Suzano Petroquimica@http://www.suzanopetroquimica.com.br/en/sobre.html@@

Suzano Petroquimica is

the Latin American leader in the production of polypropylene

resins and the 2nd largest producer of thermoplastic resins in

Brazil.

The Company has a production capacity of 625 thousand

tons/year of polypropylene distributed within its three

facilities located in Maua (State of Sao Paulo), Duque de Caxias

(State of Rio de Janeiro) and Camacari (State of Bahia).

The Companyfs total production capacity will

increase by 250 thousand tons/ year up to 2008 with the expansion

of Maua and Duque de Caxias Units. These production capacity

expansions will sustain itfs leadership position in the

polypropylene business in Latin America and will turn the Company

into the second largest thermoplastic resins producer in the

region.

In addition, Suzano Petroquimica is a joint

controlling shareholder of Riopol and Politeno, polyethylene producers, and Petroflex, synthetic elastomer producer;

both products are raw materials for the converters, as the

polypropylene (more details at SuzanoLs Groups section).

Our strategic focus is the polyethylene and polypropylene market.

Considering that the Brazilian demand for these products has

historically presented a high growth rate and that the per capita

consumption in Brazil is still much lower than other under

development countries, we believe there is an excellent growth

opportunity for those business segments in Brazil. We prioritize

investments in the polyethylene and polypropylene production in

the Southeast Region of Brazil, major consumer market for these

products, accounting for more than 60% of all the countryfs consumption.

On

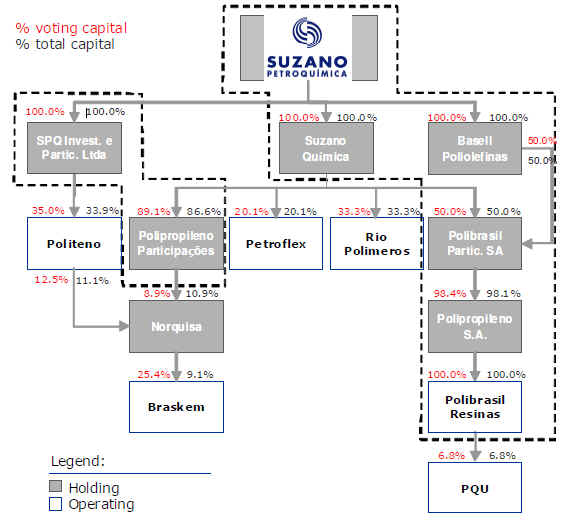

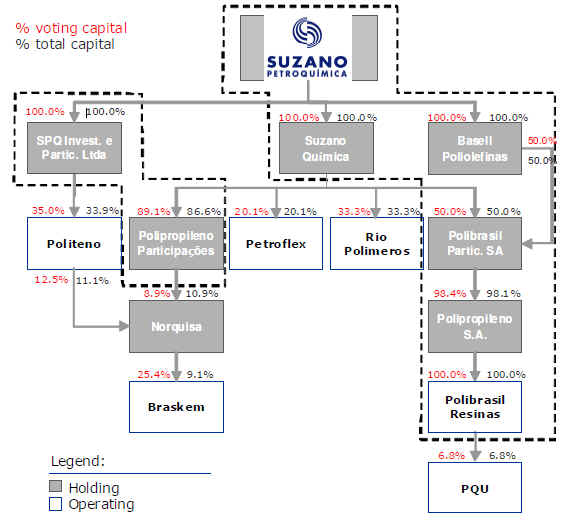

September 01, 2005, Suzano

Petroquimica accomplished an important strategic objective

becoming an operational company through the

takeover of Polibrasil, the polypropylene producer whose

control Suzano Petroquimica used to share with Basell. As a result, Suzano Petroquimica

has dramatically enhanced its activities in terms of size and

relevance, which also enabled a significant simplification of its

corporate structure.

2005/9/1 @Polibrasil ðBasell ©çû @@@2005/11/30@Riopol starts

2005/12/1 Restructuring

| Current Structure | After Restructuring |

|

|

Suzano Petroqui'micafs Businesses

Since 1974, the actions of Suzanofs companies in the petrochemical

industry have always been pioneering. For Suzano Petroqui'mica,

technological know-how and innovation walk hand in hand.

@Polibrasil

@2005/9/1û

First company to manufacture polypropylene in Latin America, is the segmentfs eading company in the region. Its three industrial units - Maua', State of Sa~o Paulo, Duque de Caxias, State of Rio de Janeiro and Camac,ari, State of Bahia - have a total installed capacity of 625 thousand ton/year. The three polypropylene plants are certified by ISO 9000, ISO 14001 and OHSAS 18001 standards.

Facilities

(Polypropylene Resins)Installed Capacity

(thousand ton/year)after expansion

(thousand ton/year)Duque de Caxias

200.0

300.0

Maua'

300.0

450.0

Camac,ari

125.0

125.0

Total

625.0

875.0

The company approved an of its Duque de Caxias complex, from 200.0 thousand tons to 300.0 thousand tons, and of its Maua' complex, from 300.0 thousand tons to 450.0 thousand tons. These investments are scheduled for the period from 2005 to 2008.

Founded in 1978, Suzano Petroqui'mica holds 100% of Polibrasil shares

2006/7/11@PRNewswire-FirstCall via COMTEX/

Suzano Petroquimica Concludes the First Phase of Its Polypropylene Capacity Expansion Project

Complying with Suzano Petroquimica's polypropylene capacity expansion schedule, the first phase of the project was concluded today. It allowed Maua's production capacity to increase by 60 thousand tons per year, reaching a nameplate capacity of 360 thousand tons per year. Maua's industrial site now has the biggest production capacity in a single site in Latin America.

The second phase of Maua's capacity expansion, which will add another 90 thousand tons per year, is estimated to be finished by the second quarter of 2008. Additionally, Duque de Caxias' facility expansion, in 100 thousand tons per year, is expected to be ready by the second quarter of 2007, together with Duque de Caxias' sea terminal.

Petroquimica will consolidate its position with a capacity of 875 thousand tons per year.

@Riopol@@@@@@@@@@@@@@Riopol starts

Riopol was created in 1996 to implement a grand project, the Rio de Janeiro Gas-Chemical Production Complex, in the vicinity of the Duque de Caxias refinery - Reduc, owned by Petrobras. The Complex was inaugurated on 23 June, 2005 and is comprised of two units - an ethane and propane pyrolysis unit, with installed capacity of 520 thousand ton/year of ethylene, and another unit producing high density (HDPE) and low density (LLDPE) polyethylene, with installed capacity of 540thousand ton/year.

Rio Poli'meros' Pyrolysis Unit has an annual production capacity of 520.0 thousand tons of ethylene and 75.0 thousand tons of propylene. Additionally, this unit has an annual production capacity of 5.0 thousand tons of hydrogen and 33.0 thousand tons of pyrolysis gasoline.

The Polymerization unit, on the other hand, has two independent production lines with an annual capacity of 270.0 thousand tons of polyethylenes each, for a total annual capacity of 540.0 thousand tons of polyethylene. This unit is of the swing type, capable of producing LLDPE and HDPE. This flexibility allows for adapting the product mix to the needs of the market.The Rio de Janeiro Gas-Chemical Production Complex is the first Brazilian petrochemical complex to use natural gas fractions as petrochemical raw-material to manufacture ethylene and the first integrated petrochemical project in Brazil, gathering production units of ethylene and polyethylene.

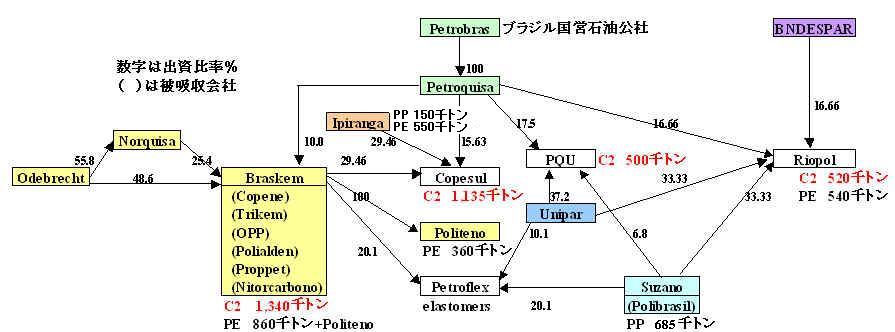

The shareholders of Riopol are Suzano Petroqui'mica (33,33%), Unipar (33,33%), Petroquisa (16,66%) and BNDESPAR (16,66%).Riopol is the result of a joint venture between us, Unipar, Petrobras (through Petroquisa) and BNDES Participac,o~es S.A.-BNDESPAR (''BNDESPAR''), and represents an investment of approximately US$ 1.08 billion. We hold approximately 33.3% of its total and voting capital being, together with Unipar, the largest shareholders. Petroquisa and BNDESPAR hold, each, approximately 16.6% of the total and voting capital of Riopol, and, in case BNDESPAR wants to sell its participation, Petroquisa has the right of first refusal, under specific circumstances.

@PQU

@Petroflex@@Duque de Caxias (RJ), Triunfo (RS) e Cabo (PE)

Largest producer in Latin America, and sixth in the world, Petroflex holds today approximately 80% of market share in the Brazilian elastomers market. It has 3 industrial units: Duque de Caxias, State of Rio de Janeiro; Triunfo, State of Rio Grande do Sul and Cabo, State of Pernambuco, all certified by ISO 9001, ISO 14001 and OHSAS 18001 standards, amounting to a total installed capacity of 410 thousand ton/year. Petroflex exports approximately 30% of its production to over 70 countries.

Petroflex offers more than 70 types of elastomers produced with raw materials from oil byproducts. Its products include synthetic ESBR, SSBR and BR rubbers, thermoplastic TR rubber, synthetic latex, PBLH and nitrilic NBR rubbers.

Units Installed Capacity

(thousand tons/year)Duque de Caxias

210.0

Triunfo

76.0

Cabo

125.0

Total

411.0

Created by Petrobras in 1962, Petroflex was the first petrochemical company to be privatized in Brazil, in 1992, as part of the National Privatization Program (PND). Petroflex is controlled by Suzano Petroqui'mica, Braskem and Unipar, which hold, together, 50.3% of the total capital.

Located in the Camac,ari Petrochemical Complex, State of Bahia, Politeno is one of the most important producers of polyethylene in Latin America.Its units, located beside the raw material central (Braskem), have installed capacity of 360 thousand ton/year and are certified by ISO 9001 and IISO14001 standards.

Plant Installed Capacity

(thousand ton/year)LDPE/EVA

150.0

LLDPE/PEAD

210.0

Total

360.0

Founded in 1974, Politeno is controlled by four shareholders: Suzano Petroqui'mica, Braskem and the Japanese Sumitomo and Itochu. For two subsequent years - 2000 and 2001 -, the Company was a finalist in the National Quality Award (PNQ), which was finally conquered in 2002. This award is considered the most important recognition of the efforts in pursuing excellence in quality in Brazil.

Companhia Suzano de Papel e Celulose@@@@@@@ @35%

Conepar--- Companhia Nordeste de Participacoes@@ 35%

Sumitomo Chemical@@@@@@@@@@@@@@@@@@@ 20%

Itochu Corporation@@@@@@@@@@@@@@@@@@@@10%

* ConeparÍBraskemqïÐ

@Prodome Qui'mica e Farmace^utica Ltda (PQF)

Ending a 15-year relationship, German pharmaceutical company Merck & Co Inc has acquired control of Brazilian health products manufacturer Prodome Qui'mica e Farmace^utica Ltda (PQF) from local company Ache' Laborato'rios Farmace^uticos SA (ALF) and minority shareholder Gian Enrico Mantegazza for an undisclosed amount.

The Company's principal activity is to produce and manufacture propylene oxide, propylene glycol, polypropylene and other petrochemical by-products.

2005/6/20

http://www.suzanopetroquimica.com.br/en/downloads/C30D97F9-2555-8A65-8DD414E024B906C1.download.pdf

Suzano Petroquimica S.A.

(gSuzano

Petroquimicah or gCompanyh) , and Basell International

Holdings BV (gBasellh), announce that today they have

reached an agreement in principle for the sale of the entire

shareholding interest of Basell at Polibrasil Participacoes S.A.

to Suzano Petroquimica, that, as a result, will own 100% of such

company and, indirectly, 98.1% of Polibrasil Resinas S.A. (gPolibrasilh), the Latin-American leader in

polypropylene production.

According to the agreement, Suzano Petroquimica will acquire 100%

of the shares of Basell Poliolefinas Ltda. (gBasell Brasilh), which has only one asset that

corresponds to its 50% stake of Polibrasil Participacoes S.A.,

controlling shareholder of Polipropileno S.A., with 98.1% of its

share capital, which has total control of Polibrasil, an

operating company with total production capacity of 625 kton/year

of polypropylene and 25 kton/year of compound polypropylene. The agreement also encompasses

the simultaneous sale to Basell of the totality of

the polypropylene compounding business of Polibrasil.

The amount to be paid for 100% of Basell Brazilfs, net of polypropylene

compounding business, is US$ 240 million.

The closing of the transaction, expected to occur during the

third quarter of 2005, is subject to the conclusion and execution

of the definitive agreements of the transaction, among other

conditions precedent and usual adjustments in this type of

transaction.

For Suzano Petroquimica this is a historical milestone, as it

represents a fundamental qualitative upgrade: the Company will

cease to be only an investor and joint controller to become a

company with integrated strategic and operating functions. At the

same time, it confirms its key role as consolidating agent of the

petrochemical sector focused on the Southeast region of Brazil.

Through the total shareholding control of Polibrasil, Suzano

Petroquimica will become the third largest producer of

thermoplastic resins in Latin America and the largest producer of

polypropylene in the region.

After the closing of the transaction Suzano Petroquimica will

implement a corporate restructuring, aiming at simplifying its

structure and formally becoming an operating company. By this

means Suzano Petroquimica confirms its strategic commitment both

to the capital markets and to value creation to shareholders. As

soon as the basic framework of this organizational restructuring

is defined the Company will inform the market accordingly, in

compliance with the applicable regulations.

The solid relationship between Suzano Petroquimica, Basell and

their shareholders, carefully and respectfully built over the

last years, was crucial for the implementation of this landmark

transaction and will continue to be essential for the sustainable

development of both companies.

2005/9/1

http://www.suzanopetroquimica.com.br/en/downloads/125A6B83-2555-8A65-8F43AABDBD5C63FA.download.pdf

Suzano Petroquimica S.A.

(gSuzano

Petroquimicah or the gCompanyh) announces that it has concluded

the

acquisition of the entire control of Polibrasil Resinas S.A. (gPolibrasilh). The financial settlement and the

property transfer , amounting to US$ 276.8 million, were

finalized today.

The transaction included the simultaneous sale to Basell

International Holdings BV (gBasellh) of Norcom Compostos

Termoplasticos do Nordeste S.A., to which the whole business of

polypropylene compounds, previously owned by Polibrasil, was

transferred to for the amount of US$ 23.0 million, resulting in a

net disbursement of US$ 253.8 million for the transaction.

Additionally, Suzano Petroquimica will implement a restructuring

to simplify its corporate structure and turn itself into an

operational company, accomplishing its commitment to the market.

As a result of this transaction, Suzano Petroquimica becomes the

Latin American leader in the production of polypropylene, with total production

capacity of 625 thousand tons per year, reaching 875 thousand tons per

year after the implementation of the approved expansion project,

and the second largest Brazilian producer of thermoplastic

resins, with consolidated net revenues of R$ 1.719 millions for

the period from Julyf04 to Junef05.

Corporate Restructuring

The corporate restructuring will evolve public tender offers to

the delisting of Polipropileno S.A. and Polipropileno

Participacoes S.A. and the incorporation, by Suzano Petroquimica,

of Suzano Quimica Ltda., Polibrasil Participacoes S.A., Suzano

Poliolefinas Ltda. (previously Basell Brasil Poliolefinas Ltda.)

Polipropileno S.A and Polibrasil Resinas S.A., besides the

incorporation of Polipropileno Participacoes S.A. by SPQ

Investimentos e Participacoes Ltda. The restructuring will allow

the use of the goodwill generated by the acquisition of

Polibrasil valued in excess of R$ 400 million, and will be

concluded until the end of 2005.

By turning itself into an operational company, Suzano Petroquimica will take a definitive step towards a new qualitative level, integrating its strategic management to the operational management, besides creating a simpler and more transparent corporate structure, as indicated above.

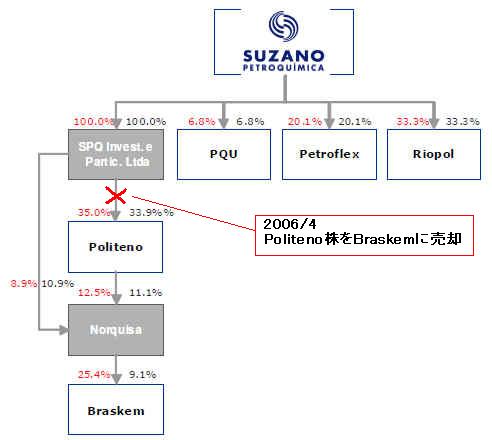

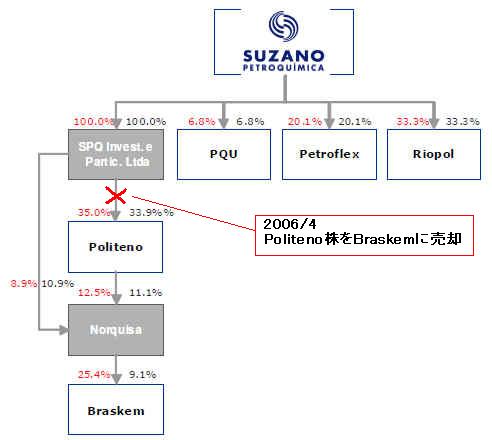

2005/12/1@Suzano Petroquimica

Suzano Petroquimica concludes its Corporate Restructuring and

becomes the largest polypropylene producer in Latin America

http://www.suzanopetroquimica.com.br/en/downloads/comunicado_reestruturacao_051201_en.pdf

Suzano Petroquimica S.A., latin-american leader in

polypropylene production and a joint controlling shareholder of

relevant players in the petrochemical sector - Rio Polimeros

S.A., Petroflex Industria e Comercio S.A. and Politeno Industria

e Comercio S.A., informs that all corporate actions necessary to

transform Suzano Petroquimica into an operational company have

been completed yesterday.

In line with the commitment of simplifying its corporate

structure and improving transparency, in the Shareholderfs General Meeting held yesterday Suzano Quimica

Ltda., Polipropileno S.A., Polibrasil Resinas S.A. and Polibrasil

Compostos S.A. were merged into Suzano Petroquimica S.A., which succeeded them in all

rights and duties, reaching the following corporate structure:

@@@@@eÐTv Riopol@Petroflex@Politeno@PQF

This important corporate

simplification was possible due to the success (i) of the Public

Tender Offer for the Acquisition of Polipropileno S.A shares, which financial settlement

happened on November 29; and (ii) the redemption of its shares.

Accordingly, the Public Tender Offer for the Acquisition of

Polipropileno Participacoes S.A shares was also successfully

implemented, with financial settlement also happening on November

29,2005. Since the remaining float of shares after the Offering

was slightly higher than 5% of the its total capital, the

minority shareholders who did not adhere yet, still have the

possibility to sell their shares during a 3-month period,

starting November 29, 2005.

It is expected that after that 3-month period, SPQ Investimentos

e Participacoes Ltda. will be able to incorporate Polipropileno

Participacoes S.A..

As a result of the corporate actions implemented yesterday, Suzano Petroquimica assumes per se the position of the leading company in the polypropylene business in Latin America. The Company believes it has exceeded the market expectations with respect to the timetable for the implementation of its corporate restructuring and reaffirms its firm proposal of positioning the Company as one of the leaders in the Petrochemical Industry in Brazil and in Latin America.

November 30, 2005. Suzano

Petroquimica

Riopol starts operation and concludes first sale of polyethylene

http://www.suzanopetroquimica.com.br/en/downloads/comunicado%201a%20venda%20Riopo%20Final%20eng.pdf

Suzano Petroquimica S.A.,

the Latin American leader in the production of polypropylene and

a joint controlling shareholder of relevant players in the

petrochemical sector - Rio Polimeros S.A., Petroflex Industria e Comercio

S.A. and Politeno Industria e Comercio S.A., aiming at keeping

the market updated on the initial operation of Riopol, announces

that the company has initiated its polyethylene production and

has already effected the first polyethylene sale.

After the start up of the industrial facilities and a period

stabilization of its operations, Riopol restarted its

polyethylene production process at its first production line last

week, which has a total production capacity of 270 thousand tons

of polyethylene

per year and that will be dedicated to the production of linear

low density polyethylene (LLDPE), which is already being produced

within the required specifications.

Almost 1,000 tons of polyethylene have been produced and the

Companyfs first sale, amounting to 50

tons, was made to a film producer in the State of Sao Paulo.

Riopol is also selling polymer-grade propylene to Suzano

Petroquimicafs polypropylene unit located close

to Riopol, and also hydrogen to Petrobrasf

Refinary in Duque

de Caxias,Rio de Janeiro.

Next week, the second polyethylene production line with also a

total production capacity of 270 thousand tons per year is scheduled to start

operating, and will be dedicated to the production of high

density polyethylene (HDPE).

The Riopol project has now overcome the normal difficulties faced

during its initial start up phase and Suzano Petroquimica is

confident that the companyfs activities should proceed at a

normal pace from now on. It is worth mentioning that Riopol

should have a quite fast learning curve, achieving the 460 thousand

polyethylene production expected for 2006.

Therefore, Suzano Petroquimica confirms its belief that Riopol, a

pioneer project in Brazil, is now definitely assuming its

relevant position in the Brazilian petrochemical industry.

PQU, Brazil's first basic

petrochemical products plant, was incorporated December 12, 1966

under the name Petroqui'mica Unia~o Ltda., with a capital of

50,000 cruzeiros. Its proposition was the ambitious project of

installing Latin America's largest petrochemical complex,

resulting from the agreement between Refinaria e Explorac,a~o de

Petro'leo Unia~o S.A., in Capuava, Santo Andre' (the present-day

RECAP of Petrobras, then owned by the Soares Sampaio, Ultra and

Moreira Salles groups), and the American company Phillips

Petroleum.

In 1968, Phillips Petroleum withdrew from the project, being

replaced on June 15 (at a special stockholder's meeting) by

Petroquisa, the latter being authorized to associate with PQU in

December of the same year. In this way, Petroqui'mica Unia~o

became a joint-stock company.

The basic design of the plants was contracted with Lummus, of New

Jersey, a company of great experience with similar facilities,

while engineering and assembly supervision were in charge of

Socie'te' Franc,aise de Techniques Lummus (SFTL), a subsidiary of

the former. The construction and assembly work started with the

laying of the foundation-stone on April 11, 1969.

Petroquisa's participation as a shareholder of PQU assured the

organized and balanced implementation of Sa~o Paulo's

Petrochemical Complex, basically comprising the central plant and

additional 39 companies being supplied with the basic and

intermediate products generated.

From 1971 onward, PQU's shareholder body was composed by 90% of domestic

capital, from Petrobras (Petroquisa) and Unipar, a domestic

private group, and 10% of foreign capital, from companies such as

International Finance Corporation, Provident International

Corporation, Citicorp, and Venture Capital Ltd.

On June 15, 1972, Petroqui'mica Unia~o S.A. started up its

production, inaugurating Phase I of the complex. Phase II was

completed in March 1974, when the rated capacity of 300 thousand

tons of ethylene per year was achieved. In the same year, the

ethylene pipeline was extended to Cubata~o. By decision of its

shareholders, PQU now also supplied the low density polyethylene

plant owned by Union Carbide.

In November 1980, the DBN I (Debottlenecking) project was

completed, increasing ethylene production from 300 thousand to

360 thousand tons per year.

In January 1989, the Polibutenos S.A. Indu'strias Qui'micas - PIB plant starts up, with 12 thousand tons yearly capacity. PIB is an association of Petroqui'mica Unia~o with Unipar and Chevron do Brasil, the plant being installed within the PQU industrial complex, making use of its infrastructure, and employing its butenes stream to produce polyisobutenes in several viscosity ranges. This product, until then imported, is employed as dispersant in lube oil additives, in the formulation of protective varnishes, water-proofing of electric cables, and manufacture of industrial products.

Brazil's Petrobras says to buy Suzano petrochem firm

Brazilian state oil

company Petrobras said on Friday it had agreed to buy control of

Suzano Petroquimica for 2.1 billion reais ($1.1 billion) in the

second major Brazilian petrochemicals deal this year.

In March, Petrobras and two partners, Latin America's largest

petrochemical company Braskem and Ultrapar Participacoes , bought

petrochemical and fuel company Ipiranga for $4 billion.

2007/3/23 uWÅÎûEÎû»wÆEÌÄÒ

uWcÎûïÐPetrobrasÆUltra GroupABraskemÌ3Ъ¤¯ÅA¯ÌÎû¸»EÌAÎû»wÌVÜÌIpirangaðû·éB19úAPetrobrasª\µ½B

@

| PP@\Í@içgj | ||||||||||||||||||||

|

Suzano Petroquimica

We are the leading

company in Latin America in the production of polypropylene, a

thermoplastic resin, 100% recyclable, widely used in the

manufacture of textile and civil construction supplies, domestic

appliances and packages for the food, cosmetics, pharmaceutical

and civil construction industries, and which is presented in

three basic types: homopolymers, heterophasic copolymers and

random copolymers.