VESTOLIT GmbH & Co. KG in Marl http://www.vestolit.com/en/

VESTOLIT GmbH & Co. KG operates in Marl the largest fully

integrated PVC (polyvinyl chloride) production plants in Europe,

with a capacity of 350.000 tonnes per annum. Integration means that, from

the starting point of energy and the raw materials ethylene and

rock salt via the intermediate products EDC (ethylene dichloride)

and VCM (vinyl chloride), the production of PVC all takes place

at one location.

On 01.01.1995, VESTOLIT GmbH & Co. KG, a wholly-owned

subsidiary of today's Degussa-Huls AG, took over the appropriate

business and production units of the then Huls AG. At 01.12.1999,

VESTOLIT GmbH & Co. KG was acquired by a finance consortium.

The consortium is led by a group of international investors under

the leadership of Candover plc., based in London, and D.

George Harris & Associates, based in New York.

All the VESTOLIT GmbH & Co. KG production units are located

on the Marl chemical complex. The interlocking layout there

provides ideal conditions for the supply of energy, raw materials

and services.

For over 50 years now, PVC has been produced in Marl. This

plastic is outstanding on account of its using such limited

amounts of raw material, and its longevity. It is therefore

particularly suitable for manufacturing products for the building

and automotive sectors. VESTOLIT GmbH & Co. KG is market

leader in the manufacture of window frames, as well as

paste-making PVC for floor coverings, tarpaulin fabrics and

underbody coatings.

Germany's Vestolit

secures Eur80-mil for Marl chloride plant

Germany's Vestolit has secured the finances to build a new,

environmentally-friendly, 260,000 mt/yr chloride plant at a cost of Eur80-mil ($96.3-mil)

at the Marl industrial plant, the company announced Tuesday.

The chloride unit was expected to come into operation in the

second half of 2007, replacing the current unit which has been in

operation for 40 years. Total investment is about Eur100-mil over

the next two to three years.

Furthermore, Vestolit was planning to increase PVC production

capacity at Marl to over 400,000 mt/yr, at a cost of about Eur20-mil.

Vestolit increased vinyl chloride capacity from 50,000 mt/yr to

400,000 mt/yr in July this year.

Vestolit operates one of the biggest fully-integrated PVC

locations in Europe at Marl. In 2004, it produced more than

360,000 mt of PVC, with turnover hitting Eur360-mil.

LVM (The Tessenderlo group) http://www.tessenderlo.com/c/r000000.htm

The Tessenderlo group's plastics

activities are managed through its LVM (Limburgse Vinyl

Maatschappij) subsidiary, ranking amongst the top European

polyvinyl chloride (PVC) manufacturers.

Ever since its foundation in 1969, LVM has been totally committed

to its core business : the manufacture of suspension PVC resins

(S-PVC) and the ongoing development of a growing range of

PVC-based engineered polymers, to suit the increasing customer

requirements and meet new application opportunities.

LVM is, within the Tessenderlo group, at the crossroads of a

highly integrated activity, both up- and downstream, from base

raw materials and compounds to pipe- and profile systems.

LVM、Vinnolit-Uhde boiling

reactor technologyでEDC生産

VCM

The raw material for PVC, vinyl chloride monomer (VCM) is manufactured at Tessenderlo, in Belgium at the LVM subsidiary. With an annual production capacity of 550,000 tonnes, this unit is the largest in Europe. Its capacity exceeds the group's own internal polymerisation requirements which allows the group to play an active role in the vinyl chloride monomer market. The raw materials for VCM are either chlorine or hydrochloric acid and ethylene.

PVC

Tessenderlo Group is currently the sixth largest producer of PVC in Europe. The two PVC suspension production units in the Netherlands (the Beek unit ) and France (the Mazingarbe unit) represent an overall capacity of 440,000 tonnes/year.

In addition to the PVC polymers intended for traditional applications such as plastic pipe systems, profiles, flexible and rigid packaging, etc., over the last ten years, Tessenderlo Group has been involved in the development of a new generation of high performance polymers.

Marvyflo, Marvyloy and Marvylex are the flagship products made from these speciality compounds. They are intended for the automotive, building, electricity and electronic industries.

The Tessenderlo group

The group is structured to clearly reflect the five core activities which are closely linked :

-inorganic chemicals

-natural organic products

-fine chemicals

-PVC

-plastics converting

Contract for first

industrial-scale EDC plant using new Vinnolit - Uhde boiling

reactor technology

http://www.uhde.biz/aktuelles/news_show.en.epl?stamp=80000021

Uhde GmbH has been awarded a

contract by the Belgian chemical company Limburgse Vinyl

Maatschappij NV (LVM), a

member of the Tessenderlo group, for a new ethylene dichloride

(EDC) plant using the innovative new Vinnolit-Uhde boiling reactor

technology. The plant will be

built at LVM's site in Tessenderlo, Belgium, and will have an

annual capacity of 250,000 tonnes of EDC. It is scheduled to come

onstream in 2006. Uhde's scope of supplies includes the licence,

basic and detail engineering, procurement services, construction

management and supervision of the commissioning activities.

This will be the first industrial-scale application of the new Vinnolit-Uhde technology for the production of EDC through the

direct chlorination of ethylene using the new boiling reactor. In

this reactor, which has been developed jointly by Uhde and

Vinnolit, liquid-phase ethylene reacts catalytically with

chlorine to form EDC. The chlorine for the new plant will be

produced at a membrane electrolysis plant currently being built

by Uhde at the same location for Tessenderlo Chemie. The EDC

produced is of such a high quality that destillative purification

is no longer necessary and it can be used immediately as

feedstock for the production of vinyl chloride (VCM) or offered

for sale. VCM will be manufactured as an intermediate from the

EDC produced at the plant and this in turn will be used to

manufacture PVC.

"Due to the new process and reaction configuration the new

Uhde-Vinnolit process is noticeably more cost effective than

other processes. It requires less energy and furthermore it is

extremely environment-friendly as no liquid by-products are

produced. Little space is required and so the new technology can

also be easily integrated into existing plant complexes,"

said Dr. Josef Ertl, Managing Director of Vinnolit.

"This first industrial-scale implementation of the new

technology is a great success for the many years of research and

development work undertaken jointly by Vinnolit and Uhde and, at

the same time, a milestone for further extending our market

leadership in the construction of EDC/VCM plants," said

Helmut Knauthe, a member of Uhde's Executive Board.

Vinnolit is - with a capacity of 650,000 tonnes a year - the

leading PVC manufacturer in Germany, one of the biggest in Europe

and ranks among the top ten in the sector worldwide. The national

and international activities of the company are controlled from

Ismaning near Munich. Its production sites are located in

Burghausen, Gendorf, Knapsack and Cologne. In the 2003 business

year Vinnolit achieved sales of Euro 536 million and employs

approximately 1,550 employees.

Uhde is a company in the Technologies segment of the ThyssenKrupp

Group and has a workforce of more than 3,900 employees worldwide.

The company's activities focus on the design and construction of

chemical and other industrial plants in the following fields:

refining technologies, plants for fertilisers, organic

intermediates and polymers, electrolysis plants, gas

technologies, plants for oil, coal and residue gasification,

coking technologies and pharmaceuticals.

2006/6/20 Tessenderlo

Tessenderlo Group presents recovery plan for the Chemicals

Business Group

Possible loss of 240 jobs, including 197 in Belgium

In the framework of its recovery plan ‘Target 2007’, the management of Tessenderlo

Group today informed the works councils of the Chemicals sites

involved of its intention to carry out a reorganisation. This

reorganisation could affect the Limburg factories in Tessenderlo

(TCT and LVM) and Ham (TCH), the Chemicals

department in Brussels and the other European production sites

and sales offices of the Chemicals business group.

In recent years, the results of the Chemicals Business Group have

nose-dived at an alarming rate. The Chemical business units

inorganics and PVC/chlor-alkali have been affected by a downward

trend in productivity and profitability since 2000.

This can be attributed to swift changes in the market conditions,

worldwide competition that has become cut-throat and high prices

for raw materials. In Belgium, the Limburg sites have been

loss-making even at structural level. Poor results of the

Chemicals business group have had a negative impact on the group.

Recovery plan “Target 2007”

Tessenderlo Group

has launched a recovery plan in order to get business,

productivity and profitability back on track. From 2007, “Target 2007”

aims to improve the

result by 30 million EUR a year, most of which will be set aside

by the Chemicals business group which is bearing the brunt of the

problems. Only in that way is there room for investments and can

we provide for the future.

With regard to the Chemicals recovery plan, ten working groups

carried out a detailed analysis of the situation for several

months. They were made up of people from different sites,

positions and countries, and produced a large number of proposals

to improve profitability. Particularly, the setting-up of one

single organisation for Europe and the merger of LVM, TC

Tessenderlo and TC Ham could create important synergies.

Based on detailed analyses, proposals will be tabled for changes

in the organisation, business processes and working methods, with

significant investments in training being made.

Restructuring and redundancies

Unfortunately, in order to create financial breathing space,

alongside reshuffles, redundancies may be a necessary evil. The

recovery plan to be considered by all parties involved may be

translated into a loss of 240 jobs in Europe. For Limburg, this

may mean a loss of 197 jobs, including the potassium sulphate

production unit in Tessenderlo that may face closure.

The Chemicals management intends to transfer its activities and

49 staff from its Brussels offices to Tessenderlo. Although the

French PVC research activities at Verneuil would be moved to

Belgium. The sales structure will also be restructured. To make

it absolutely clear, Tessenderlo Group has no intention of

transferring activities to low-wage countries. Quite the reverse,

the group has only just invested heavily (to the tune of 150

million EUR in the new electrolysis unit in Tessenderlo

(Belgium).

Today our first priority is the future of the employees who will

be affected by these plans. The management would like to take all

social circumstances into account as much as it can.

By means of open and constructive dialogue with staff

representatives, Tessenderlo Chemicals wants to look for the best

solutions in the interest of all staff. Everyone will need to

make an effort. In that way, we can guarantee a new future for

the Chemicals business group.

Background information:

The three West-Limburg plants employ 1419 people in the

production divisions of mineral chemicals, fine chemicals,

chlorine-alkali, MVC (raw material for PVC) and in various

supporting capacities.

186 people are employed at the administrative seat in Brussels.

The Chemicals Business Group has branches in the Netherlands (1),

Italy (1), France (3), and sales offices in Great Britain,

Germany, France, Italy, the Netherlands, Poland, Spain and

Switzerland.

At group level, Tessenderlo Group employs 8123 people worldwide,

2150 of whom in Belgium. The consolidated turnover was EUR 2.1

billion in 2005 and was realised in three business groups

(chemicals, specialties, plastics processing). The group is

European market leader and world leader in most of its products.

Tessenderlo Chemie NV is listed on Euronext Brussels and forms

part of Next 150, BEL Mid and NextPrime.

Norsk Hydro http://www.petrochemicals.hydro.com/

Norsk Hydro is an industrial company based on the use of natural resources, with the aim of meeting needs for food, energy and materials.

Hydro intends to create growth and development where the company can achieve good profitability through strong competitiveness.

Hydro will promote

awareness of resources and the environment, and quality

throughout its organization..

Hydro Polymers is a

leading integrated PVC manufacturer, with its main operations in

Europe. Through joint ventures, we are also well represented in

Asia, namely China, India, and Qatar. We enjoy a unique cost

position as our fellow Hydro group companies have access to gas

and hydro-electric power, two important raw materials in the

vinyl chain.

PVC is one of the most successful modern synthetic materials. It

makes excellent use of scarce resources, is long-lasting and safe

in production, use and disposal. PVC is converted into a wide and

diverse range of applications such as pipes, window frames, wire

and cable insulation, blood tubing and blood bags and domestic

and business and equipment parts - products which surround us in

everyday life.

Our product portfolio comprises suspension and emulsion PVC

resins, PVC compounds, the intermediary product VCM (vinyl

chloride monomer) and the by-product caustic soda. Ethylene and

chlorine, which are reacted to form VCM, are produced at our

Rafnes and Stenungsund plants.

Caustic soda, a by-product of the chlorine production process, is

sold to many different companies. Its greatest area of

application is in the production of paper.

| Caustic soda |

VCM | Suspension PVC |

Emulsion PVC |

PVC Compound |

||

| Hydro Polymers AS | Rafnes,NORWAY | 140 kT | 450 kT | |||

| Porsgrunn,NORWAY | 95 kT | 25 kT | ||||

| Hydro Polymers AB | Stenungsund,SWEDEN | 131 kT | 140 kT | 144 kT | 58 kT | |

| Hydro Sydplast AB | Helsingborg,SWEDEN | 14 kT | ||||

| Hydro Polymers Ltd. | Durham UK | 245 kT | 125 kT |

JV

CIRES S.A. PORTUGAL Resin & Compound

Qatar Vinyl Company Ltd, Q.S.C. Soda & EDC/VCM

Suzhou Huasu Plastics/Chemicals Co. Ltd. Resin & Foil

Singapore Polymers Corporation Ltd. Compound

Hydro S & S Industries Ltd. INDIA Compound

CertainTeed Corporation is a manufacturer of exterior building materials for new construction and home remodeling needs. Products included; insulation, vinyl windows, vinyl siding, roofing, ceilings, PVC pipe, fencing, decking, railing, attic ventilation and foundation systems.

In 1988, CertainTeed became a wholly owned subsidiary of Saint-Gobain. Renowned for its expertise in glass technology, Saint-Gobain is the world's largest building materials company. Its annual sales in 1999 were approximately $24.5 billion. Today, with the full support of this industrial leader, CertainTeed's financial and technological resources are stronger than ever.

Products:

Fencing

Fiber Cement Siding

Insulation

Pipe & Foundations Systems

PVC Polymer:Lake Charles, Louisiana

Roofing

Ventilation

Vinyl Siding

Windows: Profiles &

Specialty Shapes Company Profile

Borden Chemicals and Plastics Limited Partnership http://biz.yahoo.com/p/b/bcpuq.ob.html

Borden Chemicals and Plastics

Limited Partnership produces polyvinyl chloride resins (PVC)

products, which are used in manufacturing water distribution

pipe, residential sliding, wallcoverings and vinyl flooring. The

Company also manufactures vinyl chloride monomer (VCM), which is

used as raw material for the Company's PVC operations. These

products are manufactured at the Company's production complex at

Geismar, Louisiana, its plant at Illiopolis, Illinois, and the

Company's Addis Facility.

The Company is a limited partnership formed in 1987 to acquire,

own and operate polyvinyl chloride resins, methanol and other

chemical plants located in Geismar, Louisiana, and Illiopolis,

Illinois, that were previously owned and operated by Borden, Inc.

(Borden). In 1995, the Company, through its subsidiary operating partnership Borden Chemicals and Plastics

Operating Partnership (the Operating Partnership), purchased a

PVC resin manufacturing facility from Occidental Chemical Corporation

(OxyChem), located in Addis, Louisiana (Addis Facility). Historically, the

Company's principal product groups were PVC Polymers Products,

which consist of PVC resins and feedstocks (such as VCM and

acetylene), Methanol and Derivatives, which consist of methanol

and formaldehyde, and Nitrogen Products, which consist of ammonia

and urea.

The Company made the decision in 2000 to exit the Methanol and

Derivatives and Nitrogen Products businesses. On April 3, 2001,

the Operating Partnership and its subsidiary, BCP Finance

Corporation, (collectively, the Debtors) filed voluntary petitions for

protection under Chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for

the District of Delaware.

plant 売却

Addis, Louisiana Facility → Shintech

Illiopolis, Illinois Facility → FormosaGeismer 閉鎖 → Geismar Vinyls, an affiliate of The Westlake Group

PVC Resins

PVC is the second largest volume plastic material produced in the world. The Company produces general purpose and specialty purpose PVC resins at three plants, one located at the Geismar complex, one at Illiopolis and another at Addis, with stated annual capacities of 550 million, 400 million and 600 million pounds of PVC resins, respectively. Although there have been year-to-year fluctuations in product mix, the Company has, over time, concentrated on the higher margin grades of PVC resin and reduced its dependence on commodity pipe grade PVC resins, which have historically experienced lower margins.

The PVC industry in both the United States and Europe has entered a consolidation and rationalization phase, evidenced by the mergers of OxyChem and Geon, Georgia Gulf and Condea Vista, BASF and Solvay, EVA and BSU Schkopag and Shin-Etso, Shell and Rovin in recent years.

PVC resins are produced through the polymerization of VCM, an ethylene and chlorine intermediate material internally produced by the Company. The Company's production of certain specialty PVC resin grades also involves the consumption of purchased vinyl acetate monomer. The Company purchases vinyl acetate monomer from unrelated third parties.

All the VCM used by the Company's Geismar PVC resin plant and most of the VCM used by the Company's Illiopolis PVC resin plants is obtained from the Company's two Geismar VCM plants. Substantially all of the production of these VCM plants is consumed by the Company's PVC resins plants at Geismar and Illiopolis. The Geismar PVC resin plants obtain VCM from the Company's adjacent VCM plants in the Geismar complex and the Illiopolis PVC resin plant obtains VCM from the Company's Geismar plant via rail. The VCM requirement at the Addis Facility is currently supplied by OxyChem, which has arranged for physical delivery to the Addis Facility by pipeline via exchange, but which may also be supplied by rail car from OxyChem's plant in Deer Park, Texas, or from OxyChem's joint venture facility (OxyMar) in Corpus Christi, Texas.

VCM

VCM is principally used in the production of PVC resins. The Company has the capability of producing VCM by an ethylene process and an acetylene process. The finished product of both of these processes is essentially identical, but the production costs vary depending on the cost of raw materials and energy. The ability to produce VCM by either process allows the Company the flexibility of favoring the process that results in the lower cost at any particular time.

Ethylene-based VCM (VCM-E) is produced by the Company at a 650 million-pound stated annual capacity plant at the Geismar complex. All of the production of the VCM-E plant is consumed by the Company's PVC resin plants at the Geismar complex and Illiopolis.

Ethylene and chlorine constitute the principal feedstocks used in the production of VCM-E. Both feedstocks are purchased by the Geismar plant from outside sources.

Acetylene-based VCM (VCM-A) is produced at a 320 million-pound stated annual capacity plant at the Geismar complex. All of the VCM-A produced at the Geismar complex is consumed by the PVC resin plants at Geismar and Illiopolis.

Acetylene is primarily used as a feedstock for VCM-A and for other chemical intermediates. Until January 2000, the Company had a 50% interest in a 200 million-pound stated annual capacity acetylene plant at the Geismar complex, with the remaining 50% interest held by BASF Corporation (BASF). In January 2000, the Partnership purchased BASF's interest in the acetylene plant.

The Company's principal competitors in the sale of PVC include Shintech, Formosa Plastics, Oxyvinyl, L.P. and Georgia Gulf.

Chemical Week Apr 10, 2002

Borden May Close Geismar Complex

Borden Chemicals and Plastics (BCP) is expected to close its entire Geismar, LA vinyls complex, sources say. The move is being forced by a shortage of chlorine and a lack of vinyl chloride monomer (VCM) demand as a result of the sale of two of Borden’s polyvinyl chloride (PVC) plants, sources add.

The Geismar complex has a 1.2-billion lbs/year ethylene dichloride (EDC) plant, a 1.2-billion lbs/year VCM unit, and a 600-million lbs/year PVC plant. BCP recently idled the PVC plant because of a chlorine shortage.

The company supplies VCM from Geismar to a 400-million lbs/year Illiopolis, IL PVC plant, which it recently sold to Formosa Plastics. BCP will likely shut the Geismar complex if Formosa Plastics supplies the plant with VCM from its own plants, sources say. BCP’s Geismar PVC plant is also up for sale. Only highly integrated producers can survive in the vinyls industry, says Mark Schneider, president and CEO of BCP Management (Geismar), which owns a 2% stake in BCP, the only major PVC producer in North America that is not integrated.

Pioneer, which supplies chlorine to BCP, has been unable to raise chlorine production because of excess caustic soda inventories, a Pioneer source says. Pioneer has put its customers on chlorine order control because of the supply crunch.

Chemical Week 2002/5/1

Borden Confirms that Geismar Site Will Close

Borden Chemicals and Plastics (BCP) has confirmed CW’s report that it will close its vinyls complex at Geismar, LA. The company says it has started to idle the site’s 1.2-billion lbs/year ethylene dichloride (EDC) and 1.2-billion lbs/year vinyl chloride monomer (VCM) plants, and expects to complete the shutdown in five to six weeks.

A 600-million lbs/year polyvinyl chloride (PVC) plant at the same site was idled last month as a result of a chlorine shortage that cut VCM production significantly.

BCP was supplying VCM from Geismar to a PVC plant at Illiopolis, IL. That unit was recently sold to Formosa Plastics, which has its own VCM production.

Formosa says it is “actively considering” the restart of 200 million lbs/year of commodity grade PVC at Illiopolis, idled since early 2001. A 200-million lbs/ year specialty PVC unit at the same site has been operating normally.

Business Wire 2002/12/30

Borden Chemicals and Plastics Operating Limited Partnership Completes Sale of Geismar, La., PVC Facility to Geismar Vinyls Corporation

Borden Chemicals and Plastics Operating Limited Partnership (BCP) announced that it has completed the sale of the assets of its Geismar, La., polyvinyl chloride (PVC) facility to Geismar Vinyls Corporation (GVC), an affiliate of The Westlake Group, for $5 million cash plus a promissory note for up to $4 million depending on the earnings performance of the assets. The sale agreement was previously approved by the U.S. Bankruptcy Court for the District of Delaware on August 20, 2002.

Geismar Vinyls acquired BCP's 575-million lb./year Geismar PVC resins plant, 650-million lb./year ethylene-based vinyl chloride monomer (VCM/E) feedstock plant, and certain related assets. BCP halted PVC production at Geismar in April 2002.

"We are pleased to have closed the sale of Geismar," said Mark J. Schneider, president and chief executive officer, BCP Management, Inc. (BCPM), the general partner of BCP. "We now look forward to the plan confirmation hearing on January 24 and a successful conclusion to all the matters pending in this case."

Separately, BCP said that on December 19, the court approved the extension of BCP's $7.5 million post-petition credit arrangement with BCPM to January 31, 2003.

BCP and its subsidiary, BCP Finance Corporation, filed voluntary petitions for protection under Chapter 11 of the U.S. Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware on April 3, 2001. BCPM, the general partner of BCP, filed for bankruptcy on March 22, 2002. Their joint plan of liquidation has been submitted to creditors for approval and is scheduled to be heard by the court on January 24, 2003. Borden Chemicals and Plastics Limited Partnership, the limited partner of BCP, was not included in the Chapter 11 filings. A separate and distinct entity, Borden Chemical, Inc., is not related to the filings.

Note to Editors: Borden Chemicals and Plastics Operating Limited Partnership (BCP) and Borden Chemicals and Plastics Limited Partnership (the Partnership) are separate and distinct entities from Borden Chemical, Inc. Please do not refer to either partnership as "Borden" or "Borden Chemicals."

Georgia Gulf http://www.ggc.com/

Georgia Gulf is a major manufacturer and marketer of two highly integrated product lines, which include chlorovinyl and aromatic products.

In our chlorovinyls business, we

are:

・the third largest North

American producer of vinyl chloride monomer (VCM);

・the fourth largest North

American producer of polyvinyl chloride (PVC) resins;

・the second largest North

American producer of PVC compounds.

In our aromatics business, we

are:

・one of the two largest

North American producers of cumene, and

・a leading North American

producer and marketer of phenol.

Our manufacturing processes also generate caustic soda and

acetone. The primary products we sell externally include PVC

resins, PVC compounds and caustic soda in our chlorovinyls

business, and phenol and acetone in our aromatics business. These

products are used globally in a wide variety of end-use

applications, including construction and renovation, engineered

plastics, pulp and paper production, chemical intermediates,

pharmaceuticals and consumer products. Our integration provides

us with the flexibility to shift our product sales mix towards

those products that are experiencing relatively more favorable

market conditions. Our vertical integration, world scale

facilities, operating efficiencies, facility locations and the

productivity of our employees provide us with a competitive cost

position in our primary markets.

PVC Compounds

These formulations provide specific end-use properties that allow

PVC compounds to be processed directly into our customers'

finished products. All of our production is sold to third

parties. We produce flexible and rigid compounds used in the

following products and process applications.

Flexible PVC Compounds

Our flexible PVC compounds are used in wire and cable insulation

and jacketing, automotive window encapsulation, custom profiles,

automotive trim and body side molding, and flexible tubing.

Rigid PVC Compounds

Our rigid PVC compounds are used in a wide range of applications

and production processes. Our injection molding compounds are

used in the production of computer housings and keyboards,

electrical outlet boxes and pipe fittings. Our extrusion

compounds are used in window and furniture profiles and sheets

for household fixtures and decorative overlays. Our blow molding

compounds are primarily used for both food-grade and general

purpose bottles used to package cosmetics, shampoos, charcoal

lighter fluid, water and edible oils.

PVC Resins

PVC is among the most widely used plastics in the world today,

and we supply numerous grades of PVC resins to a broad number of

end-use markets. About 77% of our PVC resins are sold to

customers who use our resins to formulate PVC compounds which are

then heated and shaped utilizing various extrusion and molding

processes to create finished products. These products include

pipe and pipe fittings, wire and cable coatings, home siding and

windows, electrical wall boxes and apparatus, fencing, home and

office furnishings, consumer products, packaging and containers.

We use about 23% of our PVC resin internally for the production

of our PVC compounds.

VCM

We use about 89% of our VCM production in the manufacture of our

PVC resins. VCM production not used internally is sold to other

PVC resin producers in domestic and international markets.

Chlor-alkali Products

Substantially all of the chlorine we produce is used internally

in the production of VCM. As a co-product, caustic soda further

diversifies our revenue base. We sell all of our caustic soda

domestically and overseas to customers in numerous industries,

with the pulp and paper and chemical industries constituting our

largest markets. Our other markets for caustic soda include the

alumina, soap and detergent, textile and water treatment

industries. We also manufacture and sell sodium chlorate, which

is an environmentally preferred bleaching agent for the

production of pulp and paper.

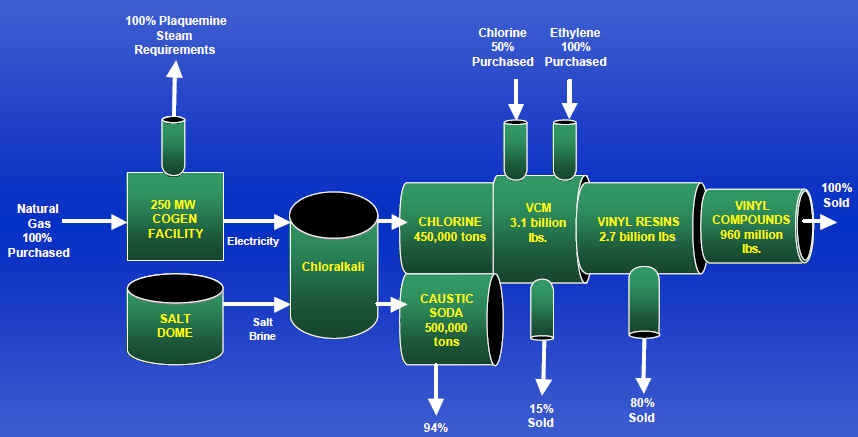

Plant Products and

Capacities

The following table sets forth the location of each chemical

manufacturing facility we own, the products manufactured at each

facility and the approximate processing capability of each,

assuming normal plant operations, as of December 31, 1999:

Plant Location |

Products |

Annual Capacity |

Segment |

| Aberdeen, MS (2) | PVC Resins | 1.0 billion pounds | Chlorovinyls |

| Vinyl Compounds | 185 million pounds | Chlorovinyls | |

| Plasticizers | 20 million pounds | Chlorovinyls | |

| Gallman, MS (3) | PVC Compounds | 310 million pounds | Chlorovinyls |

| Jeffersontown, KY (3) | PVC Compounds | 40 million pounds | Chlorovinyls |

| Lake

Charles, LA (two locations) |

VCM | 1.5 billion pounds (1) | Chlorovinyls |

| Madison, MS (2) | PVC Compounds (two plants) |

140 million pounds | Chlorovinyls |

| Mansfield, MA (3,4) | PVC Compounds | 100 million pounds | Chlorovinyls |

| Oklahoma City, OK (3) | PVC Resins | 450 million pounds | Chlorovinyls |

| Pasadena, TX | Cumene | 1.5 billion pounds | Aromatics |

| Phenol | 160 million pounds | Aromatics | |

| Acetone | 100 million pounds | Aromatics | |

| Plaquemine, LA (3) | Chlorine | 450 thousand tons | Chlorovinyls |

| Caustic Soda | 500 thousand tons | Chlorovinyls | |

| Sodium Chlorate | 27 thousand tons | Chlorovinyls | |

| VCM | 1.6 billion pounds | Chlorovinyls | |

| PVC Resins | 1.2 billion pounds | Chlorovinyls | |

| Phenol | 500 million pounds | Aromatics | |

| Acetone | 308 million pounds | Aromatics | |

| Tiptonville, TN (3) | PVC Compounds | 100 million pounds | Chlorovinyls |

| _________________ |

| (1) | Reflects 100 percent of the production at our owned facility in Lake Charles and our 50 percent share of PHH Monomers' 1,150 million pounds of total VCM capacity. |

| (2) | QS 9000 certified. |

| (3) | These plants are ISO 9000 certified except the VCM plant in Plaquemine. |

| (4) |

The property on which the Mansfield facility is located is leased under a five-year lease from CONDEA Vista Company, which is renewable at our option. Operations ceased in the third quarter of 2000. |

Lake Charles,

Louisiana Facilities

We produce VCM at our Lake Charles, Louisiana facility. Also,

through our joint

venture with PPG Industries,

we have the right

to 50% of the VCM production of PHH Monomers, which is located in close proximity to

our Lake Charles VCM facility. The chlorine needs of our Lake

Charles VCM facility and the PHH Monomers' facility are supplied

by pipeline, under a long-term contract with PPG Industries, who

is also our partner in PHH Monomers. Ethylene is supplied to both

facilities by pipeline from the adjacent CONDEA Vista ethylene facility and by pipeline from

other third parties. The majority of our ethylene requirements

for our Lake Charles VCM facility are supplied under a

seven-year, take-or-pay contract, and PHH Monomers is supplied

under a requirements-based contract. All chlorine and ethylene

contracts are primarily market price-based. VCM from these

facilities supplies our Aberdeen, Mississippi and Oklahoma City,

Oklahoma PVC facilities. A portion of VCM products at the Lake

Charles facilities is sold in domestic and exports markets.

Plaquemine, Louisiana

Facility

Our operations at this facility

include the production of chlorine, caustic soda, sodium

chlorate, VCM, PVC resins, phenol and acetone. We produce

chlorine and its co-product caustic soda at our chlor-alkali

facility by electrolysis of salt brine. We have a long-term lease

on a nearby salt dome with reserves in excess of twenty years,

from which we supply our salt brine requirements. We use

substantially all of our chlorine production in the manufacture

of VCM at this facility and we sell substantially all of our

caustic soda production externally. We also use sodium

hypochlorite, a by-product from our chlor-alkali production

process, to produce sodium chlorate for sale to third parties.

All of the ethylene requirements for our VCM production are

supplied by pipeline. About 80% of our Plaquemine VCM production

is consumed on-site in our PVC resin production, and the

remainder is shipped to our other PVC resin facilities and sold

to third parties.

Aberdeen, Mississippi

and Oklahoma City, Oklahoma Facilities

We produce PVC resins at both our Aberdeen, Mississippi and

Oklahoma City, Oklahoma facilities from VCM supplied by railcar

from our VCM facilities and PHH Monomers. In addition, the

Aberdeen facility produces plasticizers, some of which are

consumed in internal PVC compound production and the remainder

sold to third parties.

Condea Vista Sells PVC Business To Georgia Gulf

Georgia Gulf Corp. in Atlanta has signed a definitive agreement to purchase the vinyls business of Condea Vista Co., Houston. Condea Vista is a wholly owned subsidiary of RWE-DEA of Germany, whose Condea chemical division is based in Hamburg. After this acquisition, Georgia Gulf will have capacity of about 2.6 billion lb/yr of PVC resin, 3.1 billion lb/yr of vinyl chloride monomer (VCM), and 850 million lb/yr of flexible and rigid vinyl compounds.

Georgia Gulf will acquire a VCM plant in Lake Charles, La.; a 50% share of a joint-venture VCM plant also in Lake Charles; two PVC resin plants in Aberdeen, Miss., and Oklahoma City, Okla.; and three vinyl compound plants in Aberdeen, Jeffersontown, Ky., and Mansfield, Mass.

(Georgia Gulf 2000/3/23)

Georgia Gulf Corporation today announced the completion of the initial phase of the transition and integration of the CONDEA Vista vinyls business it acquired in November 1999.

(VCM) Lake Charles (100 percent of the production at our owned facility in Lake Charles and our 50 percent share of PHH Monomers' 1,150 million pounds of total VCM capacity.

(PVC) Aberdeen, Mississippi and Oklahoma City, Oklahoma

originally Conoco → DuPont → Vista → CONDEA Vista → Georgia Gulf(VCM,PVC) Plaquemine, LA

originally Georgia Pacific → Georgia Gulf (1985)

(PVC) Delaware City, DE

originally Georgia Pacific → Georgia Gulf (1985) → Kaneka

Platts 2004/11/29

Georgia Gulf permanently shuts Tennesse, US compound facility

US' Georgia Gulf Corp announced Monday that it will shutdown its

compound plant at Tiptonville, Tennessee, effective immediately as

part of its "ongoing commitment to operational

efficiency." "We considered many factors, including the

capital investment required to ensure our competitiveness, in

making this difficult decision. Our desire now is to help our

Tiptonville employees and their families through this

transition," said Bill Doherty, vice president, vinyl

compounds. "Customers will see no change as a result of this

plant closure due to increased efficiencies from the other

Georgia Gulf compound manufacturing locations," GCC said in

a statement.

GGC, headquartered in Atlanta, produces chlorine, caustic soda,

vinyl chloride monomer and vinyl resins and compounds, and

aromatics, including cumene, phenol and acetone.

Georgia

Gulf Announces Agreement to Acquire Royal Group Technologies

Georgia Gulf Corporation announced today a definitive agreement

to acquire all of the outstanding common stock of Royal Group

Technologies Limited for CAD$ 13.00 per share in cash.

The total transaction is valued at approximately CAD$ 1.7

billion, which includes payments for Royal Group’s equity of CAD$ 1.2 billion and

assumed net debt of CAD$ 491 million as of March 31, 2006. Based

on an exchange rate of CAD$ 1.10 to USD$ 1.00, this translates to

an offer of USD$ 11.82 per share and a total transaction value of

USD$ 1.6 billion.

Royal Group is a leading producer of vinyl building and

construction products, which include custom window

profiles, decorative moldings, siding, pipe and fittings and

other home improvement products. Royal Group is headquartered in

Toronto, Canada with sales primarily in North America. Georgia

Gulf manufactures commodity chemicals, vinyl resins and vinyl

compounds, which are the basic materials used to manufacture

vinyl building and construction products such as pipe, siding and

windows. The combination of Royal Group’s diversified and innovative

product portfolio with Georgia Gulf’s vinyl resins and compounding

technology as well as operational efficiencies should result in a

stronger, more competitive combined company in the vinyl building

and construction products industry.

“We are very

excited about the potential value of this combination for our

shareholders, customers and employees,” said Ed Schmitt, Chairman,

President and CEO, Georgia Gulf. “The integration of the two

companies provides an opportunity for improved earnings by

leveraging the competitive advantages of each company while

creating a foundation for future growth opportunities.”

Commenting

on the acquisition, Lawrence J. Blanford, President and CEO,

Royal Group Technologies, said, “Georgia Gulf is a recognized

leader in the area of vinyl resins and compounding technology,

known for the high quality of its products. We believe that the

combination of Georgia Gulf and Royal Group will result in a

formidable force in the vinyl building products industry.”

“We

look forward to the completion of this transaction,” said Schmitt. “Our current management team has a

proven track record of successfully integrating businesses and

producing strong financial results, as evidenced by our 1998 acquisition

of North American Plastics and our 1999

acquisition of Condea Vista.”

The

transaction will be financed with additional debt. Georgia Gulf

has commitments in place for permanent financing comprised of

senior secured debt and unsecured senior and senior subordinated

debt. The Company expects to close the transaction following

approval by Royal Group’s shareholders as

well as regulatory approvals. Merrill Lynch & Co., Lehman

Brothers Inc. and Banc of America Securities LLC acted as

advisors to Georgia Gulf in connection with its acquisition of

Royal Group Technologies. Chemical Advisory Partners provided

consulting services to the Company and Jones Day, and Osler,

Hoskin & Horcourt LLP, acted as legal advisors.

About Georgia Gulf

Georgia Gulf, headquartered in Atlanta, is a major manufacturer

and marketer of two integrated product lines, chlorovinyls and

aromatics. Georgia Gulf’s chlorovinyls

products include chlorine, caustic soda, vinyl chloride monomer

and vinyl resins and compounds.

Georgia Gulf’s primary aromatic

products include cumene, phenol and acetone.

Capacity(百万ポンド)(発表)

VCM 1,570 + Vista 1,530

PVC 1,170 + Vista 1,530

Cpd 470 + NAP 190 +

Vista 300

About Royal Group http://www.royalbuildingproducts.com/

Royal Group Technologies is a leading producer of innovative,

attractive, durable, and low-maintenance home improvement and

building products, which are primarily used in both the

renovation and construction sectors of the North American

construction industry. The Company has manufacturing operations

located throughout North America in order to provide

industry-leading service to its extensive customer network.

Georgia Gulf Goes Downstream with Compounder Purchase.(North American Plastics)

Polyvinyl chloride (pvc) producer Georgia Gulf has acquired North American Plastics (Aberdeen, MS), a privately held, $90-million/year manufacturer of flexible PVC compounds. According to Georgia Gulf, the acquisition will significantly increase its position in the market for flexible, high-value vinyl resins.

The deal will include North American Plastics' compounding facilities at Aberdeen and Madison, MS, which have capacity for 190 million lbs/year of plasticized PVC.

| Georgia Gulf Announces Royal Group Technologies Limited Name Change to Royal Group, Inc. |

Georgia Gulf Corporation today announced that recently acquired Royal Group Technologies Limited will change its name to Royal Group, Inc. The name change will occur on February 5, 2007. "We have simplified the name to make it more readily recognizable, as we continue a program aimed at building brand identity. The simplified name adds more emphasis to the fact that Royal is a Group, which we are increasingly bringing together to harness the strength of the entire organization, including its extensive product distribution network," commented Ed Schmitt, Chairman, President and CEO, Georgia Gulf. Simultaneous with adoption of the new name, Royal Group has adopted five divisional brand symbols to accompany its numerous product brands in marketing communication materials. These divisional brand symbols embody the trademarked Royal crown symbol as well as the name Royal so all products are readily recognizable as Royal Group's. "This new brand architecture will be consistently used in marketing materials to help those who have had a positive experience with one of our products readily identify others that they can utilize. It will help us to build brand identity for our broad line of PVC building and home improvement products, and in turn help us to develop sales for Royal Group and its distributors," said Mr. Schmitt. "Great Ideas Taking Shape" will be the tag line accompanying the divisional brand symbols, highlighting that Royal Group strives to develop products that are innovative. "We want the industry to know that our strategic focus encompasses development of innovative, durable, low-maintenance, building, construction and home improvement products," noted Mr. Schmitt. Georgia Gulf announced its intention to acquire Royal Group on June 9, 2006, stating that the acquisition provides a growth platform, which leverages Georgia Gulf's chlorovinyls forward integration strategy. Through the acquisition, Georgia Gulf has become well positioned in the PVC building materials industry, with its advanced raw materials technologies available to assist Royal Group with new product development initiatives. Royal Group's transition to its new brand architecture will occur during 2007. Royal Group Royal Group is a Georgia Gulf company. Georgia Gulf Corporation is a leading, integrated North American manufacturer of commodity chemicals, polymers and vinyl-based building and home improvement products. The Company's chemical and polymer product lines include chlorovinyls and aromatics. Georgia Gulf's vinyl-based building and home improvement products, marketed under Royal Group's brands, include window profiles, siding, pipe and fittings, mouldings, decking, fencing, railing, and window coverings. Georgia Gulf, headquartered in Atlanta, Georgia, has nearly 50 manufacturing facilities in North America to provide industry-leading service to customers. |

Sasol North America, formerly CONDEA Vista Company, headquartered in Houston, Texas, is an integrated producer of commodity and specialty chemicals employing approximately 800 people. Manufacturing locations are in Baltimore, Maryland, Lake Charles, Louisiana and Tucson, Arizona. The Company's Research & Development facility is in Austin, Texas.

Formed from the chemical division of CONOCO, Inc., Vista Chemical became a private company in 1984. In 1986, it became a publicly traded company, and in 1991, a wholly-owned subsidiary of the German oil and gas producer, RWE-DEA, as part of the CONDEA Group. On March 1, 2001, RWE-DEA concluded an agreement with Sasol Limited (Johannesburg, South Africa) for the purchase of the CONDEA Group.

Sasol North America will operate as part of Sasol Chemie, headquarted in Frankfort, Germany. Sasol Chemie is part of Sasol Chemical Industries Ltd. headquartered in Johannesburg, South Africa. Sasol North America strives to deliver consistently high quality products to all our customers around the world.

April 18, 2003 Financial Times

Borden Chemicals and Plastics in liquidation.

Borden Chemicals and Plastics Operating Ltd Partnership (BCP) of

the USA has reported that the US Bankruptcy Court has approved

the plan to liquidate the company and its general partner BCP

Management Inc (BCPM). The plan will convert assets of BCP and

BCPM into cash and will be given to respective claimants through

several liquidating parties. The company anticipates the

completion of the move by 1Q 2003. Its PVC production units in

Addis, LA; Illiopolis, IL and Geismar, LA, have already been

acquired by Shintech Louisiana, Formosa Plastics Corp and Geismar

Vinyls Corp, respectively. The company and its subsidiary, BCP

Finance Corp, has applied for bankruptcy protection under Chapter

11 in Apr 2001 while its general partner, BCPM, applied for

bankruptcy in Mar 2002. The bankruptcy action does not include

the independent entity, Borden Chemical Inc.

2004/7/6 Platts

US' Apollo Management buying Borden Chemicals for $1.2-bil

Apollo Management LP, a US-based

private investment firm announced Tuesday that it has signed a

definitive agreement to acquire Borden Chemical Inc for $1.2-bil.

The purchase, which includes assumption of outstanding debt, is

subject to regulatory approval and other customary closing

conditions. The transaction is targeted to be completed in the

third quarter of this year.

Included in the acquisition group are certain members of Borden

Chemical management. Borden Chemical in May, filed a registration

statement with the Securities and Exchange Commission announcing

its intent to conduct an initial public offering of common stock

in Q3 2004. With the agreement for sale of the company, that

activity has been suspended. Apollo Management is acquiring

Borden Holdings, the parent of Borden Chemical Inc, from BW

Holdings LLC, an affiliate of Kohlberg Kravis Roberts & Co.

Borden is the world's largest producer of formaldehyde, and also

produces resins, coatings and adhesives.

GE Capital Provides $175

Million to Georgia Gulf Corporation

GE Capital’s corporate lending business today

announced it provided a $175 million accounts receivable

securitization facility to Georgia Gulf Corporation, a leading

chemicals company. The proceeds will be used for working capital

needs.

In this type of structure, GE provides an asset-based loan

secured by the company’s accounts receivables.

Georgia Gulf Corporation is a leading, integrated North American

manufacturer of two chemical lines, chlorovinyls and aromatics,

and manufactures vinyl-based building and home improvement

products. These products, marketed under Royal Group brands,

include window and door profiles, mouldings, siding, pipe and

pipe fittings, and deck, fence and rail products. Georgia Gulf,

headquartered in Atlanta, GA, has manufacturing facilities

located throughout North America.

“GE

worked closely with us to quickly understand our business

objectives and structured a facility to meet our needs,”

said Greg Thompson,

CFO of Georgia Gulf Corporation. “We appreciated their ability to

commit to the entire facility amount and close quickly.”

“In this

environment, timely access to capital is a critical factor for

many of our customers,” said Tom Quindlen, president and

CEO of GE Capital’s corporate lending business. “Using a securitization facility in

many cases can provide borrowers with a cost-effective approach

and structuring flexibility to help them meet their financing

objectives.”

Georgia Gulf Amends

Credit Agreement and Enters Into New Accounts Receivable

Securitization Agreement

Senior secured credit agreement

covenants reset until March 31, 2010

Accounts receivable securitization

increased to $175 million and extended to March 2011

Georgia Gulf Corporation today announced that it has entered into

an amendment to its senior secured credit facility to reset

covenants until March 2010 with its lenders and that it has

increased and extended its accounts receivable securitization

until March 2011. The amendment also permits the Company to

exchange existing debt securities for new 2nd lien notes or

loans.

“We

are pleased to have the support of our lenders to amend the

credit agreement and replace and enlarge the accounts receivable

securitization program,” said Paul Carrico, President and

CEO of Georgia Gulf.

“This

amendment provides additional flexibility to improve our capital

structure and strengthens Georgia Gulf’s position in these challenging

economic conditions,” he added.

Due to the impact of continued weakness in the North American

housing market, the Company obtained adjustments to its leverage

and interest coverage ratios as part of the amendment. The

maximum leverage ratio was set at 8.25 for the quarter ended

March 31, 2009, 10.30 for the quarter ended June 30, 2009, 9.25

for the quarter ended September 30, 2009, and 8.75 for the

quarter ended December 31, 2009. The minimum interest coverage

ratio was set at 1.30 for the quarter ended March 31, 2009, 1.00

for the quarter ended June 30, 2009, 1.10 for the quarter ended

September 30, 2009, and 1.15 for the quarter ended December 31,

2009.

The amendment also established a trailing twelve-month minimum

consolidated EBITDA threshold covenant. The minimum compliance

EBITDA was set at $179.0 million for the quarter ended March 31,

2009, $140.0 million for the quarter ended June 30, 2009, $161.0

million for the quarter ended September 30, 2009, and $167.0

million for the quarter ended December 31, 2009.

Under the agreement, certain fees and interest rates payable to

lenders increased by 1.0 percent. Each lender that is a party to

the amendment and all lenders on the amendment’s effective date that were not

given the opportunity to consent to the amendment will receive a

1.0 percent consent fee.

In addition, the amendment includes an annual capital

expenditures limitation of $35.0 million in 2009 and $55.0

million in 2010.

The Company also entered into a new asset securitization

agreement that allows for the inclusion of Canadian receivables

and was increased to $175.0 million and may be expanded to $200

million under certain conditions. The new agreement expires on

March 17, 2011.

Further details of the senior credit agreement amendment and new

accounts receivable securitization program are available in an

8-K filed with the SEC, which will be available at www.ggc.com

under the Investor Relations section.

Georgia Gulf confirms cutting contract jobs in Louisiana

PVC manufacturer Georgia

Gulf Corporation Thursday morning confirmed it has reduced the

contract maintenance force at its Plaquemine, Louisiana,

facility.

The company did not specify the amount of affected positions, but

Platts on Wednesday reported that local newspaper the Baton Rouge

Advocate indicated a reduction of 100 positions.

"Georgia Gulf Corporation has taken several actions to

adjust our cost structure to market conditions," GGC

spokeswoman Ashley Mendoza told Platts Thursday. "The

reduction...is one step we have taken to match our costs to the

market."

"Other examples from across the company include reducing our

annual PVC (vinyl resin) capacity by more than 25% by closing our

Oklahoma City, Oklahoma and Sarnia, Ontario plants; selling our outdoor storage unit

business; and consolidating four plants into other facilities. We

reduced our SG&A expenses by $57 million and reduced total

headcount by 15% corporate-wide," Mendoza said.

She added, "With the downturn in the housing and

construction markets in the US and Canada, we have seen a

decrease in demand for our products, and have taken the necessary

steps to match our cost structure to current market conditions.

We intend to continue to operate our facilities with the highest

regard for environmental stewardship and safety, and we intend to

position Georgia Gulf to compete now and when the markets

recover."

In Plaquemine, the company has a nameplate capacity to produce

1.2 billion lbs/year of PVC, 2.1 billion lbs/year of EDC and 1.6

billion lbs/year of VCM.

The vinyls chain manufacturer also has operations in Lake

Charles, Louisiana, and Aberdeen, Mississippi.

In pricing, PVC was pegged Wednesday at $675-685/mt FAS Houston,

$25/mt higher from the previous week. The jump was attributed to

constrained supply of feedstock chlorine and improving global

demand, sources said.