CARADOL polyether polyols are available in a wide range of molecular weights and it is this variety which gives rise to a wide range of processing and application possibilities.

サウジ石化一覧表 追加 National Petrochemical Industrial Co. (NATPET)

大型石化計画 中東でラッシュ GCC/Japan Partnerships: A Model of Four Dimensions

First solar power plant opens in Farasan

Sinopec Signed MOU with Aramco

Accord Inked with SABIC for Marketing Polyolefin Products of Fujian Joint Venture

Saudi move clears way for outside

investment

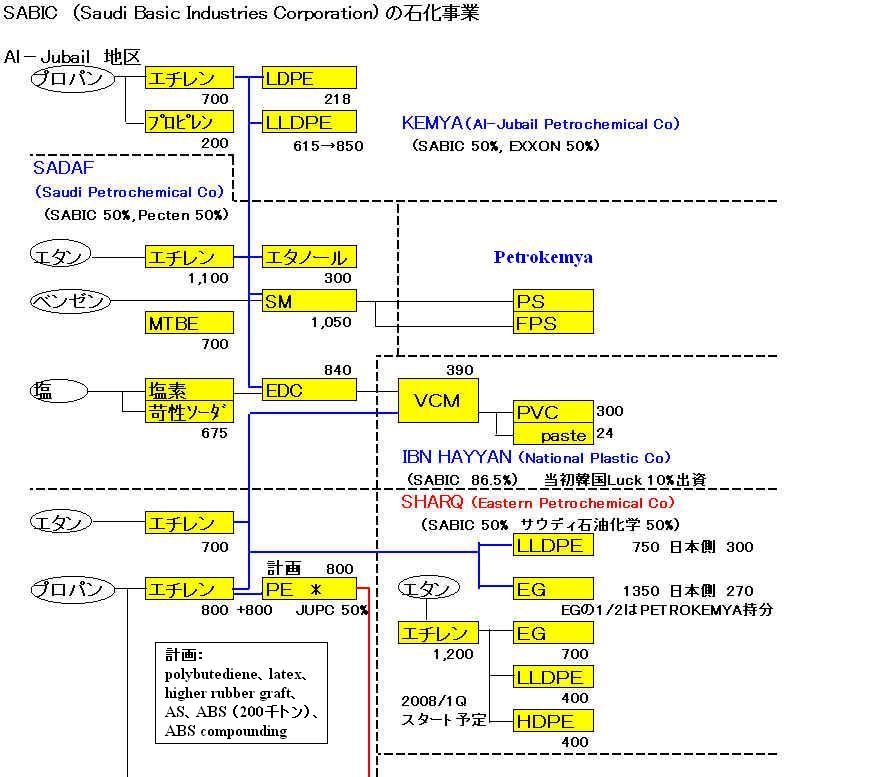

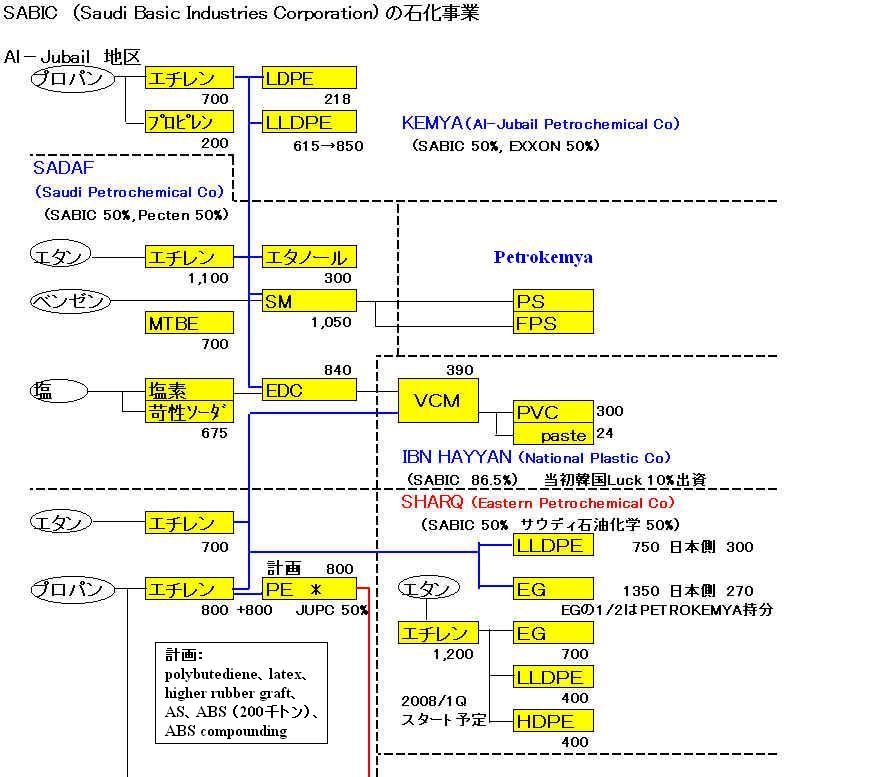

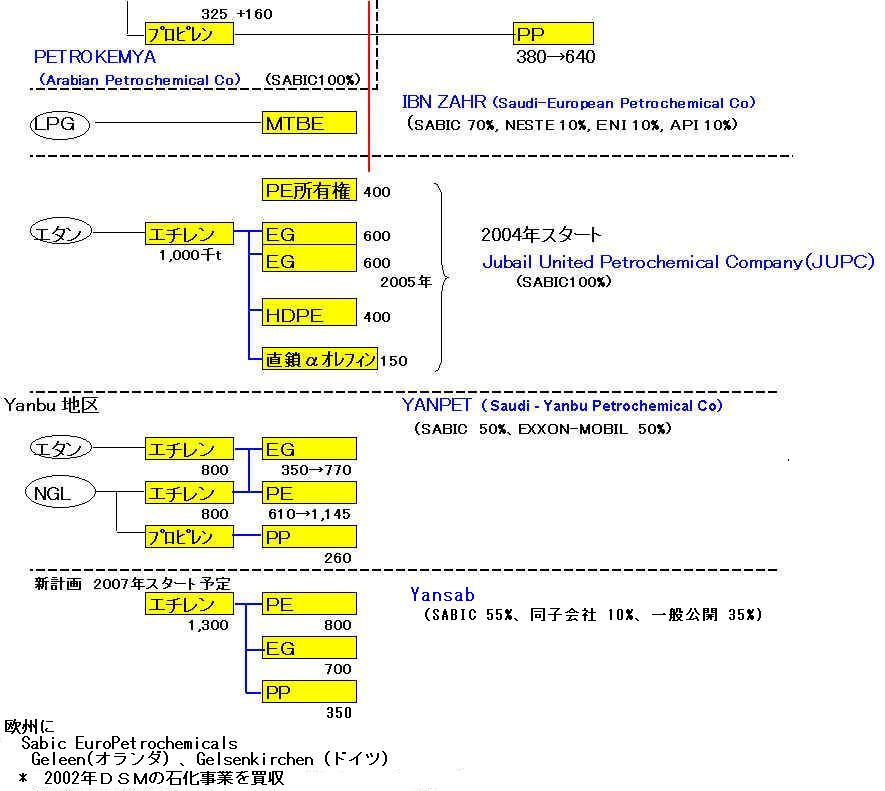

SABIC サウディ石油化学 20年のあゆみ SABIC現状

SABIC Story SABIC History SABIC Innovative Plastics

SABIC plots global growth strategy

SABIC DSMの石化部門取得 → SABIC EuroPetrochemical B.V.,

SABIC ACQUIRES DSM's POLYOLEFINS

2005/4 SABIC EuroPetrochemicals to continue as SABIC Europe

SABIC Europe is

aiming to be one of the top two marketers of polyolefins in

Europe.

SABIC Enichemの51%取得を交渉 → 交渉決裂

SABIC Europe Cracker Project in Geleen on hold

Huntsman to Sell European Commodities Business to SABIC

SABIC, planning 3rd PP plant in Europe

Sabic favours northeastern China for its potential cracker investments

Acquisition of Scientific Design Company, Inc.

SABIC to Acquire Owens Corning’s Share in StaMax BV

SABIC、JV訴訟でExxonMobilに敗訴、賠償額416.8百万$

SABIC and ExxonMobil reach a full settlement of their disputes

Samsung Engineering wins Petrokemya's buten-1 plant

SABIC Euro revives plan for 550 kt/yr Dutch cracker at Geleen

SABIC plans to build second ethylene glycol plant at Jubail United

Saudi Arabia's SABIC to produce PP block copolymer-grades in 2004

SABIC to build new 1.3-mil mt/yr cracker at Yanbu, Saudi Arabia 2003/12 SABIC役員会承認

SABIC awards contract to Technip for Yansab ethylene and propylene plant

SABIC signs LOI with the US Flour Company for YANSAB utilities

TEC, サウジアラビア・SABIC社より2基目の大型EO/EGプラント受注 2004/1

Germany's Linde gets linear alpha olefins plant deal In Saudi Arabia

Saudi SAFCO and SABIC unit to build steel plant

LyondellBasell grants Spheripol PP technology license to SABIC affiliate for a 525 KT plant

Lummus Technology awarded propane dehydrogenation contract from Ibn Rushd

SABIC and ExxonMobil Chemical sign Heads of Agreement for new Elastomers project in Saudi Arabia

Albemarle and SABIC Affiliate, TAYF, Create a Strategic Catalysts Joint Venture

Celanese and SABIC Announce Polyacetal Expansion in Middle East

SABIC Plans Iron and Steel Plant in Jubail Industrial City

SABIC signs agreement with KAUST to launch new research and innovation center

SHARQ増設計画ーエチレン 120万、LLDPE 40万、HDPE 40万、EG 60万トン

サウジ治安問題 Yanbu、Al-Khobar サウジの石油施設でテロ未遂

サウディ石油化学など、共同出資会社「シャルク」の第3次事業拡張計画を発表

SHARQ、増設計画で覚書締結(エチレン:S&W、EG:三星、PE:Linnde)

SHARQ signs three contracts for the implementation of mega expansion project in Jubail

2004/2 サウジ、Petrokemya のHDPE、LLDPE(各40万トン) 2004/3月スタート

2008/2 Petrokemya launches ABS facility

2009/3 Shaw to Provide Front End Engineering Design Services for ABS Plant in Saudi Arabia

2004/6 Sabic In Talks With Sinopec On Investing In Ethylene Proj

2004/6 SABIC Board endorses expansion investments

of 24 billion Saudi Riyals

2004/6 サウジメタノール、170万トン増設

AR-RAZI Saudi Methanol Company:三菱ガス化学ほか出資

SABIC (AR-RAZI 5) PROJECT awarded to Mitsubishi Heavy Industries

2004/6 China's Dalian Shide, SABIC aim a $5billion petrochemical complex in Northeast China

2004/10 SABIC, Dalian Shide mull

refinery-petrochemical project in China

2004/7 Jubail United MEG plant to

start commercial sales in November → October

2004/9 中国石油、SABICと合弁でサウジでナフサクラッカー

2004/10 SABIC denies take over of Nova; Mexican plans close to fruition

SABIC-Iran cracker, integrated complex joint venture plan stalls

2005/5 Saudi governor launches acetic acid technology at Ibn Rushd

2005/7 サウジYansab のEGプラント 東洋エンジが受注

SABIC、YansabのLDPE,PPの建設でAker Kvaerner/Sinopec JVとLOI締結

2005/8 SABIC selects Aker Kvaerner to double Ibn Zahr PP III plant

2005/12 SABIC's Yansab receives nod for 35% IPO on Saudi stock exchange

2006/2 SABIC signs a LOI with S&W for the engineering, procurement and construction of HDPE plant at Yansab

2006/5 Establishement of Saudi Kayan Petrochemical Company

2007/1 SAUDI KAYAN signs contracts for new PP and LDPE plants

2007/11 Saudi Kayan to raise $4b in debt

2009/1 Debt pricing threatens Saudi Kayan SIDF funding

2010/8 Sabic Signs Technology Licensing Agreement With Lurgi for Kayan's oleo chemicals

2006/6 SABIC Affiliate YANSAB signs SR 13.125 Billion (USD 3.5 Billion) loans and facilities agreements

2006/11 SABIC and ExxonMobil Chemical to study petrochemicals expansion in Saudi Arabia

2006/12 SABIC forms Polystyrene Joint Venture with Baser Petrokimya in Turkey

2006/12 Sabic expansion scheme covers India and China

2007/5 Saudi Kayan awards hdpe plant construction contract to the chinese Huanqiu company

2007/5 SABIC to join hands with Sinopec over new China ethylene project 天津計画

2008/1 SABIC and SINOPEC sign heads of agreement towards formation of 50:50 jv of PE/EG in Tianjin

2009/1 SABIC and Sinopec Celebrate 3.2 Million-Ton Petrochemical Complex at Tianjin, China

2007/5 GE Announces Sale of Plastics Business to SABIC for $11.6 Billion

2007/8 European Commission clears SABIC acquisition of GE plastics

2007/8 GE completes sale of plastics business to SABIC at $11.6 billion

2008/11 Dow and SABIC Announce Start Up of World’s Largest UNIPOL PP Train

2012/6 SABIC and ExxonMobil to Proceed with Specialty Elastomers Project at Al-Jubail

Foster Wheeler Awarded FEED/PMC Contract for New Petrochemicals Complex in Saudi Arabia

Saudi Polyolefins Company (NPIC・Tasnee & Basell PP 450千t)

Stalled Saudi NatPet PP project may be expanded to 420 kt/yr

Saudi Alujain appoints financial advisor for new petrochemical project (上記の原料C3計画)

Saudi Arabia/ Alujain Invests $1 Billion In Petrochemical Projects

Sahara Petrochemical Company PP with Basell 調印

Sahara Petrochemical and Basell sign agreement for construction of PP & propane dehy complex

Saudi International Petrochemical Company (SIPCHEM)

Sipchem Appoints NCB to Manage its Initial Public Offering

maleic anhydride/butanediol project

Saudi Sipchem starts butanediol commercial sales from Al-Jubail

Eastman, Saudi's Sipchem sign acetyls technology deal Foster Wheeler Awarded Contract

Tasnee & Acetex establish jv for acetic acid, VAM and methanol 中断

Saudi Sipchem, Helm Arabia sign AA-VAM projects JV, offtake deal 着工

Celanese Brings Suit Against Saudi Arabian Acetyls Company

Ineos to join Sipchem olefins venture in Saudi Arabia

Sipchem shelves plans of 1.3 mln tpa cracker project at Al-Jubail

Sipchem & Hanwha Chemical Sign JV Agreement for Building a Polymers Compounding Plant

Tasnee & Sahara Olefins Company and Basell sign joint venture agreement

Rohm & Haas and Tasnee & Sahara Olefins Company Form JV to Make Acrylic Monomers in Saudi Arabia

Basell JV with Sahara Petrochemical Company secures Shariah compliant financing

Al-Zamil Group and Chemtura metal alkyls JV Gulf Stabilizers Industries

Huntsman, Al-Zamil JV breaks ground on new ethyleneamines plant

Advanced Polypropylene Announces Successful Start-Up of PP Complex in Al-Jubail

Saudis ink deal with Chiyoda for $240-mil methanol plant

Saudia Arabia's IMC to start up mega methanol plant in November

Saudi NIC, Al-Zamil to jointly develop new C2 at Al-Jubail

preliminary bids for olefins complex

↓

Saudi Chevron Phillips (Chevron Phillips Chemical and Saudi Industrial Investment Group) SM

n-Paraffins, LAB Complex Gulf Farabi Petrochemicals (Riyadh)

Yusuf bin Ahmed Kanoo Group Plans Three Units at Al Jubail Complex (including PP)

Saudi's NPI to form jvs for methanol and derivatives Ethane/propane cracker計画も

Gulf Advanced Chemical offered BDO plant contract to Kvaerner

住友化学 ラービグ計画解説(住化) The Rabigh Refinery

Japan Sumitomo Chem May Build Mideast Cracker Project

住化、サウジ・アラムコと石油精製・石油化学事業開発の共同企業化調査実施サウジの石化複合プラント 日揮がFCCの基本設計受注 アラムコと住化から

ラービグ計画のEG技術、シェル/三菱化学勢がライセンス供与へ

丸紅・日揮 伊藤忠 サウジで発電・淡水化 1200億円投資 住化合弁に供給

丸紅等、サウジで大規模発電造水等の事業権を獲得 住友化学・サウジアラムコ社より受注

Foster Wheeler awarded an EPC contract by PETRORabigh for the utilities and offsites

住友化学 サウジ合弁、6600億円調達 銀行団と合意 事業規模1兆1000億円

日揮、サウジアラビアで石油精製・石油化学統合コンプレックスを受注

Work on Saudi Rabigh refinery, petchem project to start by April

三井造船、Petro-Rabigh社向けEG、PO製造プラントを受注

日本貿易保険 過去最大の保険 22億ドル 住化のサウジ合弁に

「ペトロ・ラービグ社」の新規株式公開(IPO)の売出価格等の決定

Saudi PetroRabigh says may delay some units

Aramco To Sign Sumitomo Deal For Petro Rabigh Expansion

サウジ・アラムコとの「ラービグ第 2 期計画」の共同企業化調査実施

PetroRabigh sees net loss balloon to $63 million on start-up woes 決算

KBR's Phenol Technology Selected for Rabigh II Project Feasibility Study

Saudi Aramco acquired a 40% stake in Petron, the downstream unit of the Philippines National Oil Co.

Dow is Selected for Negotiations on New Petrochem Complex

Saudi Aramco-Dow Chemical project costs surge to $22 bln -industry

Saudi Aramco, Sinopec to conclude Qingdao refinery JV deal soon

Saudi Aramco and Total confirm Jubail Refinery Project

Saudi Aramco and ConocoPhillips Confirm Yanbu Export Refinery Project

SABIC seeks deals with Saudi Aramco

Saudi Aramco eyes $129 bln investment in next 5 yrs

Innovene and Delta Oil Agree To Explore Major Petrochemical Investment in Saudi Arabia

Ineos Confirms Cancellation of Saudi Ineos-Delta ethylene Project

Brazil's Ultrapar licenses Saudi's

PMD use of ethanolamines and ethoxylates technology

PMD $3.5 billion Saudi

petrochemical project on track

PMD selects Basell's processes for new polyolefin plants in Saudi Arabia

Ma'aden and SABIC to create a strategic joint venture in a phosphate minerals project

New contract for mega size ammonia plant in Saudi Arabia Ma'aden/Sabic JV

Ciba and Astra Polymers sign JV agreement on customer specific antioxidant blends in Middle East

住友商事 サウジアラビアで炭化珪素(SiC)の製造事業に参入

SABIC was established in 1976 to

add value to Saudi Arabia's natural hydrocarbon resources. Today

we are among the leading international petrochemical companies in

terms of sales and product diversity. Headquartered in Riyadh, we

are also the Middle East's largest non-oil industrial company.

Our businesses are grouped into five core sectors: Basic

Chemicals, Intermediates, Polymers, Fertilizers and Metals. Each

sector consists of several Strategic Business Units (SBUs) that

are entirely dedicated to the customers they serve. Our

manufacturing network in Saudi Arabia consists of 18 world-scale

industrial complexes operated by 16 affiliates. (2000年に1社追加) Most of these affiliates are based in

Jubail Industrial City on the Arabian Gulf. Two are located in

Yanbu Industrial City on the Red Sea and one in the Eastern

Province city of Dammam. We are also partners in three regional

ventures based in Bahrain.

The vision that led to our creation was closely associated with

the aspirations of Saudi Arabia as a developing nation. We

continue to play an important role in achieving some of those

aspirations, including the development of the country's human

resources. We are also committed to Saudi social and cultural

values and international business and environmental standards.

SABIC is owned by the Saudi Government (70%) and the private

sector (30%). Private sector

shareholders are from Saudi Arabia and other countries of the

six-nation Gulf Cooperation Council (GCC).

| 2005/12/9 SABIC サウジ基礎産業公社

(SABIC)は時価総額が中東で最大の企業であり(1,500

億米ドル以上)、世界の10大石油化学製品メーカーの1社です。ポリエチレン、ポリプロピレン、グリコール、メタノール、MTBE、肥料のマーケット・リーダーであり、世界第4

位のポリマー・メーカーです。 |

2006/4 Establishement of Saudi Kayan Petrochemical Company

Petrokemya PE(HDPE40万トン+LLDPE40万トン)の50%持分を持つ

* SABIC、Jubail United でNo.2 EG 625千トン建設予定

* SABIC to build new 1.3-mil mt/yr cracker

at Yanbu, Saudi Arabia 2003/12

November 2000

SABIC Completes Expansion Projects To Increase Polyethylene Production

http://www.saudiembassy.net/publications/newsletter2000/11-h.html

The company completed a 300 million U.S. dollar expansion project in March to double the production of styrene at Saudi Petrochemical Company (Sadaf) in Jubail along the Arabian Gulf. The plant, part of the Sadaf complex that also manufactures ethylene, MTBE, caustic soda and industrial ethanol, was built in 1985 and produced 560,000 tons per year (tpy) of styrene before the expansion. The plant now produces 1.1 million tons per year of styrene, making it the largest single-plant producer in the world.

Expansion at two other SABIC plants, Kemya and Sharq, was also completed recently. These two plants produce polyethylene and the expansion projects raised production by 635,000 tpy.

Another SABIC plant that has undergone expansion this year is Yanpet, located at the Yanbu Industrial City along the Red Sea. Capacity at this plant has been increased almost three-fold to 1.85 million tpy of polyethylene. A new polyethylene plant has also been built at Yanpet, adding another 268,000 tpy of polyethylene production to the complex.

地図

サウディアラビア パイプライン

アル・ジュベイル

「サウディ石油化学 20年のあゆみ」から

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Saudi Basic Agrees To Buy Ibn Zahr Stake From Neste Oil

SABIC today completed operational procedures to purchase the Finnish Neste Oil's 10% share of capital in SABIC affiliate, IBN ZAHR. US$ 120 million, representing the share, has been paid to Neste Oil. The appropriate amendment to the company's Articles of Incorporation was signed today.

Accordingly, as from June 1, 2006, SABIC owns 80% of IBN ZAHR capital. The Italian Fortium Company owns 10% and the Arab Petroleum Investments Corporation (APICORP) owns the remaining 10%.

SABIC originally announced the signing of this agreement on March 26, 2006.

(日刊ケミカルニュース 2000/11/30)

エチレン100万トンン柱に SABIC次期大型石化計画

EG46万トン、PE40万トン 19億ドル投じ2004年稼働

新しい石化事業は、ジュベール・ユナイテッド・ペトロケミカル・カンパニー(JUPC)が担当。JUPCは、SABICグループの化学分野で17番目の生産会社としてこのほど設立された。石化コンプレックスの建設に関しては、米フルア・ダニエルをプログラム管理サービスの請け負い業者にすることで同社サウジ現地法人と基本合意した。新プラントに採用するプロセス技術は、今年末までに選定する予定。

石化コンプレックスは、年産100万トンのエチレン設備をはじめ同46万トンのEG、同40万トンの高密度ポリエチレン(HDPE)および同10万トンの直鎖αーオレフィン(LAO)の設備で構成。操業開始は2004年後半を計画している。総投資額は19億ドル以上になる見通し。

SABIC affiliate awards one million metric ton ethylene project to Halliburton KBR, Chiyoda & Mitsubishi

http://www.sabic.com/en/press/press_details.asp?id=40

JUBAIL UNITED is building a mega-olefin complex at Al-Jubail Industrial City in the Eastern Province of the Kingdom of Saudi Arabia. The company’s plans include an ethane cracker to produce 1,000,000 mt/y of ethylene, a 150,000 mt/y linear alpha olefins plant, a 575,000 mt/y ethylene glycol (EG) plant and 50% ownership in a 800,000 mt/y polyethylene (PE) plant being built by another wholly - owned SABIC subsidiary, PETROKEMYA. The mechanical completion of the ethylene project is scheduled for 32 months and the project will be on stream by October 2004.

2003/1 Jubail United Petrochemical completes US$1.154 billion loan facility

IBN HAYYAN PLASTIC PRODUCTS (Tayf) 上記

TAYF is a part of the petrochemicals concern Sabic. TAYF was established in 1996, with Sabic's (Saudi Basic Industries Corporation's) joint venture affiliate, Bin Hayyan (National Plastic Company), taking a 51% stake. Other partners in TAYF are the Saudi Industrial and Commercial Agencies Company (37%), the Saudi Industries Development Company (Tatweer) 10% and the Saudi Ceramic Company (2%).

PROJECT MAKE-UP

Sabic's affiliate, Ibn-Hayyan Plastic Products Company (TAYF), began the final procedure to commence construction of its plant in Jubail in late 1997. The TAYF plant will produce a variety of plastic products using as feedstock PVC resins supplied by National Plastics Company (Ibn-Hayyan) and diocthyl phtalate (DOP) produced by Al-Jubail Fertiliser Company (Samad). These plants are also located at Al Jubail Industrial City. TAYF products will be marketed in the domestic market to meet the increasing demands for industrial and consumer durable plastics.

TAYF annual production will consists of 3,200 tonnes of wall covering products, 18,000 tonnes of floor covering products, 7,800 tonnes of artificial leather products, 24,000 tonnes of cellular sheets used in the manufacture of building construction and signboards, 10,000 tonnes of soft films and sheet, 10,000 tonnes of rigid films and packaging, and 2,000 tonnes of book binding products. The project has a total investment of SR930m ($85 million), of which the Saudi Industrial Development Funds (SIDF) and local commercial banks have provided 75%. Sabic will market TAYF products, 40% of which will be sold in the domestic market.

TAYF, which is a part of Sabic, has awarded the contract to Stork Alpha Engineering, Netherlands, for the design, project management, materials procurement, and supervision for the construction of a PVC products plant at Jubail Industrial City in Saudi Arabia. Stork's part in the $85m project was worth $8.5m. Stork focused on the entire chain of project management, design, purchase of materials, supervision during construction and commissioning. Stork was in charge of offshore engineering and procurement for the project and Alpha will take care of onshore activities.

July 1, 2002 SABIC

Sale of DSM Petrochemicals to SABIC completed

http://www.sabic.com/en/press/press_details.asp?id=56

The sale of DSM’s petrochemicals business to Saudi Basic Industries Corporation (SABIC) has been completed. As a result, the activities of DSM Petrochemicals in Geleen (Netherlands) and Gelsenkirchen (Germany) have been transferred to SABIC retroactively from 1 January 2002. The European Commission has recently approved the sale effective that date.

The transaction involves the transfer of all shares of the companies that together form DSM Petrochemicals (DPC), the associated DPC participations and sales activities, and the related technology positions, patents and trade names.

DSM Petrochemicals established with effect from 1 january 2001 as a merger of the former business groups: DSM Hydrocarbons, DSM Polyethylenes and DSM Polypropylenes

(Joint press release Apr 3,2002) SABIC

EuroPetrochemical B.V.

→ SABIC

Europe

SABIC to acquire DSM's

petrochemicals business

http://www.sabic.com/en/press/press_details.asp?id=47

DSM and SABIC, the largest petrochemicals producer in the Middle East, have reached an agreement in principle on the purchase of DSM's petrochemicals business by SABIC. The transaction involves the transfer of all shares of the companies that together form DSM Petrochemicals (DPC), the associated DPC participations and sales activities, and the related technology positions, patents and trade names. After the closing, the transaction will take retroactive effect from 1 January 2002. DSM and SABIC expect the closing to take place around 30 June 2002.

The proposed sale of DSM's petrochemical activities to SABIC specifically concerns DSM Hydrocarbons B.V., DSM Polyethylenes B.V., DSM Polypropylenes B.V. (all in the Netherlands), DSM Polyolefine GmbH (DPO, Germany), and DSM Hydrocarbons Americas Inc and DSM Polypropylenes North America Inc in the United States.

The acquisition includes capacity at DSM’s major petrochem complexes at Geleen, the Netherlands and Gelsenkirchen, Germany, as well as sales offices at Sittard, the Netherlands and other European locations. DSM’s technology licensing business Stamicarbon is also included in the deal.

(Platts Apr.3,2002)

NWE PE buyers await new regime after Sabic swallows DSMNorthwest European buyers of polyethylene are set to monitor market devlopments closely following Wednesday's announcement that Sabic has purchased Dutch petrochemical producer DSM.

ENI in talks with SABIC over

possible sale of its chemicals division

http://www.gasandoil.com/goc/company/cne14720.htm

Italian oil and chemicals group ENI is in advanced talks with Saudi Arabian conglomerate Saudi Basic Industries Corp (SABIC) over the possible sale of its chemicals division. The management of ENI's chemicals division, Enichem, and SABIC had reached a key stage in discussions, which now hinged on whether SABIC would gain a 51 % controlling share in Enichem.

Chemical Week Apr 03, 2002

Sabic Delays Deal for Stake in Polimeri EuropaENI (Rome), parent company of petrochemical maker Polimeri Europa, says Sabic has asked for more time to consider taking a stake in Polimeri Europa .

Separately, Sabic is “close to” buying DSM’s petrochemical operations for E1.6 billion, say recent European press reports.

↓

European Chemical News. 22-29 April 2002

POLIMERI EUROPA TALKS Sabic decides against 51% stakeSaudi petrochemical group Sabic has terminated talks regarding the purchase of a 51% stake in Polimeri Europa from Italian energy group Eni.

サウジメタノールカンパニー第4期計画 世界最大のメタノール単一工場さらに増強

1999年4月完成予定、生産能力300万トン/年超に

http://www.mgc.co.jp/news/1997/970602.html

第4期プラントの規模は85万トン/年、完成は1999年4月を予定しています。MHIは第1期、第2期、第3期に引き続いての受注となります。

第4期メタノール計画の設備能力: 2,500トン/日、85万トン/年

第3期プラント完成により、約220万トン/年体制となり、メタノール単一工場としては世界最大となりますが、第4期プラントが完成すれば年間生産能力は300万トンを上回り、工場運営の合理化に大きく寄与するものと期待されます。

San Antonio (Platts)--25Mar2002

Saudi petchem giant SABIC plots global growth strategy

Saudi Arabia's state-owned SABIC is embracing globalization as the basis of its long-term growth strategy, according to Nasser Al-Sayyari, president of SABIC's Basic Chemical Division, who spoke Monday at the NPRA IPC. Referring to the Sep 11 terrorist attacks and the current economic slump, Al-Sayyari said, "what we are seeing now is the downside of globalization". But there is still a larger upside, he noted. "International trade has become recognized as the driver of prosperity," he said. Accordingly, SABIC has mapped out a course for expanding beyond the Middle East and into Asia and Europe, as evidenced by its active exports to China and its current negotiations for acquiring Enichem.

European Chemical News. 1-8 April 2002

NGI could start by 2011

The Saudi Arabian Natural Gas Initiatives (NGI), core ventures 1-3, will yield petrochemical projects producing up to 3.5m tonne/year of ethylene and derivatives, estimates CMAI consultant Pat Rooney.

Core venture 1, led by ExxonMobil based at South Ghawar, North Rub Al'Khali, has already identified feedstocks to build more than 2m tonne/ year of ethylene and derivatives. Core venture 3, led by Shell based at Shaybah, South Rub Al'Khali, currently has feedstocks to produce at least 1m tonne/year of ethylene and derivatives. CMAI suggests crackers could come on stream by 2011.

Eight petroleum majors sign agreements for three giant gas projects

http://www.saudiaramco.com/publications/jot/Fall2001/pages55to58.pdfSaudi Arabia on June 3,2001 signed historic preparatory agreements with eight major international oil companies (IOCs) for three huge projects to help develop the Kingdom's natural gasresources. The Natural Gas Initiative (NGI) projects are in the north Rub' al-Khali and Shaybah areas in the Eastern Province and on the Red Sea in the northwest.

Core Venture-1 ExxonMobil 35%, Royal Dutch/Shell 25% , British Petroleum 25%, Phillips 15%

Core Venture-2 ExxonMobil 60%, Marathon 20% , Occidental 20%

Core Venture-3 Royal Dutch/Shell 40% ,TotalFina 30%, Conoco 30%

Chemical Week May 22, 2002

Saudi Firm

Plans Three Units at Al Jubail Complex

Privately owned Yusuf bin Ahmed Kanoo Group (Riyadh, Saudi Arabia) says it will build a $30-million plant to produce 45,000 m.t./year of phthalic anhydride (PA) and 5,000 m.t./year of maleic anhydride (MA) at Al Jubail, Saudi Arabia.

The company says it also has secured land from the Royal Commission for Jubail & Yanbu for a grassroots, 500,000-m.t./year polypropylene (PP) plant at Al Jubail.

Platts 2004/2/11

Saudi Sabic to launch 800 kt/yr PE complex in Al-Jubail in March

Saudi Arabia's Sabic plans to start up its two new 400,000 mt/yr polyethylene plants in Al-Jubail next month, a source close to the firm said Wednesday.

The plants would be able to produce linear low density polyethylene and high density polyethylene.

注 Petrokemya のプラント

うち 50%を Jubail Unitedが引き取り権を持つ。

2007/3/12

ameinfo.com

Ma'aden and SABIC sign strategic partnership agreement

Dr. Abdullah Ibn Issa Al-Dabbagh, President and CEO of Ma'aden, and Mohamed

Al-Mady, Vice-Chairman and CEO of SABIC today signed an agreement

opening the way for the two companies to create a strategic joint

venture in a phosphate minerals project.

Total

capital investment in the project is SR13 billion. SABIC will have a

thirty percent (30%) equity

share with the seventy percent (70%) balance of ownership being

retained by Ma'aden. The project aims to utilize phosphate

reserves in the north of Saudi Arabia to produce phosphate

fertilizers in the Minerals Industrial City at Ras Az Zawr

The

phosphate ore reserves in the North of the country will be

surface mined and have an estimated mineable resources of 1.6

billion tonnes in addition to further resources of 1.5 billion

tonnes.

Ma'aden was established as a Saudi Arabian joint stock company in March 1997 under Royal Decree Number M/17. Its purpose is to facilitate the development of Saudi Arabia’s non-petroleum mineral resources and to diversify the Kingdom’s economy away from the petroleum and petrochemical sectors. Ma’aden engages in the development, advancement and improvement of all aspects of the mineral industry, mineral products and by-products and related industries in Saudi Arabia. It encourages private sector participation in the development and production of all types of minerals, either independently or in joint ventures with foreign companies.

New contract for mega size ammonia plant in Saudi Arabia

Samsung Engineering Co., Ltd. of Seoul has commissioned Uhde to provide the licence and comprehensive engineering and supply services as part of a major plant contract for the engineering and construction of a turnkey ammonia plant. The contract, worth the equivalent of some US$950 million, was awarded to Samsung Engineering Co., Ltd. in South Korea by Ma'aden, the Saudi Arabian Mining Company.

The ammonia plant will form part of one of the world's largest fully integrated fertiliser production operations - a joint venture project between Ma'aden and Saudi Arabian Basic Industries Corp. (SABIC) to mine world-scale phosphate reserves in the north of the country to produce fertilisers at the new purpose-built processing facility in Ras Az Zawr, some 400km north-east of the Saudi Arabian capital Riyadh. The facility will also comprise a sulphuric acid plant, a phosphoric acid plant and two diammonium phosphate plants. The project, including the ammonia plant, is due for completion in late 2010.

Uhde's scope of services includes the process licence and basic engineering as well as the supply of special equipment for a single-train ammonia plant, which, with a production capacity of 3,300 tonnes per day, will be one of the world's biggest. For Uhde, the contract is worth a sum in the three-figure millions of euros.

2007/4/11

arabianbusiness.com

SABIC seeks deals with Saudi Aramco

Saudi Basic Industries Corp. (SABIC) aims to develop chemical

projects with state-owned Saudi Aramco, Saudi Arabia's al-Riyadh

newspaper reported on Wednesday, citing SABIC's chief executive.

"We aspire to the emergence in the very near future of an alliance

between Aramco and SABIC in the petrochemicals industry," Mohamed

al-Mady said, according to the newspaper. The newspaper did not

give details.

2007/5/23 ameinfo

SABIC Chairman opens two new offices in China

His Highness Prince Saud bin Abdullah bin Thenayan Al-Saud,

Chairman of SABIC (Saudi Basic Industries Corporation), has

officially opened two new offices for SABIC in China; in Beijing

and Shenzhen.

In combination with SABIC's existing offices in Shanghai and Hong

Kong, SABIC has strengthened its position in the world's most

important and fastest growing polymers market and can now provide

even stronger support locally to its customers in China.

SABIC now has 11 offices in eight countries in Asia Pacific; in

Beijing, Shanghai, Shenzhen, Hong Kong, Taipei, Tokyo, Seoul,

Manila, Jakarta, Ho Chi Minh City and Singapore, where SABIC's

regional headquarters is based.

March 19, 2014

SABIC Awards FEED Contract for Polyurethane Plant

Saudi Basic Industries Corporation (SABIC) and Dutch Shell Group awarded a

contract for a jointly-owned polyurethane plant to be constructed at the Saudi

Arabia Petrochemical Company (Sadaf) complex in Jubail.

Engineering firm KBR won the front-end engineering and

design (FEED) contract for the complex and the project’s budget is expected to

be $3 billion (SR11.3 billion). Currently planned units will provide the plant

with the capacity to produce toluene diisocyanate, methylene diphenyl diisocyanate,

polyol, and polyurethane.

--------

SABIC & Shell progress on plans for

expansion at Sadaf joint venture

Saudi Basic Industries Corporation (SABIC) and Shell announced today that they

are progressing plans for the expansion of various projects at the Saudi

Petrochemical Company (Sadaf). The joint venture partners are also looking to

expand their partnership beyond Saudi Arabia.

Both parties are developing

a full range of polyols

(a polyurethane building block) and styrene monomer

propylene oxide (SMPO) plants at the existing Sadaf site, which is

located in one of the world’s largest and most competitive petrochemical

complexes – the Al Jubail industrial zone on Saudi Arabia’s eastern coast. SABIC

and Shell will jointly conduct the necessary studies to implement the project.

The proposed full range of polyols and SMPO plants would be the first of their

kind in the Middle East. The assets would employ Shell’s proprietary polyols and

SMPO technologies to produce chemical building blocks for the polyurethanes

industry and petrochemicals sector in the Middle East and beyond. The partners

are committed to the polyurethanes, styrene, propylene oxide and derivatives

sectors, and have access to leading technologies as major international

suppliers.

Shell chemicals companies are among the leading suppliers of polyether polyols, with a product range and global reach unrivalled by most of our competitors. We support our high quality CARADOL* polyether polyols with professional sales staff, specialist technical services for key customers, and advice on health, safety and environment issues.

CARADOL polyether polyols are derived from propylene oxide. They are organic materials with two or more alcohol end-groups (OH) and sometimes with micrometer polymer particles present in suspension. When polyether polyols and isocyanates are reacted together they form polyurethanes.CARADOL polyether polyols are available in a wide range of molecular weights and it is this variety which gives rise to a wide range of processing and application possibilities.

イソシアネート基を持つ化合物として、

TDI: トリレンジイソシアネート (2,4or2,6-Tolylene diisocyanate)

MDI: ジフェニルメタンジイソシアネート(4,4'or2,4'-Diphenylmethane diisocyanate)

HDI:ヘキサメチレンジイソシアネート(1,6-Hexamethylene diisocyanate)

などがあります。 このほかにも、多数のイソシアネート化合物があります。

水酸基(OH)を2個以上含有する化合物はポリオールとも呼ばれ、一般的には以下の種類のものが使用されています。

ポリエーテルポリオール(Polyetherpolyol)

ポリエステルポリオール(Polyesterpolyol)

ポリカーボネートポリオール(Polycarbonatepolyol)

ポリカプロラクトンポリオール(Polycaprolactonepolyolポリエーテルポリオール:塩基性触媒の存在下、開始剤にエチレンオキサイドやプロピレンオキサイドを付加重合させて製造される。

開始剤には官能基数別に以下のような多価アルコールやアミンが使用される。

官能基数=2 プロピレングリコール、エチレングリコール

官能基数=3 グリセリン、トリメチロールプロパン、トリエタノールアミン

官能基数=4 ペンタエリスリトール、エチレンジアミン、芳香族ジアミン

官能基数=5 ジエチレントリアミン

官能基数=6 ソルビトール

官能基数=8 スクロース(蔗糖)

| 別途 2012/3/2

三井化学、ウレタン事業でSABICとの提携を検討、ウレタン事業を再構築 1. ライセンス契約

2. SABIC社との事業提携検討

|

||||||||||||||||||||||||||||||||||||||||||||

Saudi Arabia’s Sabic Considering Shale Gas

Investments in U.S.

Saudi Basic Industries Corp., the world’s second-biggest chemicals manufacturer,

plans to expand investment in U.S. shale gas projects through joint ventures,

according to acting Chief Executive Officer Yousef al Benyan.

Sabic, as the company is known, signed an agreement with Houston, Texas-based

Enterprise Products Partners L.P. to get shale gas,

al-Benyan said in an interview in Riyadh. The company may use the feedstock in

the U.S. or export it to other countries such as the U.K., he said. Sabic has

converted crackers at U.K. plants to use shale gas as feedstock to produce

olefins and their derivatives more competitively.

“The main areas in the U.S. we are looking to

invest in are the northeast and the south as they fit our overall expectations

including government support, labor laws and unions,” al-Benyan said. “At this

point we are not looking to acquire any U.S. companies.”

Sabic, which in 2007 bought General Electric Co.’s plastics unit for $11.6

billion, said in April it plans to expand in China and the U.S. because it’s

difficult for the company to grow in Saudi Arabia due to a shortage of gas. The

Marcellus shale formation spread across Pennsylvania, West Virginia and Ohio is

America’s biggest natural gas producer, with output rising more than 14-fold

since January 2007.

Sabic won’t be directly involved in Saudi Arabia’s shale production, he said.

The discovery of shale gas in the country will “open up some opportunities for

indirect investments for Sabic,” al-Benyan said.

-----

Acting CEO of the organization Yousef

Abdullah Al-Benyan said that his company has plans to expand investment in the

US shale gas projects through joint ventures.

SABIC had signed an agreement with Houston, Texas-based Enterprise Products

Partners L.P. to get shale gas. He said it may use the feedstock in the United

States and export it to other countries, including the UK.

SABIC has converted crackers at the UK plants to use shale gas as feedstock to

produce olefins and their derivatives more competitively.

He also pointed out that SABIC will not directly involve in the Kingdom’s shale

production. He hoped that the discovery of shale gas in the country will pave

the way for opportunities for indirect investments for SABIC.

August 24, 2017

Saudi Aramco, SABIC launch bidding at key chemical project

Saudi Aramco and Saudi Basic Industries Corp (SABIC) have launched bidding for

engineering work on their joint crude oil to chemicals project, industry sources

said, a key step towards developing the $20-billion-plus complex.

The project, known as COTC, the first major scheme

to bring the two giants together, is expected to process Arabian Light and Extra

Light crude oil, one of the sources told Reuters.

Several plants are expected to be built including a

400,000-barrels-per-day integrated crude distillation and vacuum unit,

a distillate hydrotreater, a vacuum gas oil hydrocracker,

a residual fluid catalytic cracking unit, a mixed feed cracker, as well

as polyethylene, polypropylene, butadiene and aromatics

recovery units.

Aramco and SABIC are still considering where to locate the chemicals site; at

Yanbu, near a power plant; or in Jubail, close to Sadara, which is an Aramco

joint venture with U.S. company Dow Chemical.

The closing date for bids for pre-front end engineering and design work

(pre-FEED) and FEED for the COTC is Sept. 25, one of the sources said, adding

that the plant is expected to be commissioned by the end of 2024.

Another source said pre-FEED is expected to be completed by late 2018, with FEED

to be finalised by late 2019. Aramco and SABIC are expected to launch bidding

for construction by mid-2020.

SABIC did not immediately respond to a Reuters request for comment. Aramco said

it “declines to comment on rumor or speculation”.

Aramco’s chief executive has said it was a priority for the company to convert

crude oil to chemicals as the state oil producer aims to diversify operations in

the run-up to an initial public offering of shares next year.

Downstream, which covers refining and chemicals, will help Aramco boost value

from hydrocarbons by securing revenue streams and become less vulnerable to oil

price swings.

LESS GAS

Analysts say the project will help reduce natural gas usage in petrochemicals at

a time when the kingdom is trying to use more gas to generate power, rather than

burning crude oil, as it seeks to diversify its energy mix.

“What is new and different is that the prices of crude and gasoline/diesel have

come down more than petrochemicals. This makes the incentive to produce

petrochemicals greater than to make gasoline and diesel,” Mark Routt, chief

economist for the Americas at KBC Advanced Technologies, said.

“It certainly could usher in a new ’wave’ of investments in producing those

petrochemicals,” he said.

The project is strategic for Saudi Arabia, which plans to expand further into

the petrochemical chain to export more end products and grow beyond oil.

It is also crucial for Saudi Arabia's economic reform plan and could create as

many as 100,000 jobs.

SABIC's CEO told Reuters in May that COTC could produce more than 18 million

tonnes of materials yearly.

-------------------

SABIC announces intention to merge

Sadaf with Petrokemya

AS part of its strategic transformation plan and to increase efficiency

and competiveness of all its global operations, SABIC announced on

Wednesday its intention to merge two of its manufacturing affiliates,

Saudi Petrochemical Company (Sadaf) and Arabian Petrochemical Company (Petrokemya).

This step has come as part of the company’s transformation program,

which was initiated three years ago to enhance agility across all its

operations.

All assets, rights, liabilities and obligations of Sadaf will be

transferred to Petrokemya. Subject to regulatory approvals,

Petrokemya will continue to exist, while

Sadaf will cease to exist as a legal entity. The merger process is

scheduled to be completed in the second half of 2019.

With the merger, SABIC seeks to create a more efficient platform to

optimize assets and unlock value from the synergies between the two

companies’ product streams. It is also expected to create more effective

and streamlined operations, maintenance and project execution.

Sadaf, a limited-liability company based in Jubail, produces ethylene,

styrene, caustic soda, MTBE, and ethanol. It operates six petrochemical

plants with a total production capacity of more than 4 million metric

tons per year, besides a cogeneration power station.

Petrokemya, also a limited liability company in Jubail, produces

ethylene, propylene, butene, benzene, butadiene, polystyrene,

polyethylene and acrylonitrile butadiene styrene.