トップページ

Solutia

Solutia was founded in St. Louis

in 1901 as Monsanto

Company. For decades,

chemicals were the foundation of Monsanto, which eventually

expanded beyond its original identity as a local producer of

saccharin to become one of the world's leading chemical companies

by the 1960s.

Solutia was created as an

independent company on September 1, 1997, after Monsanto

shareholders approved the spin-off of the company's chemical

businesses. Today, Solutia is a specialty chemicals company with

a growth-oriented business strategy that drives our commitment to

excellent customer service. A true global enterprise, Solutia has

more than $3 billion in annual sales, $4 billion in assets and

more than 10,000 employees located at 35 manufacturing sites

throughout 13 countries.

Solutia is a major producer

for:

- Laminated glass and

aftermarket applications

- Resins and additives for

high-value coatings

- Specialties such as heat

transfer fluids, aviation hydraulic fluids,

environmentally friendly cleaning solvents for aviation

- An integrated family of

nylon products, including high-performance polymers and

fibers

- Process development and

scale-up services for pharmaceutical fine chemicals

July 31, 2001 Solutia, JLM発表

SOLUTIA AND JLM INDUSTRIES, INC. END

BENZENE TO PHENOL COMMERCIAL AGREEMENT

http://www.jlmi.com/pressreleases/073101.html

Solutia Inc. today announced a mutual agreement with JLM

Industries, Inc. to end the commercial agreement to establish

a new benzene to phenol plant. The site, which would have

used Solutia's AlphOx BtoP technology, was to have been located at

Solutia's Pensacola, Florida, facility.

"Solutia started up a new phenol to KA oil facility at

Pensacola earlier this year," said Mike Berezo, director

of Nylon Intermediates at Solutia. "And we may certainly

decide to explore

benzene to phenol production in the future, should the market

dynamics change."

PENSACOLA

INTEGRATED NYLON 6,6 PLANT, FLORIDA, USA

http://www.plastics-technology.com/projects/pensacola/

In 1998 Solutia

Inc. approved plans to expand its nylon polymerisation

capacity at the company's plant site in Pensacola in

Florida in the United States.

THE NYLON 6,6 EXPANSION

In 1998, Solutia agreed to a joint venture with JLM

Industries Inc. to build a phenol facility at the Pensacola plant.

Phenol is used as an ingredient in the manufacture of

nylon.

The enhanced plant benefits from Solutia's technological

innovations. Much of the initial work on the Pensacoula

plant's technology was done at Russia's

Boreskov Institute of Catalysis (BIC), although it has been

refined by Solutia. The new process involves fewer steps

than its predecessors do. It also has lower costs, mainly

because it is able to produce adipic acid less

expensively. No acetone by-products result from this process.

TECHNOLOGICAL DEVELOPMENT FOR NYLON

In 1998, Solutia and Dow Plastics signed an

agreement over sales and marketing. Under the terms of this

agreement, Solutia continues to develop and

manufacture nylon, while Dow has

taken over the compounding and marketing.

2003/12/18

米国のソルーシアは17日、日本の会社更生法に当たる連邦破産法11条申請を行ったと発表した。

ソルーシアは1997年に当時のモンサントの化学品部門がスピンオフしたが、その際に引き継いだ法的債務(訴訟費用・賠償金、環境対策費用、退職者医療費債務等)で毎年1億ドル程度を支払い、これが負担となっていた。本年8月には旧モンサントがアラバマ州で健康への危険を隠蔽しながら、河川に危険な化学薬品を投棄したとの住民訴訟に対し総額6億ドルの和解が行われ、ソルーシアはそのうち5千万ドルを負担している。

11条申請は、コストダウン等による対応が限界にきたとして、これらの負担を免れるために行ったもので、業務は引き続き継続する。

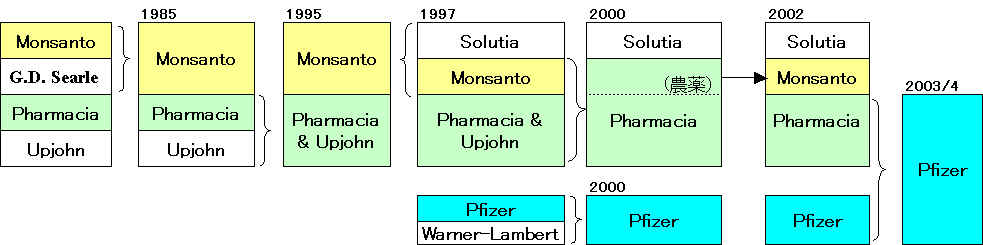

なおモンサントはその後ファーマシア&アップジョンと合併しファーマシアとなり、2003年にファイザーの子会社になった。なお農薬部門は再度モンサントとしてスピンオフされている。

2003/12/17

Solutia

Seeking Relief from

Former Monsanto Company Legacy Liabilities, Solutia Files

Voluntary Petition for Chapter 11 Reorganization

Worldwide Operations Continue Without

Interruption

Company Obtains Commitment for $500

million in Debtor-in-Possession Financing

http://www.solutia.com/fir/reorganization/doc141Solutia%20-%20Ch.%2011%20Release.pdf

Solutia Inc. (NYSE:SOI),

a leading manufacturer and provider of performance films,

specialty chemicals and an integrated family of nylon products,

announced today that it and 14 of its U.S. subsidiaries have

filed voluntary petitions for reorganization under Chapter 11 of

the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the

Southern District of New York. Solutia's affiliates outside the

United States were not included in the Chapter 11 filing. Solutia

has approximately 6,700 employees worldwide.

The decision to file was

made to

obtain relief from the negative impact on the Company caused by

legacy liabilities,

which include litigation and settlement costs, environmental

remediation and Monsanto retiree healthcare obligations, Solutia

was required to assume when the Company was spun-off from the

former Monsanto Company, which is now known as Pharmacia, a

wholly owned subsidiary of Pfizer. These legal liabilities have

been an obstacle to Solutia's financial stability and success.

Under the U.S. Bankruptcy Code, these liabilities will be

discharged as pre-petition liabilities pursuant to a plan of

reorganization.

Alabama PCB litigation

2003/8/20 Solutia

Inc.

Solutia Reports

Settlement of Alabama PCB Litigation; $600 Million Cash

Settlement and Community Outreach Programs

http://www.corporate-ir.net/ireye/ir_site.zhtml?ticker=SOI&script=410&layout=-6&item_id=442488

Solutia Inc. (NYSE:

SOI) today announced a settlement resolving the Abernathy and

Tolbert PCB litigation against the Company in Alabama.

The settlement, which includes no admissions of wrongdoing,

will be funded by Solutia, Monsanto Co. and Pharmacia, a

wholly-owned subsidiary of Pfizer and the companies'

commercial insurers. It resolves all outstanding claims

including potential punitive damages that might have been

sought by plaintiffs and their lawyers. Solutia's portion of

the settlement will be $50 million paid in equal installments

over a period of 10 years.

RubberWorld

2005/1/26

Solutia to Exit Acrylic Fibers Business

Solutia Inc. announced Tuesday that it will exit the acrylic

fibers business, pending approval by the U.S. Bankruptcy Court.

The company's plant in Decatur, Ala., will continue to operate as

a producer of chemical intermediates for use in nylon products,

but will close its acrylic fiber operation in early-to-mid April.

This action will impact approximately 250 Solutia employees and

200 contractors, most of whom work at the Decatur plant.

2006/6/21

Solutia Inc.

Solutia to Increase Polyamide 66 Resins Manufacturing Capacity

Focusing on two of its key growth businesses, Solutia Inc. today

announced it is increasing manufacturing capacity for its

polyamide 66 resins and compounds (PA66) at its Pensacola, Fla.,

plant, the world's largest integrated PA66 manufacturing

facility. The move will allow the company to respond to the

significant increase in demand throughout the world, especially

in China.

Solutia will increase the annual production capacity of its

Vydyne and Ascend PA66 products by 32,000 metric tons (70 million

pounds), beginning in the third quarter of this year. This is the

first in a series of capacity expansions that will continue in

2007 and 2008.

"This significant capacity expansion demonstrates Solutia's

commitment to PA66 markets, and to meeting the emerging needs of

our Vydyne and Ascend customers around the globe, particularly in

the Asian region," says Nadim Qureshi, general manager,

Nylon Plastics and Polymers, Solutia Inc. "Our customers

recognize the value of our high-quality PA66 products and their

consistent performance, and this increase will help ensure we

continue to meet their supply needs."

To accomplish this series of capacity increases, Solutia is

reconfiguring existing assets at its Pensacola plant. The plant's

large scale and integrated structure make it the most efficient

location for PA66 capacity expansion.

"By utilizing existing manufacturing resources, our plant is

able to quickly implement production increases. We have developed

a plan which allows us several further expansions, all at very

competitive economics," said Craig Ivey, Pensacola plant

manager. "Vydyne and Ascend are key brands within the

Solutia family, and we're proud to participate in their

growth."

Vydyne PA66 resins are used primarily in injection molding and

extrusion applications in the automotive, consumer,

electrical/electronic, and industrial markets. Ascend PA66

polymers are used primarily in the textile, carpet, and

industrial fiber markets. For more information, please visit

http://www.vydyne.com or http://www.ascendnylon.com.

Note to Editor: Vydyne and Ascend are registered trademarks of

Solutia Inc.

British Plastics

& Rubber 2006/12/17

Solutia to take control of Flexsys rubber chemicals ゴム薬品ビジネス

Solutia is

planning to buy out its partner in rubber chemicals producer

Flexsys. Flexys is a 50:50 joint venture

between Solutia and Akzo Nobel and says it is the world's leading

supplier of chemicals to the rubber industry. It had sales last

year of around $600 million and employs more than 1,000 people

worldwide. Flexys is based in Brussels, Belgium, and has 15

manufacturing plants - eight in Europe, three in North America,

two in South America and two in Asia. Also included in the deal -

which has reached the agreement-in-principle stage - is that Solutia

should buy Akzo Nobel's toll manufacturing operation for Flexsys

at its Kashima site in Japan.

http://www.flexsys.com/i

St.

Louis Business Journal - June 7, 2005

Monsanto

agrees on Solutia bankruptcy exit plan

Bankrupt Solutia has

reached an agreement with its unsecured creditors' committee and

Monsanto that could take the company out of bankruptcy

protection, the companies said Tuesday.

The plan calls for

Monsanto to provide $250 million in funding to offset Solutia's

liabilities.

Chemical company Solutia

Inc. filed for Chapter 11 bankruptcy protection in 2003. Solutia

was formed in 1997 when Pharmacia Corp., formerly known as

Monsanto, spun it off. Present-day Monsanto Co. was established

by Pharmacia in 2000, and it agreed to indemnify Pharmacia for

certain liabilities assumed by Solutia at its spinoff. Pharmacia

Corp. is now a subsidiary of Pfizer Inc.

The liabilities Solutia

assumed when it was spun off included retiree benefit

obligations, environmental remediation and litigation.

The St. Louis-based firms

and unsecured creditors reached an agreement in principle that

calls for an infusion of $250 million into Solutia through a

rights offering to unsecured creditors, who could buy up to 22.7

percent of Solutia's common stock. Monsanto would exercise the

remaining rights up to $250 million in exchange for up to 52.5

percent equity.

Solutia said $150 million

of the proceeds from the offering will be used to satisfy

liabilities for pre-spinoff retiree benefits, $50 million or

environmental remediation and the remaining $50 million to

satisfy liabilities at its discretion.

Monsanto and Solutia

would each manage designated environmental remediation programs,

and an advisory board would oversee shared sites.

The reorganized Solutia

would continue as an independent, publicly traded company,

Solutia said. Solutia said it would file the plan in bankruptcy

court later this summer. The plan is subject to court approval.

Monsanto Co. develops

insect- and herbicide-resistant crops and other agricultural

products.

2007/9/28 CCR

Solutia Expands Presence in China

On September 21, 2007, Solutia Inc. celebrated the grand opening

of its new plant in Suzhou, China. The plant is a manufacturing

site for the company's Saflex business. Saflex is the world's

leading producer and seller of polyvinyl butyral (PVB)

interlayers 中間層. The Suzhou plant site

is ideally suited for future expansion of Saflex and for other

Solutia businesses.

The plant has been developed as a full-scale facility that

currently produces Saflex interlayer for the automotive market,

with room for future capacity to serve the architectural market

as well. The current manufacturing line is designed to produce

approximately 10 million square meters of Saflex interlayer per

year, with space for further expansion as market growth requires

more capacity.

2007/11/29

Court

Confirms Solutia Plan of Reorganization

Solutia

Inc., a leading manufacturer and provider of high-performance

specialty materials and chemicals, today announced that the U.S.

Bankruptcy Court for the Southern District of New York has

confirmed its plan of reorganization.

"While

this has been a long process, we have used our time in Chapter 11

to truly transform and revitalize Solutia - shaping a strong

portfolio of businesses, shedding $1.3 billion in liabilities,

and growing the company by $1 billion in sales while more than

doubling our earnings. We will emerge from Chapter 11 as a

growing, vibrant company that is positioned for success,"

said Jeffry N. Quinn, chairman, president and CEO, Solutia Inc.

Quinn

added, "We are pleased to have gained confirmation of a plan

of reorganization that was supported by all of the major

constituents in our case and that provides for significant

creditor recoveries."

The

company anticipates that the plan of reorganization will become

effective in the late December or January timeframe.

Solutia

Poised to Emerge From Bankruptcy After Reaching Settlement

With All Major Constituents in Chapter 11 Case

2008/2/28

Solutia

Solutia Inc. emerges from Chapter 11 as a market-leading

specialty chemicals company with global leadership positions in

each of its business segments

Solutia Inc. today emerged from Chapter 11 reorganization.

"Solutia has emerged as a well-positioned specialty

chemicals and performance materials company with market-leading

global positions and a diverse portfolio of high potential

businesses," said Jeffry N. Quinn, chairman, president and

chief executive officer. "We believe we are a stronger,

healthier and more competitive company than at any point in our

history. Over the past four years, we have transformed our

portfolio through strategic acquisitions, internal investments,

asset dispositions, and the re-deployment of significant nylon

assets to higher-value uses."

May 19, 2008 Solutia

Solutia Breaks Ground at

Plant in Springfield, Mass., for Expansion of PVB Resin

Manufacturing Operations

Global Tightness in Supply and

Growth in Demand Drive Expansion Projects Throughout the Saflex

Business

Saflex(R), a unit of

Solutia Inc., will break ground today for an expansion of its PVB resin manufacturing operations at

its plant in Springfield, Mass., USA. The expansion will add 12,000 metric

tons of

annual capacity, which is planned to come on-stream in early

2009.

ポリビニルブチラール

The Springfield plant was

the industry pioneer in the development and production of plastic

interlayers for laminated glass, which it began more than 80

years ago. Today it hosts Solutia's largest Saflex manufacturing

site in North America, playing a critical role in serving Saflex

customers around the world. The Springfield plant also is home to

the Technical Center for Solutia's Saflex and Specialty Fluids

businesses.

In addition to the PVB

resin expansion project in Springfield, Saflex announced earlier

this month that it will expand its PVB resin manufacturing

facilities in Antwerp, Belgium, adding 15,000

metric tons

of annual capacity that is planned to come on-stream in 2010. The

additional resin capacity at Antwerp will feed the new Saflex PVB

sheet extrusion line in Ghent, Belgium, which will start up later

in 2008 and will create 40 million square meters of new capacity

once it ramps up to full production.

In addition to the

Springfield, Antwerp, and Ghent projects noted above, Solutia has

recently constructed a new Saflex PVB sheet

production facility in Suzhou, China, and added capability at its Saflex PVB sheet

production facility in Santo Toribio, Mexico.

Saflex, a

business unit of Solutia Inc., is the world’s largest manufacturer of

polyvinyl butryal (PVB) interlayer for laminated glass.

Saflex interlayer strengthens laminated glass in homes,

buildings and automobiles. This innovative glass interlayer

is tough, resilient and versatile. Used in commercial and

residential applications, Saflex interlayer provides

solutions for almost every glazing challenge and offers a

variety of benefits ranging from hurricane resistance to UV

protection.

・ Manufacturing

locations: Trenton, Mich., and Springfield, Mass., United

States; Ghent, Belgium; Sao Paulo, Brazil; Singapore; Santo

Toribio, Mexico; Suzhou, China

Jun 30, 2008

Solutia

Solutia Retains HSBC to

Explore Strategic Alternatives for Its Nylon Business

| Solutia

Inc. today announced that it has retained HSBC Securities

(USA) Inc. to explore strategic alternatives with respect

to its nylon business, including a possible sale. We have transformed our

nylon business from a North American-focused fiber

business into the world's second-largest

producer of nylon 66 plastics, commented Jeffry N.

Quinn, chairman, president and chief executive officer of

Solutia Inc. The nylon business is on a path for further

growth and improvement in financial performance, and we

believe strongly in the strategic course we have set for

the business. However, given the strength of our

high-margin specialty chemical and performance materials

businesses and the current industry dynamic in the nylon

segment, it is an appropriate time to explore strategic

alternatives available with respect to the nylon business

that would better position both the nylon business and

the rest of Solutia for reaching their ultimate

potential.

In 2007, the

nylon business generated net sales of $1,892

million or approximately 51% of Solutia's total

revenue, and adjusted EBITDAR of $106 million, or 28% of

Solutia's total pro forma adjusted EBITDAR(Earnings

Before Interest, Taxes, Depreciation, Amortization and

Rent). In 2008,

first quarter net sales for the nylon business were $468

million, an increase of 10% when compared to the first

quarter of 2007; however, the business' adjusted EBITDAR

was a loss of $7 million for the

quarter,

a decrease of $35 million year-over-year, largely due to

higher raw material costs that were only partially

recovered with higher selling prices in the quarter. In

contrast, Solutia's other three business platforms --

Saflex(r), CPFilms(r), and Technical Specialties, which

generated net sales of $1,850 million and adjusted

EBITDAR of $270 million in 2007, generated $108 million

in adjusted EBITDAR in the first quarter 2008, an

increase of 23% over the same period in 2007.

主に、自動車、建築、輸送、産業用に機能材料を生産するが、主要製品は以下の5つ。

・Saflex®:合わせガラス用

polyvinyl butyral (PVB) 中間膜

・CPFilm® :窓ガラス用フィルム

・Nylon Plastic & Fibers:アジピン酸、ヘキサメチレンジアミン、Nylon

66、ナイロン繊維

・Flexsys® :合成ゴム加硫剤

・Specialty Products

:高温合成系熱媒体、航空機用作動油、航空機用洗浄溶剤、

ポリビニルブチラール樹脂、ジフェニルオキサイド

|

2005/9 CEOインタビュー

ナイロンについては、「ソルーシアの重要な一部を構成する事業で、財務面への貢献も大きい」と判断しているが、「原料やエネルギー価格などに左右されやすく、景気循環の影響を受けやすい」ことから、これまで収益基盤の強化に取り組んできた。競合メーカーに比べても収益性は高いとしているが、将来については「あらゆる選択肢に対してオープン」とし、事業の価値を最大化する運営方法を選択する意向だ。

2009/4/1 Solutia

Solutia Agrees to Sell

Nylon Business

Divestiture Will Complete

Transformation to Specialties Portfolio

Solutia Inc. today

announced it has entered into a definitive agreement to sell

its nylon business to an affiliate of SK Capital

Partners II, L.P.,

a New York-based private equity firm that is focused on the

chemical, material and health care sectors. At the closing of the

sale, Solutia will receive $50 million in cash and a two

percent equity stake

in a new company formed to hold substantially all of the assets

of the nylon business. Solutia will also receive $4 million in

deferred cash payments to be paid in annual $1 million

installments beginning in 2011. The agreement includes a minimum

level of working capital to be delivered at closing, which is

approximately $100 million lower than the actual reported balance

at the end of 2008 and approximately $25 million lower than the

expected balance at the end of the first quarter. The affiliate

of SK Capital will assume substantially all of the liabilities of

the nylon business, including employee and pension liabilities

relating to the active employees of the business, and

environmental liabilities. Solutia will use the nylon sale

proceeds to pay down debt under its asset-based revolving credit

facility.

In addition, SK Capital will secure replacement of $25 million of

letters of credit associated with the nylon business, which will

result in increased availability for Solutia under its credit

agreements.

August 2009 Specialty

Fabrics Review

Solutia Inc. becomes

Ascend Performance Materials

SK

Capital Partners, an investment firm based in New York City

and Boca Raton, Fla., has added Solutia Inc.’s integrated nylon chemical,

plastic and fiber business to its portfolio. The business has

been re-named Ascend Performance Materials, and will be led by former

American Standard chairman and CEO Frederic Poses.

Solutia/Ascend had $1.8 billion in revenues in 2008. SK

Capital Partners has special investment expertise in the

areas of specialty materials, specialty chemicals and

healthcare.

March 1, 2010

Solutia Announces

Agreement to Acquire Etimex Solar

Uniquely positions Solutia as a global provider of both major

encapsulants to the fast-growing photovoltaics industry

Solutia Inc. today announced that it has reached a definitive

agreement to purchase Etimex Solar GmbH, a wholly owned subsidiary of

Etimex Holding GmbH, which is controlled by funds affiliated with

Alpha Gruppe. The purchase price of euro 240 million in cash is

expected to be financed from existing cash on the balance sheet

and additional debt. Etimex Solar is a leading supplier of ethylene vinyl

acetate (EVA) encapsulants to the photovoltaic market. The

acquisition is a significant step in Solutia's plan to

strategically grow its specialty chemicals and performance

materials portfolio by enhancing its current businesses.

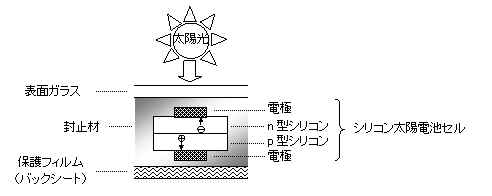

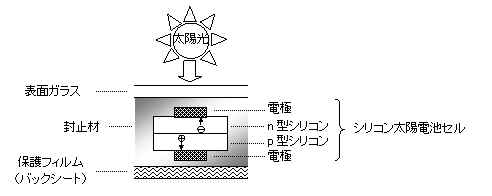

封止樹脂としてはEVA、PVBシートが使用されている。EVAの透明性、柔軟性、接着性、引張強度、耐候性が生かされた用途だが、太陽光を常時浴びるという過酷な環境であるため、架橋剤、紫外線吸収剤、接着補助剤等が配合されるのが一般的。

Combining EVA with its

existing polyvinyl butyral (PVB) encapsulant capabilities positions Solutia as

the world's only one-stop source for solar encapsulant solutions.

This will enable Solutia to better meet customer needs by

providing the broadest product offering in the industry. In

addition, Saflex's processing expertise, global commercial

capabilities, and technology resources will enable rapid

expansion in the photovoltaic market. Additional immediate

benefits include:

* Diversification and expansion of end markets

* Enhancement of Solutia's already strong EBITDA margins

* Enhancement of Solutia's position as a leading components

supplier to the high-growth renewable energy sector

* Product development and commercial synergies

"This acquisition is a solid step forward that strengthens

our core competencies, expands our end markets and supports

Solutia's growth strategy," said Jeffry N. Quinn, chairman,

president and chief executive officer of Solutia Inc.

"Renewable energy is an acknowledged source of long-term

growth that fits well with Solutia's businesses, and the

combination of EVA and PVB encapsulant manufacturing capabilities

will result in access to additional opportunities. I am extremely

excited about Etimex Solar and the role it will play in Solutia's

future success."

Etimex's VistaSolar(R) products, manufactured in Dietenheim,

Germany, offer ultra fast curing EVA films as well as new

thermoplastic polyurethane (TPU) films which do not require the

necessity of curing. This business reported 2009 net income of

$31 million and 2009 EBITDA of approximately $34 million. This

transaction is expected to close during the second quarter of

2010, contingent upon customary closing conditions, including

receipt of governmental approvals. Deutsche Bank Securities Inc.

and Kirkland & Ellis LLP acted as advisors on this

transaction.