中近東の石油化学一覧

Gulf

Petrochemicals and Chemicals Association (GPCA)

中東湾岸 素材産業の拠点に

サウジの石油化学

カタールの石油化学

U.A.E(Abu

Dhabi)の石油化学

Oman

Kuwaitの石油化学

バーレーン Gulf

Petrochemical Industries Company (Bahrain)

Gulf

Investment Corporation

(Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab

Emirates)

イランの石油化学

イラク

エジプト

トルコ

イスラエル

シリア

リビア

アルジェリア

Petrochemicals in Russia/CIS

カタールの石油化学

単位:千トン (Q-Chem II ~

new JV) 契約

* 720千tへの増設計画 → 日揮がエチレン設備を受注

** Qapco

Plans Third LDPE Unit

Basell grants license to QAPCO for

new 250 KT per year PE plant

2013/1 三菱化学、カタール石油公社およびシェルケミカルズ社へのオキソ製造技術ライセンス供与

Al-Karaana Petrochemicals Project

2004/6 Qatar Petroleum and

ExxonMobil Chemical Sign Statement of Intent

for

Ethane Cracker, Derivatives Complex

2004/7 State Of

Qatar and ExxonMobil Announce Signing of Gas-To-Liquids Heads of

Agreement

2005/5 Qatar,

ExxonMobil sign MOU for 1.6-mil mt/yr ethylene cracker → 1.3-mil(下記)

2006/10 Qatar Petroleum

and ExxonMobil Chemical Sign Heads of Agreement for Petrochemical

Complex

2010/1 Qatar

Petroleum and ExxonMobil Chemical Sign Agreement for

Petrochemical Complex in Ras Laffan

千代田化工建設 液化天然ガスプラントを受注

2006/3 Qatar Petroleum and Shell sign a

Letter of Intent for the Development of a World-Scale

Petrochemical Complex

Qatar Petroleum and

PetroWorld of South Africa for Methanol Plant in Qatar

GSL 計画

Qatar's

First Linear Alkyl Benzene Plant Inaugurated

Qatar Petroleum and ExxonMobil to

scrap gas-to-liquids plan

Qatar Petroleum and Shell jointly

pursue international opportunities

S Korean Honam Petchem to build,

invest in $2.6 bil Qatar plant

Qatar Petroleum International,

Sinopec to build ethylene plant in China

Norsk Hydro sells its 29.7 %

ownership interest in Qatar Vinyl to Qatar Petroleum

Petrochina, Shell

and QPI planned petrochemical complex in Zhejiang

Qatar: QAPCO, Uhde Sign EPC

Contract for Launching LDPE-3 Plant

Qatar Petroleum plans Hainan and

Vietnam Petrochemical Project

出光・コスモ石油など4社参加のカタール・ラファン製油所

竣工

カタール、LNG 7,700万トン体制完成

Qatar Petroleum and Shell sign MoU

to jointly develop major petrochemicals project in Qatar

QAPCO Atofina buys

out Eni's 10%stake

政府、15%を民間に売却

Qatar Petroleum (2001/1改称)

旧 Qatar General Petroleum Corporation (QGPC) 80%

Atofina

10% → 20%

Enichem of Italy

10% → 0%

QATAR Vinyl http://www.qatarvinyl.com/

Qatar Petrochemical Company (QAPCO) 31.9%

Norsk Hydro

29.7% →0

Atofina

12.9% + 31.9%*20%=19.29%

Qatar Petroleum Corporation

25.5% + 29.7%

Q-Chem

complete ethylene, PE plants Sep 2002 Q-Chem Plant

Inaugurated

Qatar Petroleum=QGPC 51%

Chevron Phillips Chemical

49%

Q-Chem II

Qatar Petroleum=QGPC 51%

Chevron Phillips Chemical

49%

Qatofin

Qatar Petrochemical Co.

(Qapco; Doha) 63%

Qatar Petroleum=QGPC 1%

Atofina

36% Total

48.6%(36%+63%*20%)

Ras Laffan Olefins Company (RLOC)

Q-Chem II

53.31%

Qatofin

45.69% Atofina's share 45.69%*48.6%=22.2%

Qatar Petroleum=QGPC 1%

Qatar Petroleum and

ExxonMobil Chemical

エチレン 160万トン

PE 65万トンx2

EG 70万トン

Al Sejeel Petrochemicals Complex

QAPCO holds an 80% share in the

project while QP holds the remaining 20%.

The complex will produce 1.4MMTA of

ethylene, 850,000 metric tonnes per annum (KMTA) of high-density

polyethylene (HDPE), 430 KMTA of linear low-density polyethylene (LLDPE),

760 KMTA of polypropylene, 83 KMTA of butadiene and py-gasoline.

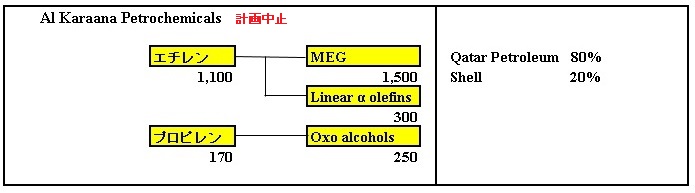

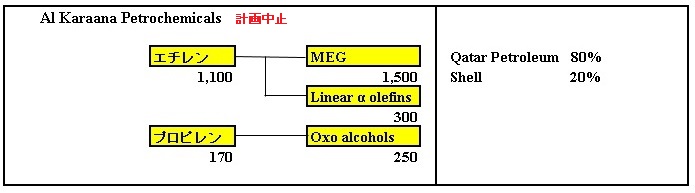

Al Karaana Petrochemicals

Complex

Qatar Petroleum (BP) holds an 80% share

in the project, and Shell holds the remaining 20% share.

The complex, on its commissioning, will

be capable of processing 1.1 million tonnes per year (mtpa) of ethylene,

170,000mtpa of propylene, 1.5mtpa of MEG, 300,000mtpa of LAO and 250,000mtpa

of OXO.

Qatar Petroleum and Shell sign MoU

to jointly develop major petrochemicals project in Qatar

MEG 150万トン OMEGA法

other olefin derivatives

2013/12

Qatar Petroleum, Zeon and

Mitsui sign MOU for Ras Laffan elastomer project ブタジェン抽出、エラストマー

2003/4/16 Platts

Qatar to sell 15% in new

state-owned holding company

Qatar plans to launch the

sale of a 15% stake in a new state-run holding company

grouping Qatar's petrochemical, MTBE, fertilizer and steel

businesses to Qatari nationals in a public offering next

month.

Platts 2002/9/17

Atofina buys out Eni's 10% stake in Qatar's Qapco

France's Atofina said Tuesday

it finalized the purchase of Enichem's 10% share in

Qatar Petrochemical Company on September 16. The deal raises

Atofina's interest in Qapco to 20 %, making it the only

remaining partner of the national oil company Qatar Petroleum

which owns the other 80%. This deal allows Atofina to

consolidate its direct involvement in two major projects to

develop its petrochemicals operations in Qatar through the

creation of Qatofin, a joint venture held by Atofina (36%),

Qapco (63%) and Qatar Petroleum (1%), announced in June 2002.

Atofina there raises to 22.2% its interest in the 1.3-mil mt/yr ethane cracker

due for start-up in 2007 at Ras Laffan, in the north-east

Qatar.

Atofina raises its share from

16,1% to 19.29 % in Qatar Vinyl Company (QVC), the chlorochemicals complex located

in the industrial zone of Mesaieed which came on stream in

the spring of 2001.

Platts--23Apr2002

Qatar's Q-Chem to complete ethylene,

PE plants Sep 2002

The complex will use ethane

feedstock and have the capacity to produce 500,000mt of ethylene and 450,000mt

of high density polyethylene yearly.

Q-Chem is a 51:49 joint

venture between the Qatar General Petroleum Corp and Chevron

Phillips.

2002/12/25 Chemnet Tokyo

カタールケミが大型エチレンプラントを完成

大手商社筋によると、カタールケミカル(Q-Chem)はこのほどMesaieed地区に年産50万t能力のエチレンプラントを建設した。エタンを原料に1月中に本格操業を開始すると見られている。

2003/1/21

Qatar Petroleum

Q-Chem Plant Inaugurated by His Highness the Emir

http://www.qp.com.qa/qp.nsf/0/6322a2237e181e3943256cb5002f5ab3?OpenDocument

The multi-billion Qatari Riyals project is a joint

venture between QP (51%) and Chevron Phillips Chemical

Company LLC (49%). Construction on the project started

almost three years ago after His Highness the Heir

Apparent Sheikh Jassem Bin Hamad Al Thani laid the

Foundation Stone December 21, 1999.

2002/6/13 Qatar Petroleum

Qatar Petroleum Signs Three

Agreements for Petrochemical Projects

http://www.qp.com.qa/qp.nsf/0/fe5c6b6634919ebb43256bd70037bb95?OpenDocument

The first project, to be

known as Q-Chem

II includes QP (51%) and

Chevron Phillips Chemical (49%) as shareholders. Q-Chem II

will have new HDPE and Normal Alpha Olefins plants in

Mesaieed adjacent to present Q-Chem plant.

The second project will be

known as Qatofin with a shareholding profile showing

QAPCO (63 %), Atofina (36 %) and QP (1 %). Qatofin will

establish a world scale LLDPE plant in Mesaieed, adjacent to

QAPCO facilities.

A third

Project established

between QP, Q-Chem II and Qatofin will include an ethane

cracker and a 120 km. pipeline to transport the ethylene

produced by the cracker project. The shareholding profile in

this project is Q-Chem II (53.31%), Qatofin (45.69 %) and QP

(1.00 %).

The ethane cracker will be one of the largest in the world

and will be located in Ras Laffan Industrial City with a

capacity of 1.3 MM MTA of ethylene, while the derivative plants will be

located in Mesaieed within existing facilities of Q-Chem and

QAPCO. The new Q-Chem II Normal Alpha Olefins and High Density

Polyethylene plants will have a production capacity of

350,000 metric tons per

year each. The new Qatofin LLDPE plant at QAPCO will produce

450,000 metric tons per

annum of polyethylene

Chevron Phillips

Chemical and Qatar Petroleum Announce Construction of

Petroleum Plant in Qatar

http://www.cpchem.com/news/pr/2001/0625.asp

Chevron Phillips

Chemical Company LLC and Qatar Petroleum of Qatar have

signed a joint venture agreement for the development of a

world-scale petrochemical company in the State of Qatar,

officials of both companies said today.

The project

involves the development of an ethylene

cracker with the capacity to produce up to 1.2 million

metric tons

per year, a polyethylene plant capable of

producing more than 750,000 metric tons per year, associated

utilities and offsite facilities.

This venture

marks the second cooperation undertaken by the two

companies in the State of Qatar. Qatar

Chemical Company LTD (Q-Chem), joints venture between

Qatar Petroleum and Chevron Phillips Chemical, is

currently constructing a 500,000-metric-ton-per-year

ethylene

plant, a 450,000-metric-ton-per-year

polyethylene

plant and a 47,000-metric-ton-per-year

hexene-1

plant in Messaieed, Qatar. This plant is on schedule for

a third quarter 2002 start-up.

Qatar

General Petroleum Corporation, now known as Qatar

Petroleum,

was established in 1974 as a national corporation

completely owned by the State of Qatar.

QAPCO (homepageより)

Established in 1974,

QAPCO is a unique and pioneering petrochemical venture

In line with the industrialization plan of the State of Qatar,

QAPCO is a joint venture project initiated by Qatar General

Petroleum Corporation (QGPC) to utilize the ethane gas associated

with petroleum production.

Established in 1974, with production beginning in 1980, QAPCO is

a unique pioneering petrochemical venture in the Gulf Region, and

the Middle East.

QAPCO is a multi-national joint venture between Qatar General Petroleum

Corporation (QGPC) holding 80% , Elf Atochem of France (10%), and

Enichem of Italy (10%) of the

shares.

Producing Ethylene,

low density Polyethylene (LDPE) and solid Sulphur, QAPCO’s Ethane feedstock requirement is met by

QGPC. The company markets its products worldwide, with a

substantial increase in the annual projected turnover, with the

completion of planned expansion projects.

Ethylene

Plant

Ethylene

annual production capacity is 525,000 MT.

The expansion project being completed in 1996. The Ethylene

annual production increased to 245,000 MT.

Polyethylene

Plant

In 1997, LDPE plants operated

without major defects. As production costs and quantity of

raw materials, the production increased by 28,000 mt.

QAPCO today is the largest producer of LDPE in the Middle

East with annual capacity of 360,000 metric tons (MT).

Production comes from two lines with annual capacity of

180,000 MT each using tubular and vessel reactor technology.

Applications for LDPE include films, injection moulding, blow

moulding, pipes, cables, coating, roto moulding and other

different applications.

Sulphur

Annual capacity of pure

prilled sulphur is 70,000 MT.

Chemical Week Mar 13,

2002

Qapco Plans Ethylene Capacity

Hike at Mesaieed

Qatar Petrochemical Co

(Qapco; Mesaieed, Qatar), a joint venture of Qatar

Petroleum, Atofina, and EniChem, says it plans to hike

ethylene capacity at Mesaieed from 525,000 m.t./year, to 720,000 m.t./year.

FujiSankei

Business i. 2004/3/30 発表

日揮がエチレン設備を受注、カタール社から200億円で

http://www.business-i.jp/news/car/art-20040329215613-EOUNGRUDNK.nwc

日揮は29日、カタールの石油化学大手、カタールペトロケミカルカンパニーからエチレン設備増設プロジェクトを受注したと発表した。受注金額は約200億円で、納期は2006年後半を予定している。

受注したのは、カタールのメサイード地区にある年産52万5000トンの既設プラントのエチレン生産能力を同72万トンに引き上げる設備増強プロジェクト。日揮は設計、機材調達、建設工事を一括請け負う。

2004/03/30 日揮

カタールのエチレン増設プロジェクトを受注

http://www.jgc.co.jp/jp/01newsinfo/2004/release/20040330.html

日揮株式会社(代表取締役会長兼CEO

重久吉弘、横浜本社 横浜市西区みなとみらい2-3-1)は、カタールペトロケミカルカンパニー社からエチレン増設プロジェクトを受注しましたのでお知らせします。詳細は、下記の通りです。

1. 顧客名 :

カタールペトロケミカルカンパニー社(QAPCO)

カタールペトロリアム社 80%

アトフィナ社 20%

(仏トタール社の子会社)

2. 建設地 : カタール・メサイード地区

3. 契約内容 :

既設のエチレンプラント増設のための設計、機材調達、建設工事

4. 契約形式 : ランプサム契約

5. 契約金額 : 約200億円

6. 納期 : 2006年後半

7. プロジェクトの概要 :

QAPCOは湾岸諸国でも早くから石化プラントの建設に取り組み、1980年にカタール・メサイード地区に初のエチレンプラント(年産28万トン)を建設しました。その後、1994年にプラントの能力を増強し、現在は年産52.5万トンに至っています。

今回のプロジェクトは、操業効率の改善および生産量の増加を目的として既設プラントの生産能力を年産72万トンにスケールアップするもので、当該プラントから主製品として生産されるエチレンは、下流のポリエチレン、塩化ビニールプラントの原料となるほか、輸出用として計画されています。また、エチレンプラントから生産される副製品は、メサイード工業団地内の他のプラント・工場の原料として使用される予定です。

QATAR VINYL

MESAIEED (QATAR VINYL) INTEGRATED

PETROCHEMICAL PLANT, QATAR

http://www.chemicals-technology.com/projects/mesaieed/

Power for the whole process is supplied by a 110MW unit,

which is already part of the QAPCO plant. Salt is imported

from outside the plant to feed the chlorine unit. This is

broken down into chlorine (260,000t/yr capacity),

caustic soda (295,000t/yr capacity) and hydrogen. The hydrogen is used as a fuel gas.

The chlorine is fed into the ethylene dichloride (EDC) unit, along with ethlyene from the

QAPCO plant (capacity of 106,000t/yr). The EDC unit produces

175,000t/yr for sales, as well as 193,000t/yr of EDC for the

vinyl chloride monomer (VCM) unit. This EDC is fed in with

52,000t/yr of ethylene (again from the QAPCO facility) as

well as 5,000t/yr of caustic soda. This produces 230,000t/yr of VCM for sale. The remaining 290,000t/yr

of caustic soda is sold.

THE QATAR

VINYL COMPANY

The Qatar Vinyl Company (QVC) was formed in 1997 to create

the project. It is a subsidiary of four companies. The Qatar

Petrochemical Company (QAPCO) is the biggest shareholder,

with 31.9%. Norsk Hydro is next with a 29.7% share. Elf

Atochem has 12.9%. Qatar General Petroleum Corporation (QGPC)

has 25.5%. QGPC is 80% owned by QAPCO, with 10% owned by Elf

Atochem and Enichem respectively.

June 24, 2004 ExxonMobil

Qatar Petroleum and ExxonMobil

Chemical Sign Statement of Intent for Ethane Cracker, Derivatives

Complex

http://www2.exxonmobil.com/Corporate/Newsroom/NewsReleases/xom_nr_240604.asp

Qatar Petroleum and ExxonMobil

Chemical Company, a division of Exxon Mobil Corporation,

announced today that they have signed a Statement of Intent (SOI)

to conduct a feasibility study for a world-scale, ethane-based cracker and

ethylene derivatives complex in Ras Laffan Industrial City,

Qatar. The SOI was signed by

H.E. Abdullah bin Hamad Al-Attiyah, Qatar's second deputy

premier, minister of energy and industry and chairman of Qatar

Petroleum, and by Mr. Daniel S. Sanders, president, ExxonMobil

Chemical Company.

The Qatar Petroleum and ExxonMobil

joint study will define the technical and commercial aspects of a

world-class petrochemical growth platform in Qatar. The complex

will utilize ethane

feedstock from new gas development projects in Qatar's North

Field and supply

competitively advantaged products to Asia and Europe.

Exxon Mobil Corporation, through

its subsidiaries, has had a presence in Qatar since 1935. Qatar Petroleum and

ExxonMobil are currently working together to diversify the use of

the North Field gas into new

areas in addition to LNG, including the supply of pipeline gas to

domestic and regional customers, Gas-to-Liquids (GTL) and other

projects.

2004/7/14 ExxonMobil

State Of Qatar and ExxonMobil Announce Signing of Gas-To-Liquids

Heads of Agreement

http://www2.exxonmobil.com/Corporate/Newsroom/NewsReleases/xom_nr_140704.asp

The Government of the State of

Qatar and an Exxon Mobil Corporation subsidiary, ExxonMobil Qatar

GTL Limited, announced today that the parties have entered into a

Heads of Agreement (HOA) for an approximately $7 billion, Gas-to-Liquid (GTL)

project, which would be the

world's largest single, fully integrated GTL project. The

facility would be built at the Ras Laffan Industrial City in

Qatar. The agreement was signed by H.E. Abdullah bin Hamad

Al-Attiyah, Second Deputy Premier and Minister of Energy and

Industry for the State of Qatar, and Harry J. Longwell, Director

and Executive Vice President, Exxon Mobil Corporation.

Platts 2005/5/16

Qatar, ExxonMobil sign MOU for 1.6-mil mt/yr ethylene cracker →1.3-mil

mt/yr ethylene cracker

Qatar Petroleum and ExxonMobil have signed a memorandum of

understanding in New York for the construction of a 1.6-mil mt/yr of

ethylene cracker

at Ras Laffan in Qatar, Qatari officials said Monday.

2006/10/15

ExxonMobil

Qatar Petroleum and ExxonMobil Chemical Sign Heads of Agreement

for Petrochemical Complex

Qatar Petroleum and ExxonMobil Chemical Qatar Limited, a

subsidiary of Exxon Mobil Corporation (NYSE:XOM), today announced

they have signed a Heads of Agreement (HOA 基本合意書) to progress studies for a

proposed $3 billion world-scale petrochemical complex in Ras Laffan

Industrial City,

Qatar. The announcement was made by His Excellency, Abdullah Bin

Hamad Al-Attiyah, Qatar Second Deputy Premier and Minister of

Energy and Industry, and by Michael J. Dolan, President,

ExxonMobil Chemical Company, at a signing ceremony today in Doha.

The proposed petrochemical complex includes a world-scale, 1.3 MTA steam

cracker and associated derivative units, including polyethylene and

ethylene glycol,

and will employ ExxonMobil's proprietary steam cracking furnace

and polyethylene technologies. It will utilize feedstock from gas

development projects in Qatar's North Field and serve markets

with premium products in both Asia and Europe. Currently,

start-up of the proposed facility is estimated in 2012.

2005年12月21日 千代田化工 カタールガス第6および第7系列

カタールガス3&4社(カタール国)より超大型LNG(液化天然ガス)プラント受注

千代田―仏テクニップ社ジョイントベンチャーの契約金額は5,000億円規模

http://www.chiyoda-corp.com/cgi-bin/chiyoda/frame.cgi?/news/0512/news0512-1.shtml

千代田化工建設(本社:横浜市 社長:関誠夫)は、カタールガス3社(出資:カタール・ペトロリウム68.5%

/コノコフィリップス30%、三井物産1.5%)及びカタールガス4社(出資:カタール・ペトロリウム70%

/シェル30%)の両社よりカタール国における超大型LNGプラント増設プロジェクトの設計・調達・建設(EPC)業務を受注しました。 この契約は当社がリーダーとなり、テクニップ社(フランス、パリ)と共同で受注したものです。本プロジェクトは当社がすでに基本設計業務(FEED)を実施したものです。契約額は、5,000億円規模です。

本プロジェクトは、カタール国ラスラファン工業地帯において当社が既に建設したカタールガス第1~3系列、および当社とテクニップ社JV(CTJV)が隣接敷地内にて建設中のカタールガスⅡプロジェクトと同じ規模の世界最大の年産780万トンのプラントを2系列(第6および第7系列)建設するものです。第

6系列からは2009年に北米へ、第7系列からは2010年後半に北米へLNGが供給される予定です。

今回のカタールガス3社及び4社との商談では、これまでの当社のカタールガス第1~3系列、ラスガスII第3~4系列における完成工事の実績、現在遂行中のラスガスII第5に加え最近の当社とテクニップ社によるカタールガス向けLNG増産プロジェクトの完成、カタールガスⅡ、ラスガス(3)での受注から、当社JVの高い技術的信頼性が客先から評価され受注となりました。今回の受注により、2004年12月のカタールガスⅡ以降、当社とテクニップ社が受注したこれら6系列が全て完成すると、カタールが世界一のLNG輸出国になる目標への加速的な前進と言えます。

2005年9月23日 千代田化工

ラスガス第6および第7系列

ラスガス(3)社(カタール国)より

超大型LNG(液化天然ガス)プラントを受注

米国向け年産780万トンを2系列 - 契約金額は4,500億円規模

http://www.chiyoda-corp.com/cgi-bin/chiyoda/frame.cgi?/info/press-j.shtml

千代田化工建設(本社:横浜市 社長:関誠夫)は、ラスラファン液化天然ガス(3)社(略称:ラスガス(3)、出資:カタール・ペトロリウム70%

・エクソンモービル30%)よりカタール国における超大型LNGプラント増設プロジェクトの設計・調達・建設(EPC)業務を受注しました。この契約は当社がリーダーとなり、テクニップ社(フランス、パリ)と共同で受注したものです。

本プロジェクトは当社がすでに基本設計業務(FEED)を実施したもので、同じく当社が隣接敷地内にて建設中のカタールガス(Ⅱ)プロジェクトと同じ規模の世界最大の年産780万トンのプラントを2系列(ラスガス第6および第7系列)建設するものです。第6系列は2008年後半、第7系列はその約1年後の完成を予定しています。契約額は、4,500億円規模です。

2004年12月16日

カタールガスⅡ カタールガス第4および第5系列

カタールガスⅡ社より超大型液化天然ガスプラントを受注

世界初・最大の年産780万トンを2系列、受注金額は史上最大の4000億円

千代田化工建設(本社:横浜市 社長:関誠夫)は、テクニップ社(フランス、パリ)と共同で、カタール液化天然ガスⅡ社(略称:カタールガスⅡ、出資:カタール・ペトロリウム70%

/ エクソンモービル30%)よりカタール国における超大型LNGプラント増設プロジェクトの設計・調達・建設(EPC)業務を受注しました。受注金額は史上最大4000億円規模です。

本プロジェクトはカタールが有する世界最大級のガス田「ノースフィールド」(推定埋蔵量900兆立方フィート)からの豊富なガスを利用し、世界初・最大となる年産780万トンの超大型LNGプラント2系列(カタールガス第4および第5系列)とその関連設備を建設するものです。完成予定は第4系列が2007

年末、第5系列がその約9か月後です。生産されるLNGは英国向けに出荷される予定であり、カタール・ペトロリウムとエクソンモービルとの関連会社により英国に受入基地が建設されることが決まっています。カタールガスⅡ社は既にカタールでのアップストリーム開発(ガス田開発)、LNG船およびLNG貯蔵設備への投資も開始しています。

新しい2系列は、カタール液化天然ガス社(略称:カタールガス)の、1996年から稼動し現在年産800万トンを超えるLNG生産をおこなっている既存3

系列と同じ敷地に建設されます。既存3系列は全て当社により設計施工されたもので、2001年末に締結された契約の下、当社とテクニップ社とのジョイントベンチャーにより成功裏に能力増強されています。

2004/7/6 千代田化工建設 ラスガスⅡ第5系列 (第3系列及び第4系列に隣接)

カタールより液化天然ガスプラントを受注

http://www.chiyoda-corp.com/cgi-bin/chiyoda/frame.cgi?/news/0407/news0407-1.shtml

千代田化工建設(本社:横浜市、社長:関 誠夫)はスナムプロジェッティ社(イタリア、ミラノ市)と共同でカタール国ラスラファン液化天然ガス社(略称ラスガスⅡ)向けLNGプラント増設プロジェクト(第5系列及LNG関連設備)の設計・調達・建設(EPC)を一括受注しました。

今回増設される第5系列は、当社とスナムプロジェッティ社が共同でラスラファンに2003年12月に成功裏に完工した第3系列及び建設中の第4系列に隣接して建設するものです。

本プロジェクトはカタールが有するガス田「ノースフィールド」(推定埋蔵量900兆立方フィート)からの豊富なガスを利用し、LNG生産量としては1系列として世界最大規模の年産470万トンです。 本プロジェクトは2006年末の完成を予定しており、生産されるLNGは、2007年第1四半期より出荷が予定されています。

カタール向けガス関連プラントとして千代田化工建設は、1998年完成のカタール液化天然ガス社(カタールガス)向け第1~3系列、2001年に受注した同プラント増強工事、ラスガス社向け第3/4系列、湾岸ガス開発プロジェクトに続いて、今回第5系列を受注したもので、中東地域におけるLNGプラント商談において圧倒的な強さを示しています。

Qatar Fuel Additives Company Ltd.

(QAFAC)

http://www.qp.com.qa/qp.nsf/web/qafac?opendocument

QAFAC was established as a Qatar

joint stock company to build, own and operate facilities at

Mesaieed in Qatar for the production of methanol and methyl

tertiary butyl ether (MTBE) for sale to customers worldwide.

The QAFAC plant is designed to produce 832,500 metric tons per

annum (MTA) of methanol and 610,000 MTA of MTBE.

Methanol production for 2002 was 772, 604 metric tons - lowevr

thanthe deisgnb capacity due to the extyended turnaround at the

begining of the year. MTBE production was 576,173 MT for 2002,

higher than 2001.

During 2002, the major exports of methanol were made to countries

in Asia , India, Europe and the Arabian Gulf. MTBE was exported

to the US, Europe, the Middle East and Arabian Gulf.

A total of 84 vessels, up from 70 in the 2001, of various parcel

sizes were safely loaded and sailed out of QAFAC's dedicated

berth for MTBE and methanol during the year.

The company is owned by Qatar Petroleum (QP) 50%, Chinese

Petroleum Corporation (CPC) 20%, Lee Chang Yung Chemical Industry

Corporation (LCYCIC) 15% and International Octane Limited 15%.

Gulf Investment Corporation

http://www.gulfinvestmentcorp.com/index.asp

GIC is one of the largest

regional financial institutions in the Arabian Gulf region.

Established under the auspices of the Gulf Cooperation Council

(GCC) in 1983, GIC is equally owned by the governments of the

six GCC member states: Bahrain, Kuwait, Oman,

Qatar, Saudi Arabia, and the United Arab Emirates.

We provide services that focus on the development of private

enterprise and economic growth in the Gulf region. Our clients

include governments, quasi governmental institutions, the

corporate sector and other major investors either based in or who

are active in the region.

| Our

services include |

| ・ |

Regional

equity participations |

| ・ |

Financial

advisory |

| ・ |

Gulf equity

products |

| ・ |

Marketing

selected international equity and credit products of

third parties including alternative investments and hedge

funds |

| ・ |

Treasury |

GIC maintains a unique focus on

the Gulf region. Headquartered in Kuwait, the authorized capital

is US$ 2.1 billion and total shareholders equity is over US$ 1.0

billion.

Our regional, international, sectoral and product expertise means

we are able to help clients based or operating in the Gulf region

achieve their commercial and investment objectives.

Our intimate knowledge of the region's business, legal and

regulatory environment enables us to provide clients with

effective and practical solutions that fit their investment

needs.

GIC History

Gulf Investment Corporation (GIC) was established in 1983 to

further investment opportunities in the Gulf Cooperation Council

(GCC), to support regional co-operation and to stimulate private

enterprise. As the Gulf's premier investment institution, this is

a role that the Directors, Management and Staff are proud to

undertake.

Since 1983, GIC has been a principal investor in over 40 projects

in various economic sectors covering agriculture, manufacturing,

industry and services in the GCC region.

GIC used to fully own Gulf International Bank (GIB), which was

acquired in 1991. As a result of a merger between GIB and Saudi

International Bank (SIB), GIC retained ownership of 72.5% of GIB.

Subsequently in April 2001, that remaining ownership was sold

directly to the six governments that comprise the GCC: Bahrain,

Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates.

The divestment of GIB coincided with the completion of a strategy

review by GIC in which McKinsey & Co. was the advisor. A new

strategy for GIC was approved by its Board of Directors in 2001

that focuses on GIC's role in principal investments in GCC

projects and ventures in addition to an emphasis on GIC's role as

a promoter of Gulf investment products and services to clients

inside and outside the region. The commitment of GIC to the Gulf

region represents the mainstay of the new strategy.

Gulf Petrochemical Industries

Company

http://www.internationalspecialreports.com/middleeast/00/bahrain/17.html

Gulf Petrochemical Industries Co.

is Bahrain's first venture into the petrochemical industry. It

was formed in 1979 as an equal partnership between the Government

of Bahrain, Saudi Basic Industries Corp. and Petrochemical

Industries Co., Kuwait.

The objective was to use the

country's natural gas to produce basic petrochemicals to

contribute to the economic development of Bahrain. Production of

ammonia and methanol (1,000 tons/day) started in 1985.

Capacity was increased to 1,200

tons/day of each product in 1989. In 1996 and 1997 a 1,700

tons/day granular urea plant and associated storage and marine

export facilities were added to the complex. Urea is produced by

synthesis for liquid ammonia and gaseous carbon dioxide, which is

a byproduct of the ammonia production process. The new plant was

designed with an initial production capacity of 1,700 tons of

urea per day, and produces enough fertilizer to help grow the

wheat required to produce 24 million loaves of bread a day.

The entire complex is

self-sufficient in terms of all utilities and houses its own

medical center, fire brigade and training facilities.

"In just under two decades we

have grown to become a major petrochemical industrial venture,

contributing to the international growth and development in this

prestigious field," said H.E. Isa bin Ali Al Khalifa,

minister of oil and industry and chairman of Gulf Petrochemical

Industries Co. We have earned an excellent international

reputation for quality, safety, reliability and care for the

environment."

Since inception GPIC has established

itself as a leading producer of petrochemicals in the

international markets. It is renowned for its achievements in

reliable production, efficiency of operation, safety and concern

for the environment.

GPIC maintains a fishery near the

factories as an assurance that no damage is being done to the

environment - be it sea, land or air. As a result of this

project, thousands of fish, spawned at the fishery, are given to

the local poor throughout the year, and 10 percent of these fish

are released into the sea. All this is part of its drive to

protect the environment.

2006/2/28 Shell

Qatar Petroleum and

Shell sign a Letter of Intent for the Development of a

World-Scale Petrochemical Complex

http://www.shell.com/home/Framework?siteId=qatar&FC2=/qatar/html/iwgen/news_and_library/press_releases/2005/zzz_lhn.html&FC3=/qatar/html/iwgen/news_and_library/press_releases/2005/letter_intent_010305.html

Qatar Petroleum (QP) and

Shell Chemicals Limited (Shell) today signed in Doha a Letter of

Intent (LOI) for the development of a world-scale ethane based

cracker and derivatives complex in Ras Laffan Industrial City,

Qatar.

Linda Cook

commented, “Shell is very pleased to partner

with QP on the development of this world-scale ethane cracker

project. The signing of this LOI is indeed an important milestone

and marks the further development of the strong partnership

between QP and Shell, building on the Pearl

GTL project and

the recently announced QatarGas 4

project.

This project clearly combines the strengths of both QP and Shell

in the petrochemical industry and represents the basis for

delivering long-term value to both Qatar and Shell.”

2005/2/27 Shell

Qatar Petroleum and Shell

sign a Heads of Agreement for the development of Qatargas 4 - a

large-scale LNG project

http://www.shell.com/home/Framework?siteId=qatar&FC2=/qatar/html/iwgen/news_and_library/press_releases/2005/zzz_lhn.html&FC3=/qatar/html/iwgen/news_and_library/press_releases/2005/lng_press_releasse_270205.html27/02/2005

Qatar Petroleum

(QP) and The Royal Dutch/Shell Group of Companies (Shell) signed

today in Doha a Heads of Agreement (HOA) for the development of a

large-scale Liquefied Natural Gas (LNG)

project

located in Ras Laffan City, Qatar. The project is called Qatargas 4.

2003/9/14 Qatar

Petroleum

Qatar

Petroleum and PetroWorld of South Africa Sign Heads of Agreement

for Methanol Plant in Qatar

Qatar Petroleum

and PetroWorld Ltd. of South Africa signed, today, a Heads of

Agreement for the development of a Large Scale Fuel Grade

Methanol Project. The signing ceremony, held at Qatar Petroleum’s Headquarters in Doha, was

attended by senior officials from Qatar Petroleum and the South

African company. The targeted output of the Ras Laffan-based

project to be will be 12,000 to 15,000 tons of

methanol per day.

The agreement was signed by His Excellency, Abdullah Bin Hamad Al

Attiyah, Minister of Energy and Industry, Chairman of Qatar

Petroleum on behalf of Qatar Petroleum and Her Excellency,

Phumzile Mlambo-Ngcuka, Minister of Minerals and Energy of South

Africa, representing the South African company. In this project,

the State of Qatar will be represented by Qatar Petroleum (51%)

and the South African Government will be represented by

PetroWorld Limited (49%).

Qatar Petroleum (QP), a state-owned corporation, is responsible

for all phases of the oil and gas industry in Qatar while PetroWorld

Ltd. is a joint venture owned by Petroleum Oil and Gas

Corporation of South Africa (50%) and TransWorld Group of

Companies (50%).

The Plastic

Exchange 2006/5/25

Qapco Plans Third LDPE Unit

Qatar Petrochemical Co. (Qapco) says it is planning to invest

$250 million to build a third low-density polyethylene (LDPE)

plant at Mesaieed, Qatar. The plant will have a capacity of

250,000 m.t./year and is due to come onstream in 2010-11, the

company says. It will increase Qapco's LDPE capacity to 645,000

m.t./year. Qapco will select technology for the LDPE unit by the

second half of next year, Hamad Rashid Al-Mohannadi, vice

chairman of Qapco says. The company will complete a $220-million

expansion of ethylene capacity at Mesaieed from 525,000

m.t./year, to 720,000 m.t./year, also in the second half of 2007,

Al-Mohannadi says. Qapco is an 80-20 joint venture between

Industries of Qatar (IQ; Doha) and Total Petrochemicals. Qatar

Petroleum owns 70% of IQ and the rest is publicly traded.

2001/5

カタール:QPと南アSasolは,8億ドルのGTLプラント建設で合意

http://oilresearch.jogmec.go.jp/publish/pdf/2001/200105_139t.pdf

Qatar Petroleum (QP,旧GPCより社名変更)と南アSasolは,2001年3月12日,GTL事業実施に関する共同事業合意書に調印した。調印式は,第4回ドーハ・ガス会議の会場となったホテルにおいて行われた。

両社は,カタールGTL事業実施のための30百万ドルのfront-end

engineering and design(FEED)契約にも調印した。同プロジェクトは1995年以来,FS契約に基づき事業性の検討が進められてきたが,近日中に,今回の合意書調印に関する必要な法的手続が完了し次第,エンジニアリング業務が開始され,正式に事業がスタートすることになる。

名称:ORYX GTL

<カタールGTLプロジェクト概要>

世界有数の規模であるカタールNorth Fieldガス田で産出される天然ガスを原料として,低環境負荷の次世代燃料として注目されている

G T L液体燃料の製造プラントを建設する。

GTL技術の先駆者であり,世界で初の商業ベースのGTLプラント(石炭ベース)を稼動させたSasol社がプラント建設及び技術全般を担当する。

| ・ |

生産開始

2005年(目標) |

| ・ |

生産能力

合計33,750b/d |

| |

|

(概略内訳 中間留分(灯軽油)24千b/d,ナフサ9千b/d,LPG1千b/d)

(販売先のターゲットは極東,欧州)。

10年後には,ワックス等パラフィン系製品の生産を加え,120千b/d規模への増強を計画 |

| ・ |

プラント建設場所

Ras Laffanコンビナート内(カタールガス及びRas

GasのLNGプラントに隣接) |

| ・ |

総投資額 約8億ドル |

| ・ |

出資比率 QP:51%,Sasol:49% |

| ・ |

プロジェクトの経済性 |

| |

|

Sasolによれば,原油価格19$/bbl時の軽油販売価格は22$/bblであり,固定費,変動費等のコスト(4.5$/bbl),投資及びファイナンスコスト(7.5$/bbl)を控除しても,10$/bblのマージン(ガスコスト含む)が確保されるとしている。 |

なお,本プロジェクトには,当初,QP,Sasolに加えPhillipsが共同パートナーとなることが予定されていたが,Phillipsは2000年5月,カタール国内での戦略的事業再構築を進める一環として,GTLプロジェクトからの撤退を表明している。

日本経済新聞 2006/6/2

カタール 次世代燃料を量産 天然ガス利用

環境にも配慮 石油の代替狙う

カタールは天然ガスを利用した自動車向けなどの次世代燃料、ガス・ツー・リキツド(GTL)の大規模商業生産を開始した。生産能力は日量3万4千バレル、数年以内に同10万バレルを追加する。GTLは石油製品に比べ有害物質の発生が少なく環境への負荷が小さい。価格が高騰している石油の代替燃料として、日本を含む先進国を中心に普及に弾みがつく可能性もある。

カタール国営石油会社(QP)と南アフリカの石油会社サソールがそれぞれ51%、49%を出資して合弁会社オリックス・GTLを設立した。合弁会社はカタール北部の天然ガス施設集積地区ラスラファンにプラントを建設。第1期の投資額は約10億ドルで、今月6日にハマド首長が出席する完工式を開催する。

第2期以降の設備増強工事では米シェブロンが合弁事業に参画する予定。60億ドル程度が追加で投じられる見通し。また、ロイヤル・ダッチ・シェルが日量14万バレルの設備を2009年に、エクソンモービルは同15万バレルの設備を11年までにそれぞれラスラファンに建設する方針だ。

ガス・ツー・リキッド(GTL)

天然ガスを一酸化炭素と水素に分解した後、分子構造を組み替えて製造する液体燃料。灯油や軽油などとして利用される。大気汚染の原因となる硫黄やアロマ分など不純物を取り除くため、石油製品より有害物質の発生量が少ない。環境への負荷が小さい次世代エネルギーとして注目を集めている。

従来の暖房器具やディーゼルエンジンで利用可能。原油よりも可採年数が長いとされる天然ガスを利用するため、長期の安定供給が可能とみられている。低温で取り扱う液化天然ガス(LNG)とは異なり、常温で流通させることができる。先進国では自動車向けの代替燃料などとして有望視されている。 |

2004/3/23

QP

QP,

Sasol Chevron Announce US$6 Billion Blueprint to Boost GTL

Qatar Petroleum

(QP) and Sasol Chevron today announced plans to evaluate the

expansion of ORYX GTL from 34,000 bbl/day to

100,000 bbl/day.

QP and Sasol Chevron have signed a Memorandum of Understanding

(MOU) for the ORYX GTL Expansion project and have discussed the

technical and business principles that will support the planned

increase in the output of the foundation plant to 100,000

bbl/day. This will involve defining the feasibility of a three

(3) train, 65,000 bbl/day facility with an expected start up by

2009.

QP and Sasol Chevron have also signed a Letter of Intent (LOI) to

examine GTL Base Oils opportunities in Qatar.

QP and Sasol Chevron have agreed to pursue the opportunity to

develop a 130,000 bbl/day upstream/downstream integrated GTL

project based on the Sasol Slurry Phase Distillate Process and

utilising resources from the North Field. This will involve

defining the feasibility of a six (6) train facility with an

expected start up by 2010. These efforts will lead to the

establishment of a Heads of Agreement (HOA) for the project.

| Sasol Chevron

was formed in order to take advantage of the synergies of

Sasol's and Chevron's Gas To Liquids strengths. Sasol has

the world's most advanced Fischer-Tropsch technology.

Chevron has extensive global experience with respect to

natural gas utilisation, product marketing and

hydrotreating technology. 1999/6/9

http://www.sasolchevron.com/pr_06.htm

Sasol and Chevron

signed a Memorandum of Understanding today for the

creation of a new global alliance to implement ventures

based on Sasol's gas-to-liquids (GTL) technology.

|

2004/7/8

Qatar

Petroleum and Shell Sign DPSA for Pearl GTL Project

Qatar Petroleum (QP) and

Qatar Shell GTL Limited (Shell), a company of the Royal

Dutch/Shell Group, today signed an integrated Development and

Production Sharing Agreement (DPSA) that provides for the fiscal

and legal terms for the Pearl GTL project. 'Pearl GTL' is the name given to the project

announced by QP and Shell last October at a Heads of Agreement

signing in Doha. The agreement reaffirms Shell's long-term

commitment to Qatar and confirms the company as a leader in GTL

development.

The Pearl GTL project comprises the development of upstream gas

production facilities as well as an onshore GTL plant that will

produce 140,000 barrels per day (bpd) of GTL products as well as

significant quantities of associated condensate and liquefied

petroleum gas. The project will be developed in two phases with

the first phase operational in 2009, producing around 70,000 bpd

of GTL products with the second phase to be completed less than

two years later. The project includes the development of a block

within Qatar's vast North Field gas reserves, producing

substantial quantities of natural gas.

2007/2/12 Qatar Petroleum

Qatar's

First Linear Alkyl Benzene Plant Inaugurated

Under the Auspices of His

Highness, Sheikh Hamad Bin Khalifa Al-Thani, Emir of the State of

Qatar, His Excellency Sheikh Hamad Bin Jassim Bin Jabr Al-Thani,

First Deputy Prime Minister and Minister of Foreign Affairs,

officially inaugurated, on behalf of His Highness, the SEEF Ltd. Company's new Linear Alkyl

Benzene

plant in Mesaieed today. The ceremony was attended by dignitaries

and guests from Qatar and abroad.

Built at a cost of about US$300 million, Linear Alkyl Benzene

(LAB) plant is situated adjacent to Qatar Petroleum Refinery in

the industrial area of Mesaieed, about 40 Kms from Doha. Its

proximity to the QP Refinery was selected for its source of

feedstock and sharing of various common utilities.

The LAB plant is designed to produce 100,000 metric

tons of

Linear Alkyl Benzene per annum which is a detergent intermediate

used for manufacture of environmental friendly household

detergents.

SEEF Limited is a joint stock company with Qatar Petroleum

holding 80%

of the shares while 20% is held by United Development

Company (UDC).

The Company was incorporated under the law of State of Qatar and

was registered in July 2004.

For more information please visit: www.seefqatar.com.qa

United

Development Company (UDC) was established in July 1999

as one of the leading private sector shareholding companies

in the State of Qatar, in the Middle East, and has been

listed on the Doha Securities Market since June 2003.

Through a combination of substantial project

activities and commercial enterprise, UDC has made

substantial progress toward becoming the first-choice private

sector joint venture partner for international investors in

Qatar.

Since 1999, UDC has moved from an initial program of detailed

project research into specific investments and joint venture

developments in petrochemicals, district cooling and land

reclamation.

The company prides itself on its ability to research and

select quality investment opportunities as these arise, at

home and overseas. The company is empowered to invest in

financial instruments in Qatar, and also to act as a sponsor

for international companies entering the Qatar market for the

first time.

Seef

Limited

is a joint venture between Qatar Petroleum (QP) and UDC, with

UDC holding 20% of the shares. Seef will produce and sell

Linear Alkyl Benzene (LAB), a downstream petrochemical

feedstock for the world's detergent manufacturing industry.

Total project cost is estimated at around $ 289 million (QR

1.05 billion).

Project construction started in May 2004 at Mesaieed

Industrial City, adjacent to the Qatari Petroleum refinery,

and completion is expected by the end of 2005. Commercial

production is planned for January 2006, with QP responsible

for the operation and maintenance of the plant as well as

marketing of the products.

February 22, 2007 http://www.dailystar.com.lb/

Qatar Petroleum and

ExxonMobil cite spiraling costs for decision to scrap

gas-to-liquids plan

Qatar

Petroleum and ExxonMobil dropped plans Wednesday to build

a gas-to-liquids (GTL) plant in Qatar due to spiraling costs and

will instead turn their attention to developing part of the

country's huge North gas field. Qatari Energy Minister Abdullah

al-Attiyah said other projects in Qatar were not under threat and

ground

would be broken Thursday for a multi-billion-dollar GTL plant

with Royal Dutch Shell.

Costs for that facility, which processes gas into refined

market-ready products, have risen to as much as $18

billion from a 2003 estimate of around $5 billion. The Exxon/QP GTL scheme, signed

in 2004, had an initial budget of $7 billion.

2007/4/19 Basell

Basell grants 50th

Lupotech T technology license to QAPCO for new 250 KT per year PE

plant in Qatar

Qatar Petrochemical Co. Ltd (QAPCO), a joint venture of

Industries of Qatar and Total Petrochemicals, has chosen Basell’s Lupotech T technology for a new 250 KT per year

low density polyethylene (LDPE) plant to be built in Mesaieed, Qatar.

The start-up of the new plant is expected in 2011.

“This

is the 50th Lupotech T technology license worldwide and we are

very pleased to work together with QAPCO in their important

expansion project,” Just Jansz, president of Basell’s Technology Business, said

yesterday at the signing ceremony in Doha.

2007/6/8 Doha Time

QPI, Shell jointly pursue

international opportunities

Qatar

Petroleum International (QPI) a wholly-owned subsidiary of Qatar’s

state-owned Qatar Petroleum and Royal Dutch Shell yesterday

signed A Memorandum of Understanding (MoU) aimed at

identifying and developing international projects of mutual

interest throughout the energy chain.

The MoU was signed on behalf of QPI by HE the Deputy Premier and

Energy and Industry Minister Abdullah bin Hamad al-Attiyah and by

Linda Cook, executive director of Royal Dutch Shell.

Attending the signing ceremony were Nasser al-Jaidah, CEO of QPI,

and Jeroen van der Veer, chief executive of Shell.

“Qatar

Petroleum’s goal to

become a leading global energy company can only be attained

through its participation in the development of key international

projects.

“This

agreement with Shell, a top player in the global energy business,

represents a significant step in our quest to meet this ambitious

target, said al-Attiyah.

“We are

very pleased to see our growing partnership with Shell take on a

new dimension and look forward in the successful delivery of this

joint project,’

added al-Attiyah.

Cook said: “We are

delighted to team up with QPI in joint pursuit of global business

opportunities. Our combined experience and strength within the

energy sector make for an ideal partnership.

“Shell is

proud to be a part of this exciting new endeavour and we look

forward to further developing our strong relationship with Qatar.” ? QNA

2008/3/23

ANI 中国石油化工、クウェートと石油精製で提携 広州で

Qatar Petroleum International,

Sinopec to build ethylene plant in China

Qatar Petroleum International (QPI) and China’s Sinopec

have signed a memorandum of understanding for construction of an

ethylene plant with the capacity to produce between

700,000 and 800,000 tons of ethylene a year in

China.

As of now, the location of the plant has not been decided.

Nasir Jaidah, QPI’s

Managing Director, told reporters that Qatar

would supply the condensate feedstock for the

plant, which is expected to start production in 2013.

Jaidah pointed out that the ethylene plant would be QPI’s first

investment in China.

At present, China produces about 10 million tons of ethylene a

year, while the country’s demand is close to 24

million tons a year.

Ethylene is the most produced organic compound in the world;

global production of ethylene exceeded 75 million metric tons per

year in 2005.

To meet the ever increasing demand for ethylene, sharp increases

in production facilities have been added globally particularly in

the Gulf countries. Ethylene cracker capacities in the Gulf

region alone are projected to increase from eight million tons in

2000 to 28 million tons by 2010.

August 18, 2008 Norsk

Hydro

Sale of QVC shareholding

completed

Norsk Hydro ASA has today

completed the sale of its 29.7 percent ownership interest in

Qatar Vinyl Company (QVC) to Qatar Petroleum. The transaction represents net

proceeds to Hydro of USD 136 million (NOK 735 million). The

transaction is expected to result in a gain of approximately NOK

100 million to be recorded in the third quarter results. This

completes the divestment of Hydro’s Polymers activities.

Hydro entered into an

agreement to sell its Polymers activities to

INEOS in

late May 2007, consisting of production facilities in Norway,

Sweden and the UK, and the 29.7 percent ownership interest in

QVC. The sale to INEOS was completed February 1, 2008, excluding

the QVC ownership interest as Qatar Petroleum exercised its

pre-emptive right to acquire the QVC ownership interest.

June

02, 2009

Qatar: QAPCO, Uhde Sign EPC

Contract for Launching LDPE-3 Plant

Qatar Petrochemical Company (QAPCO), has signed with Uhde of

Germany the EPC contract for launching its new LDPE-3 plant in

Mesaieed.

In a press conference following the signing ceremony, Dr. Mohd

Yousef Al-Mulla, GM of QAPCO, said that throughout its history,

QAPCO has undergone some significant revamps and expansions,

including the expansion of the Ethylene Plant (EP2), which was

successfully completed in 2007 and boosted its annual ethylene

production capacity from 525,000 metric tons to

720,000 metric tons.

Dr. Al-Mulla referred to the underway Qatofin

project, a joint venture between QAPCO

(63%), Total Petrochemicals of France (36%) and Qatar Petroleum

(1%), for establishing a world-class Linear Low Density

Polyethylene (LLDPE) plant in Mesaieed, that shall receive the

ethylene delivered from a new 1,300,000

metric tons ethylene cracker plant, set up in

Ras Laffan through a 120 km pipeline to produce 450,000

metric tons of linear low density polyethylene per year,

and it is expected to commence in the 4th quarter of 2009.

It is worth mentioning that Qatar Petrochemical Co. (QAPCO), a

joint venture between IQ (80%), and Total Petrochemicals France

(20%), was the first petrochemical company in the Middle East

region, established in 1974 as a multinational joint venture to

utilize associated and non-associated ethane gases for the

production of Ethylene and of various grades of LDPE, marketed

under the 'LOTRENE' brand name. QAPCO today is supplying its

productions of Ethylene and polyethylene to local and to the

world strategic international markets.

The LDPE-3 Project will be

using the excess ethylene produced by QATOFIN and QAPCO, and it

is planned to produce annually 300,000

metric tons of low density poly ethylene using the

high pressure tubular reactor technology from "Basell"

of Germany, the leading technology provider in this application,

which was acquired in 2007.

In addition to the new 300,000 metric tons low density

polyethylene train, the LDPE3 Project includes a new Central

Control Room common for all QAPCO and QATOFIN plants and the

integration with existing utility and logistics facilities of

QAPCO and QATOFIN.

The LDPE3 Project is planned to be completed on December 2011 and

will be managed by QAPCO's Project Management team. This project

will be the last in the matrix of projects connected to RLOC. i.e

Qatofin, Q-Chem and LDPE-3.

Nov 20, 2009 SinoCast

Daily Business Beat

Qatar Petroleum

& CNOOC Tap Hainan Petrochemical Project

Qatar Petroleum International (QPI), China National Offshore Oil

Corporation (CNOOC), and another partner will jointly build a

petrochemical project with an investment of USD 5.8 billion in

the southmost Chinese province of Hainan, told foreign media.

Moreover, the Qatari

company will construct a petrochemical project with USD 4 billion

in Vietnam. Both these projects will use the LPG

(liquefied petroleum gas) made in Qatar.

The QPI CEO Nasser

Al-Jaidah said that the Asian market owned huge potentials,

especially China. He thought the two projects would help QPI not

only expand

its market

but also make use of its LPG, but did not disclose its stake in

each of the two projects.

The Hainan-based project is expected to gain approval from

Chinese regulators in the second half of next year, predicted the

CEO. Each year, it will consume 3.8 million tons of LPG and turn

out such products as polypropylene. Earlier reports told that the

first phase of the project would produce 2.6 million tons of

olefin, and that the capacity would possibly jump to 5 million

tons in the future.

January 06, 2010

Qatar Petroleum and ExxonMobil

Chemical Sign Agreement for Petrochemical Complex in Ras Laffan

Proposed project includes world's largest steam cracker and

specialty polyethylene plants

Qatar Petroleum (QP) and

ExxonMobil Chemical Qatar Limited, a subsidiary of Exxon Mobil

Corporation, announced they have signed an agreement to progress

the joint development of a world-scale petrochemical complex in

Ras Laffan Industrial City, Qatar. The proposed complex would

include the world's largest steam cracker and polyethylene

plants, and one of the world's largest ethylene glycol plants.

The announcement was made by His Excellency, Abdullah bin Hamad

Al-Attiyah, Qatar Deputy Premier, Minister of Energy and Industry

and QP Chairman, and by Steve Pryor, President, ExxonMobil

Chemical Company, at a signing ceremony held in Doha.

“ExxonMobil

Chemical is looking forward to working with Qatar Petroleum

to develop this world-class petrochemical complex featuring

ExxonMobil’s industry-leading,

proprietary technology.”

“The

State of Qatar has embarked on ambitious programs to utilize and

develop its hydrocarbon resources. This agreement represents

another important step to achieve the vision of His Highness the

Emir Sheikh Hamad Bin Khalifa Al-Thani, for the optimal

utilization of the country’s natural resources,”

His Excellency

Al-Attiyah said.

"Teams from Qatar

Petroleum and ExxonMobil have worked together to develop a

leading-edge project that will meet the growing global demand for

petrochemical products," added Pryor. "ExxonMobil

Chemical is looking forward to working with Qatar Petroleum to

develop this world-class petrochemical complex featuring

ExxonMobil’s industry-leading, proprietary

technology.”

The proposed

petrochemical complex would include a 1.6 MTA steam

cracker, two 650 KTA gas phase polyethylene plants, and a 700 KTA

ethylene glycol plant. The project will employ

ExxonMobil's proprietary steam cracking and polyethylene process,

and product technologies. It will utilize feedstock from gas

development projects in Qatar's North Field and produce a range

of premium products to serve global petrochemical demand, with a

particular focus on the growing Asia markets.

Start-up of the proposed

facility is estimated in late 2015.

Qatar Petroleum and

ExxonMobil are currently working together to diversify the use of

Qatar’s North Field gas including the

expansion of facilities to deliver liquefied natural gas

resources to targeted markets, and the supply of pipeline gas to

domestic customers.

カタール石油とエクソンモービルは2006年10月15日、ラスラファンに30億ドルのワールドクラスの石化コンプレックスを建設する検討を進める基本合意書を締結したと発表した。

North Field

ガス田からのエタンを原料に、エクソンモービルの技術で、エチレン130万トンのほか、ポリエチレンやエチレングリコール等を生産する計画で、アジアと欧州市場を対象にし、2012年のスタートを予定している。

両社は2004年6月に本件に関する基本覚書を締結している。

Dec 14, 2010 bloomberg

Qatar Gathers CEOs

to Mark LNG Milestone, Sees Further Gains

Qatar gathered chief executives from the biggest energy companies

to celebrate reaching an annual production capacity of 77 million tons of

liquefied natural gas,

underscoring its rank as the world’s biggest LNG exporter.

同国のLNG生産能力は2008年末と比べ2.5倍となり、世界のLNG生産能力の約3割を一国で握る。世界最大の生産国としての地位を固めた結果、天然ガス価格への影響力を強めることになりそうだ。

カ タールは1996年にLNG生産を開始した。単一鉱区としては世界最大級のノースフィールド・ガス田から産出する天然ガスを液化、06年にインドネシアを

抜いて世界最大の生産国となった。08年末の生産能力は年3000万トンだったが、09年から10年に大型プラントが相次ぎ稼働。残っていた2系列の設備

もほぼ完成した。

日本は世界最大のLNG輸入国。カタールからも電力・ガス会社が全輸入量の12%に相当する800万トン(08年、スポット取引含む)を輸入している。プラント建設や海運、商社、銀行など広範な分野でも日本企業がカタールのLNG事業に関与している。(日本経済新聞)

The Persian Gulf state

may further increase its capacity by as much as 10 million tons a year if it can improve

efficiency at its production units, Energy Minister Abdullah

al-Attiyah told reporters. Exxon Mobil Corp.’s Rex Tillerson, Royal Dutch Shell

Plc’s Peter Voser and ConocoPhillips’

Jim Mulva were

among the chief executives attending the ceremony at the

industrial city of Ras Laffan yesterday.

“If

in the future we want to expand, we will expand as a revamp and

de-bottlenecking,” al-Attiyah said yesterday, adding

that constructing new LNG units would be a costlier option.

While Qatar is recognized as the biggest LNG exporter and holds

the world’s third largest natural gas

reserves, its gas fields also supply rising volumes of natural

gas liquids such as propane, butane and condensate. These

products, collectively known as NGLs, have commercial uses

similar to crude or refined oil products, boosting Qatar’s overall energy sales.

Qatar will be able next year to pump 1.19 million barrels of NGLs

a day, according to a forecast by the Paris-based International

Energy Agency. The country’s NGL output will for the first

time exceed its production capacity for crude, which the IEA

estimates will be 1.02 million barrels a day in 2011. Qatar’s combined capacity for producing

NGLs and crude will overtake that of its OPEC partners Algeria

and Libya, according to the agency’s forecast.

“It

very clearly pushes Qatar up the ranks of oil producers and also

-- because of the semi-refined nature of some of these -- the

rankings of the refined-product producers as well,”

said Lawrence

Eagles, global head of commodities research at JPMorgan Chase

& Co. in New York, speaking in a telephone interview in

November.

The tiny nation of 1.6 million people has the third-largest

reserves of natural gas after Russia and Iran and is the second-

smallest producer of crude in the Organization of Petroleum

Exporting Countries. Ecuador is the smallest. OPEC quotas only

cover crude, not NGLs.

千代田化工は、1976年に中東アブダビに年産100万トンクラスのLNGプラントを建設して以来、35年以上にわたり数多くのLNGプラントを設計・建設してきました。

2009年にはカタールで1トレイン(系列)として世界最大規模の年産780万トンを2トレイン完成させるまでになりました。

2013年1月9日 三菱化学

カタール石油公社およびシェルケミカルズ社へのオキソ製造技術ライセンス供与について

三菱化学は、サブライセンサーである三菱化学エンジニアリングを通じて、カタール石油公社およびシェルケミカルズ社と、三菱化学独自のオキソ製造技術を供与する旨のライセンス契約を締結しました。

カタール石油公社とシェルケミカルズ社は、カタール・ラスラファン工業地帯において、天然ガスを原料とした大規模な石化プロジェクト(Al-Karaana

Petrochemicals Project)を進めており、誘導品としてモノエチレングリコール、アルファオレフィン、オキソ製品などを製造する計画となっています。2013年にはエンジニアリング会社との基本設計(Front

End Engineering Design: FEED)契約が締結される予定です。

このたび、同プロジェクトにおけるオキソ製品(年産25万トン)の製造プロセスとして、当社独自開発の「オキソTプロセス」が選定されました。

The world-scale project would produce

cost-competitive products to be marketed worldwide.

The scope under consideration includes:

a world-scale steam cracker with feedstock from natural gas projects in

Qatar;

an MEG plant of up to 1.5mn tonnes per year,

300,000tpy of linear alpha olefins and

250,000 tpy of Oxo derivatives.

同技術は、高品質なオキソ製品を安定的に製造できることが特長で、当社水島事業所において20年以上にわたり安定生産を続けており、これまでにも中国、インドネシア、南アフリカへのライセンス実績があります。当社は、今後もオキソ需要のさらなる成長が期待できる海外の企業ヘのライセンス活動を積極的に推進してまいります。

なお、当社は石化事業におけるナレッジビジネスを積極的に推進することを目的として、2011年1月に「ナレッジビジネス推進室」を設置し、EOG、テレフタル酸、ビスフェノールA、PTMG、マレイン酸、アクリル酸などのライセンス活動も強力に進めております。

May 29, 2014

EPS Qatar picks Ineos EPS process for

polystyrene project

INEOS Technologies is pleased to announce that it has licensed its INEOS EPS

process for the manufacture of regular and flame retardant expandable

polystyrene to EPS Qatar at a new complex to be

built in the Doha region, Qatar.

The 50ktpa INEOS EPS plant will produce a wide

range of expandable polystyrene grades to cover all the applications from

construction to packaging and serve the growing demand in the GCC region. The

plant will feature expansion capabilities to reach 100kta in a second phase.

Peter Williams, CEO of INEOS Technologies, commented: "INEOS Technologies is

proud to have been selected by EPS Qatar as its technology partner for the

launching of its expandable polystyrene business. The EPS Qatar plant will be

the biggest EPS unit in the MENA region.”

Ihab El Zahaby, CEO of EPS Qatar, stated: "We are pleased to have selected INEOS

Technologies' EPS process as an integral part of our petrochemical project. The

INEOS EPS process will provide EPS Qatar with an advanced and robust EPS process

with advantaged economics and broad product reach."

ーーーーーーーーー

25 February 2014

Qatari firm plans largest EPS project in

MENA – CEO

EPS Qatar is planning to set up a 50,000 tonne/year expandable polystyrene

(EPS) plant in Mesaieed industrial city in the

south of Doha, Qatar at a cost of €110m, its CEO Ihab Barakat ElZahaby said

on Tuesday.

The company — sole proprietary of Qatari entrepreneur

Hitmi Ali AlHitmi who has been in real estate business — signed a

technology licensing agreement with Switzerland-headquartered chemicals

producer INEOS earlier this month, ElZahaby told ICIS by email.

The company intends to sell EPS in the Gulf Cooperation Council (GCC), north

Africa and Turkey, ElZahaby said.

The company intends to complete the EPS plant by the end of 2017 and also

has plans to increase the EPS capacity to 100,000 tonnes/year by the end of

2020, he added.

It also wants to invest in a styrene unit in the near future, ElZahaby said

but gave no further details.

2015/1/14 Shell

Qatar Petroleum and

Shell not to pursue Al Karaana petrochemicals project

The Al Karaana project was initiated with a

Heads of Agreement (HOA) between QP and Shell in

December 2011, and envisioned the construction of a new

world-scale petrochemicals complex in the

Ras Laffan Industrial City

north of Qatar. The complex was to be operated as a

stand-alone QP-Shell joint venture

(80% QP, 20% Shell).

QP and Shell’s existing

partnerships include Pearl GTL – the world’s largest

integrated gas-to-liquids plant located at Ras Laffan, which

has boosted Qatar’s position as the world’s GTL capital. The

partnerships also include Qatargas 4 -an integrated

Liquefied Natural Gas (LNG) asset- in addition to joint

downstream and upstream investments in Singapore and Brazil.