The company is

committed to innovation and sustainability and is investing heavily in

research and development of new technologies to improve the energy ecosystem

in the region. For more information, visit www.taqatgroup.com.

20 Dec 2023

Rabigh Refining and Petrochemical Co. (Petro Rabigh) announces the completion

and operation commencement of the project to capture CO2 emissions from the MEG

plant at the company complex

Rabigh Refining and Petrochemical Co. (Petro Rabigh), in collaboration with Gulf

Cryo, a leading provider of industrial, medical, and specialty gases in the

region, announces the inauguration of the new carbon capture and utilization

facility.

The project agreement was signed in March 2022, to design, construct, and

operate an advanced carbon capture plant at Petro Rabigh's Mono Ethylene Glycol

(MEG) plant. The new facility captures 300 metric tons of

CO2 per day directly from MEG plant, representing 85% reduction in its

total annual CO2 emissions footprint. The captured CO2 is equivalent to the

sequestration capacity of approximately 360 thousand Mangroves Trees.

By preventing the release of CO2 emissions into the atmosphere, the project

supports Saudi Arabia's target of achieving net zero emissions by 2060 under

Vision 2030 and in alignment with UN Sustainable Development Goals. The captured

CO2 will be purified to a high-purity for other productive uses including water

desalination, food and beverage carbonation, agriculture and in ready mix

concrete.

----------------------------

24 Mar 2022

Petro Rabigh has signed an

agreement with GULF CRYO to

capture CO2 emissions from

the MEG plant at Petro

Rabigh complex

Petro Rabigh has signed

an agreement with Gulf

Cryo to capture CO2

emissions from the MEG

plant at Petro Rabigh

complex. The agreement

was signed in Rabigh by

Petro Rabigh P&CEO Eng.

Othman A. Al-Ghamdi and

Gulf Cryo Chairman Mr.

Amer Al Huneidi,

establishing a new

strategic collaboration

that reinforces the

commitment of both

companies towards

enhancing local content

and securing a resilient

supply chain and a

sustainable business

environment.

In line with Petro

Rabigh’s commitment to

reduce its emissions and

support the objectives

outlined by the

Kingdom’s Vision 2030,

Gulf Cryo will invest,

build and operate a

state-of-the-art CO2

capturing plant. The

plant will be fully

operative by the second

quarter of 2023, and it

will be the first CO2

capturing plant in the

Western Region of Saudi

Arabia. Part of the

total captured and

highly-purified gas will

be transformed into a

food-grade quality with

a volume of 300 metric

tonnes/day. It will be

supplied via pipeline to

Petro Rabigh for its

internal processes. The

remaining volume of CO2

will be provided in

liquid form to

industrial end-users

replacing fossil fuel

burning plants and

contributing to an

environmentally friendly

economy. In return, the

captured and purified

CO2 emissions are

utilized as a valuable

resource for food-grade

innovative gas

applications in Oil &

Gas, Desalination, Food

& Beverage, Cement, and

Agriculture industries.

15 Oct 2024

Rabigh Refining and

Petrochemical Company announces

the signing a Memorandum of

Understanding with Jiahua

Chemicals 佳化化学

|

Element

List |

Explanation |

|

Introduction |

Under the Patronage

of the Ministry of

Energy, Petro Rabigh

and Jiahua Chemicals

have signed on

October 15, 2024 a

Memorandum of

Understanding (MoU)

to explore the

establishment

a state-of-the-art

manufacturing

facility in Rabigh.

The facility will

focus on the

production of

several

Specialty Chemicals

derived from

Ethylene Oxide and

Propylene Oxide

which are the key

materials for this

project supplied

through Petro Rabigh.

The targeted

products range are

widely used in the

constructions, and

automotive sectors.

This strategic

collaboration aligns

with Saudi Arabia's

strategy set forth

by the Ministry of

Energy to boost

local downstream and

specialty chemicals

production and

reduce reliance on

imports. With a

strong emphasis on

fostering downstream

industries related

to the construction

and automotive

sectors, this

collaboration aims

to enhance local

content and meet the

rising demand from

these key sectors. |

|

Memorandum Signing

Date |

2024-10-15

|

|

Counterparty |

Jiahua Chemicals

佳化化学 |

|

Memorandum Subject |

Collaborate in

establishment of a

Specialty Chemicals

Manufacturing in

Rabigh |

|

Memorandum Duration |

12 Months |

|

Related Parties |

Not applicable |

|

Financial Impact |

There is no

financial impact on

signing this

memorandum |

|

Additional

Information |

Not applicable |

JIAHUA CHEMICALS

INC. 佳化化学

is dedicated to

the research and

development,

production and

sales of

ethylene oxide

and propylene

oxide downstream

derivatives and

other specialty

chemicals.

The

company has set

up five business

units:

Construction

Chemicals,

Performance

Materials, Care

Chemicals,

Coating and

Industrial

additives, and

Functional

Materials. The

products are

widely used in

construction,

automobile, home

furnishing,

coatings, oil

fields, textile

printing and

dyeing,

pesticides and

other

industries.

Petro Rabigh And Jiahua

Chemicals to Investigate

Establishment of

Specialty Chemicals

Plant

Rabigh Refining and

Petrochemical Company

(Petro Rabigh) has

signed a memorandum of

understanding (MoU) with

China’s Jiahua Chemicals

to explore the

establishment of a

specialty chemicals

manufacturing plant in

Rabigh, according to the

several media reports.

The facility will focus

on producing specialty

chemicals derived from

ethylene oxide and

propylene oxide, which

are essential for the

construction and

automotive industries,

according to a statement

released to the Saudi

stock exchange on

Tuesday.

Petro Rabigh will supply

the key materials needed

for the new project,

ensuring a consistent

source of essential

inputs. The MoU is set

to last for 12 months,

providing both parties

with adequate time to

conduct feasibility

studies and outline the

operational framework

for the proposed plant.

This collaboration

aligns with Saudi

Arabia’s broader

strategy to enhance

domestic production of

specialty chemicals. The

initiative aims to

reduce reliance on

imports while supporting

downstream industries

related to construction

and automotive sectors.

By increasing local

manufacturing

capabilities, the

project is expected to

contribute to the

kingdom's economic

diversification efforts

and create job

opportunities.

Leveraging Petro

Rabigh’s resources and

Jiahua Chemicals'

expertise in specialty

chemicals, the project

has the potential to

drive significant

advancements in the

sector. The

establishment of this

facility is poised to

strengthen the local

supply chain and meet

the growing demand for

specialty chemicals,

which are vital for

various applications

within the construction

and automotive fields.

The agreement also

underscores the

importance of

collaboration between

local and international

companies in achieving

the kingdom's industrial

objectives. The

partnership with Jiahua

Chemicals not only

enhances Petro Rabigh's

production capacity but

also fosters knowledge

transfer and

technological exchange.

This could lead to more

innovative solutions

tailored to the specific

needs of the Saudi

market.

Rabigh Refining &

Petrochemical Company

(Petro Rabigh) was

established in 2005 as a

joint venture between

Saudi Aramco and

Sumitomo Chemical. The

plant has an estimated

value of approximately

SAR 16.71 billion, with

25% of the funding

coming from the public

and the remaining amount

equally shared between

Saudi Aramco and

Sumitomo Chemical.

Initially, it produced

18.4 million tons per

annum (MTPA) of

petroleum-based

products, along with 2.4

MTPA of derivatives

based on ethylene and

propylene.

Petro Rabigh's products

find applications in a

variety of end products,

including plastics,

detergents, lubricants,

resins, coolants,

antifreeze, paints,

carpets, ropes,

clothing, shampoos,

automotive interiors,

epoxy adhesives,

insulation, films,

fibers, household

appliances, packaging,

candles, pipes, and many

other uses.

Petro Rabigh II is an

expansion initiative

valued at $9 billion,

which achieved full

production by the fourth

quarter of 2017. This

project introduced a

diverse range of new

high value-added

products, some of which

are exclusive to the

Kingdom of Saudi Arabia

and the broader Middle

East region.

Under the

patronage of the Ministry of Energy, Saudi Arabia, Petro Rabigh and

Honeywell signed a Memorandum of Understanding (MoU).

THE MOU

includes licensing and the demonstration of

Naphtha-to-Ethane-and-Propane (NEP) technology at the Petro Rabigh

refinery.

This

collaboration aims to optimize the conversion of crude oil into value-added

petrochemical products, promote sustainability, and drive innovation within

the energy sector, in line with the goals of Saudi Vision 2030 to advance

and enhance the efficiency of petrochemical industries.

2025/3/13

Petro Rabigh and Indian firm

to study joint project investment

The Saudi refined products and

petrochemicals producer has signed an MoU with Rossari to explore

building a propoxylates and ethoxylates

manufacturing facility in Rabigh, Saudi Arabia

ーーー

Petro Rabigh and

Rossari International Limited have signed an MoU under the Ministry of Energy’s

patronage to explore the development of Propoxylates and Ethoxylates

manufacturing in Rabigh.

The company

stated that, this collaboration is a key step in strengthening Saudi Arabia’s

specialty chemicals industry, supporting local production, reducing import

dependency, and fostering innovation in critical sectors such as construction

and personal care.

Aligned with

Vision 2030, the initiative will contribute to the Kingdom’s industrial

self-sufficiency and economic growth.

Rossari

Biotech Limited is a leader in delivering exceptional solutions across

industries.

From acrylic

polymers to textile chemicals and beyond, we consistently set the benchmark

for excellence and innovation, driving superior results for our clients.