他のページへ トップページ アジアの石油化学 中近東(目次) 連絡先 knak@js2.so-net.ne.jp |

Iraq Cabinet Approves Shell & Mitsubishi's Gas Deal In South Iraq

Iraq

Economy

http://0-www.search.eb.com.library.uor.edu/eb/article-232273?tocId=232273

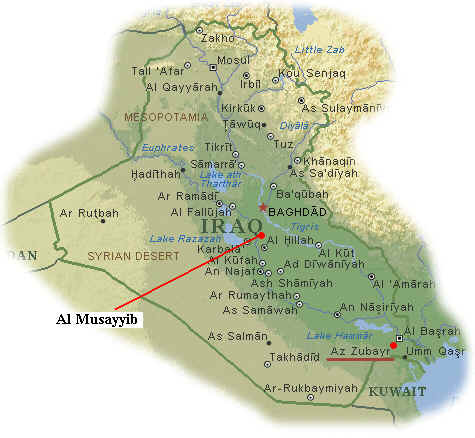

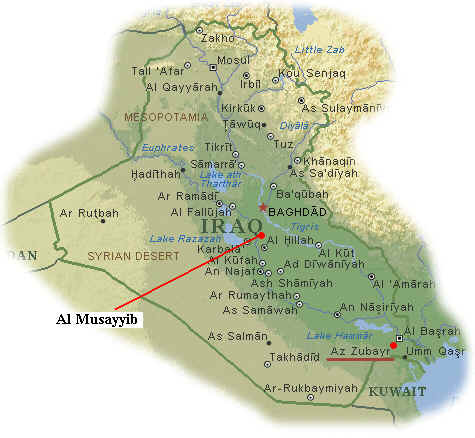

The manufacturing sector developed rapidly after the mid-1970s, when government policy shifted toward heavy industrialization and import substitution. Iraq's program received assistance from many countries, particularly from the former Soviet Union. The state generally has controlled all heavy manufacturing, the oil sector, power production, and the infrastructure, although private investment in manufacturing was at times encouraged. Until 1980 most heavy manufacturing was greatly subsidized and made little economic sense, but it brought prestige for the Ba'th regime and later, during the Iran-Iraq War, served as a basis for the country's massive military buildup. Petrochemical and iron and steel plants were built at Khawr al-Zubayr, and petrochemical production and oil refining were greatly expanded both at Al-Basrah and at Al-Musayyib, 40 miles (65 km) south of Baghdad, which was designated as the site of an enormous integrated industrial complex.

Platts

Guide to Iraq's Oil Industry

http://www.platts.com/features/Iraq/index.shtml

With proven reserves of 112-bil bbl and probable reserves of 214-bil bbl, Iraq has the second largest crude reserves in the world after Saudi Arabia. The infrastructure of the country's oil industry is however in a lamentable state after suffering badly in the 1991 Gulf War.

Reserves could top 300-bil barrels

Production cannot be sustained

Unofficial exports through Syria

IRAQ - The Petrochemical Sector.

湾岸戦争前に2つのコンプレックス

1.Khor Al Zubair (PC-1)

エチレン 130千トン

LDPE 60千トン

HDPE 30千トン

EDC 110千トン

VCM 66千トン

PVC 60千トン

1980 完成後、1980-88 イラン戦争で不稼動

1991 戦争で被害

2003年 部分再開

2.Musayyib 空爆の対象

エチレン 250千トン

LDPE 160

EG

55

EO 20

PP 100

ブタジェン

70

SM

145

PS

80

SBR 80

MTBE 60

ブテン1

15

ABS 15

styrene

acrylonitrile copolymer 5

1980年代

戦争で建設延期

1988 着工

1991 ほぼ完成時に戦争で被爆

1992年 部分稼動

現在、Khor Al Zubairのみが稼動 (下記 情報1、情報 2)

稼動能力

LDPE 36千トン

HDPE 19千トン

Ministry

of Industry & Minerals- Chemical & Petrochemical Sector

( Iraq Investment

and Reconstruction

Task Force of the U.S. Department of Commerce. )

April 15, 2003 Financial

Times

Iraq has the resources to become oil/chemical giant.

Iraq has one chemical site still operating, including a 130,000 tonnes/y cracker, and plants for 60,000 tonnes/y of low density polyethylene (LDPE) and 30,000 tonnes/y high density polyethylene (HDPE). All these plants were operating at 20-30% of capacity before the war.

立地: Khor-al-Zubair

http://www.geodesign.co.uk/iraq/iraq_why.htm

In the Arabian Gulf, Iraq has three tanker terminals: at Mina al-Bakr, Khor al-Amaya, and Khor al-Zubair.

Mina al-Bakr is Iraq's largest oil terminal, with four 400,000-bbl/d capacity berths capable of handling very large crude carriers (VLCCs). The terminal has a capacity as high as 1.2 MMBD.

Khor al-Amaya terminal could load 600,000 bbl/d. Upon full completion of repairs, Iraq projects Khor al-Amaya's capacity will rise to 1.2 MMBD.

Khor al-Zubair Iraq's third terminal, is linked to the Umm Qasr port by a 30-mile long canal. While Khor al-Zubair generally handles dry goods, it has the capability to service small quantities of liquefied petroleum gas (LPG) and refined products. Like Umm Qasr, Khor al-Zubair is being outfitted with crude loading capabilities.

APS Review Downstream Trends December 09, 2002

http://static.highbeam.com/a/apsreviewdownstreamtrends/december092002/iraqthepetrochemicalsector/

Before the 1991 war, Baghdad had impressive plans for its

petrochemicals industry. Officials have said that, after the

sanctions, Iraq may eventually become the world's second largest

exporter of petrochemicals. This depends on whether Iraq can

outpace the rapidly expanding petrochemical sector of Iran as

well as that of Saudi Arabia.

One of the targets for allied bombing in

Jan. 1991 was the 1.5m t/y petrochemical complex at Al Musayyib, in

the centre, which was intended to become an industrial zone

matching those of Baiji to the north or Khor Al Zubair to the

south. Technical teams have managed to rehabilitate several of

the damaged plants which now meet domestic requirements for a

range of plastics. But, as with oil products, the quality is

questionable since most units were only partly restored.

Iraq has two main petrochemical complexes, one in operation at Khor Al Zubair near Basra, called PC-1, and the other under construction at Musayyib,・・・・・

AllBusiness

2005/5/9

IRAQ - The Petrochemical Sector.

http://www.allbusiness.com/periodicals/article/414801-1.html

Iraq has two main

petrochemical complexes, one at Khor Al-Zubair near Basra,

called PC-1, and the other under construction at Musayib, 60 km

south of Baghdad called PC-2. Both owned and run by the State Enterprise

for Petrochemicals (SEP).

PC-1 - Khor Al Zubair - was badly damaged in the

previous war, by March 1991 leaving Iraq with no thermo-plastic

building blocks. It resumed limited operations in

February 1992.

The complex was mothballed on its completion in 1980 because of

the 1980-88 war with Iran. It went on stream in early 1989 to

produce: 130,000 t/y of ethane-based

ethylene; 110,000 t/y of ethylene dichloride; 60,000 t/y of LDPE;

30,000 t/y of HDPE; 66,000 t/y of vinyl chloride monomer (VCM);

and 60,000 t/y of PVC.

PC-2 - Musayib: Construction of this complex, in

central Iraq, had been postponed since the early 1980s because of

the war with Iran. Soon after Iran accepted the ceasefire in

August 1988, SEP went ahead with the project. A UK unit of

Bechtel was contracted as a technical consultant and did the

initial studies. The complex was nearly complete as the 1991 war

began. Allied bombing severely damaged

its units. It was brought on

stream partly in October 1992, with Iraqi engineers having done

the designs. Its ethylene unit was to have a 250,000 t/y capacity

compared to 420,000 t/y planned.

Musayib was being developed as an industrial centre, with West

Qurna field to provide crude oil, fuel and gas feedstocks. Under

pre-war plans, the first phase of PC-2 was to cost up to $2.5 bn

and was due to come on stream in the second half of 1991. It was

to have the following capacities:

250,000

t/y of ethylene, - 160,000 t/y of low-density polyethylene, -

55,000 t/y of ethylene glycol, - 20,000 t/y of ethylene oxide, -

100,000 t/y of polypropylene, - 70,000 t/y of butadiene, -

145,000 t/y of styrene monomer, - 80,000 t/y of polystyrene, -

80,000 t/y of styrene butadiene rubber (SBR) and polybutadiene

rubber, - 60,000 t/y of MTBE, - 15,000 t/y of butene-1, - 15,000

t/y of acrylonitrile butadiene styrene (ABS), and - 5,000 of

styrene acrylonitrile copolymer (SAC).

OGN online.com

2003/11/24

Sector hope in Petchem plant launch

http://www.oilandgasnewsonline.com/bkArticlesF.asp?IssueID=290&Section=1480&Article=11860

Hopes are high that

private-sector investment will secure the future of Iraq's Khor

al-Zubair petrochemicals plant.

Engineers at the Khor al-Zubair petrochemicals

plant, about

40 kilometres south of Basra, are on the brink of a major

breakthrough. In late October, gas pressure at the plant reached

levels high enough to restart production of chlorine for the

first time since it was shut down just before the outbreak of war

in March.

The plant requires 80 million-85 million cubic feet a day of gas

feedstock. Some of this is siphoned off to fuel the complex's

four gas turbines, which have capacity to produce about 60 MW of

power. Only one of the turbines is operating at present. The US'

Bechtel, under its US Agency for International

Development (USAID) reconstruction contract, has brought in Dubai-based

Masaood John Brown to repair the units, which it originally

installed.

Iraq considering $2 bln

petrochemical plant

Iraq is considering building a $2 billion petrochemical plant and

could begin talks with potential international investors in the

project this year, the country's industry minister said on

Sunday.

The plant would have an annual capacity of 1 million tones of

ethylene and derivatives, he said.

Hariri said on Wednesday that Royal Dutch Shell Plc and Dow

Chemical Co were in talks with the government to renovate and expand a chemical

plant in southern Iraq at a cost of up to $2.1 billion.

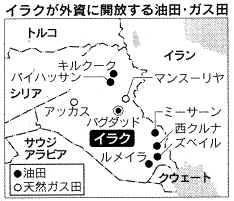

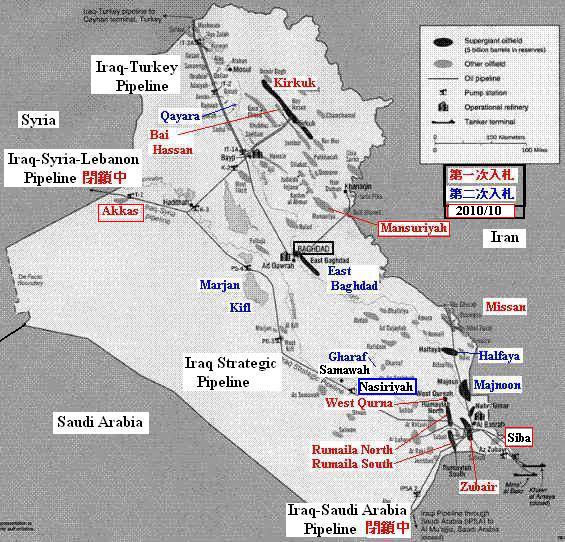

日本経済新聞 2008/7/1

イラク 8油田・ガス田、外資導入

13年に原油8割増産 日系4社など応札資格

イラクのシャハリスタニ石油相は30日、外資導入の対象となる油田と天然ガス田、計8ヶ所を発表した。イラクは世界第三位の石油埋蔵量を有する。戦後復興を急ぐ同国は外国石油会社への油田開放により原油生産能力を2022年に現在の8割増となる日量450万バレルに引き上げる計画。すでに日本企業4社(国際石油開発帝石ホールディングス、石油資源開発、新日本石油、三菱商事)を含む外資が応札資格を得ており、イラク参入をめぐる競争が本格化する。

外資導入による油田開発は03年のイラク戦争後初めて。対象となるのは北部の主要油田キルクークや南部の大油田ズベイル、ルメイラなど油田6カ所と、西部のアッカスなど天然ガス田2カ所。イラク石油省は事前審査で絞り込んだ41社を対象に09年3月までに入札を実施、落札企業と同年6月までに契約する。

外資導入による油田開発には、外国企業の開発への参加の枠組みや石油収入の分配などのルールを定めた基本法が必要。しかし、同法をめぐっては国内各派の対立で連邦議会での審議が停滞している。

Sep 01, 2008 (AsiaPulse via COMTEX)

Iraq signes first major oil deal with China

Iraq has signed its first

major oil deal with a foreign company since the fall of Saddam

Hussein's regime, a spokesman for the Iraqi Oil Ministry said

Saturday.

The contract with the China National Petroleum

Corporation could

be worth up to US$3 billion and marks the first time in more than

35 years that Iraq has allowed a foreign oil company to do

business inside its borders.

The deal allows the CNPC to develop an oil field in

southern Iraq's Wasit province for about 20 years, Oil Ministry spokesman Assim

Jihad said.

Iraq's Cabinet must still approve the contract, but Jihad said

that would happen soon and work could start within a few months.

The Chinese company will provide technical advisers, oil workers

and equipment to develop al-Ahdab oil field, providing fuel for al- Zubaidiya

power plant in Wasit, southeast of Baghdad, bordering Iran, Jihad

said.

Iraq

currently produces about 2.5 million barrels a day, 2 million of which are exported

daily, Jihad said. That is close to its status before the US-led

war that toppled Saddam in 2003, but below its levels prior to

the Persian Gulf War in 1991.

Iraqi Oil Minister Hussein Shahrestani said in July that he is

confident Iraq will be able to double its

production in the next five years.

As it did with other international companies, the Saddam regime

had a partnership contract with CNPC signed at the

end of the 1990s that entitled the company to share profits. The current contract, however,

will be only a "service

contract" under which CNPC is simply paid for its services, Jihad said.

2008/8/29 CNN

バグダッド南方の油田開発で合意、調印 イラクと中国国営企業

イラク石油省高官は28日、同国と中国がイラクの首都バグダッド南方にあるアハダブ油田開発の合意文書に27日調印したと述べた。同油田の開発で 両国は、2003年の米軍事作戦の開始前に合意、調印していたが、戦時の影響で、政府間の承認が出来ない状態となっていた。

日本経済新聞 2009/5/16 情報錯綜(下記)

来月からクルド自治区の原油輸出 イラク政府、歳入減少で妥協

イラクの北部三州で構成するクルド人自治区から初の原油輸出が6月に始まる。原油の主権をめぐり対立してきた中央政府とクルド自治政府の間で妥協が成立、ノルウェーやカナダなどの石油会社が日量10万バレル程度の原油を中央政府が管理する既存パイプラインを使ってトルコの地中海岸の積み出し港に運ぶ。

Tawke油田はノルウェーのDNO International ASA が、Taq Taq 油田はカナダのAddax Petroleum などの企業連合が開発する。

Tawke is being developed jointly by independent Norwegian oil company DNO and Turkey's Genel Enerji, while Swiss-Canadian Addax Petroleum Corp. is jointly operating the Taq Taq field with Genel Enerji.

Oslo-based DNO became the first independent Western oil company to secure an oil deal in post-Saddam Iraq, signing a production sharing contract with the Kurds in June 2004 to develop the Tawke field.

Three years later, the field came on stream but DNO was forced to sell the produced oil on the local market where prices are lower because it could not obtain an export permit due to the standoff between the Kurds and Baghdad. The field has 14 wells and more will be drilled.

Earlier this year, Genel Enerji teamed up with DNO in the Tawke development project.

In July 2005, the Swiss-Canadian independent Addax Petroleum joined Genel Enerji in a production sharing contract to develop Taq Taq.

The field, which has 11 wells, came on stream in November 2006 and faced the same export problem.

The northern Kurdish region has reserves of at least 40-45 billion barrels of oil, nearly half of Iraq's proven 115 billion barrels.

中央政府と自治政府は今回、2油田で産出する原油の販売はイラク石油省傘下の国営石油会社(SOMO)が担当し、外国石油会社は自治政府と交わした開発契約(生産物分与契約)の比率に基づいて売却代金を受け取ることで合意したもよう。

ーーー

6月1日、原油輸出が始まった。1日に自治区首府アルビルでの開始式典にはタラバニ大統領と自治政府のバルザニ議長が出席し、和解を演出した。

中央政府が原油収入増を望んだため例外的に妥協が成立したとの見方もあり、長期的な対立緩和につながるかは不透明。

両油田からの収入の88%は中央政府に入り、このうち17%を自治政府が受け取る。残りは開発企業分となる。

About 40,000 barrels per

day will initially be sent from Taq Taq, which is in a remote

area of Irbil, with another 60,000 barrels a day from the Tawke

field in nearby Dahuk province.

The two fields are expected to reach a total capacity of 250,000

barrels per day within a year and 1 million barrels per day in

the coming two to three years, said Khalid Saleh, a spokesman for

the region's Natural Resources Ministry.

Iraq currently produces about 2.4 million barrels of oil per day and exports about 1.9 million - most from ports in the Shiite south.

May 31 (Reuters) -

UAE's Dana Gas will go ahead with its project in Iraq's Kurdistan region despite the federal government's rejection of the deal, a Dana Gas source told Reuters on Sunday.

This month the UAE's Crescent Petroleum and affiliate Dana Gas formed a consortium with Austria's OMV and Hungary's MOL to pump enough gas from Iraq's Kurdistan region to kick-start the Nabucco pipeline to Europe via Turkey.

Shortly following the announcement, the Iraqi federal government rejected the deal signed by the Kurdish Regional Government (KRG), creating a potential hurdle for the project.

"These are all inner conflicts and we have nothing to do with them," said a source from Dana Gas who spoke to Reuters under condition of anonymity on the sidelines of a conference in the emirate of Sharjah.

"From a legal stand, our contact is one hundred percent valid ...what is happening between the Kurdish government and the federal government is a conflict we have no part in," the source added.

In the past the Iraqi oil ministry has criticised oil and gas contracts that the Kurdistan government has signed with international oil companies, calling them illegal.

The Western-backed Nabucco pipeline aims to lessen Europe's dependence on Russian gas. Until now, the $10 billion pipeline project had plenty of willing buyers in Europe but little gas to sell.

OMV will pay $350 million to Crescent and Dana for a 10 percent stake in their Kurdistan operating unit Pearl Petroleum. Before the deal, Crescent and Dana each held 50 percent in Pearl.

MOL will give 3 percent of its shares each to Crescent and Dana. In return, MOL will also take 10 percent in Pearl.

This month Badr Jafar, executive director for Crescent Petroleum, told Reuters that the assets in the region have the potential to produce over 3 billion cubic feet per day (cfd) by 2014.

ーーー

Iraq's oil minister confirmed that the federal government doesn't recognize oil contracts signed by the Kurds with several foreign companies.

The Kurdish government says drilling contracts with around 25 foreign companies are permitted under Iraq's constitution, which gives the Kurds a high degree of governance over its own affairs, including oil policy.

ーーー

Korea Times 2009/5/14

KNOC, Iraq Engaged in

Accidental Truth Game Over Oil Deals

A sort of game of truth is under way following the Iraq central

government's announcement over the weekend that all oil deals cut

between foreign firms and Kurds were invalid.

To the contrary, the state-run Korea National Oil Corporation

(KNOC) says that everything was okay, alluding to an earlier

announcement by the Kurds that oil deals with foreign firms were

effective.

The

Kurds said last Friday they will begin their first-ever crude oil

exports next month.

Under the plan, oil from their Tawke and Taq Taq fields will be

sold outside Iraq through a pipeline into to Turkey.

Accordingly, the company said Tuesday it will start drilling oil

blocks in the northern Iraqi region in the fourth quarter of the

year, explaining that Baghdad had given them permission

to go ahead with their oil deals.

``Our exploration plan has been independently going on,

regardless of what is happening there,'' said KNOC spokesman

Seong Hyun-soo. ``Still, it's positive that we are seeing Iraq

changing its view on the Kurdish issue.''

The company added it had confirmed the Iraqi government in

Baghdad had sent a written guarantee to Heritage Oil, a U.K-based

firm. But acknowledged KNOC hadn't received any guarantee.

Starting with the Bazian block, KNOC will work on the Sangaw

South block in the first half of next year and the Qush Tappa

block in the second half, the state-run oil company said. It

currently owns a majority stake in the three blocks, including an

80-percent stake in Qush Tappa.

Following a Bazian deal in a consortium in November 2007, KNOC

inked contracts for another five blocks a year later. Those

blocks are estimated to have a total of 7.2 billion barrels of

oil reserves in aggregate ― and Korea will be able to secure

three billion barrels of crude, if its explorations are

successful, the company said in a statement.

Then came a retraction from the central government, which said

that all deals with the Kurds were ``illegal and illegitimate.''

``The region does not have the right, nor does any province or

anyone else, to sign contracts on behalf of Iraq without

authorization,'' Iraqi oil minister Oil Minister Hussain

al-Shahristani was quoted as saying during an interview with the

state television, Iraqia, on Tuesday. ``All contracts should be

submitted to the ministry.''

On the same day, Iraq's oil ministry spokesman Asim Jihad said no

deal has been concluded between the two parties so far.

However, KNOC dismissed those statements.

``It's not a surprise. The minister has always been standing on

the opposing end and won't change his official stance in a

moment,'' Seong said. ``But now it appears Baghdad is fine-tuning

agreements before giving full permission to the Kurdistan

government."

Seoul has been trying to further tap into oil-rich Iraq. In

February, the government signed a memorandum of understanding

with Iraq to take part in a $3.6-billion oil field exploration

project during the visit of Jalal Talabani, the first Iraqi

president to visit Korea.

Some Korean firms have suffered some setbacks in Iraqi business

as the price for dealing with Kurdistan, which signed several oil

exploration deals with overseas firms in defiance of warnings

from Baghdad. SK Energy, Korea's No.1 refiner, was banned from

importing crude oil from the Middle Eastern country from January

last year before resuming its business a year later.

Iraq-Eni sign Zubair oil

deal

Iraq's oil ministry on Monday signed an initial deal with a

consortium led by Italy's Eni SpA to develop a prized southern

oil field, an agreement representing a key step forward in the

country's obstacle-strewn road to revamp its dilapidated oil

sector.

Eni,

the U.S.'s Occidental Petroleum Corp. and South Korea's KOGAS will develop the 4.1 billion

barrel Zubair field, with an eye to boosting output

from around 200,000 barrels per day to 1.1

million barrels a day within seven years.

Although the deal must still be approved by the Cabinet, Iraqi

Oil Minister Hussain al-Shahristani, hailed it as a significant

achievement at Monday's signing ceremony in Baghdad.

"Today, Iraq made a big leap on the way to develop its oil

industry," said al-Shahristani of the deal, which comes a

day before Iraq is to finalize an agreement with Britain's BP PLC

to develop the nation's largest oil field. "We are happy

with this progress and the achievement."

Shahristani also promised "more good news in the coming days

that will "put Iraq on the international oil map."

The Eni-led consortium will receive $2 per barrel of

crude produced. That's

less than half $4.80 per barrel they had bid in the licensing

round in held in June in Baghdad. The 20-year contract could be

extended by another five years.

In June Iraq's Oil Ministry said Eni, with other bidders, was not willing to accept the government's contract terms for the Zubair oilfield.

"(We changed our minds) because the tax terms are different now," said Eni's Chief Operating Officer for E&P Claudio Descalzi on Thursday.

Speaking to analysts on a conference call, Descalzi said that under the original Zubair terms taxes were on total revenue -- on both cost oil and profit oil.

"Now taxes are just on profit oil," he said.

Iraq Awards 2 Giant Oil Fields, Expects More Saturday

Iraq succeeded Friday in awarding two supergiant oil fields to two consortia--led by Royal Dutch Shell PLC and by China National Petroleum Corp.--as it began the second oil-licensing auction since the Saddam Hussein era.

Under beefed up security at the Iraqi oil ministry headquarters after a string of recent bombings here, Iraq awarded two untapped oil and gas fields--Majnoon, which means crazy in Arabic, and Halfaya in southern Iraq.

The auction is key to Iraq's goal of reviving an oil industry battered by years of war and sanctions. The country plans to increase oil production over the next six or seven years to six million barrels a day from 2.5 million now, though the task will be challenging.

Iraqi oil officials hailed the first day of the two-day auction as a success overall, though three of the five groups of oil and gas fields either failed to draw interest or received bids that didn't meet the Iraqi government's minimum terms.

"Today is a great success for Iraq," which secured favorable remuneration terms and strong projected production levels in the agreements for both fields, Iraq's Oil Minister Hussein al-Shahristani said.

Saturday, the Iraqi oil ministry will auction five more groups of oil and gas fields. Included among those is West Qurna Phase 2, the second largest oil field in this bidding round, with proven reserves estimated at more than 12 billion barrels.

Malaysia's national oil company Petronas secured stakes in both of the awarded oil fields Friday--the only company to do so out of 15 international oil companies submitting bids for them.

Petronas' stake in Majnoon is 40% while Shell holds 60% of the field. The Majnoon field holds some 12.8 billion barrels of oil reserves.

Petronas also secured a 25% share in the Halfaya oil field, which holds some 4 billion barrels of oil reserves.

French oil giant Total SA partnered with China National Petroleum Corp. in a failed bid attempt Friday for the Majnoon field.

Total's years of negotiating with the former regime of ousted Iraqi leader Saddam Hussein to develop Majnoon didn't clinch a development deal with the current Iraqi government, but Total didn't walk away empty-handed Friday. It holds a stake in the CNPC-led consortium, which won the giant Halfaya oil field.

For the Majnoon field, the winning companies proposed to receive a fee of just $1.39 a barrel and pledged to increase production to 1.8 million barrels a day. The remuneration fee was below what Iraq had said it would be willing to pay, but the winners sealed the deal by proposing more than double the production level that Iraq had sought, Shahristani said.

Total owns a 25% stake in the consortium that won the Halfaya development deal. CNPC holds 50%, and Malaysia's national oil company Petronas has 25%. They proposed a fee of $1.40 a barrel and a production plateau of 535,000 barrels a day for developing the Halfaya field.

The development deals are considered technical service contracts because the oil companies won't be allowed to book a share of the fields' reserves. The oil companies will receive the agreed remuneration fee per barrel, and will be reimbursed for development costs. The Iraqi government will provide security for the fields, though the international oil companies will be permitted to hire international security firms to protect their personnel.

The Iraqi government tightened security on Friday around the oil ministry headquarters in Baghdad where the auction took place. The government deployed military trucks and police armed with heavy machine guns early in the morning on the streets leading to the ministry. They blocked some streets in the capital to ensure safe passage for the convoys of company executives who defied the volatile security situation in Baghdad and attended the bidding round.

For big international energy companies, the licensing marks the latest stage of their return to a country from which they've been barred since 1972, when Saddam Hussein nationalized the oil industry.

Iraq is thought to have proven reserves of 115 billion barrels of oil, making the nation a magnet for Western firms shut out elsewhere in the Middle East.

Yet none of the companies Friday submitted bids for the East Baghdad oil field, despite its huge oil reserves estimated at 8 billion barrels. Analysts said oil firms declined to bid because of the unstable security situation in Baghdad, where massive bomb explosions over the last few weeks have killed hundreds of Iraqis.

Unlike the two awarded fields, East Baghdad produces heavy crude oil that is more difficult and costly to refine. The field also is geologically complicated, making it tougher to extract the oil.

Likewise, none of the companies submitted bids Friday for Eastern Fields, a cluster of smaller oil and gas fields. The oil minister said companies were unwilling to develop the Eastern Fields because of the unstable security situation in Diyala province, where the fields are located.

"We urge our people in Diyala to fight against al-Qaeda and the remaining of the former Baathist regime," Shahristani said.

The only company that bid for Qaiyarah near Mosul in northern Iraq was Angola's state-run Sonangol. It didn't win the field, the last in Friday's auction, as it didn't meet the ministry's maximum remuneration fee of $5 for each produced barrel. The company proposed a payment fee of $12.50 a barrel.

During the first bidding round, held in June, the oil ministry only awarded Rumaila--Iraq's largest oil producing field--to a consortium consisting of BP PLC and CNPC.

Some companies, however, changed their minds later, accepting the dollar-per-barrel remuneration fees set by the ministry and signing contracts.

But analysts say there are major obstacles to the government's efforts to expand oil output. Parliament has yet to pass an oil law covering key issues such as revenue allocation, and elections next year could bring in a government that might not honor oil contracts. Also, security remains fragile.

ーーー

Dec 13, 2009 Reuters

Details on bidding for

Iraqi oilfields

Iraq's Oil Ministry

awarded seven service contracts to international oil companies to

develop some of its biggest oilfields in the second bidding round

since the 2003 U.S.-led invasion.

The fields could

triple current production. When the deals that were awarded after

the first auction in June are included, capacity could reach 12

million barrels per day (bpd) from a current 2.5 million bpd.

Here are details

from the weekend's bidding:

* WEST QURNA, PHASE

TWO

Russia's LUKOIL

(LKOH.MM) and Oslo-based Statoil won the contract for this

supergiant field with reserves of 12.9 billion barrels. LUKOIL

controls 85 percent of the venture, while Statoil owns 15

percent.

They proposed a

remuneration fee of $1.15 per barrel and output of 1.8 million

bpd, compared with the government's minimum target of 750,000

bpd.

Petronas, Pertamina

of Indonesia and PetroVietnam sought $1.25 per barrel and

targeted 1.2 million bpd in production. Total (TOTF.PA) of France

bid on its own and proposed a fee of $1.72 and output of 1.43

million bpd.

BP and China

National Petroleum Company (CNPC), which won a contract to

operate the Rumaila field at the first auction in June, proposed

a $1.65 fee per barrel and 888,000 bpd.

After the deal is

ratified, LUKOIL and Statoil must pay a non-refundable signature

bonus of $150 million, according to a protocol for the tender.

They are also required to invest a minimum of $250 million.

* MAJNOON

Royal Dutch Shell,

Europe's biggest oil company, owns 60 percent and Malaysia's

Petronas owns the rest of the venture that won a contract for

this supergiant field in southern Iraq.

The companies

proposed a remuneration fee of $1.39 per barrel and a plateau

production target of 1.8 million bpd. Majnoon currently produces

45,900 bpd of oil.

Total and CNPC

offered the only other bid: $1.75 per barrel and an output target

of 1.405 million bpd.

The Oil Ministry's

minimum plateau production target was 700,000 bpd. Shell and

Petronas will pay $150 million once the deal is ratified, and the

agreement also requires them to invest a minimum of $300 million.

* HALFAYA

CNPC owns half of

the venture, while Petronas and Total each hold 25 percent

stakes, that won this field with 4.1 billion barrels of reserves.

They proposed a fee of $1.40 per barrel and plateau production of

535,000 bpd from a current 3,100 bpd.

The government put

the minimum output at 300,000 bpd.

LUKOIL and Statoil

offered a fee of $1.53 per barrel and a target of 600,000 bpd.

India's ONGC led a

consortium with TPAO, Turkey's state-run petroleum company, and

Oil India that proposed a fee of $1.76 per barrel and production

of 550,000 bpd.

A fourth bid came

from a group led by Italy's Eni that said it would take $12.90

per barrel and produce 400,000 bpd. Eni's partners were South

Korea's KOGAS, U.S.-based Occidental, Sonangol of Angola and

China's CNOOC.

Halfaya's

non-recoverable signature bonus is $150 million, and the minimum

expenditure obligation is $200 million.

* GHARAF

Petronas and Japan

Petroleum Exploration Co (Japex) won the rights to operate this

field, which has 900 million barrels in reserves, by proposing a

per-barrel fee of $1.49 and production of 230,000 bpd.

The minimum output

target was 150,000 bpd.

A venture including

the Kazakh KazMunaiGas, Kogas and Italy's Edison offered a fee of

$2.55 per barrel and targeted production of 185,000 bpd. TPAO and

ONGC offered $2.76 and 200,000 bpd. A fourth bid came from

Pertamina, which proposed a $7.50 per-barrel fee and 150,000 bpd

of output.

Petronas and Japex

will pay a $100 million signature bonus and invest at least $150

million.

* BADRAH

Russia's Gazprom,

the world's biggest supplier of natural gas, led the consortium

that submitted the only offer for Badrah, with reserves of 100

million barrels.

The group offered a

$6 remuneration fee per barrel, which it agreed to lower to

$5.50, the maximum Iraq would pay.

The production

target is 170,000 bpd, compared with the government's minimum

80,000 bpd.

Gazprom owns 40

percent of the venture, Kogas holds a 30 percent stake, Petronas

owns 20 percent and TPAO owns 10 percent. The signature bonus and

the minimum investment requirement are both $100 million.

* QAYARA

Sonangol, Angola's

state petroleum company, made the only offer for this field,

proposing a remuneration fee of $12.50 per barrel. It later

agreed to lower that to $5, the maximum the government would pay.

Sonangol's

production plans are the same as the government's minimum target

of 120,000 bpd. The signature bonus is $100 million, and the

minimum expenditure required is $150 million.

* NAJMAH

Sonangol was again

the lone bidder for this nearby field. It initially proposed a

per-barrel fee of $8.50, which it lowered to $6, and output of

110,000 bpd, matching the ministry's minimum target. The

signature bonus is $100 million, as is the minimum investment for

the field.

* EAST BAGHDAD,

EASTERN FIELDS, MIDDLE FURAT

No bids were

received at the auction for these fields.

East Baghdad is a

supergiant with reserves of 8.1 billion barrels. It currently

yields 10,300 bpd, and the ministry is seeking minimum plateau

production of 250,000 bpd.

The signature bonus

is $150 million, as is the minimum investment requirement.

The Eastern Fields

are comprised of Khashm al-Ahmar, Naudoman, Gulabat and Qamar,

which have combined estimated reserves of 300 million barrels.

The minimum production requirement is 80,000 bpd.

The signature bonus

is $100 million and the minimum expenditure obligation is $150

million.

Middle Furat is a

cluster of three fields with reserves of 600 million barrels. The

output must be at least 75,000 bpd, according to the tender

protocol. The signature bonus is $100 million, as is the minimum

investment.

No more Iraqi oilfields

for foreign companies: prime minister

Iraq has no further plans to use foreign firms to develop its

oilfields beyond ones auctioned off last year, the country's

prime minister said on Saturday(2/20), ahead of a national

election next month.

Analysts say that foreign companies may have accepted the tough

terms in oilfield development contracts awarded in two rounds

last year partly to secure an initial foothold in Iraq, with a

view to possible access to other untapped reserves later.

Iraq has the world's third-largest crude reserves and is the

world's 11th-biggest oil producer.

Prime Minister Nuri al-Maliki said Iraq should start thinking

about developing its national oil firms and warned of

"staying captive in the hands of foreign oil firms."

"I told the oil minister during a cabinet meeting that we

will never sign any more contracts with foreign oil

companies," Maliki told supporters at a rally in the

southern oil hub of Basra, weeks before a parliamentary election

on March 7.

"We will depend on our national companies in developing our

oilfields," Maliki said.

His nationalistic tone could discomfort oil firms such as BP Plc

and Royal Dutch Shell, which are monitoring their likely

reception in a country wracked by years of war and with little

recent experience of working with foreign companies.

Baghdad has struck deals with international oil firms that could

boost its output capacity to 12 million barrels per day (bpd)

within seven years from about 2.5 million bpd now.

Oil Minister Hussain al-Shahristani said in December there were

no plans for a third oil contract auction.

Maliki's coalition is not expected to repeat its triumphant

performance in last year's local polls. Huge bombings have since

chipped away at his claims to have improved security, and

opponents have united to oust him.

Analysts expect the ten oil deals awarded in auctions last year

will likely survive the change in Iraq's government after the

parliamentary vote next month, seen as a crucial test for Iraq as

it tries to move away from years of war and sanctions.

Foreign capital and expertise is seen as essential if Iraq is to

rebuild its battered economy and infrastructure.

The country's oil installations and pipelines have suffered

repeated bombings and sabotage, and many of its most qualified

workers fled the country in the violent and chaotic aftermath of

the 2003 U.S.-led invasion.

産経 2010.3.3

“ご破算”の危機、イラクのナシリヤ油田開発 日本側、追加援助の可能性も

新日本石油と国際石油開発帝石(INPEX)、エンジニアリング大手、日揮の3社連合がイラク南部・ナシリヤ油田開発のため同国政府と進めてきた交渉が暗礁に乗り上げた。大筋合意をしたはずだが、イラク側から「交渉終了」などの発言が飛び出し始めたのだ。ただ、発言は7日に行われる連邦議会選挙を控えた国内向けのメッセージとの見方もある。現状打破のため、日本側にはさらなる資金援助などを迫られる可能性も出てきた。

「新日石側との交渉は、最終合意に達せずに終了した」。イラク石油省契約ライセンス局のアルアミディ局長は3月2日にこう断言した。

Nippon and its partners, oil explorer Inpex Corp and engineering firm JGC Corp, had been negotiating the deal since the first half of last year, but a final deal was held up by issues over financing.Iraq plans to develop the Nassiriya oilfield on its own after months of talks with a Japanese group led by Nippon Oil Corp reached a dead end, the head of Iraq's South Oil Co. said on Feb 28, 2010.

Iraqi Oil Minister Hussain al-Shahristani said on March 1 that the country would develop the field itself.昨年11月にはライバルとみられていたイタリア企業が事実上撤退し、交渉が日本連合に絞られ、契約は近いとみられていた。

「新日石側との交渉は、最終合意に達せずに終了した」。イラク石油省契約ライセンス局のアルアミディ局長は2日、こう断言した。2月20日にはマリキ首相も「外国石油会社との契約はこれ以上交わさないよう閣議で石油相に伝えた」と発言している。

戦後復興を急ぐ同国政府は、油田開発を外国資本に開放。とりわけナシリヤ油田(日量60万バレル)は、指名競争入札で「イラク政府が早期に外貨を獲得できる魅力的な案件だった」(関係者)という。自主開発の「日の丸油田」を確保したい日本との思惑は一致し、昨年8月末、資金調達の方法などで大筋合意した。

第一次開放とは別枠でNasiriyah油田(Samawahの南東)の交渉が行われている。

将来、日量数十万バレルの生産が見込まれる有望油田で、日本連合(新日本石油/国際石油開発帝石/日揮)とEniが争ってきた。

Eniは今回調印したZubair開発に注力するため、Nasiriyah油田は放棄する意向で、日本側に権利が与えられるのは確実とみられている。

ところがロイターの報道によると、日本石油の代表が交渉のために11月初めにバグダッドに到着したが、空港から出て石油省に行くのを拒否しているとのこと。

Hussain al-Shahristani 石油相は10日、「多忙のためオフィスを離れて外で交渉する訳には行かない。多くの石油会社が石油省で交渉をしているのに、石油省に来ないというのは分からない。日本石油のやり方は不可解である」と述べた。

これが本当なら、本当に不可解である。

その後の報道では "due to traffic jams and the security situation" となっている。.

日本石油は11日、依然交渉中であるとし、コメントを拒否した。

ただ、昨年末までにナシリヤ油田以外の開発をめぐって2次の国際入札が行われ、国際石油資本(メジャー)を軸に10件の契約が成立している。見込まれる生産量を合計するとサウジアラビアの日量800万バレルを上回る同1200万バレル。

入札でメジャーは価格面で厳しい条件をのんだとされる。選挙期間中、現政権が国民に受けのよい「外資排除」を訴えるのは確実との読みから“駆け込み契約”をしたというわけだ。

イラク国内では宗派や部族間の対立が先鋭化。油田開発を外資に任せずイラクの手で行い、できるだけ多くの利益を国民に還元する「資源ナショナリズム」にもとづく政策が、治安維持のカギを握る可能性が高まっている。

欧米メディアによると、マリキ首相は「国営石油会社の創設」を進めたい意向を示しているという。

日本側としてはナシリヤ油田開発で「婚約までこぎつけた」(業界関係者)との自負がある。イラク政府側から正式な「交渉打ち切り」は伝えられておらず、新日石などは依然として「交渉中」とのスタンスをとっている。

ただ、このまま手をこまぬいていれば、原油開発に加えて発電所や製油所建設を含めた1兆円規模のナショナルプロジェクトの「ご破算」が現実のものとなる。米国に次ぐイラクへの政府開発援助(ODA)供与国として日本は製油所建設にも協力しているが、その努力も水の泡になりかねない。

アフガニスタンへのODA増額を決めた鳩山由紀夫首相だが、業界関係者の間では、ナシリヤ獲得に向け「イラクへの追加支援の方が相乗効果を期待できる」との声も浮上している。

新日本石油の渡文明会長は2009年3月3日、イラク政府に対し油田開発と製油所・発電所の建設を一括提案したことを明らかにした、と報じられた。

国際石油開発帝石、エンジニアリング大手の日揮との共同事業体で提案。3社の会長は2月下旬にイラクを訪問し、マリキ首相に会って交渉した。

Iraq Cabinet Approves Shell Gas Deal In S Iraq

The Iraqi cabinet Tuesday approved a deal with Royal Dutch Shell PLC and Mitsubishi Corp. to develop a gas-structure project in southern Iraq, paving the way for a final signature of the multibillion deal, a government spokesman.

Ali al-Dabbagh said that Shell and Mitsubishi Corp. would hold 49% stake in the venture while Iraq's state-owned South Gas Co. would hold 51%.

The decision was taken at the cabinet's weekly meeting, Dabbagh said in a statement, a copy of which was emailed to Dow Jones Newswires.

The proposed $10 billion-$20 billion joint venture aims to capture a huge amount of gas from four super-giant oil fields in the southern governorate that is currently being wasted.

"The venture will process associated gas produced from Rumaila, Zubair, West Qurna Phase 1 and Majnoon oil fields," Dabbagh said.

Dabbagh didn't say, however, when exactly the deal will be signed.

According to the preliminary agreement signed in September 2008, South Gas Co. will control 51% of the project, while Shell will hold 44%, and the remaining 5% will be owned by Mitsubishi.

A Shell executive welcomed the approval of the deal. "We expect to meet with our Iraqi side for discussions in the next few days," Mounir Bouaziz, a vice president of Shell International Gas and Power Ltd., told Dow Jones Newswires. He said that Shell has yet to be informed officially on the decision.

The project was supposed to be signed in March, but the two sides failed to finalize the deal and agreed to a six-month extension, which expires in September. Iraqi oil ministry officials then said the main obstacle to signing the deal was Iraq's inability to finance the project.

The cabinet's statement didn't elaborate on how Iraq would finance its portion of the deal.

Iraq, whose budget deficit is running at about $19 billion this year, needs to contribute $5 billion to $7 billion to the project.

The second problem was that many senior Iraqi politicians and government officials opposed the deal, arguing that Shell and its partner didn't have to compete with other international companies. The oil ministry that insisted other international firms were invited to compete.

About 1 billion cubic feet a day, or 10 billion meters a year, of associated gas is burnt off from Basra's oil fields because there isn't sufficient infrastructure to utilize it.

Iraq, which has proven natural-gas reserves of 3.15 trillion cubic meters, has a daily natural-gas production of 1.64 billion cubic feet, 70% of which is flared. Licenses for two gas fields listed in Baghdad's first licensing auction in June last year weren't awarded to international companies. Another one was dropped from the list in the second licensing auction held in December.

However, the Iraqi oil ministry plans to hold a third licensing auction next September for the three gas fields--Akkas in eastern Iraq, Mansouriya to the west and Sibba in the south.

Shell, Mitsubishi Win Government Approval for $17 Billion Iraq Gas Project

Iraq approved a $17 billion contract with Royal Dutch Shell Plc and Mitsubishi Corp. for the capture of natural gas at three oilfields in the south of the country, a government spokesman said.

Iraq has a 51 percent stake in the venture known as South Gas Co., Ali Al-Dabbagh said today. Shell has a 44 percent stake, while Mitsubishi owns the rest, he said by telephone from Baghdad. The agreement is for 25 years, according to Al-Dabbagh.

Iraq, holder of the fifth-biggest gas reserves in the Middle East, is struggling to restore power capacity after years of conflict and economic sanctions. The captured gas will supply domestic needs and may be exported at a later stage, Hans Nijkamp, Shell’s country chairman for Iraq, said Sept. 29.

“The cabinet approved it today and thus gave its green light to this $17 billion project,” he said. The venture will help collect more than 2 billion cubic feet (57 million cubic meters) a day from the Rumailah, Zubair and West Qurna fields, said Al-Dabbagh, one of the country’s state ministers.

第一次開放対象は以下の通り。

発見 埋蔵量

(億バレル)現状

(千b/d)北ルメイラ油田(Rumaila)

南ルメイラ油田1953 92

73470

585BP/CNPC 西クルナ油田(Qurna) 1973 74 300 ExxonMobil/Shell ズベイル油田(Zubair) 1949 40 240 Eni/Occidental Petroleum/KOGAS

Shell, Europe’s largest oil company, has been in talks with the government since 2008 to gather gas that's currently burned off, or flared. The preliminary agreement for the new venture was signed on July 12.

Fourth Licensing Round

Iraq has signed 15 licenses for the development of energy resources, including three for gas, since 2008, five years after the U.S.-led invasion that ousted the regime of then-President Saddam Hussein. It plans a fourth licensing round of oil and gas exploration rights for March.

Iraq burns off more gas as a percentage of output than any other country, losing $5 million a day, according to Fabrice Mosneron Dupin, an adviser at the Sustainable Energy, Oil, Gas and Mining Division of the World Bank-led Global Gas Flaring Reduction program. The nation ranks fourth for the amount of gas it flares, behind Russia, Nigeria and Iran, Dupin said Sept. 29.

Iraq’s flaring of so-called associated gas随伴ガス, which occurs naturally with oil underground, has increased to 10 billion cubic meters a year from 3 billion in 1994, in tandem with the country’s rising production of crude, he said.

イラク共和国 第4次公開入札におけるブロック10鉱区(探鉱鉱区)の落札について

国際石油開発帝石株式会社(以下、当社)は、ロシア大手石油会社であるルクオイル社の子会社ルクオイル・オーバーシーズ社(以下、LO社)とともに、このたび実施されたイラク共和国の第4次公開入札に共同で参加し、ブロック10鉱区(探鉱鉱区)(以下、本鉱区)を落札しましたので、お知らせいたします。今後イラク政府当局との間で本鉱区に係る石油契約の締結について協議を進めて参ります。

本鉱区はイラク南部のバスラ市から西125kmに位置する陸上鉱区であり、鉱区総面積は5,500km2です。同鉱区の東方にはルメイラ油田やウェスト・クルナ油田など世界有数の油田があり、また北方にはガラフ油田などがある有望なエリアです。LO社は、ウェスト・クルナ油田ブロック2(同油田の北の部分)の開発・生産事業をオペレーターとして手掛けており、今次LO社と当社が落札した本鉱区においても、同社が蓄積しているイラクにおける操業知見などを活用してオペレーターとなります。

当社は本鉱区において40%の権益を保有し、60%の権益を保有するLO社とともに、今後地震探鉱のデータ収録作業や試掘井の掘削等の探鉱作業を実施します。

このたびの落札により、当社はイラクにおいて石油・天然ガス開発事業に初めて参画します。イラクは、世界有数の石油埋蔵量を有する一大産油国であり、このプロジェクトの成功により、INPEX中長期ビジョンに掲げた当社の中長期的な成長目標、とりわけ生産量・埋蔵量の増大のための大きな足掛かりとなることと期待されます。当社は、今後もイラクを始めとする周辺地域における事業展開に積極的に取り組んで参ります。

May 31, 2012

Iraq Starts First Auction of Oil, Gas Exploration Rights

Iraq failed to attract partners for most of

the 12 oil and natural-gas exploration licenses

offered in a two-day auction at which Asian and Russian bidders were more active

than Western companies.

Three of the 12 blocks were awarded, two for oil and one for gas.

Russia’s OAO Lukoil and Inpex Corp. of Japan won a

joint bid to explore for crude in southern Iraq(ブロック10),

the head of the Oil Ministry’s licensing department, Abdul Mahdy Al-Ameedi, said

in Baghdad today, the final day of the auction. Pakistan

Petroleum Ltd. won rights to an eastern gas block, he said.

Thursday opened with a winning bid from Pakistan Petroleum for a 6,000 square kilometre exploration block which is thought to contain gas covering Diyala and Wasit provinces in central Iraq, with the company agreeing to $5.38 per barrel of oil-equivalent eventually extracted.

Block 8

1. Pakistan Petroleum – Bid: $5.38/boe

2. Japex (80%), Itochu (20%) - Bid $ 10.57/boeAnd shortly afterwards, a partnership between Russian energy giant Lukoil and Japan’s Inpex won a contract for a plot covering Muthanna and Dhi Qar provinces in the south, believed to hold oil, with an offer of $5.99 per barrel of oil.

The licensing comes amid an energy-industry

revival that has boosted Iraq into third place among the 12 members of the

Organization of Petroleum Exporting Countries, nine years after the U.S.-led

invasion that toppled Saddam Hussein. In its three previous bid rounds since

2003, Iraq auctioned rights to produce at oil fields already discovered or in

operation, whereas this week’s was for new exploration.

“Of course, we will prepare for a fifth round, and we have more than 60 blocks

ready for bidding,” Oil Minister Abdul Kareem al-Luaibi told reporters after

today’s auction. “We will start, God willing, during the next month to prepare

the data packages,” he said.

Gas Priority

Iraq offered five areas to be searched for oil and

seven for gas during this week’s auction, in which 47 companies from 25

countries were qualified to participate. The ministry is seeking to develop gas

deposits as fuel for power plants, which meet less than half of the nation’s

electricity needs.

Kuwait Energy Co., Dragon Oil Plc (DGO) and Turkiye

Petrolleri AO won the single license granted yesterday, to explore for

crude in a plot along the Iranian border.(Block 9)

A consortium led by Kuwait Energy that also includes Turkey’s TPAO and Dubai-based Dragon Oil won the 900 square kilometre block in the southern province of Basra, for a service fee of $6.24 per barrel of oil.

In an earlier round in June 2009, the

ministry awarded only one of eight areas on offer for redevelopment, assigning

rights to the Rumaila field, the country’s largest, to BP Plc. It negotiated

contracts later for the seven unawarded fields.

“Expectations were low going into this as the terms were so fundamentally

unsuitable, but I am slightly surprised by how bad the turnout was,” Samuel

Ciszuk, a consultant at KBC Energy Economics in Walton-on-Thames, U.K., said

yesterday.

International companies proved reluctant to commit to costly exploration

projects in return for a per-barrel fee they would receive under the service

contracts on offer. Iraq holds the world’s fifth-largest crude reserves,

according to data from BP Plc (BP/) that include Canadian oil sands.

2012-05-31 Platts

Iraq oil ministry fails to award all but one

exploration block at auction

Iraq's oil ministry awarded only one exploration block on the opening day of

what turned out to be a dismal start to a two-day auction of oil and gas acreage

as international oil companies failed to submit bids or, in one case, rejected

an Iraqi counter-offer to accept a lower remuneration fee.

Kuwait Energy as

operator, bidding alongside Turkey's TPAO and the

UAE's Dragon Oil, submitted the sole, and so far, only winning bid for

Block 9, believed to hold potential oil reserves.

Kuwait Energy has a 40% operating stake in the consortium with the other two

partners holding 30% each.

The group is seeking a remuneration fee of $6.24 per barrel of oil, below the

maximum set by the oil ministry, which did not reveal its figure.

The remuneration fee was the only bidding parameter adopted for the current

bidding round for 12 oil and gas exploration blocks being auctioned over two

days with 39 of 47 qualified companies taking part.

Under the terms of the tender documents for long-term service contracts, the

winning remuneration has to be below that set by the oil ministry for each block

and would be declared only if bids come in higher.

The only other bidder of the day was the UK's Premier Oil, which submitted a bid

for another potential oil block at a rate far higher than that set by the oil

ministry, resulting in rejection of its offer at the public auction.

Premier Oil, which teamed up with PetroVietnam and

Russia's Bashneft, submitted a sole bid for Block

12, also in southern Iraq, for a remuneration fee of $9.85/barrel against

a maximum of $5 set by the ministry. The consortium rejected the ministry's

offer to reconsider its bid and walked away, leaving Kuwait Energy as the only

winning bidder of the day.

Block 12, in Iraq's Muthana province in southern Iraq near the Saudi Arabian

border, carries a minimum expenditure requirement of $120 million and a $15

million non-refundable signature bonus. One well has been drilled so far in the

area.

Kuwait Energy and its partners submitted a bid on the basis of a remuneration

fee of $6.24/barrel, which Iraqi oil ministry official Abdul Mahdi al-Ameedi

said was below the ministry's number.

Block 9, near the border with Iran, covers an area of 900 sq km and carries a

non-refundable signature bonus of $25 million. The minimum expenditure

requirement was set by the ministry at $90 million.

Ameedi, who led the auction in his capacity as head of the ministry's Petroleum

Contracts and Licensing Directorate, said earlier that no exploration wells have

been drilled in the block.

The latest licensing round, the fourth since the US-led invasion of Iraq, covers

roughly one fifth of the country's territory and has been delayed repeatedly

since last November as qualified companies pored over final tender protocols and

model contracts. Despite some minor amendments to the contract, some major oil

companies like France's Total said the terms were not attractive enough to

entice them.

Of the four other blocks -- all with gas potential -- offered up on Wednesday,

none secured bids from the foreign oil executives attending the auction in

Baghdad. Blocks 2 and 6 are to be re-offered on

Thursday, when the remaining six blocks will be up for grabs, oil ministry

officials said.

The location of Block 2 in provinces known to have been hotbeds of Sunni Muslim

militant activity may have dampened interest by the oil companies present in

Baghdad, which is still grappling with security issues in the wake of the US

troop withdrawal late last year.

The oil ministry's insistence on retaining an option to put a seven-year hold on

development of any oil discoveries was believed to be among the less popular

clauses in the exploration contracts, a provision that does not apply to gas

discoveries.

Baghdad, which relies almost exclusively on oil revenues for its income, had

hoped to take a total $235 million in signature bonuses for all 12 blocks, which

were selected with a focus on its vast unexploited free gas reserves.

The oil ministry had estimated that the oil and gas exploration drive would add

10 billion barrels of crude oil and 30 Tcf of natural gas to the country's

already huge reserves should all blocks be taken up. The ministry in 2010

revised both its oil and gas reserves, raising crude oil reserve estimates by

25% to 143 billion barrels and gas reserves to 130 Tcf.

Although Iraq has no immediate plans to export gas, it has envisaged building a

gas pipeline through Syria, currently in the grips of a violent anti-government

rebellion. Analysts say the lack of existing gas infrastructure -- much of

Iraq's associated gas is flared -- and price system, as well as the Syrian

export plans, may have deterred potential bidders.

The stay on further oil development was inserted in the exploration contracts

because existing plans for the development and further development of Iraqi oil

fields, mainly in the south, are set to more than quadruple the OPEC state's oil

production to over 13 million b/d by 2017.

Foreign oil companies awarded 20-year service contracts for upstream

developments at two licensing rounds in 2009 are ramping up production from

Iraq's major oil fields in the south with current output now at its highest in

over two decades.

Iraqi Oil Minister Abdul Karim al-Luaibi told reporters on the sidelines of the

ceremony that oil production so far this month had risen to 3 million b/d. He

put exports at 2.445 million b/d as of Wednesday.

Dhia Jaffar, director general of the South Oil Company, said output from

southern oil fields averaged 2.35 million b/d. He put southern exports at 2.13

million b/d.

Official oil ministry data obtained by Platts last week showed that production

for the whole month of April averaged 2.942 million b/d, the highest level since

early 1990, just before Iraq's invasion of Kuwait. Iraqi output briefly hit 3

million b/d just before March 2003 but was not sustained at that level. Exports

in April were just above 2.5 million b/d.

Jan 28, 2015 Reuters

Shell signs $11 billion deal to build petrochemicals plant in Iraq

Royal Dutch Shell signed a deal with Iraq on Wednesday worth $11 billion to

build a petrochemicals plant in the southern oil hub of

Basra, boosting the country's aim to become a major regional energy

player and diversify its income.

Industry Minister Nasser al-Esawi told a news conference the

Nibras complex, which is expected to come online

within five to six years, would make his country the largest petrochemical

producer in the Middle East.

Iraq, which relies on oil for more than 90 percent of its revenue, has been hit

hard by the steep fall in global oil prices since June, with Brent crude now

hovering around $50 a barrel.

Prime Minister Haider al-Abadi said last week he feared lower revenues from oil

could hurt Iraq's military campaign against the Islamic State militants who

swept across northern Iraq last summer, prompting U.S.-led airstrikes.

"The Nibras complex will be one of the largest (foreign) investments (in Iraq)

and the most important in the petrochemical sector in the Middle East," Esawi

said.

He said the factory would produce 1.8 million tonnes of petrochemical products

per year.

A Shell spokesman told Reuters Iraq's cabinet had authorised the project on Jan

13. Company officials declined to confirm the size or types of output expected

from the facility.

"Shell has been working with the Iraqi ministries of industry and minerals and

jointly with the ministries of oil and transport to develop a joint investment

model for a world-scale petrochemical cracker and derivative complex in the

south of Iraq," the spokesman said.

Shell is one of the main major oil companies operating in south Iraq, operating

the Majnoon oilfield and leading the Basra Gas Company joint venture. It signed

a memorandum of understanding with the ministry for the Nibras project in 2012.