アーチ・ケミカルズ・インコーポレーション(Arch Chemicals,lnc.)

本社:米国コネチカット州ノーウォーク

99年2月 オーリン・コーポレーションから特殊化学品部門が分離独立

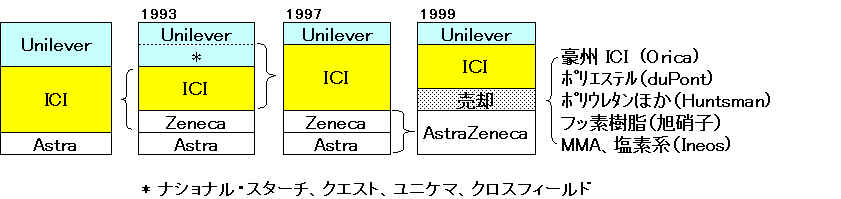

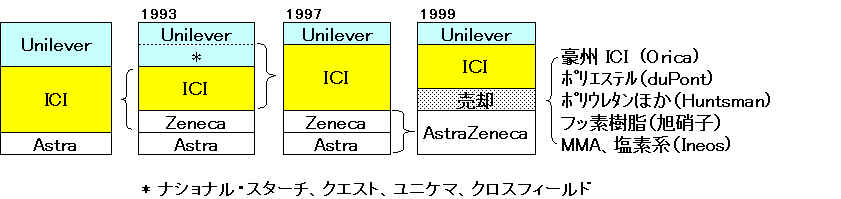

アイ・シー・アイ(ICI=lmperial Chemical lndustries PLC)

1926年12月設立

Brunner Mond (アルカリ製品)、British Dyestuffs(染料・顔料など)、Nobel

Industries(火薬類)、

United Alkali(アルカリ製品)の4社が企業合同

1982 Wilton LDPE plant をBPに売却 (2001 BP 同工場を閉鎖)

93年6月 医薬・農薬関連事業を分離・独立 「ゼネカ社」設立

スペシャルティ事業への集中を世界戦略に掲げ大規模な事業再編

97年7月 英蘭系ユニリーバ社(Unilever)

の特殊化学品4社買収

ナショナル・スターチ社(工業用接着剤、レジン、産業用でんぷん)

クエスト社(香料、乳化剤、芳香剤)

ユニケマ社(脂肪酸、グリセリン)

クロスフィールド社(シリカ、ケイ酸塩、ゼオライト) 後、売却

97年 ICIオーストラリア社の所有株式(62.4%)を売却(公募→オリカ社)、

ポリエステル事業(および酸化チタン事業)を米デュポン社へ売却する合意

98年2月にポリエステル事業移管

酸化チタン事業

99年6月末に米ハンツマン・ケミカルヘポリウレタンや芳香族、オレフィン事業と共に売却

合弁会社「ハンツマンICI」(ハンツマン 70%、ICI 30%出資)が運営

(2000年 ICI持分売却価格決定 →Huntsman調達不可能→2002年 ICIが持分売却)

→ 2003/5 Huntsman Buys Out Minority

Interests In Huntsman International Holdings )

フッ素樹脂事業も旭硝子に売却

塗料事業では、自動車補修用塗料事業ICI

Autocplourを米PPG Industriesに売却

アクリル事業、代替フロンを含む塩素化学品事業を共に英イネオスグループに売却

その他の事業処分

◎スペシャルティ化学品を中心とした「新生ICI」

ナショナル・スターチ、クエスト、機能性化学品(ユニケマ及びシネティクス=触媒事業)

及び塗料の4事業部門

・National Starch and Chemical Company is a leading manufacturer of adhesives, sealants, specialty food and industrial starches, specialty synthetic polymers, and electronic and engineering materials.

・Quest International is a leading fragrance, flavours and food ingredients company, with particular strengths in flavour and fragrance creation, customer understanding, texture solutions and applied bioscience.

・Performance Specialties - the Uniqema and Synetix businesses - supply products and services, which create special effects that improve how customers' products feel or perform.

*2002/9 触媒事業Synetix をJ・マッセイに売却

・ICI Paints is a leading international paint business with a particularly wide geographic spread. The business is headquartered in the UK and operates 49 manufacturing sites in 25 countries, selling in more than 120 countries.

ICI rejected Akzo Nobel 's takeover approach

Further Proposal

from Akzo Nobel

Akzo Nobel Brings In Henkel To Win

a Deal for ICI

2007/8/13 Akzo、ICI 買収合意発表

化学工業日報 2002/9/26

ICI、触媒事業をJ・マッセイに売却ICIは触媒事業のシネティックスをジョンソン・マッセイに売却する。

2002/9/23

ICI Agrees Sale of Synetix for £260 Million

http://www.synetix.co.uk/news/23092002-sale.htm

Imperial Chemical Industries PLC has agreed to sell its catalyst business, Synetix, to Johnson Matthey plc for a total of £260 million in cash.

Ward's Auto World, May,

1992

DuPont/ICI swap nylon and acrylic business - Imperial Chemical

Industries - Brief Article

Du Pont Co. is acquiring ICI's worldwide nylon business, and ICI

is taking Du Pont's global acrylics business. The agreements

include a net cash payment to ICI of about $430 million, based on

the difference in value between the two businesses. ICI's nylon

business had 1991 sales of about $1 billion and is centered in

Europe while Du Pont's acrylics business had sales of about $300

million last year and largely is based in the U.S.

The swap will give DuPont 43% of the European market for nylon fibers used to manufacture carpets.

Lucite International is the successor to the acrylic businesses of DuPont and ICI.

1930s ICI invents the first commercial technology process for MMA.

ICI commences production of MMA and Perspex sheet at Cassel, UK

DuPont commences production of MMA and Lucite sheet at Belle, USA

1990s DuPont and ICI invest $500m in new MMA facilities at Beaumont, Texas, Cassel, UK, and KMC, Taiwan

1993 ICI acquires the DuPont Methacrylates business

1999 Charterhouse Development Capital acquires ICI Acrylics and forms Ineos Acrylics

1999/6/30

ICI Completes Sale of Polyurethanes, Tioxide and

Selected Petrochemicals for £1.7 Billion

http://www.ici.com/po_arch_story.jsp?archive=1&year=1999a&newsId=236

ICI has completed the sale of its polyurethanes, titanium dioxide and selected petrochemicals businesses to Huntsman, the largest privately owned chemicals group in North America, for an anticipated aggregate consideration of £1.7 billion.

Huntsman has acquired the businesses through a new company, Huntsman ICI Holdings ("HICI") established in partnership for that purpose. HICI, which also includes Huntsman's US propylene oxide assets, will be controlled by Huntsman, and ICI will retain a 30 per cent shareholding.

2000/11/2

Divestment of ICI's Investment in Huntsman ICI

http://www.ici.com/po_arch_story.jsp?archive=1&year=2000b&newsId=52ICI and Huntsman have agreed terms relating to the sale by ICI of its residual 30% equity ownership in Huntsman ICI Holdings LLC ("HICI") to Huntsman Specialty Chemicals Corporation or its nominee ("Huntsman") for $365m (£250m) plus interest accruing until completion.

2002/6/17 ICI

ICI agrees sale of interests in Huntsman International Holdings

http://www.ici.com/po_arch_story.jsp?archive=1&year=2002a&newsId=321

ICI has reached agreement with CSFB Global Opportunities Partners, L.P. for the sale of ICI's interests in Huntsman International Holdings ("HIH" formerly Huntsman ICI ). Net proceeds, before interest, to be received by 15 May 2003 are expected to be circa US$430million (£295million) of which US$160million (£110 million) has been received.

ICI Australia Starts A

New Era As Orica

http://www.orica.com.au/business/cor/2001/wcor00002.nsf/0/3628e5923806d1c7ca256af1000a6329?OpenDocument

ICI Australia's name change to Orica was launched today with a wave of celebrations across its sites around Australia, New Zealand, Fiji, PNG and Asia.

The name change follows the sale of ICI PLC's majority shareholding in July last year. The sale created an independent company with Australian, New Zealand and international operations and more than 40,000 new shareholders.

Divestment of ICI's

Chlor-Chemicals, Klea and Crosfield Operations

http://www.ici.com/po_arch_story.jsp?archive=1&year=2000b&newsId=69

ICI has agreed terms with Ineos, a major global producer of Acrylics, Ethylene Oxide and derivatives, for the sale of its Chlor-Chemicals, Klea and Crosfield businesses. The consideration payable to ICI places a value on these businesses of about £325m in aggregate. Subject to certain conditions and regulatory approvals, completion is expected in January 2001 and net cash proceeds will be used to reduce Group indebtedness.

Klea and Crosfield

Chlor-Chemicals

October 27, 2004 Financial Times Information

ICI deal cuts link to chlorine company

Chemicals giant ICI finally severed all ties with Ineos Chlor yesterday after the chlorine company agreed to forgo one last pounds 55m payment in exchange for ICI's 15pc stake in the business.

ICI sold its chlorine division to Ineos Capital three years ago in a deal that saw ICI write off pounds 100m and set aside pounds 60m for Ineos Capital to draw upon. As part of the arrangement ICI kept a 15pc stake.

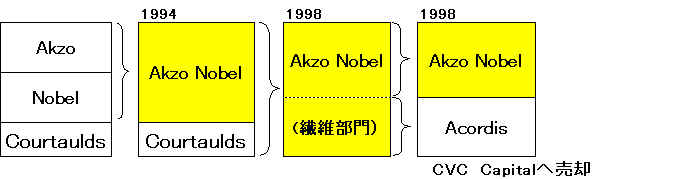

アクゾノーベルN.V.(Akzo Nobel N.V.) 中国事業まとめ

アクゾ

1969年 オランダの2つの会社「AKU」と「KZO」が合併し発足

AKU:Algemena Kunstzijde Unie 家庭用品および工業用化学繊維

KZO:Koninklijke Zout Organon

工業塩、基礎化学品、特殊化学品、塗料、

医薬品および消費者向け製品

94年2月 スウェーデンの化学会社ノーベル・インダストリーズと合併

現社名に

98年4月 英コートルズ (Courtaulds) を買収、アコーディス(Acordis)発足

99年末 英CVC Capital

Partnersへ売却

1999/4/9 Akzo Nobel receives offer of EUR 825 million for Acordis from CVC

1999/11/18 Negotiations for sale of Acordis to CVC completed

1999/12/23 信越化学にSHELLとの塩ビ合弁Rovin売却

2003/4 Akzo Nobel opens powder paints unit in Vietnam.

2003/7 Akzo Nobel to build new decorative coatings factory in China

2003/9 Akzo Nobel to Sell Catalyssts, Coating Resins and Phosphorus Chemicals

2004/1 Akzo Nobel expands powder coatings operations in China

2004/8 Akzo Nobel completes two Chemicals divestments (Catalysts and Phosphorus Chemicals businesses)

2005/10 Akzo Nobel expands chemicals activities in China

2006/1 Akzo Nobel Makes Progress With Chemicals Divestments

2006/10 Akzo Nobel Plans to Establish Chemicals Multi-Site in China

2006/11 Akzo Nobel opens new paper chemical plant in China

2007/3 Akzo Nobel announces intended sale of Organon BioSciences to Schering-Plough

2007/6 Akzo Nobel Sets USD 2 Billion Revenues Target in China

ICI rejected Akzo Nobel 's takeover approach

2007/7 ICI Rejects 650p per share proposal from Akzo

2007/8 Further Proposal from Akzo Nobel

Akzo Nobel Brings In Henkel To Win a Deal for ICI2007/8/13 Akzo、ICI 買収合意発表

2007/12 HSFCC Starts up Polyester Resin Project Phase I

2008/1 Akzo Nobel Opens Historic Plant in Dubai

2008/5 AkzoNobel Strengthening Specialty Chemicals Portfolio

2008/11 AkzoNobel got approval from NDRC for ethylene amines project in Ningbo

2009/5 AkzoNobel to Sell Stake in Pakistan PTA Activities to KP Chemcal of Korea

2010/6 AkzoNobel to divest National Starch business for $1.3bn

2010/9 AkzoNobel、常州Prime汽車塗料を買収

2006/10/12 Akzo Nobel 中国事業まとめ

Akzo Nobel Plans to Establish Chemicals Multi-Site in China

Akzo Nobel has today signed a memorandum of understanding with the Ningbo Chemical Industry Zone (NCIZ) which paves the way for the creation of a new chemicals multi-site in China. The company plans to install the facilities on a 50 hectare plot, making it one of the biggest sites for Akzo Nobel's activities in the world.

The project which provides the basis for a variety of future investments in grassroots chemicals production facilities would involve building plants for the manufacture of ethylene amines and chelating agents. The company also intends to produce organic peroxides 有機過酸化物 on the site. More details about these intended investments will be announced early next year.

The company already operates two production sites in Ningbo (Polymer Chemicals and Powder Coatings) and receives excellent cooperation from the local government.

The NCIZ not only offers excellent transport links, with a sea port located nearby, but official approval has also been given for a petrochemical cracker to be installed within the complex, which will give access to a number of basic raw materials.

(SINOPEC Zhenhai Refining and Chemical 1,000 thousand t/y)

Ningbo Chemical Industry Zone

Ningbo Chemical Industry Zone is the only new chemical industry zone approved by Ningbo Municipal Government. It is located in spacious shallows northeast of Zhenhai District of Ningbo on the south bank of the Hangzhou Bay. It has open and flat terrain and is suitable for the construction of large and medium projects. The planned area of the zone is over 58 [km.sup.2]. 2.8 [km.sup.2] of the total has already been developed with complete infrastructure facilities. More than 40 domestic and foreign enterprises have put their projects on stream in the zone.

April 2, 2003 Financial Times

Akzo Nobel opens powder paints unit in Vietnam.Akzo Nobel has opened a powder paints unit in Ho Chi Minh City, Vietnam in association with local company Chang Cheng Securities.

Akzo Nobel had already strengthened its position on the powder paints market with the acquisition of Ferro's operations in America and Pacific Asia (representing a turnover of $100 M).

Akzo Nobel sells Rovin Stake to Shin-Etsu

Akzo Nobel N.V. and Shell Chemicals Ltd. have reached final agreement with Shin-Etsu Chemicals Co. Ltd. of Japan on the sale of their PVC joint Rovin v.o.f.

Rovin, the number four player on the European PVC-market is a 50/50 joint venture between Akzo Nobel and Shell. Rovin has a Vinyl Chloride Monomer plant on Akzo Nobel’s Rotterdam Botlek site with annual production capacity of 550,000 tons and a PVC plant on Shell’s Pernis site with 295,000 tons capacity. In addition, Rovin has a 90,000 tons processing arrangement at the Neste Chemicals PVC plant at Porvoo, Finland.

Negotiations for sale of Acordis to CVC completed

http://www.fibersource.com/f-info/More_News/Acordis1.htm

Akzo Nobel has signed a contract to sell its Acordis fibers business to a CVC Capital Partners led consortium (CVC) for EUR 825 million.CVC will take a 64 percent stake in equity of the new company, with the Acordis management holding 15 percent; the remaining 21 percent will be acquired by Akzo Nobel.

Akzo Nobel receives offer of EUR 825 million for Acordis from CVC

http://www.fibersource.com/f-info/More_News/Akzo%20Nobel.htm

Akzo Nobel has received an offer of EUR 825 million from CVC Capital Partners for its Fibers business Acordis.

Acordis is the child of the parents Akzo Nobel and Courtaulds. This section describes the ancestors of Acordis. http://www.acordis.com/ 変遷図

Akzo Nobel has a long history of growth.

Akzo was formed as a result of a merger of Koninklijke Zout Organon and AKU. Nobel Industries was founded in 1984 through the merger of KemaNobel (established 1871) and Bofors, which was founded in 1646 but is no longer part of the Company.

Early in 1994, Akzo Nobel was formed through Akzo's acquisition of the Nobel shares owned by Securum and through a successful bid for the remaining shares.

In July 1998, Akzo Nobel acquired Courtaulds, the international chemical company which had leading positions in high-tech industrial coatings and man-made fibres.

2003/7/22 Akzo

Nobel

Akzo Nobel to build new decorative coatings factory in China

http://www.akzonobel.com/news/news_detail.asp?id=jGjfZTiClyc%3D&lan=English

Akzo Nobel is strengthening its position in the Chinese coatings market by investing in a new factory for decorative coatings. The facility, which will produce water-based wall paints for the Chinese market, will be built on the Company’s existing site in Suzhou near Shanghai, where Coatings already operates plants for its Car Refinishes, Transportation Coatings, Powder Coatings and Coil Coatings businesses.

September

5, 2003

Akzo Nobel to Sell Catalyssts, Coating Resins and Phosphorus

Chemicals

http://www.akzonobel.com/news/news_detail.asp?id=tBkm%2FI93gMc%3D&lan=English

Akzo Nobel announced Thursday it intends to sell three businesses from its Chemicals portfolio to create more room to maneuver for the Company. Catalysts, Coating Resins and Phosphorus Chemicals will be divested. Hans Wijers, Chairman of the Board of Management, said: "Akzo Nobel will create value by moving towards a more consistent portfolio of businesses."

January 20, 2004 Akzo

Nobel

Akzo Nobel expands powder coatings operations in China

http://www.akzonobel.com/news/news_detail.asp?id=1Hff6eJeObQ%3D

Akzo Nobel will expand its powder coatings operations in China. Two new factories will be constructed during 2004 in a move which will further build on Akzo Nobel's world leadership status in powder coatings and strengthen its position in China, the fastest growing powder market in the world.

The expansion plan involves building two new factories: one in Langfang - which is halfway between Beijing and Tianjin - the other in Guangdong Province in the south, on a site neighboring the existing powder operation in Shenzhen.

イーストマンケミカルカンパニー(Eastman Chemical Company)

1994年1月 イーストマン・コダックから分離独立 CHDM

Eastman Agrees to Sell Polyethylene Business to Westlake

Kodak to Sell Health Group to Onex for up to $2.55 billion

Essar and Eastman Announce Memorandum of Understanding for Joint Oxo Project

Eastman to Sell Spanish PET Plant to La Seda

Eastman to expand coal-based petrochemical production

Eastman provides key differentiated coatings, adhesives and specialty plastics products; is the world's largest producer of PET polymers for packaging; and is a major supplier of cellulose acetate fibers.

Eastman Expands Specialty Copolyester Capabilities

Eastman Announces Key Roles in 2 Major Gulf Coast Gasification Projects

Eastman and Green Rock Energy, L.L.C. Agree to Joint Investment in Industrial Gasification Project

Eastman buys out Green Rock in Beaumont gasification project

Mexico's Alfa to buy Eastman's Latin America PET business, assets

Wellman Sues Eastman Chemical For Patent Infringement

Thai Indorama affiliates to buy Eastman PTA, PET assets in Europe

Eastman to Sell PET, PTA Assets in Europe

SK Chemicals, Eastman Chemical Form JV for cellulose acetate tow

Eastman Acquires Specialty Polymers Manufacturing Facility in China

Eastman Reviewing Strategic Options for Performance Polymers Business

Eastman to Sell Performance Polymers PET Business

Eastman to Acquire Sterling Chemicals

Nov 04, 2005 Chemweek's Business Daily

Eastman to Expand Hydrocarbon Resin in China

Eastman Chemical says it will expand of hydrocarbon resin production capacity by 30% at its Nanjing Yangzi Eastman Chemical jv in Nanjing, China, citing growing demand in Asia. The expansion will increase production capacity of hydrocarbon resins at the site from 40 million lbs/year to 52 million lbs/year, Eastman says. "In the four years since our jv began production, demand for Eastman hydrocarbon resins has increased significantly throughout Asia, and most notably in China," says Damon Warmack, v.p. and general manager of Eastman's coatings, adhesives, specialty polymer and inks business. The plant is a 50/50 jv between Eastman and Yangzi Petrochemical.

Nanjing Yangzi Eastman Chemical Ltd. http://www.njyec.com/english/gsjj/gsjj-jj.htm

Nanjing Yangzi Eastman Chemical Ltd. (hereinafter referred to as "YEC") is a petrochemical enterprise jointly established by Nanjing Yangzi Petrochemical Industry Corporation and American Eastman Chemical Co., Ltd. (hereinafter referred to as "Eastman"). It has a registered capital of 13.5 million USD with an investment of 39.98 million USD. It mainly produces and sales products associated with C5 petrochemical resin. YEC was established on November 16th ,1998 and registered in Nanjing Hi-tech Industry Development Zone.

As a major project determined at Nanjing Golden Autumn Talks' 98, the construction of project was organized completely with the international practice in the operation mode, and commenced on June 28th, 1999. The construction for this world-level scale project of high-grade C5 hydrogenated petroleum resin plant with an annual capacity of 18,000 ton was completed on Oct. 30th, 2000. It was then commissioned with feedstock and turned out qualified products on December 20th, 2000. →23,600t(上記)

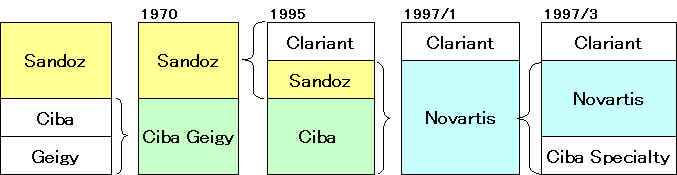

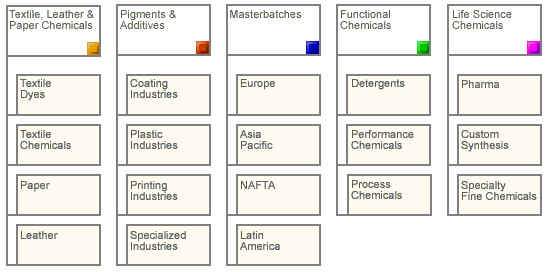

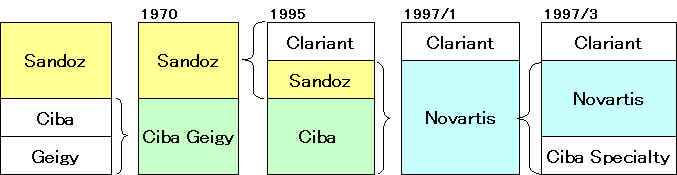

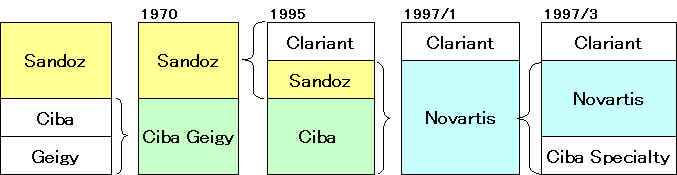

サンド 1886年設立

1995年夏 化学品部門がスピン・オフしクラリアントとして独立

(サンド社は97年1月にチバガイギー社と合併し、生命科学分野に特化した新会社ノバルティス Novartis が誕生)

97年7月 ヘキストのスペシャルティ化学品事業を買収

ヘキストがクラリアント株式の45%を取得(1999年に処分)

98年11月 チバ・スベシャリティ・ケミカルズとの合弁合意

同年末までに破談

2007/5 Clariant sells Custom Manufacturing Business to International Chemical Investors Group

2006/11 Clariant inaugurates 20 kt/year polymer site in Germany

2006/10 Clariant to acquire Masterbatches business from Ciba Specialty Chemicals

2004/9 Clariant Sells Its Stake In SF-Chem

2003/11 信越化学、クラリアント社のセルロース事業買収で合意

2003/8 Clariant unveils restructure plan.

2000 Acquisition of BTP

1999/7 Hoechst concludes disposal of its 45 percent stake in Clariant

1998/12 Clariant ends merger talks with Ciba Specialty Chemicals

1998/11 Ciba Specialty Chemicals and Clariant to merge

1998/4 BASFに吸水性樹脂事業を売却

1996/12 Clariant and Hoechst to combine their specialty chemicals activities

2007/11 Clariant Masterbatches Expands in Latin America Through Acquisitions and Investments

2008/3 High-Performance Pigment Expansion Project in China

2008/9 Clariant to be broken up after new CEO named

2011/2 Clariant plans acquisition of Süd-Chemie

2012/12 SK Capital to Acquire Textile Chemicals, Paper Specialties, and Emulsions Businesses of Clariant

Platts 2006/11/29

Clariant inaugurates 20 kt/year polymer site in Germany

Switzerland's Clariant has inaugurated a new 20,000 mt/year

low-molecular polyolefins production facility for its

Licocene brand of polymers, near its pigments and additives

division at Frankfurt-Hochst, Germany. メタロセン触媒を用いたオレフィンワックス・ポリマー

November 14, 2006

Clariant

Clariant focusing on profitable growth with stringent cost

management; Long-term topquartile performance targeted

・ Objective:

Above-average 10% Return on Invested Capital by end of 2009, up

25%

・ Profitable

growth at or above GDP, led by service-driven

businesses

・ Focus

on

fast-growing markets, particularly China and India

・ Wide-ranging

cost-cutting initiatives launched; emphasis on reducing

complexity

・ Global

site network to be optimized by closing 10% of the

sites

・ Existing job positions to

be reduced by 10%

by 2009

・ Performance

management initiatives to increase leadership skills and

entrepreneurial behavior

1999/7/9

Hoechst concludes

disposal of its 45 percent stake in Clariant

http://www.clariant.com/corporate/internet.nsf/vwWebFramesets/7C204C70E95BD6B6C1256D6A0050FE24?openDocument

Hoechst AG is pleased to announce the successful completion of its disposal of 45 percent of Clariant AG. (The sales of the whole of the Hoechst interest assumes the exercise of the relevant over-allotment options and the full conversion of exchangeable bonds).

On June 1, Hoechst AG announced its intention to make a substantial reduction in its 45 percent interest in Clariant AG. The enthusiasm of the market response has permitted the disposal of the entire stake, raising 2,827,634,128.8 euros.

1998/12/9

Clariant ends merger talks with Ciba Specialty Chemicals

http://www.clariant.com/corporate/internet.nsf/vwWebFramesets/FCF63E9932D31B93C1256D6A005789D1?openDocument

Clariant announced today that its Board of Directors has decided not to approve the proposed merger agreement with Ciba Specialty Chemicals. Negotiations to merge with Ciba Specialty Chemicals have been terminated.

1998/11/9

Ciba Specialty Chemicals and Clariant to merge

http://www.clariant.com/corporate/internet.nsf/vwWebFramesets/FCF63E9932D31B93C1256D6A005789D1?openDocument

The Chairmen of the Boards of Ciba Specialty Chemicals and Clariant announced today the signing of an Agreement in Principle to form the world's largest specialty chemicals company through a merger of equals. The new company will assume the name Clariant combined with Ciba's distinctive butterfly symbol.

1996/12/10

Clariant Ltd

Clariant and Hoechst

to combine their specialty chemicals activities

Move intended

to strengthen and expand business success

http://www.clariant.com/corporate/internet.nsf/vwWebFramesets/FCF63E9932D31B93C1256D6A005789D1?openDocument

Clariant Ltd, Muttenz/Switzerland, and Hoechst AG, Frankfurt/Germany, have entered into a general agreement with the intention of combining their respective specialty chemicals businesses. Clariant will merge Hoechst's specialty chemicals business with its own activities and integrate it. In exchange Hoechst will own a significant minority shareholding in the expanded Clariant Ltd and will furthermore join the existing Board of directors with 3 members, of which one will serve in the otherwise unchanged Committee of the board. Clariant will remain headquartered in Muttenz.

August 6, 2003 Chemical & Engineering News

CLARIANT UNVEILS RESTRUCTURE PLAN

Sale of several businesses aims to cut debt, boost profits

http://pubs.acs.org/cen/today/aug06a2003.html

After foundering since its 2000 acquisition of BTP, Clariant has embarked upon a wide-reaching transformation to reestablish itself as a leading specialty chemicals company.

Clariant, which reported a net loss of $36 million for the first half of 2003, will sell two major businesses--cellulose ethers and electronic materials--and several other unnamed operations. The units to be sold account for about 15 to 20% of total sales, the company says.

2000/06/08 Clariant

Clariant achieves rapid integration of BTP plc

http://www.clariant.com/corporate/internet.nsf/vwWebFramesets/AB10EA5E71410A11C1256D6A004B6806?openDocument

In less than three months

Clariant has integrated the businesses of the British fine

chemicals producer BTP acquired earlier this

year into three of its

divisions. The new integrated structures include people from both

Clariant and BTP in key positions.

A new force in fine chemicals

Leader in leather chemicals

An integrated Biocides business

| Annual Report 2003 The goodwill arising on the

acquisition of BTP plc. in 2000 (CHF 2,702 million) was

reassessed for recoverability in 2001. The resulting

special amortization amounted to CHF 1,226 million. |

2000/03/03 Clariant

Recommended Cash Offer by Clariant PLC for BTP plc, Offer Unconditional in All Respects

http://www.clariant.com/corporate/internet.nsf/vwWebFramesets/AB10EA5E71410A11C1256D6A004B6806?openDocument

Accordingly, Clariant PLC now owns or has received valid acceptances in respect of a total of 124,516,847 BTP Shares, representing approximately 70.3 per cent. of BTP’s issued ordinary share capital.

Clariant to acquire Masterbatches business from Ciba Specialty Chemicals

Clariant today announced

the intention to acquire the Ciba Specialty Chemicals'

masterbatches business for an undisclosed price in order to

further strengthen its globally leading position for color and

additive concentrates for plastic products. The transaction is

subject to approval of the relevant authorities and is expected

to be closed before the end of the year.

With production facilities in France, Saudi Arabia and Malaysia

and around 300 employees Ciba Specialty Chemicals' masterbatches

business generates annual sales of approximately CHF 80 million.

The acquisition will help Clariant's Masterbatches division to

optimize its service capabilities to the European countries and

to enhance its presence in the fast growing Middle Eastern and

Asia Pacific markets.

"The acquisition of Ciba's masterbatches business perfectly

fits into Clariant's strategy of expanding number one market

positions and driving growth in service-driven businesses. It

gives us the opportunity to leverage our technological expertise

and to further provide innovative solutions", said Chief

Executive Officer Jan Secher.

Clariant Masterbatches Expands in Latin America Through Acquisitions and Investments

Clariant Masterbatches has received regulatory approval to purchase MasterAndino S.A., an important manufacturer in Colombia. The transaction, which was finalized at the end of October, will strengthen Clariant’s ability to offer superior value to its customers throughout Colombia. Clariant will acquire the product inventory, equipment and business portfolio of MasterAndino and will continue manufacturing at the existing MasterAndino plant until early in 2008, when both operations will be merged in a newly constructed Clariant Masterbatches facility in Cota, on the outskirts of Bogota.

March 12, 2008 Clariant

High-Performance Pigment Expansion Project in China

Clariant International Ltd and Zhejiang Baihe Chemical Holding

Group today announced the expansion of the Hangzhou Baihe

Clariant Pigments Co. LTD joint venture by investing in a

world-scale plant for the production of Quinacridone specialty

organic pigments. The new plant will be built at the existing

joint venture facility located in Hang Zhou City, Zhejiang

Province (PRC).

Quinacridone

organic pigments increasingly find a wide application in

high-performance coatings - including architectural, automotive

and industrial applications as well as plastics and printing

applications.

Hangzhou Baihe Clariant Pigments Co. LTD currently operates a

world-scale high-performance Azo organic pigments at the same

site.

Sep 21, 2008

Reuters

Clariant to be broken up after new CEO named

Swiss speciality chemicals company Clariant could be broken up

after it named a new chief executive earlier this month, a

newspaper reported on Sunday.

Citing unnamed sources, the Sonntag newspaper said the struggling

company planned to sell its pigments and additives

division to a competitor and its textile,

leather and paper chemicals unit to a private equity company.

That would leave the company with just its

functional chemicals and masterbatches divisions, which make up just half its

turnover, the newspaper said. Clariant was not immediately

available to comment on the article.

acquisition of Mead Johnson & Company's global adult medical nutrition business

Novartis to acquire Hexal AG and Eon Labs, creating the world leader in generics

Novartis announces agreement to acquire remaining stake in Chiron

Swiss drug giant Novartis targets China vaccines sales

Novartis creates new strategic biomedical R&D center in Shanghai

Nestle to Acquire Novartis Medical Nutrition, Moving Toward Nutrition, Health and Wellness

Novartis to acquire 25% stake in Alcon from Nestlé with right to take over majority ownership

http://www.novartis.com/about_novartis/en/history.shtml

On 7 March 1996, the news struck the business world like a thunderbolt. Sandoz and Ciba, two proud Swiss-based companies with almost three hundred years of tradition, have agreed to become one. The creation of Novartis, as the new company was called, was at that time the largest corporate merger in history.

*Novartis then divests Ciba Specialty Chemicals and Novartis Seeds (to form Syngenta with AstraZeneca).

Novartis creates new strategic biomedical R&D center in Shanghai

Novartis announced plans today to build an integrated biomedical Research & Development center in Shanghai's Zhangjiang Hi-Tech Park that will become an integral part of the Group's global research and development network.

日本経済新聞 2003/2/13

会社研究 ノバルティス(スイス)

M&Aで規模の拡大追求 「世界標準」で積極情報開示

▼役員報酬も個別開示

▼決算を米ドル建てに変更ノバルティスは、ライバルであるロシュの議決権株を著名投資家のマーチン・エブナー氏から譲り受け、21.3%を保有する。

▼日本市場に照準

Novartis acquires Roche

stake

http://www.ims-global.com/insight/news_story/0105/news_story_010509.htm

The pharmaceutical industry was surprised on May 7 2001, when Novartis announced that it had acquired a 20% voting stake in fellow Swiss-based pharmaceutical giant, Roche.

50.1% of Roche's bearer voting shares are still held by its controlling shareholders, the Hoffmann and Oeri-Hoffmann families - although they own less than 10% of the issued securities.

日本経済新聞 2003/3/7 夕刊

ノバルティス ロシュ株を買い増し 3分の1まで 合併を働きかけ

中外製薬の経営に影響も

スイスの医薬品最大手ノバルティスが、2位ロシュの株式をほぼ3分の1まで買い増し、合併を働きかけていることが明らかになった。買い増しがさらに進むと、昨年ロシュの傘下に入った中外製薬の経営に影響が出る可能性がある。

ノバルティスは2001年3月、スイスの著名投資家からロシュ株の20%余りを譲り受けた。

2006/7/12 新華社

Swiss drug giant

Novartis targets China vaccines sales

Swiss pharmaceutical giant Novartis AG announced in Beijing it

would increase investment in vaccines research

and production in China.

The company will join international manufacturers Glaxo Smith

Kline and Sanofi Pasteur in competing for the booming Chinese

vaccines market, said Wednesday's Beijing News.

China's vaccines market is expanding at a rate of 20 percent

annually, with the market value expected to hit three billion

yuan (375 million U.S. dollars) this year.

Novartis has just completed the purchase

of U.S. vaccines maker Chiron Corp. at a cost of 5.1 billion dollars.

2005/10/31 Novartis

Novartis announces agreement to acquire remaining stake in Chiron

| ・ | Acquisition provides Novartis with attractive growth platforms in the dynamic vaccines market and in a rapidly growing molecular diagnostic business |

| ・ | Biopharmaceutical activities to be integrated into Novartis Pharma drugs business |

| ・ | Annual cost synergies of USD 200 million within three years |

| ・ | Chiron Independent Directors unanimously support offer of USD 45.00 per share in cash, or USD 5.1 billion |

About Chiron

Chiron Corporation is a pharmaceutical company based in

Emeryville, California, that addresses patient needs with more

than 50 diverse products to detect, prevent and treat disease

worldwide. The company, which had 2004 overall sales of USD 1.7

billion, operates in three business segments: Vaccines, which

offers more than 30 products including influenza, meningococcal,

travel and pediatric vaccines; Blood Testing, which develops and

commercializes a range of blood safety products used by the blood

banking and transfusion medicine industry; and

Biopharmaceuticals, which discovers, develops, manufactures and

markets a range of therapeutic products focusing on infectious

disease and cancer. R&D efforts are focused on developing

high-value products for infectious disease and cancer. Founded in

1981, Chiron has approximately 5,400 associates worldwide.

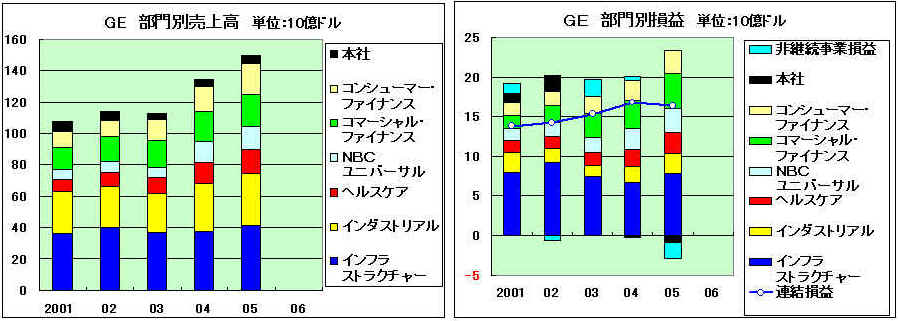

ゼネラルエレクトリックカンパニー(GENERAL ELECTRlC COMPANY)

→ SABIC Innovative Plastics

本社:米国コネティカット州フェアフィールド

1982年4月 エジソン・エレクトリック・ライト・カンパニーと、トムソン・ヒューストン・エレクトリック・カンパニーが合併、現社名に

98年末 スペイン・カルタヘナに年産13万トンの大型ポリカーボネート(PC)製造設備

米国アラバマ州バークヒルズとスペインのカルタヘナで2002年には年産100万トン体制

GEシリコーン 98年欧州のシリコーン事業をバイエルと統合、

GEバイエル・シリコーン・ヨーロッパを設立

GE to acquire Crompton silicone unit (OSi Specialties)

Crompton Announces Acquisition of GE's Specialty Chemicals Business

GE Plastics announces the next generation of Polycarboneate

2004/4 GEメディカルシステムから、「GE Healthcare」と名称変更

GE Plastics adds capacities for plastics compounding and film extrusion in China

GE Reorganizes; Combines Plastics and Silicones

GE dedicates third phase of GE Advanced Materials, Plastics Complex in Cartagena

GE Plastics and PetroChina to Build Chinese Polycarbonate Plant

2007/2 GE Plastics, PetroChina Suspend Work China Polycarbonate Project

Thermoplastic polyimide from GE

2006/9 Sale of GE Advanced Materials Business to Apollo Management, L.P.

2006/11 GE Silicones will change to Momentive Performance Materials

2007/1 General Electric has asked for bids on its plastics business

2007/1 GE to Acquire Abbott’s in vitro and Point-of-Care Diagnostics Businesses for $8.13 Billion

2007/5 GE Announces Sale of Plastics Business to SABIC for $11.6 Billion

2007/8 European Commission clears SABIC acquisition of GE plastics

2007/7 GE Announces Termination of Contract with Abbott

2007/8 Bayer MaterialScience is to transfer EXATEC shares to GE Plastics

GE completes sale of plastics business to SABIC at $11.6 billion

2007/12 GE, Novavax team up on pandemic flu vaccine

2008/5 G.E. Looks to Sell Its Appliances Unit

2008/6 SABIC to build new PP compounding plant in Genk

2010/9 SABIC opens second PEI plant in Spain

CHEMICAL WEEK NEWSWIRE 2003/12/9

GE Reorganizes; Combines Plastics and Silicones

GE says it will reorganize all businesses under two groups -“growth engines” and “cash

generators”- effective

January 1. The plan includes combining GE's plastics, silicones,

and quartz business to form a new $9-billion/year unit, GE Advanced Materials,

that will be one of the cash generators. John Krenicki, currently CEO of GE

Plastics, has been named CEO of GE Advanced Materials

(Pittsfield, MA). GE's water treatment business will become part

of GE

Infrastructure (Wilton, CT), a $4-billion growth engine business, that will include GE's security and

sensors businesses as well as GE Fanuc Automation. William

Woodburn, currently CEO of GE Specialty Materials, will become

CEO of GE Infrastructure. GE's other growth platforms will be

commercial finance; consumer finance; energy; healthcare;

NBC-Universal; and transportation. Its other cash generators

include its consumer business; equipment services; and insurance.

British Plastics &

Rubber 2006/11/12

Thermoplastic polyimide from GE

GE Plastics is to commercialise a thermoplastic polyimide under

the name Extem. It describes the new TPI as 'the first truly

new polymer in almost two decades', providing 'superior

performance, while eliminating the drawbacks of semi-crystalline

materials, imidized thermosets, and competitive amorphous

thermoplastics'.

The material combines melt processability with very high thermal,

chemical and mechanical properties. It is also inherently

flame-retardant without the use of halogenated additives.

The only other supplier of TPI is Mitsui Chemicals, with its Aurum product.

チバ・スペシャルティ・ケミカルズ(Ciba Specialty Chemicals Inc.)

チバ

1848年 設立 合成染料を中心に発展、医薬品、合成樹脂、農薬、写真機材などで事業拡大

ガイギー

コールタール染料、医薬品、さらにDDTの発明を機に農薬にも進出

チバ/ガイギー/サンド 「利益協定組合」を結成、

チバ/ガイギー 70年に合併

* In 1970 Ciba and Geigy merge to form Ciba-Geigy Ltd. In 1992, the company is renamed Ciba in line with the introduction of a new logo.

97年1月 チバ社とサンド社が合併 生命科学分野に特化した新会社ノバルティス

Novartis

同年3月 スペシャリティケミカルズ部門(添加剤事業、コンシューマーケア事業、ポリマー事業、顔料事業、染料事業)が独立し、チバ・スペシャルティ・ケミカルズとして発足

98年11月 クラリアントとチバ・スベシャリティ・ケミカルズとの合弁合意

同年末までに破談

2004/2 Ciba to focus on Asia for all new plants

2004/11 Ciba Specialty Chemicals acquires remaining 50% stake in Daihan Swiss of Korea

2005/9 Ciba Specialty Chemicals to invest in a new antioxidant production plant in Singapore

2006/2 チバ・スペシャルティ・ケミカルズ、テキスタイル機能材ビジネスの売却でハンツマン社と合意

Ciba Specialty Chemicals

introduces its new corporate identity

http://www.cibasc.com/view.asp?id=1175&nArticleId=213

Since 1 January 1997, Ciba Specialty Chemicals has operated as an autonomous subsidiary within Novartis Inc., the life sciences company formed through the merger of Ciba and Sandoz. As part of the merger agreement, Ciba Specialty Chemicals is expected to spin-off from Novartis to form an independent company prior to, but no later than, Novartis' 1997 ordinary general meeting.

Ciba Specialty Chemicals is made up of the former Ciba's industrial businesses - Additives, Consumer Care, Performance Polymers, Pigments and Textile Dyes.

2004/11/22 Ciba Specialty

Chemicals

Ciba Specialty Chemicals acquires remaining 50% stake in Daihan

Swiss of Korea

http://www.cibasc.com/index/med-index.htm?reference=31758&checkSum=AEEF10AA5F82FC5142B05FB81F98F2C6

Ciba Specialty Chemicals today announced the acquisition of the remaining 50 per cent stake in the Daihan Swiss Chemical Corporation in Korea for a consideration of 28.5 billion Korean Won (CHF 30.5 million). The transaction gives Ciba 100 per cent of the equity and is expected to take effect before the year end. It is subject to the customary regulatory approvals. Daihan Swiss makes and markets pigments and preparations for the Korean coatings, plastics and inks markets, and exports products globally through Ciba Specialty Chemicals. It has 225 employees and a state of the art research and development facility.

DPI(once called Daihan Offset Printing Ink Manufacturing Co.)

http://www.dpi.co.kr/english_2003/company/introduct.aspSince its establishment in 1945, DPI, once called Daihan Offset Printing Ink Manufacturing Co., has led the paint and ink Industry in Korea. The company has taken giant strides to become a true national enterprise in various business areas

including paint, ink, resin and plastic. The famous "Deer" brand has been at the forefront of this growth, and embodies our special skills and meticulous attention to detail for success in a demanding world.

2005/9/30 Ciba

Specialty Chemicals

Ciba Specialty Chemicals to invest in a new antioxidant

production plant in Singapore

http://www.cibasc.com/index/med-index.htm?reference=40279&checkSum=08675729EF8940F1E2531488D9929FC1

* State-of-the-art

manufacturing facilities for antioxidants for plastics on Jurong Island,

Singapore

* New plant will cover the growing demand for antioxidants for

plastic manufacturing especially in Asia and the Middle East

Ciba Specialty Chemicals has decided to make a major

investment of around CHF 125 million (USD 100 million) in a new

production plant for antioxidants for plastics in Singapore. The

new plant comprises synthesis, blending and form giving

facilities for granular forms of Ciba(R) IRGANOX(R)

1010 and Ciba(R) IRGAFOS(R) 168 and its blends, with an overall initial capacity

of 30.000

metric tons.

State-of-the-art technology and innovative manufacturing

processes will ensure Ciba’s longterm competitiveness. The

plant’s location in the fast developing

Jurong Island petrochemical complex offers excellent

infrastructure and support facilities, backward integration into

key raw materials and options for future expansion. Production

start up is expected in early 2008.