http://www.syngenta.co.jp/syngenta/gaiyo.html

シンジェンタは、世界をリードするアグリビジネス企業です。

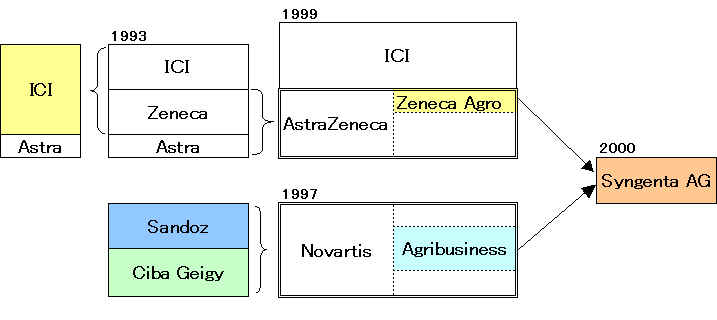

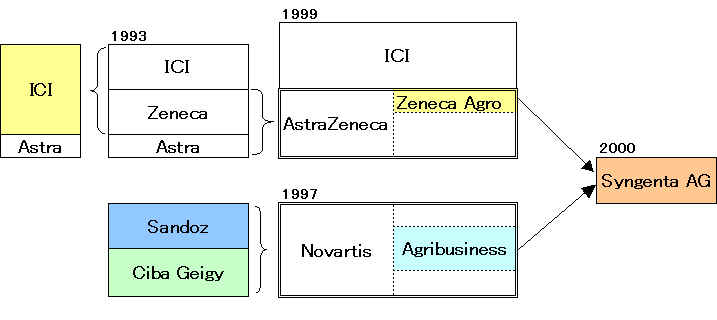

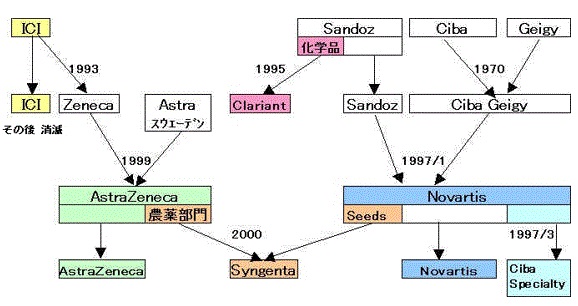

2000年11月に、ノバルティス アグリビジネスと、ゼネカ アグロケミカルズが合併して、シンジェンタが誕生しました。私たちは革新的な研究と技術で、持続可能な農業の実現に向けて努力を重ねています。世界50カ国以上で事業を展開し、2万人を超える従業員を擁しています。

日本では、シンジェンタ ジャパン株式会社が2001年7月1日に発足しました。ノバルティスとゼネカの幅広いノウハウと技術力。そこから生まれる多彩な商品群。研究・開発から販売までの一貫体制。さらに各地の流通、食品・飼料チェーンまで見据えた戦略、マーケティング力。これらは、きっと日本の農業にも新しい時代をもたらすことでしょう。より豊かな農業の実現のために。そして、より豊かな食文化のために。私たちは、日本の地に根ざしてまいります。

Syngenta and Fox Paine to acquire seed company Advanta BV

Syngenta sells stake in SF-Chem

2000年11月2日

シンジェンタ合併をFTC(米国連邦取引委員会)が承認

世界をリードするアグリビジネス企業の誕生

http://www.syngenta.co.jp/syngenta/newsrelease/news_001107.html

FTC(米国連邦取引委員会)は、ノバルティスのアグリビジネスと、アストラゼネカのアグロケミカル部門を統合することを承認しました。これにより、世界をリードするアグリビジネス企業、シンジェンタ設立が可能になりました。

July 26, 2000

EUROPEAN COMMISSION APPROVES SYNGENTA MERGER

http://www.astrazeneca.com/pressrelease/332.aspx

AstraZeneca and Novartis announced today that the European Commission (EC) has cleared the planned merger of the Zeneca Agrochemicals business with the Novartis Agribusiness to form Syngenta AG, the world’s first global dedicated agribusiness company.

2004/5/12 Syngenta

Syngenta and Fox Paine to acquire Advanta BV

http://www.syngenta.com/en/media/article.aspx?article_id=397

Syngenta and Fox Paine today announced an agreement to acquire Advanta BV, one of the world’s leading seed companies, from AstraZeneca of the UK and Royal Cosun of the Netherlands for a consideration of Euro 400 million. Advanta sales in 2003 were Euro395 million.

| ・ | Syngenta to acquire NAFTA corn and soybean business with sales of Euro135 million in 2003 |

| ・ | Significantly enhances market share in US corn to 11% and soybean to 10% |

| ・ | Complete range of corn input traits from 2005 |

| ・ | Fox Paine to acquire global business outside NAFTA and non-corn, non-soybean business within NAFTA with sales of Euro260 million in 2003 |

Syngenta also announced today the purchase of glyphosate tolerance technology for corn, called GA21, from Bayer CropScience.

Fox Paine & Company, LLC manages investment funds in excess of $1.5 billion that provide equity capital for management buyouts, going private transactions, and company expansion and growth programs.

Advanta

http://www.advantaseeds.com/show?id=23797&langid=96Advanta is the culmination of a joint venture between two well-established and progressive seed enterprises: the Royal Vanderhave Group from the Netherlands and Zeneca Seeds from the United Kingdom. Established in 1996, the business has developed into a major force in a rapidly changing seed industry. Our company has a rich tradition in plant breeding. The foundations of important R&D programmes in maize, grasses, cereals and sugar beet were laid in the first half of the 20th century.

Nowadays, this experience is combined with modern science and technology. Advanta is focussed on the future whilst preserving our traditional values.

Syngenta statement on unsolicited preliminary approach from Monsanto

Michel Demaré, Syngenta Chairman said, “Syngenta is the world leader in Crop Protection, the number three in Seeds and the first company to introduce integrated solutions for growers. Monsanto’s proposal does not reflect the outstanding growth prospects of Syngenta’s integrated strategy and the significant future value potential of the company’s crop-focused innovation and market leading positions.

“While Syngenta’s valuation is currently affected by short term currency and commodity price movements, the business outlook is strong, with emerging markets accounting for over 50% of our sales. Our integrated strategy has been particularly successful in these markets which in 2014 registered double digit growth rates for the fifth consecutive year, and which represent a major part of the future growth potential for our industry. Recently launched new products are achieving rapid sales growth globally as growers demand the latest technologies, and we have a strong pipeline of innovative crop protection products in development, which have total peak sales potential of over $3 billion.

“In 2015, we are on track to achieve the first $265 million of savings from our Accelerating Operational Leverage Program, and we are targeting savings of $1 billion in 2018. This will allow us to realize the full benefits of the integrated strategy and will ensure that increases in profitability are sustained for the benefit of Syngenta’s shareholders.”

| Businesses |

|

May 8, 2015

Monsanto Comments On Proposal for Syngenta

Monsanto has long respected and followed Syngenta`s business and believes combining the two companies would deliver significant value to all stakeholders, including shareholders. Creating a new company from the combination of Syngenta`s strengths and leadership in crop protection chemicals and Monsanto`s leadership in seeds, traits and information technology would form an integrated global leader in agriculture with comprehensive and complementary product portfolios, and an Ag-focused organization with enhanced abilities to develop and accelerate innovative solutions for growers. Monsanto believes the combined company would be uniquely positioned to deliver a comprehensive suite of integrated solutions to farmers around the world and to accelerate technological innovation through precision agriculture and advanced research and development capabilities aimed at increasing the world`s food supply in a sustainable fashion.

Monsanto believes a combination would deliver significant value to shareholders of both companies. The combination is expected to result in substantial synergies as the company delivers more integrated solutions to customers.

Monsanto, in conjunction with its financial and legal advisors, has devoted significant time and resources to analyzing a potential combination of Syngenta and Monsanto and is confident in its ability to obtain all necessary regulatory approvals.

Monsanto does not intend to make any additional comments on this matter at this time.

-------

Bloomberg

Syngenta Rejects $45 Billion Takeover Offer From Monsanto

Syngenta AG, the world’s largest maker of agricultural chemicals, rejected a

41.7 billion Swiss-franc ($45 billion) takeover

offer from U.S. rival Monsanto Co., saying it undervalued the company and a

merger would have significant execution risks.

Monsanto proposed paying 449 Swiss francs a share with 45 percent in cash,

Basel-based Syngenta said Friday in a statement, confirming a Bloomberg report

that it had received and rejected an offer while leaving the door open for

further talks. The Swiss company’s shares surged the most in more than 14 years

in Zurich.

A deal would make Monsanto, a U.S. maker of genetically modified seeds and

weedkillers, into the largest player in both seeds and crop chemicals. It timed

its approach with a lull in Syngenta’s performance amid currency moves and lower

crop prices. Syngenta said the offer is too low as it bets that the benefits

from grouping products into specific crop units -- from seeds to herbicides --

will soon accelerate, adding to extra sales from a slate of new technologies.

“The long-term outlook of Syngenta is good, so I can understand that they are

asking for a higher premium,” Patrick Rafaisz, an analyst at Bank Vontobel AG,

said by phone. “These two companies have different corporate cultures. So it

will be difficult to merge them without inefficiencies.”

Syngenta climbed 19 percent to 396.90 francs in Zurich, the biggest increase

since the shares began trading in November 2000, valuing the company at 36.9

billion francs. Monsanto rose 1.4 percent to $120.79 in New York.

The offer values Syngenta at about 17 times its earnings before interest, taxes,

depreciation and amortization in the last 12 months. Large agrochemical

transactions in the last decade have commanded a median multiple of about 12

times, so a purchase of Syngenta would also rank as one of the industry’s more

expensive deals, according to data compiled by Bloomberg.

Combining Syngenta’s leading pesticide products with Monsanto’s expertise in

genetically modified seeds “would form an integrated global leader in

agriculture,” St. Louis-based Monsanto said in a statement Friday. “The combined

company would be uniquely positioned to deliver a comprehensive suite of

integrated solutions to farmers around the world and to accelerate technological

innovation.”

Monsanto ‘Confident’

The company said it’s “confident” in its ability to obtain regulatory approvals

for the deal.

The companies held preliminary talks last year with advisers about a

combination, before Syngenta’s management decided against negotiations, people

familiar with the matter said at the time. No agreement was reached after

concerns were raised about the strategic fit, antitrust issues and the location

of headquarters.

If the Monsanto-Syngenta deal goes through, it would be the biggest ever

acquisition of a European company by a U.S. rival, according to data compiled by

Bloomberg. The deal would’ve only been exceeded by Pfizer Inc.’s attempted

purchase of AstraZeneca Plc last year and AbbVie Inc.’s plan to buy drugmaker

Shire Plc, both of which were abandoned.

Tempting Syngenta to the negotiating table and agreeing to terms would also make

Monsanto a formidable competitor to Bayer AG, BASF SE, Dupont Co. and Dow

Chemical Co. Syngenta is the world’s largest maker of crop chemicals whereas

Monsanto is the largest maker of seeds and dominates the global market for

genetically modified crops like corn and soybeans.

‘Growth Prospects’

Still, Syngenta Chairman Michel Demare said Friday the offer isn’t good enough.

“Monsanto’s proposal does not reflect the outstanding growth prospects of

Syngenta’s integrated strategy and the significant future value potential of the

company’s crop-focused innovation and market leading positions,” he said. “While

Syngenta’s valuation is currently affected by short-term currency and commodity

price movements, the business outlook is strong.”

Demare said the offer also underestimates significant execution risks, including

regulatory and public scrutiny in many countries.

To address antitrust issues, Monsanto has planned for a deal that would include

a sale of portions of the combined business, a person familiar with the matter

said last month. The U.S. company last year reached out to potential bidders for

those assets, including Bayer, this person said.

Antitrust Issues

The largest business overlaps are the North American and Latin American

herbicide markets as well as in seeds in North America, according to Morgan

Stanley analysts Paul Walsh and Charles Webb.

Monsanto’s dominance in the seed industry has been the subject of U.S. antitrust

probes at the federal and state levels. The U.S. Justice Department’s antitrust

division dropped its probe into possible anti-competitive practices in the seed

industry in 2012, and a month later at least seven states led by Iowa ended

their five-year investigation without taking action.

The company has also been criticized by environmental groups such as Greenpeace

that oppose its development of genetically modified crops.