トップページ

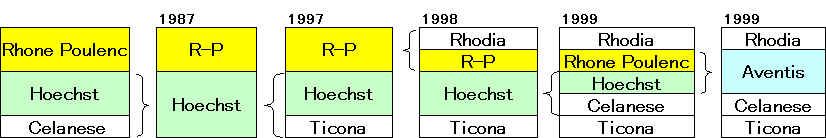

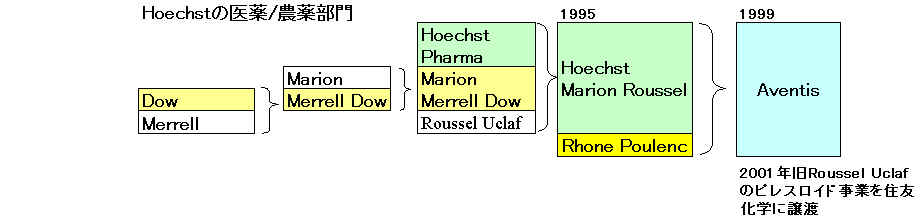

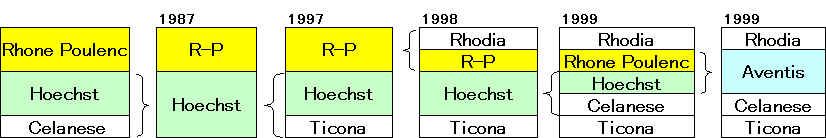

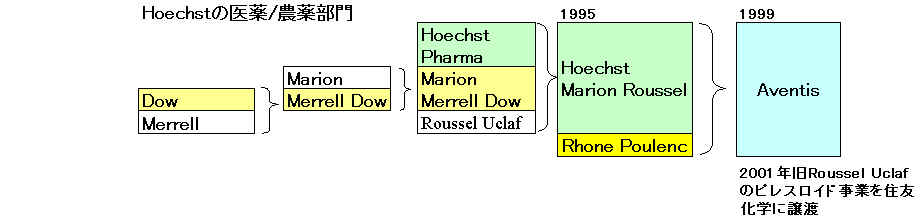

Aventis

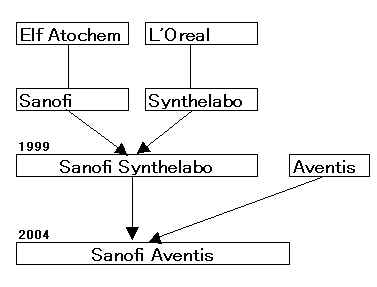

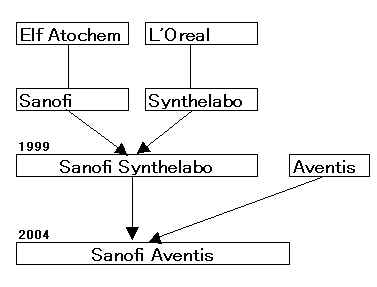

Sanofi-Synthelabo

サノフイ

アベンティス買収へ 7兆円で合意

Aventis

Supervisory Board Recommends Substantially Improved Offer

from Sanofi-Synthelabo

「サノフィ・アベンティス」 2004/8/20に正式発足

Is

Sanofi-Aventis After Bristol-Myers?

Sanofi

Aventi

Sanofi-aventis Announces

Non-Binding Offer to Acquire Genzyme

2004/09/03 グラクソ・スミスクライン

グラクソ・スミスクライン、サノフィ・アベンティスより

抗血栓症剤 フラキシパリン、アリクストラおよび関連生産施設の買収を完了

http://release.nikkei.co.jp/detail.cfm?relID=80418

2004年9月1日 ロンドン発−グラクソ・スミスクライン(以下、GSK)は、サノフィ・アベンティス社より注射剤の抗血栓症剤 フラキシパリンとアリクストラおよび関連資産(フランスのノートルダム・ド・ボンドビルにある製造施設を含む)について世界規模での買収が成功裏に完了したことを発表しました。

この買収において、GSKは現在進行しているアリクストラの臨床試験の実施の責任も担います。

サノフィ・サンテラボ社によるアベンティス社の買収は、統合における必須条件を処理し欧州委員会および米国連邦公正取引委員会からの承認を得て完了しました。この度の製品の買収はそれにともない成立に至ったものです。

(以下略)

BusinessWeek

January 29, 2007

Word is the two

major pharmaceuticals may soon merge and become the world's

largest drugmaker ahead of some best-selling drugs coming off

patent

Speculation is mounting

that the long-rumored merger between Franco-German drugmaker

Sanofi-Aventis and New York-based Bristol-Myers Squibb may soon

be reality. If true, the deal will enable Sanofi to vault past

Pfizer and Britain's GlaxoSmithKline to become the world's

largest drugmaker, with combined annual revenues of nearly $55

billion. Neither company is commenting. But a recent report in

French financial newsletter La Lettre de

l'Expansion claims the two companies have

already signed a pre-merger agreement.

December 15, 2015

Sanofi and Boehringer Ingelheim Enter Exclusive Negotiations on Business Swap

Sanofi Would Become a Global Leader in

Consumer Healthcare and Boehringer Ingelheim Would Become Second largest

Animal Health Company

Sanofi and Boehringer Ingelheim today

announced that the companies have entered into exclusive negotiations to swap

businesses.

The proposed transaction would consist of an exchange of

Sanofi animal health business ("Merial") with an enterprise value of €11.4 bn

and

Boehringer Ingelheim consumer healthcare (CHC) business with an enterprise value

of €6.7 bn.

Boehringer Ingelheim CHC business in China would be excluded from the

transaction.

The transaction would also include a gross cash payment from Boehringer

Ingelheim to Sanofi of €4.7 bn.

The transaction would allow Sanofi to become the number one ranked player in

consumer healthcare with expected pro forma sales of approximately €5.1 bn in

2015(e) and a global market share close to 4.6%1. Sales of Boehringer Ingelheim

CHC business (excluding China) are estimated at about €1.6 bn for 2015 and are

highly complementary with those of Sanofi CHC, both in terms of products and

geographies.

Boehringer Ingelheim CHC would improve the position of Sanofi in Germany and

Japan where Sanofi CHC presence is limited, and expand Sanofi presence in its

Priority Categories. Sanofi would gain access to iconic brands in

Antispasmodics, Gastrointestinal, VMS and Analgesics, and attain critical mass

in Cough & Cold. Sanofi CHC business in the US, Europe, Latin America and

Eurasia would also expand significantly, giving it multiple leadership postions

in key countries and/or on key product categories.

The animal health industry is a very attractive industry in terms of innovation,

growth potential and profitability. Combining Merial's and Boehringer

Ingelheim's complementary strengths would create the second largest player in

the global animal health market with pro forma sales of approximately € 3.8 bn

in 2015(e) with the ability to compete for global market leadership. The

combined portfolios and technology platforms in anti-parasitics, vaccines and

pharmaceutical specialities would place the combined company in the key growth

segments of the industry. The species portfolios are highly complementary

building on Merial's expertise in companion animals and poultry and BI's

expertise in swine.

"In entering into exclusive negotiations with Boehringer Ingelheim, we have

acted swiftly to meet one of the key strategic objectives of our roadmap 2020,

namely to build competitive positions in areas where we can achieve leadership.

This transaction would allow Sanofi to become a world leader in the attractive

non-prescription medicines market and would bring a complementary portfolio with

highly recognized brands, allowing for mid and long term value creation," said

Olivier Brandicourt, M.D., Chief Executive Officer, Sanofi. "I am confident that

Boehringer Ingelheim will enable Merial to fully express and develop its

potential in the attractive but competitive animal health market."

Germany would become a key center of Sanofi CHC business, including in

particular for Gastro-Intestinal and Cough & Cold categories that will benefit

from the strong capabilities of Boehringer Ingelheim teams. Sanofi will pay

particular attention to social matters as well as skills and people retention

sensitivities.

"Boehringer Ingelheim's strategic priority is to focus on the company's core

areas of expertise and businesses with an established global scale, or where a

pathway to a global scale can be achieved and prioritized among Boehringer

Ingelheim's portfolio opportunities," said Prof. Dr Andreas Barner, Chairman of

the Board, Boehringer Ingelheim. "Boehringer Ingelheim Animal Health is and will

stay strongly committed to bringing novel, innovation driven solutions to

veterinarians and animal owners. Our combined Animal Health business would be

well positioned for growth and emergence as a leader globally. I am confident

that Sanofi will enable our CHC business to fully live its potential supported

by highly professional and committed teams."

Lyon would be a key operational center of Boehringer Ingelheim's Animal Health

business. Boehringer Ingelheim will commit to maintain business operations, R&D

and Manufacturing Centers in France. As the U.S. market is an important part of

Merial's business, Boehringer Ingelheim would pay particular attention to

sustain the momentum of the U.S. operations. Boehringer Ingelheim will give

particular attention to social matters as well as skills and retention

sensitivities.

The execution of definitive agreements is expected in the coming months

following consultations with the relevant social bodies. Boehringer Ingelheim

and Sanofi's goal currently is to close the potential transaction in Q4 2016,

subject to appropriate regulatory approvals.

Sanofi intends to use a portion of the net proceeds of the transaction to

repurchase shares. Taking into account the anticipated CHC results, share

buybacks and potential synergies, the overall transaction is expected to be

business EPS neutral in 2017 and accretive in subsequent years.

About Boehringer Ingelheim's CHC activities

Boehringer Ingelheim Consumer Healthcare is the 8th largest Consumer Healthcare

business in the world. Sales of Boehringer Ingelheim's CHC business were €1.4 bn

in 2014, contributing 11 per cent to Boehringer Ingelheim's net sales. It aims

to create and drive inspiring and sustainable solutions that will efficiently

develop compelling and true global brands for consumers.The leading brands of

Boehringer Ingelheim's CHC business are the antispasmodic Buscopan® (2014 sales

of €219 million; mainly sold in Europe and Latin America), the laxative Dulcolax®

(2014 sales of €204 million; sold in more than 40 countries with a strong

presence in the U.S.), the multivitamins Pharmaton® (2014 sales of €133 million,

with majority of sales in Latin America), the cough treatments Mucosolvan® (2014

sales of €165 million, mainly in China, Germany and Russia) and Bisolvon® (2014

sales of €101 million with a fragmented worldwide presence with largest

countries being Spain and Italy) and the cold treatment Mucoangin®/Lysopaine®

(2014 sales of €48 million).

About Sanofi CHC activities

Sales of Sanofi CHC business were €3.3 bn in 2014. The leading brands of

Sanofi's CHC business are the allergy products Allegra® (2014 sales of €350

million) and Nasacort® (2014 sales of €114 million), the pain killers Doliprane®

(2014 sales of €310 million), No-Spa® (2014 sales of €109 million) and Dorflex®

(2014 sales of €90 million), the digestive products Essentiale® (2014 sales of

€235 million), Enterogermina® (2014 sales of €156 million) and Maalox® (2014

sales of €98 million), the feminine care product Lactacyd® (2014 sales of €104

million) and the vitamins, minerals and supplements Magné B6® (2014 sales of €88

million). In 2014, 52.6% of CHC sales were generated in emerging markets, 21.2%

in the U.S. and 20.3% in Western Europe.

Sanofi and Boehringer Ingelheim combined worldwide CHC businesses - Priority

Categories

(pro forma)

Source: Nicholas Hall & Company, FY 2014

| Global Categories*

|

Segment size in €bn |

Sanofi + BI CHC |

| Pain Care

|

13.2 |

#2 |

| Allergy Solutions

|

3.1 |

#3 |

| Cough & Cold Care

|

17.2 |

#6 |

| Feminine Care

|

0.8 |

#1 |

| Digestive health |

14.4

|

#1 |

| ビタミン・ミネラル・サプリメント VMS2

|

27.6 |

#3 |

About Merial

Merial is a world-leading, innovation-driven animal health company, providing a

comprehensive range of products to enhance the health and well-being of a wide

range of animals. Merial employs 6,600 people and operates in more than 150

countries worldwide with €2.5 billion of sales expected in 2015.

Merial has three main business areas: pets, farm animals, and veterinary public

health. Our pharmaceuticals and vaccines focus on disease prevention and overall

health and wellness in animals, and target more than 200 diseases and conditions

across a variety of species.

The main Merial brands in the field of pet health include Frontline®, Heartgard®,

NexGard® and Purevax®; and in farm animals Vaxxitek®, Eprinex®, Ivomec®,

Longrange®, Circovac® and GastroGard®. Merial is a strategic partner for

veterinary public health (VPH), providing governments with vaccines to control

foot and mouth disease (FMD), Rabies and Blue Tongue Virus (BTV).

As part of our commitment to innovation and excellence, Merial has a global

footprint with 13 R&D centers and 18 production sites. Working with global

trends in mind, such as population growth, increased demand for animal proteins,

needs of emerging markets, growing middle classes, resource constraints, and

sustainability concerns, we aim to consciously and constantly innovate and

provide solutions to our customers' and animals' needs.

For more information, please see www.merial.com

About Boehringer Ingelheim Animal Health

Boehringer Ingelheim Animal Health is the 6th largest animal health business in

the world and is committed to providing leading innovative solutions to prevent,

treat and cure animal diseases. With approximately 4,000 employees worldwide,

Boehringer Ingelheim Animal Health achieved net sales of about € 1.13 billion in

2014. Main brands of Boehringer Ingelheim's Animal Health portfolio are Ingelvac

Circoflex® (2014 sales of € 260 million), Metacam® (2014 sales of € 93 million),

Ingelvac PRRS® (2014 sales of € 74 million), Duramune® (2014 sales of € 69

million) and Vetmedin® (2014 sales of € 57 million), representing 8% of the

corporation's revenue base. From a regional perspective, Boehringer Ingelheim

has its legacy as an Animal Health company in the US with most of its R&D and

manufacturing infrastructure located there. Significant investments have been

made recently in Hannover, Germany and are underway in China. The Boehringer

Ingelheim Animal Health Business is currently holding strong positions in swine

and cattle vaccines as well as in pharmaceutical specialties for animal use. In

its research-driven Animal Health business, Boehringer Ingelheim continually

invests more than 12% of net sales of the Animal Health business in R&D.

Boehringer Ingelheim and Merial combined businesses - priority categories (pro

forma)

| Global Categories |

Global segment size

in €bn |

Boehringer Ingelheim + Merial |

| Small Animals

|

7,1 |

#1 |

| Ruminants 反芻動物 |

5,8

|

#4 |

| Swine

豚 |

2,6 |

#1 |

| Poultry

家禽 |

2,4 |

#3 |

| Equine

馬 |

0,6 |

#1 |

About Sanofi

Sanofi, a global healthcare leader, discovers, develops and distributes

therapeutic solutions focused on patients' needs. Sanofi has core strengths in

diabetes solutions, human vaccines, innovative drugs, consumer healthcare,

emerging markets, animal health and Genzyme. Sanofi is listed in Paris (EURONEXT:

SAN) and in New York (NYSE: SNY).

About Boehringer Ingelheim

The Boehringer Ingelheim group is one of the world's 20 leading pharmaceutical

companies. Headquartered in Ingelheim, Germany, Boehringer Ingelheim operates

globally with 146 affiliates and a total of more than 47,700 employees. The

focus of the family-owned company, founded in 1885, is researching, developing,

manufacturing and marketing new medications of high therapeutic value for human

and veterinary medicine.

Social responsibility is an important element of the corporate culture at

Boehringer Ingelheim. This includes worldwide involvement in social projects,

such as the initiative "Making more Health" and caring for the employees.

Respect, equal opportunities and reconciling career and family form the

foundation of the mutual cooperation. In everything it does, the company focuses

on environmental protection and sustainability.

In 2014, Boehringer Ingelheim achieved net sales of about 13.3 billion euros.

R&D expenditure corresponds to 19.9 per cent of its net sales.

2020年4月14日

2020/6 第1/2相試験を2020年9月に開始する計画 別途、サノフィは

Translate Bio と提携(下記)

COVID-19ワクチンの開発に向けて、サノフィとGSKが前例のない提携を開始

-

両社の技術を組み合わせ、アジュバント添加COVID-19ワクチンの開発を目指す

-

2020年下半期に候補ワクチンの臨床試験を開始する予定であり、成功すれば、2021年下半期に実用化の見込み

サノフィ(本社:フランス)とグラクソ・スミスクライン(本社:英国、GSK)は本日、現在の新型コロナウイルスによる感染症の世界的大流行に対処するため、両社の技術を活かし、COVID-19に対するアジュバント添加ワクチンを開発する同意書に署名したことを発表しました。

サノフィは、遺伝子組換えDNA技術をベースとするS-タンパク質COVID-19抗原を提供します。遺伝子組換えDNA技術により、ウイルスの表面に検出されたタンパク質と正確に一致する遺伝子配列を作成することができます。抗原をコード化するDNA配列を、サノフィが米国で開発に成功し承認された遺伝子組換えインフルエンザワクチンの基盤となったバキュロウイルス発現プラットフォームに組み込みます。

GSKは、実証済みのパンデミックアジュバント技術を提供します。アジュバントの使用はパンデミックの状況下では特に重要です。アジュバントを使用することにより、1回の接種に必要なワクチン用タンパク質の量が抑えられるため、ワクチンの生産量を増やすことができ、より多くの人々を守ることに貢献できるからです。

サノフィ最高経営責任者(CEO)のポール・ハドソンは、次のように述べています。「世界は未曾有の医療危機に直面しており、1つの企業が単独で対処することは不可能です。そのため、サノフィは、GSKなどの業界他社と協力し自社の専門知識とリソースを補完することで、十分な数量のワクチンを作り出して供給するという目標に向けて取り組んでいます。」

GSK最高経営責任者(CEO)のエマ・ウォルムズリーは、次のように述べています。「この提携により、世界トップクラスのワクチン企業2社が協力することになります。両社の科学的専門知識、技術、能力を組み合わせることにより、ワクチンを開発する世界的な取り組みを加速し、できるだけ多くの人々をCOVID-19から守りたいと考えています。」

タンパク質ベースの抗原をアジュバントと組み合わせる方法は、現在提供されている多くのワクチンで使用されている確立された方法です。アジュバントは、免疫応答を高めるために一部のワクチンに添加するもので、それによって感染症に対し、ワクチン単体よりも、強力かつ長期的に持続する免疫を作り出すことができます。また、有効なワクチンを大量に生産できる可能性も高まります。

両社は、2020年下半期に第I相臨床試験を開始する予定であり、これに成功すれば、規制当局による審査を経て、2021年下半期までに実用化できるよう、開発の完了を目指します。

これまでにサノフィが公表したとおり、遺伝子組換え技術をベースとするCOVID-19ワクチン候補の開発は、米国保健福祉省(HSS)事前準備・対応担当次官補局(ASPR)の一部門である米国生物医学先端研究開発局(BARDA)との協力の下で、同局の資金提供を受けて実施されています。両社は、他の政府や世界的なアクセスを優先する国際機関からの財政支援について協議を進める予定です。

BARDAのディレクターであるリック・A・ブライト博士(Rick

A. Bright, Ph.D)は次のように述べています。「コロナウイルスのワクチンをできるだけ早く提供するには、ワクチン業界のリーディングカンパニーによる戦略的提携が不可欠です。COVID-19に対するアジュバント添加遺伝子組換えワクチン候補を開発すれば、ワクチンの用量を減らし、より多くの人々にワクチンを提供しこのパンデミックを収束させ、将来的なコロナウイルスの流行に適切に備えるだけでなく、予防することも可能になるでしょう。」

両社は、サノフィのワクチン事業部門のグローバルヘッドであるデヴィッド・ロウと、GSK グローバルワクチン

プレジデントのロジャー・コナーが共同議長を務める共同タスクフォースを設置しました。タスクフォースは、両社のリソースを動員し、ワクチン候補の開発を加速するあらゆる機会を模索していきます。

パンデミックには大きな人的・資金的課題が伴うことを考慮し、両社はCOVID-19ワクチンが世界中で使用できるようにすることを最優先し、すべての国の人々に対して、公正に提供できる仕組みを通じて、一般の人々がこの提携によって開発されたワクチンを使用できるよう努めていきます。

今回の提携は、COVID-19との闘いにおいてサノフィとGSKが現在取り組んでいる活動の中で、重要な節目となります。両社は、研究成果有体物移転契約(MTA)を締結し、すみやかに共同研究を進められるようにしました。提携の最終的な条件は、今後数週間以内に確定する予定です。

サノフィについて

サノフィは、健康上の課題に立ち向かう人々を支えます。私たちは、人々の健康にフォーカスしたグローバルなバイオ医薬品企業として、ワクチンで人々を守り、革新的な医薬品で痛みや苦しみを和らげます。希少疾患をもつ少数の人々から、慢性疾患をもつ何百万もの人々まで、寄り添い支え続けます。サノフィでは、100カ国において10万人以上の社員が、革新的な医科学研究に基づいたヘルスケア・ソリューションの創出に、世界中で取り組んでいます。

サノフィは、「Empowering

Life」のスローガンの下、ヘルスジャーニー・パートナーとして人々を支えます。日本法人であるサノフィ株式会社の詳細は、http://www.sanofi.co.jpをご参照ください。

June 23 2020

Sanofi and Translate Bio expand collaboration

to develop mRNA vaccines across all infectious disease areas

The two companies will build upon their

existing collaboration to pursue novel mRNA vaccines aimed at broadly

addressing current and future infectious diseases

Translate Bio to receive $425 million in upfront payment and common stock

equity investment and overall is eligible to receive up to $1.9 billion of

potential milestones/payments as well as tiered royalties on worldwide sales

of developed vaccines

Sanofi to receive exclusive worldwide

rights to develop, manufacture and commercialize infectious disease vaccines

using Translate Bio technology

The expanded collaboration brings together Translate Bio’s leading mRNA

technology and manufacturing with Sanofi’s world class vaccine development

and distribution

Sanofi Pasteur, the vaccines global business

unit of Sanofi, and Translate Bio, a clinical-stage messenger RNA (mRNA)

therapeutics company, have agreed to expand their existing

2018 collaboration and license agreement to develop

mRNA vaccines for infectious diseases.

The expansion of this agreement will further unite Translate Bio’s expertise and

knowledge from more than 10 years of mRNA research and development with Sanofi’s

leadership in vaccine research and development.

Under the expansion agreement, Translate Bio will receive

a total upfront payment of $425 million, consisting of a

$300 million cash payment and

a private placement common stock investment of $125 million at $25.59 per

share representing a 50 percent premium to the 20-day moving average share price

prior to signing.

Translate Bio will also be eligible for

potential future milestones and other payments up to $1.9

billion, including $450 million of milestones under the 2018 agreement.

Of these potential milestones and other payments, approximately $360 million are

anticipated over the next several years, inclusive of COVID-19 vaccine

development milestones. In addition, Translate Bio is also eligible to receive

tiered royalty payments based upon worldwide sales of the developed vaccines.

Sanofi Pasteur will pay for all costs during the collaboration term. Under this

agreement Sanofi Pasteur will receive exclusive worldwide rights for infectious

disease vaccines.

“As all eyes are on prevention of infectious disease through vaccines, this is a

pointed moment in time where we are called upon to seek innovative ways to

protect public health,” said Thomas Triomphe, Executive Vice President, Sanofi

Pasteur. “We are excited by the novel technology and expertise Translate Bio

brings, and we believe that adding this mRNA platform to our vaccines

development capabilities will help us advance prevention against current and

future infectious diseases.”

“The expansion of our collaboration with Sanofi Pasteur validates the progress

we’ve made in the development of mRNA vaccines for infectious diseases since our

work together began in 2018 and also speaks to the potential of our mRNA

platform. We are excited to work with Sanofi in this broadened capacity with the

goal of ultimately delivering vaccines on a global scale, a need underscored by

the current pandemic,” said Ronald Renaud, Chief Executive Officer of Translate

Bio. “Translate Bio will also be well positioned financially to continue to

build upon our internal capabilities with a focus on advancing innovations in

platform discovery and on the development of ongoing and additional preclinical

therapeutic programs as we aim to bring multiple programs towards clinical

development.”

Under the collaboration, Translate Bio is using its mRNA platform to discover,

design and manufacture vaccine candidates and Sanofi Pasteur is providing its

deep vaccine expertise to advance vaccine candidates into and through further

development. Translate Bio will also transfer technology

and processes to allow Sanofi Pasteur to develop and manufacture mRNA vaccines

for infectious diseases.

The teams are currently evaluating multiple COVID-19 vaccine candidates in vivo

for immunogenicity and neutralizing antibody activity to support lead candidate

selection and the companies have the goal of initiating a first-in-human

clinical trial in the fourth quarter of 2020.

The companies are also advancing an mRNA vaccine development candidate against

influenza through preclinical studies with clinical trial initiation anticipated

in mid-year 2021. Additional mRNA vaccine development programs under the

collaboration include another viral pathogen and a bacterial pathogen.

The transactions, including the equity sale, are subject to customary closing

conditions, including termination or expiration of any applicable waiting

periods under the Hart-Scott-Rodino Act. For more information regarding the

financial and other terms of the agreement, please refer to the Current Report

on Form 8-K which will be filed by Translate Bio with the U.S. Securities &

Exchange Commission on June 23, 2020.

Evercore acted as financial advisor to Translate Bio for the expansion of the

collaboration agreement.

About mRNA Vaccines

Vaccines work by mimicking disease agents to stimulate the immune system;

building up a defense mechanism that remains active in the body to fight future

infections. mRNA vaccines offer an innovative approach by delivering a

nucleotide sequence encoding the antigen or antigens selected for their high

potential to induce a protective immune response. mRNA vaccines also represent a

potentially innovative alternative to conventional vaccine approaches for

several reasons - their high potency, ability to initiate protein production

without the need for nuclear entry, capacity for rapid development and potential

for low-cost manufacture and safe administration using non-viral delivery. This

approach potentially enables the development of vaccines for disease areas where

vaccination is not a viable option today. Additionally, a desired antigen or

multiple antigens can be expressed from mRNA without the need to adjust the

production process offering maximum flexibility and efficiency in development.

About the Sanofi Pasteur and Translate Bio collaboration

In 2018, Translate Bio entered into a collaboration and exclusive license

agreement with Sanofi Pasteur Inc., the vaccines global business unit of Sanofi,

to develop mRNA vaccines for up to five infectious disease pathogens. This

agreement was first expanded in March 2020 to include the collaborative

development of a novel mRNA vaccine for COVID-19. This collaboration brings

together Sanofi Pasteur’s leadership in vaccines and Translate Bio’s mRNA

research and development expertise. Under the agreement, the companies are

jointly conducting research and development activities to advance mRNA vaccines

and mRNA vaccine platform development during a research term of at least four

years after the original signing in 2018. Translate Bio and Sanofi Pasteur have

advanced the preclinical development vaccine programs including screening,

optimization and production of mRNA and LNP formulations across multiple

targets.

About Translate Bio

Translate Bio is a clinical-stage mRNA therapeutics company developing a new

class of potentially transformative medicines to treat diseases caused by

protein or gene dysfunction. Translate Bio is primarily focused on applying its

technology to treat pulmonary diseases caused by insufficient protein production

or where the reduction of proteins can modify disease. Translate Bio’s lead mRNA

therapeutic program is being developed as a treatment for cystic fibrosis (CF)

and is in a Phase 1/2 clinical trial. The Company also believes its technology

is applicable to a broad range of diseases, including diseases that affect the

liver. Additionally, the platform may be applied to various classes of

treatments, such as therapeutic antibodies or vaccines in areas such as

infectious disease and oncology. For more information about the Company, please

visit www.translate.bio or on Twitter at @TranslateBio

Sanofi to acquire

Principia Biopharma

・Further

strengthens core R&D areas of autoimmune and

allergic

diseases

・Provides

full control of brain-penetrant BTK

inhibitor SAR442168 in

multiple sclerosis (MS), making commercialization more efficient and

eliminating future royalty payments

・Allows

expansion of SAR442168 development program into other

central nervous system diseases and therapeutic areas

・Adds

clinically

advanced oral BTK inhibitor rilzabrutinib

with

potential

across a range of immunology and inflammation indications,

complementing Sanofi’s

existing R&D pipeline

Principia Biopharma

Inc.は臨床段階のバイオ医薬品会社である。

【事業内容】同社は免疫・腫瘍学分野において患者に対する経口療法の開発に焦点を当てる。同社はテーラード・コバレント・プラットフォームを使用して、可逆的な共有結合および不可逆的な共有結合性小分子阻害剤を設計・開発する。同社のパイプラインはPRN1008、PRN1371およびPRN2246を含む。PRN1008薬物候補は慢性免疫学的障害の治療に設計される。PRN2246は多発性硬化症(MS)および他の中枢神経系(CNS)疾患の治療用不可逆的共有結合BTK阻害剤である。PRN1008はまた、天疱瘡などの複数の自己免疫疾患の治療に開発される。PRN1371は、固形腫瘍の治療に設計された線維芽細胞増殖因子受容体(FGFR)の阻害剤である。同社はまた、炎症および自己免疫疾患の治療用経口免疫プロテアソーム阻害剤の開発に焦点を当てる。

2017/11

Principia Biopharma has signed a deal

worth up to $765 million with Sanofi for the development of a multiple

sclerosis drug candidate.

Sanofi will develop privately-held Principia’s Bruton's tyrosine kinase

(BTK) inhibitor PRN2246(SAR442168),

an experimental oral treatment for MS. The drug is designed to access

the brain and spinal cord by crossing the blood-brain barrier and impact

immune cell and brain cell signaling. Through this mechanism of action,

the company believes it has the potential to treat MS as well as other

diseases of the central nervous system. Principia said it has initiated

a Phase I trial for PRN2246 in healthy volunteers.

2020/2 サノフィがPrincipiaから導入したBTK阻害剤SAR442168による多発性硬化症(MS)治療の第2相試験が、主要評価項目である脳のMRI病変減少を達成

今回、Principia Biopharmaを買収し、SAR442168

をfull control へ

Sanofi

and

Principia Biopharma

Inc.,

a

late-stage

biopharmaceutical

company

focused

on

developing

treatments for immune-mediated

diseases,

entered into a definitive agreement

under which Sanofi will acquire all of the

outstanding

shares of

Principia

for $100 per

share

in cash, which represents an aggregate equity

value of

approximately $3.68billion

(on a

fully diluted basis).

The

Sanofi and

PrincipiaBoards

of Directors unanimously approved

the transaction.

“This acquisition advances our ongoing R&D transformation to accelerate

development of the most promising medicines that will address significant

patient

needs,”

said Paul Hudson, Sanofi Chief Executive

Officer.

“The addition of

multiple

BTK inhibitors

to our pipeline

demonstrates our commitment to strategic product

acquisitions in our

priority therapeutic areas. Full

ownership of

our brain-penetrant

BTK inhibitor ‘168

removes

complexities for this priority development program and

simplifies future commercialization.”

“The

Phase 2b data in

relapsing multiple sclerosis showed the

strong potential of

‘168 to address disability and disease progression, and triggered

the start of

Phase

3 studies

across the full spectrum of MS.

Through this acquisition, we will be able

to expand and accelerate development

of

BTK inhibitors

across multiple

indications.

Both‘168

and rilzabrutinib, have

‘pipeline in a product’ potential, and

we look forward to

unlocking their

full treatment

benefits

across

an array of

diseases,”

said John Reed, M.D., Ph.D., Global Head of Research & Development

at Sanofi.

“Principia’s

successful design and development

of a whole portfolio of BTK

inhibitors for immunology is aimed to transform the treatment for patients with

immune-mediated

diseases. By combining with Sanofi, we will bring significant

resources to expand and accelerate the potential benefits of these therapies.

The

benefit of developing several BTK inhibitors will allow us to target specific

organ

systems for optimal patient benefit. The merger will provide global resources to

get

these novel therapies to patients faster,” said

Martin Babler,

President

and CEO at

Principia Biopharma.

Principia’s

Bruton

tyrosine kinase (BTK) inhibitors

add to Sanofi’s efforts to accelerate and

build a portfolio of the next generation of transformative treatments

for auto immune

diseases.

BTK is present in the signaling pathways of key innate

and adaptive

cell types of

the immune system.

Being

able to block

or disrupt these signaling

processes can

help in

stopping inflammation and tissue destruction related to autoimmune diseases and

target

some of the underlying pathophysiology.