Braskem http://www.braskem.com.br/

Braskem figures

as the largest petrochemical operation in Latin America and among

the three largest private companies in Brazil. With a

verticalized structure integrating the first and the second

petrochemical generations, Braskem reports annual earnings of R$

14,3 billion (2004). The company employs directly 3.000 people

and indirectly 5.000 people, achieving a production of 5,7

million tons of primary base, secondary and intermediate

petrochemical products.

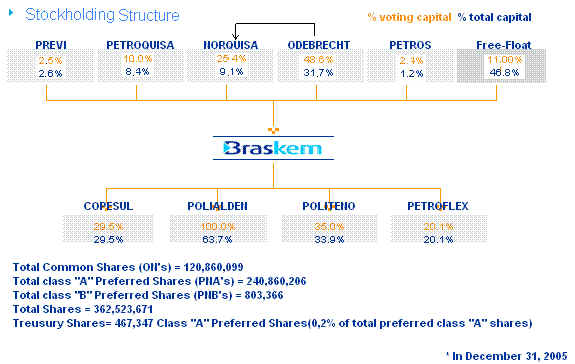

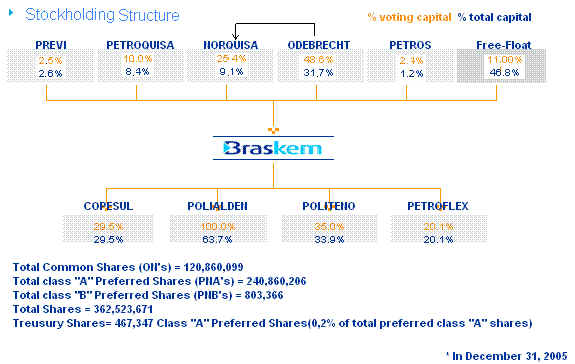

Braskem is coordinated by Odebrecht, group that have direct and indirect participation in the company and control Norquisa, a holding that belongs to Braskem group. Other companies such as Petroquisa (a Petrobras petrochemical subgroup), Petros (Petrobras) and Previ (Bank of Brazil) pension founds are also shareholders. Shares of the company are listed and traded on the St Paulo (Bovespa) and the New York Stock Exchanges, and on the Madrid (Latibex).

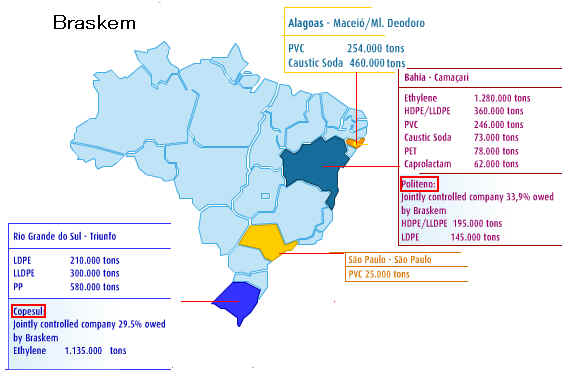

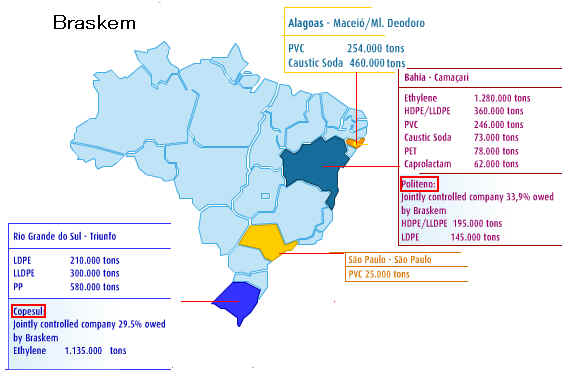

With 13 industrial facilities located in Alagoas, Bahia, St Paulo and Rio Grande do Sul, Braskem produces primary base petrochemicals such as ethylene, propylene, benzene, caprolactam, DMT and termoplastic resins (polypropylene, polyethylene, PVC and PET), gas, UHMW-PE (an engineering plastic) and GLP.

Braskem aims to

be a worldclass Brazilian company by making fuller use of the

potential synergies that exist within the company to assure

competitive production scale. It is also comitted to investments

in research and development in order to achieve high

technological standards and figure among the world's leading

petrochemicals players. In Latin America, Braskem is the leader

in the thermoplastic resins segment.

Commited to the development of the petrochemical chain, Braskem works in partnership with its customers, the plastic products transformers, to develop products always seeking for new business opportunities. Managed according to the principles of an effective and ethical corporate governance, the company presents policies based on transparency in the financial market and equal relationship with all shareholders.

Odebrecht

Odebrecht is a traditional company in the construction sector that started its activities in the petrochemical area in 1979. Odebrecht increased its participation in the sector through representative acquisitions, when the company changed from investor to operator, controlling other companies in the market. In 2001 Odebrecht, finally, in a joint venture with Mariani, took over Copene Petroqumica do Nordeste S.A and started a process to integrate all its companies to create Braskem.

How the Petrochemical

industry started in Brazil

The use of plastic in Brazil has been relevant since the 1950s.

The necessity of national industrial sites is a result of the

social demand to substitute importation in the sector.In the

1960s, Uniao Group ? an association of companies from Sao Paulo

State, created Petrochemical Uniao, in Capuava, Sao Paulo country

side.

Foreign companies were involved in that project to implement the

second and the third generations of plastic chain, with the State

support, by Petroquisa (a Petrobras company). The model called

Tripartite was then created and it was consolidated in the 70s

with the creation of Copene and the Petrochemical pole of

Camacari (BA).

During the 1970s, the government authorized the creation of

Copesul, Petrochemical central of Triunfo, that counted on a

greater Brazilian engineering participation.

In the 1980s, the Tripartite model no longer responds to demands.

The government concentrated the investments on petroleum

exploration and production sectors, what caused the reduction of

investments on the Petrochemical sector.

From 1992 to 1995, during the privatization program sponsored by

the Federal Government, the shares of the State were sold. The

Tripartite model no longer exists. The petrochemical Uniao (PQU),

the first in the country, was privatized in 1994, whith Unipar

group as the most important shareholder.

In the south, Copesul started being controlled by Odebrecht and

Ipiranga presenting management strategies that focused on the

company growth and technological innovation. In 1995- during the

consuming "Boom" promoted by the new currency “Real” plan - the company controllers

decided to duplicate the pole of Triunfo in a project of US$ 1.6

billion. The facilities were ready in 2000.

However, in Camacari (BA) some of the important investments on

Copene and on the second generation of the petrochemical chain,

had to be postponed due to the conflicts caused by the

privatization of the baiano pole.

In Dezember of 2000, the Central Bank tried to auction off the

participation that Banco Economico had on Conepar S.A, a holding

that played an important role on the capital of Norquisa,

controller of Copene at that time. The auction wasn’t successful.A new auction took

place in March 2001, at that time with a price reduction of 20%.

However, there was no interest in the shares and the auction wasn’t successful once again.

Odebrecht and Mariani decided to buy the participation of

Economico Bank in Conepar and prepared a proposal that was taken

to the Central Bank. In July 2001, The Central bank decided for a

third auction selling the parcel that belonged to Economico Bank.

The only group that had made an offer, Odebrecht and

Mariani, won the auction what guaranteed the control of Norquisa,

the holding that controlled Copene at that time.

Right after the acquisition, a process of integration was

initiated with the companies from the second and third

generations.This project started a new step in the Brazilian

petrochemical history, with the group Odebrecht and Mariani

promoting a project of vertical integration of petrochemicals in

Brazil, creating Braskem.

Braskem in talks with

third parties on Venezuela olefins project

Braskem, Latin America's largest petrochemicals company, is in

talks with several potential partners to build a Venezuelan olefins

complex

worth up to $2.5 billion, the company's financial director told

Platts Friday. The project is slated to come onstream by 2011.

Braskem is already working with Venezuela's PDVSA to develop the project, which

would be located at the northwestern Venezuelan Jose

petrochemicals complex and produce 1.2 million

mt/year of polytehylene and other products. In April, Braskem signed an MOU

with PDVSA's petrochemicals arm, Pequiven, on the project, a

gas-fired cracker, and said it would cost between $1.5-2.5

billion.

Braskem is also discussing a 400,000 mt/yr Venezuelan

polypropylene project known as El Tablazo, in joint-venture with

Pequiven. A

decision to build the plant, which would cost about $370 million,

could come in the first quarter of 2007, and production could

begin in 2009, Atlit said.

Braskem and Pequiven announce signature of joint venture agreement for the Jose Petrochemical complex

Braskem,

leader in the thermoplastic resins segment in Latin America and

second largest Brazilian industrial company owned by the private

sector, announces that it signed today with Pequiven, the main

petrochemical company in Venezuela, an agreement aiming at the

formation of two Joint Ventures to develop and implement in that

country what is expected to be the most modern and competitive

integrated petrochemical project in the Americas, named Jose Petrochemical

Complex.

One of the projects includes the construction of an ethane cracker

from natural gas

with annual capacity of 1.3 million tons of ethylene, 1.1

million tons of polyethylene (PE) and other petrochemical

products.

The second project involves the construction of a polypropylene (PP)

plant with annual production capacity of 450 thousand tons, previously announced to be

constructed in El Tablazo, but now to be developed in the same

site as the Jose Complex, with estimated investments of

approximately US$ 370 million. Therefore, the Jose Complex will

be more integrated increasing its competitiveness by capturing

synergies in the implementation and operation, among other

factors.

On that day, the project cornerstone was launched. The projects

are expected to begin operations in the second half of

2011 for the ethylene and PE production and at the end of 2009

for the PP plant.

Having access to one of the richest oil and natural gas

reserves in the world, Venezuela offers differentiated

competitiveness for the development of petrochemical projects.

The creation of the joint ventures is expected to be concluded

within the next 90 days, with the approval by the respective

Board of Directors of the companies. The corporate model provides

that

the same shareholding for both companies. Investments for

the production of ethylene and PE are expected to reach

approximately US$2.5 billion. For the PP plant, investments are

expected to be around US$ 370 million. Braskem is analyzing its

participation in the vinyl´s chain projects, including

caustic soda and PVC.

Platts 2007/8/30

Construction of Pequiven-Braskem olefins plant to begin in 2009

Construction on a new Venezuelan olefins plant, a product of a joint venture between Venezuela's state petrochemical company Pequiven and Brazil's Braskem, is scheduled to begin in mid-2009, Juan Jose Garcia, Venezuela's vice minister for petrochemicals and refining, told Platts Friday.

2007/12/13 PRNewswire-FirstCall Braskem とVenezuela 国営Pequiven、石化JV計画で合意

Braskem and Pequiven Announce the Creation of Companies to Install Petrochemical Projects in Venezuela

BRASKEM, the leading

company in the thermoplastic resins industry in Latin America and

third-largest Brazilian industrial company owned by the private

sector, announces, in partnership with Pequiven, the creation of

two companies to install in Venezuela the most modern and

competitive integrated petrochemical project in the Americas, at

the Jose Petrochemical Complex. The official announcement of the

creation of Propilsur and Polimerica is being made today,

December 13, in Caracas during a meeting held between the

president of Venezuela, Hugo Chavez, and the president of Brazil,

Luiz Inacio Lula da Silva.

Prolipropileno

del Sur, S.A.

- Propilsur will be responsible for the construction of a polypropylene

plant with capacity of 450,000 t/year integrated into a propane

dehydrogenation unit,

providing the project with greater integration and operational

flexibility. In light of this new scope, the total investment in

the project is estimated at approximately US$ 900 million. The

operational startup of Propilsur is expected for the second half

of 2010.

Polietilenos

de America, S.A.

- Polimerica will be responsible for the construction of an

ethane cracker with natural gas as feedstock, with ethylene

production capacity of 1.3 million t/year, combined with the

production of 1.1 million t/year of polyethylene, which will be

produced in three industrial plants -- high density polyethylene,

low density polyethylene and low linear density polyethylene,

with estimated cost of US$2.6 billion and operational startup

scheduled for the second half of 2012.

Based on the shareholders' agreement signed today, the companies

will be equally controlled by Braskem and Pequiven and will be

based on modern corporate governance practices, ensuring equal

rights for partners in the management and equal representation in

the Board of Directors, where decisions will be taken based on

the shareholders consensus.

The hired financial advisor has already started contacting

multilateral organizations, export credit agencies, development

banks and private banks for structuring financing for 70% of the

total investment through project finance and the remaining 30%

through transfers in equal proportions by the partners.

Braskem has the first

certified green Polyethylene in the World

Company studies project for

commercial production of plastic made from ethanol starting in

2009

Braskem, the leading

company in the thermoplastic resins segment in Latin America and

second largest Brazilian industrial company owned by the private

sector, announces production of the first

internationally certified polyethylene made from sugarcane

ethanol,

using competitive technologies developed at the company’s Technology and Innovation

Center.

The green polymer developed by Braskem - a high-density

polyethylene,

one of the resins most widely used in flexible packagings - is

the result of a research and development project that has already

received some US$ 5 million in investment. Part of this amount

was allocated to implementing a pilot unit for the production of

ethane,

which is the basis for the production of polyethylene, from

renewable feedstock at the Braskem Technology and Innovation

Center, which is already producing sufficient quantities for

commercial development of the product. The project’s target customer will soon

receive the green polyethylene and have the opportunity to

confirm the performance of the product, which can meet all of the

quality standards required to be competitive in the international

market.

The project is now in technical and economic specification

process and the startup of green polyethylene

production on an industrial scale is expected in late 2009. The new unit will have modern

technology and competitive scale, and could reach annual

production capacity of up to 200,000 tonnes. The location and industrial

design of the unit will be determined within the next few months.

Braskem to build 200,000mt/yr renewable plastics plant: CEO

Braskem was to build a plant that would produce 200,000 metric tons per year of ethanol-based polyethylene by the end of 2009, CEO Carlos Grubisich said in a written statement.

Braskem was to build a plant that would produce 200,000 metric tons per year of ethanol-based polyethylene by the end of 2009, CEO Carlos Grubisich said in a written statement.

Details of how much the plant would cost to build, where it would be located and how much ethanol feedstock it would require were not provided. Grubisich presented the plans in Frankfurt, at the K 2007 plastics industry exposition, the statement said.

Braskem to boost stake in synthetic rubber-maker Petroflex

Braskem said Tuesday it would boost its participation in Petroflex to

33.5%, from a previous 20.1%, using an option to buy part of

the shares in Petroflex held by Suzano Petroquimica, which

was recently bought by Petrobras.

According to a shareholders agreement, Braskem and Unipar would

have rights to buy Suzano's stake in Petroflex if control over

Suzano ever changed hands.

It wasn't clear whether Unipar would use an option to buy

Petroflex shares to supplement its current 10.1% stake in the

company. Suzano's stake in Petroflex, before the sale to Braskem,

is 20.1%.

Braskem achieves new

technological advance for production of green polymers

New technological route with green butene enabled the company to manufacture

the first linear polyethylene from 100%

renewable raw materials

This announcement

represents a new landmark in Braskem's biopolymer development

program, initiated in June 2007, with the launch of the first

green resin, a

high

density polyethylene geared towards markets that

demand products with superior performance and quality,

underscoring the automobile, food packaging, cosmetic and

personal hygiene industries.

Antonio Morschbacker, the technician responsible for biopolymers

at the company, explains that this development represents an

important technological leap for Braskem, since the production of

green linear polyethylene demands the use of a second monomer

(molecules used as raw material to make the polymer) from a 100%

renewable source. In other words, besides sugarcane ethylene, a technology already dominated

by Braskem, the researchers needed to elaborate a new

technological route that would allow them to obtain high-yield butene

from a renewable raw material.

The main market for

this linear polyethylene is the flexible packaging segment

(films), which mostly serves the food industry. Still being

produced at a laboratory scale, production of the green linear

polyethylene will permit the product to be tested by selected

clients interested in its performance and environmental

advantages. At present, Braskem is concluding a project to set up

an industrial unit to produce green ethylene that will supply the already

existing polyethylene units in their installations, with the

capacity to product 200 thousand tons per year and projected to start

operations in 2010.

The company also recently announced it will invest R$ 100 million

in Camaçari, Bahia, to convert its current

production of MTBE into ETBE, as already occurred at Copesul,

thus offering the market an additive for gasoline made from

ethanol with important environmental advantages. When the

investment is finished, in 2009, Braskem will have the capacity

to produce 300 thousand tons of ETBE per year, which besides using a

renewable natural resource, also reduces CO2 emissions by 76%

compared to MTBE, taking into account the period from the

sugarcane crop to production of the additive.

2008/4/3

modplas.com

Petrobas president details Brazilian expansion plans for PE, PP

and PET

The same week the project received an environmental license and

one week before soil grading begins, Jose Lima, president

Petrobas Quimica SA, offered details on the $8.5 billion Rio de Janeiro

Petrochemical Complex (COMPERJ), which will use a

patented fluid catalytic cracking (FCC 流動接触分解) process to convert heavy

Brazilian crude oil directly into petrochemical feedstocks like

ethylene and propylene, with polyolefins capacity

planned as well.

Lima said when the operation commences production in the

2012-2013 time frame, it will process 150,000 barrels/day of

Brazilian crude into 800,000 tonnes/yr of high-density

and low-density polyethylene; 850,000 tonnes/yr of polypropylene;

and 600,000 tonnes/yr of polyethylene terephthalate.

The country's next major petrochemical investment will be the Rio de Janeiro Petrochemical Complex (Comperj) integrated refinery and cracker complex. The project is a partnership between Petrobras and Brazilian chemical producer Grupo Ultra, and CPS is expected to become a shareholder. (Petrobras、Ultra Group、Braskemの3社が共同Ipirangaを買収)

Phase one of the $8.5bn project, which will boost Brazil's heavy oil refining capacity significantly and reduce naphtha imports, is scheduled for completion in 2012.

Two major chemical companies will emerge from the consolidation process: an enlarged Braskem and a new company, known as Companhia Petroquimica do Sudeste (CPS).

The creation of CPS, owned by Petrobras and petrochemical holding company UNIPAR, brings the key petrochemical assets in the southeastern states of Rio de Janeiro and Sao Paulo under one company.

Braskem Starts Up New

Plant for the Production of 350,000 Tons of Polypropylene in

Paulinia

This project consolidates the Company's leadership in the Latin

American polypropylene market

Braskem, the leading company in the thermoplastic resin industry

in Latin America and the third-largest resin producer in the

Americas, announces the start up of its polypropylene production

plant in the city of Paulinia, Sao Paulo state.

With the inauguration of this new industrial unit, which has

annual production capacity of 350,000 tons, Braskem further strengthens its

leadership position in the Latin American polypropylene market,

increasing its annual production capacity in this product to 1.1 million

tons.

The project was built through a joint venture between Braskem and

Petroquisa,

with the companies holding interests of 60% and 40%,

respectively. The plant is one of the assets included in the

Investment Agreement between Braskem and Petrobras announced to

the market on November 30, 2007, which will result in an increase

in Braskem's interest in Petroquimica Paulinia from the current

60% to 100%. Through this agreement, Petrobras will become holder

of 25% of Braskem total capital.

Braskem, Petroperu to

Sign Petrochemical Letter

Petroleos

del Peru SA

and Brazil's Braskem SA will sign a letter of intent

tomorrow to build an $800 million petrochemical plant in southern

Peru, the Peruvian company's chief executive officer, Cesar

Gutierrez, said today.

The state-oil company known as Petroperu and Sao Paulo- based

Braskem, Brazil's largest petrochemical company, will negotiate

with Argentina's

Pluspetrol SA to

supply the project with 100 million cubic feet a day of ethane,

Gutierrez said. The plant seeks to produce polyethylene for

export, he

said.

Braskem, Petrobras and

PetroPeru sign agreement to study an integrated petrochemical

project in Peru

Project will represent the

installation of the largest petrochemical complex on the western

coast of the America

Today, May 17, Braskem,

Petrobras and PetroPeru signed an agreement aimed at assessing

the technical and economic feasibility to implement an integrated

project for the production of 700 thousand to

1.2 million tons of polyethylene from competitive natural gas

available in Peru.

This project will represent the installation of the largest

petrochemical complex on the western coast of the America,

combining global scale, cutting edge technology and high

competitiveness. Peru has current and potential reserves of natural gas rich

in ethylene,

with content levels exceeding 10%. The competitiveness and strong

attractiveness for new investments that exist in Peru today, as

well as its privileged geographic position, were important points

in approaching the companies for the project study.

The venture will also contribute to Peru’s economic and social development,

generating favorable conditions for attracting investments by new

plastic manufacturing industries.

Petrobras, which is already very present in the Peruvian market,

made an important gas discovery in January 2008, in partnership

with other companies. It expects the studies will contribute

towards defining the best use of future production in Peru. The

company thus reaffirms its commitment with the development of

business and creation of value in South American companies,

accentuating its operations in the petrochemical sector. The

studies will also reinforce the agreement signed in 2006 between

Petrobras and Petroperú, which has already given rise to

several joint projects in the E&P and downstream areas.

For Braskem, the consolidation of the venture will be a new an

important step in its growth strategy with the creation of value,

which combines an internationalization program with access to

competitive sources of raw materials, in line with its vision of

being among the 10 largest petrochemical companies in the world.

The installation of the new integrated complex on the Pacific

coast is in line with the two projects in Venezuela that are in

the implementation phase and which aim at supplying resin to the

domestic market in Venezuela and consolidating Braskem’s presence in North America and

Europe.

The markets focused on by this new project are those countries on

the western coast of the Americas, especially the United States,

Peru, Chile, Ecuador and Colombia. Besides that, as a result of

easy access to the Pacific and already available infrastructure

in the region, the venture could become an important platform for

exports to the Asia and western United States.

Peru's President Alan Garci'a and his Brazilian counterpart Luiz Ina'cio Lula da Silva were present at the signing ceremony, held in the presidential palace in Lima.

Petroperu' president Ce'sar Gutie'rrez was reported as saying by Peruvian state news agency Andina that the three companies will approach Argentina's Pluspetrol, operator of the Camisea natural gas consortium in Peru, to negotiate the supply of ethane.

May 17, 2008 Reuters

Brazil Petrobras, Braskem eye $2.5 bln Peru plants

Brazilian firms Petrobras and Braskem may invest up to $2.5 billion in petrochemical projects in natural gas-rich Peru, officials said on Saturday.

Peruvian President Alan Garcia and his Brazilian counterpart, Luiz Inacio Lula da Silva, signed a series of accords that included commitments by the Brazilian firms to study the feasibility of building new plants that would tap into Peru's growing gas sector.

"For the fertilizer plant, or methane, we're talking about between $800 million and $1 billion and for the petrochemical plant, or ethane, this would be $1.5 billion," said Pedro Grijalba, head of Petrobras' Peruvian unit.

Petroperu, Peru's state-owned petroleum company, may participate in the construction of plants by the Brazilian companies.

Peru's government is trying to lure billions in foreign investment for its mining and energy sectors to reap the benefits of high commodities prices.Petroperu' and Petrobras are currently seeking a partner specialized in fertilizers as that project is to produce ammonium phosphate, ammonium nitrate and sodium cyanide.

Brazilian mining and metals group CVRD is being considered, though alternatives continue to be sought, according to the Andina report.

PetroPeru 2008/5/19

Petroperú

Petrobras and

Braskem sign memorandum to study petrochemical project in Peru

In order to evaluate the technical

and economic feasibility for the implementation of an integrated

petrochemical project in Peru

In special ceremony held at Government Palace, with assistance

from the president, Dr. Alan García Perez and the president of

Brazil Inacio Lula, Petroperú, Braskem and Petrobras signed an

agreement with the objective of evaluating the technical and

economic feasibility for the implementation an integrated

petrochemical project in Peru, from natural gas, with production capacity of at least 700

thousand tons per year of polyethylene.

The chairman of Petroperú, engineer Cesar Gutierrez, noted

that the project foresees the creation of the largest

petrochemical complex on the Pacific coast of the americas,

combining global scale, high-tech and high competitiveness.

He said that Peru had reservations current and potential natural gas rich

in ethane, with ratios above 10%. The geographical position of

Peru and conditions conducive to new investment were also

relevant points in bringing companies to study the project, he

added

The owner of Petroperú indicated that the performance of

the enterprise will also contribute to economic and social

development of Peru, creating favourable conditions for

attracting investment by new industries manufacturing plastic.

He recalled that Petrobras, which already has significant

presence in the Peruvian market, made a major gas discovery in

January 2008, in lot 57, and hoped that the studies will help to

define the best use of their future production in Peru.

That, he argued, the company reaffirms its commitment to business

development and value creation in the countries of South

americas, accentuating its performance in the petrochemical

sector. In addition, investigations will reinforce the agreement

signed in 2006 between Petrobras and Petroperú, which originated several joint

projects in the areas of E & P, petrochemical and downstream.

For Braskem-Gutierrez-stressed concrete expression to this

endeavor will be an important new step in its strategy of growth

with value creation, combining a programme of

internationalization with access to competitive sources of raw

materials, according to its vision of being among the top 10

largest petrochemical overall.

That initiative, he said, complements the two projects that Braskem is developing in Venezuela, turned to the markets of the

East Coast of the United States and Europe - a unit of

polypropylene with a capacity of 450 thousand tons per year to

operate in 2011 and a polyethylene integrated unit with a

capacity of 1.1 million tons per year to operate from 2013.

He said that the markets served by the new project will be the

countries of the West Coast of the americas, especially Peru,

Chile, Ecuador and Colombia.

Finally, the engineer Gutierrez estimated that due to easy access

to the Pacific and infrastructure already available in the region

concerned, the venture may become an important platform for

exports to the Asian market and the West Coast of the United

States.

Braskem announces

investments of more than R$ 1.0 billion in Rio Grande do Sul

Production of green plastic will be developed at the Triunfo

Complex

Braskem is inaugurating a new cycle of investments at the Triunfo Petrochemical Complex starting by consolidating the sector in the south through an investment of more than R$ 1.0 billion scheduled over the next 3 years and the decision to produce green polyethylene in Rio Grande do Sul. This investment program is in line with the company’s growth with the creation of value strategy that aims at making Braskem one of the ten largest companies in the sector in the world.

ブラジルに於ける第一世代および第二世代の石油化学製品の生産は3箇所の石油化学コンビナートに集中している − Bahia州のCacamari市に位置するCacamari石油化学コンビナート

− Sao Paulo州のMaua市に位置するSao Paulo石油化学コンビナート

− Rio Grande do Sul州のTriunfo市に位置するTriunfo石油化学コンビナートIpiranga は南部のTriunfo にCopesulに隣接して5工場を持つ。

Ever since it announced

the acquisition in March 2007, Braskem has invested nearly R$ 300

million in the state, especially for the ETBE project, an automotive bioadditive

produced from ethanol, and the modernization initiatives and

technological updating made during the recent scheduled

maintenance period at Copesul. "Approval of the investment

agreement with Petrobras, which allocated its shareholder participation in

Copesul, Ipiranga Petroquímica, Ipiranga Química and Petroquímica Paulínia, will permit accelerating our

growth programs in Rio Grande do Sul", says José

Carlos Grubisich,

president of Braskem.

The highlight of this investment commitment has been the decision

to install the green polyethylene project in

Triunfo,

with estimated investments of between R$ 400 and R$ 500 million.

This will be the first commercial scale operation in the world to

produce green polyethylene from 100% renewable raw material. This

pioneerism is the result of the priority Braskem gives innovation

and technology, one of the corporate strategy pillars, which has

permitted certification of the first green polyethylene. The

initiative also corresponds to its commitment to contribute

towards sustainable development, opening the way for the use of

renewable raw materials.

The green polyethylene project will have the capacity to produce 200 thousand tons

per year with

projected earnings of about US$ 400 million/year. The raw

material will be received through the Santa Clara Terminal. The

alcohol will initially be acquired in the southeast. However, the

intention is to prioritize the consumption of local ethanol from

raw material production in the state. "Braskem’s annual consumption of ethanol

will be approximately 700 million liters, 450 million of which

will be for this project," says Grubisich. This volume is

similar to the current demand for alcohol in RS, which is around

500 million liters/year.

Braskem delays construction of two plants in Venezuela

Brazilian firm Braskem,

Latin America's largest petrochemical company, announced on

Wednesday that it postponed for at least one year part of its project to build two plants in Venezuela in

partnership with Venezuelan state petrochemical corporation

Pequiven due

to the current global financial crisis.

The announcement was made Wednesday by the president of Braskem,

Bernardo Gradin, in a video conference in which he commented the

massive losses incurred by the Brazilian petrochemical firm in

the third quarter of the year.

Gradin said that Braskem chose to delay some of the investments

it had planned, due to the credit crunch and to the fact that the

company foresees a drop in the international demand for plastic

next year as a result of the crisis that affects the United

States and Europe, among others.

Braskem approves Green

Polyethylene Project

Braskem, the leading company in the thermoplastic resins industry

in Latin America and third-largest resin producer in the

Americas, announces that its Board of Directors has approved the

Green Polyethylene Project. This project, for which investment of

R$500 million was approved, will produce ethylene and

polyethylene from sugarcane ethanol, with operational startup

scheduled for 2011 at the Southern

Petrochemical Complex in Rio Grande do Sul state.

Braskem has already concluded the conceptual and basic-design

phase, and the detailing phase and start of construction will

begin in early 2009. The company has already made firm

reservations for the project’s critical equipment, such as the

feed gas compressor and refrigeration compressor, which are

high-technology equipment that must be ordered in advance to

ensure the project timetable is met. To finance what will be the

first commercial-scale operation in the world producing green

polyethylene made from 100% renewable raw materials, Braskem

plans to use 30% own funds and seek finance for the remaining

70%.

With demand identified at approximately 600,000 tons, mainly in

the international market, the green polyethylene will command a

premium of between 15% and 30% over the price of polyethylene

made from nonrenewable raw materials. The project could be the

first of other larger-scale projects that are currently being

analyzed, and has return estimated at US$200 million in net

present value.

Commenting on the project, Braskem CEO Bernardo Gradin said,

"The approval of this project by the Board of Directors

demonstrates Braskem’s confidence in the project’s potential for value creation and

management’s concern with financial

discipline, by investing selectively in projects that offer high

return. A project like this offers excellent opportunities for

the development of plastic products made from renewable raw

materials, a field in which Brazil has natural competitive

advantages and high potential demand."

豊田通商 Braskem と植物由来ポリエチレンに関し業務提携

Braskem: Acquisition of Petroquímica Triunfo

Petrochemicals group Braskem is to take over plastics producer Petroquímica Triunfo. Braskem reports that the Brazilian authorities gave the go-ahead for the merger at the start of May 2009.

Petroquímica Triunfo, which produces LDPE, ethylene copolymers and EVA for Brazilian and international customers, is to be fully integrated into Braskem. Further details of the transaction have not been disclosed.

Petrobras の100%子会社のPetroquisa の子会社。

2007年11月30日、Petrobras は石化事業の再構築を発表した。

(100% allocation of Petroquimica Triunfo to Braskem を前提)

Braskem and Novozymes to

make green plastic

Partners

take a step toward the bio-based economy by developing

polypropylene from sugarcane.

Braskem, the largest petrochemical company in Latin America, and Novozymes, the world’s leading producer of industrial

enzymes, today announced a research partnership to develop

large-scale production of polypropylene from sugarcane. 酵素メーカー

“Braskem was the

first company in the world to produce a 100% certified green

polypropylene on an experimental basis. The partnership with

Novozymes will further boost Braskem’s technology development and be a

key step in the company's path to consolidate its worldwide

leadership in green polymers, all leveraged by Brazil’s competitive advantages within

renewable resources,” says Bernardo Gradin, CEO of

Braskem.

Sugar is the new oil

Polypropylene is a plastic used in a wide range of everyday

products, from food containers, drinking straws, and water

bottles to washing machines, furniture, and car bumpers. It is

the second most widely used thermoplastic with a global

consumption in 2008 of 44 million metric tons. The market is

estimated to be USD 66 billion, with an annual growth rate of 4%.

Today, polypropylene is primarily derived from oil, but Braskem

and Novozymes will develop a green alternative based on Novozymes’

core fermentation

technology and Braskem’s expertise in chemical technology

and thermoplastics. Initial development will run for at least

five years.

“We

live in a world where oil is limited and expensive, and the

chemical industry is looking for alternatives to its

petroleum-based products. Novozymes’ partnership with Braskem is a move

toward a green, bio-based economy, in which sugar will be the new

oil,” says Steen Riisgaard, CEO of

Novozymes.

Both companies have ongoing interests in a bio-based economy:

Braskem is currently building a 200,000-tons-per-year green

polyethylene plant in Brazil with ethanol from sugarcane as the

raw material. Novozymes is producing enzymes to

turn agricultural waste into advanced biofuels and has partnered to convert

renewable raw materials into acrylic acid.

January 14 2008

Cargill and Novozymes to enable production of acrylic acid via 3HPA from renewable raw materials

Cargill and Novozymes today announced a joint agreement to develop technology enabling the production of acrylic acid via 3-hydroxypropionic acid (3HPA:3-ヒドロキシプロピオン酸) from renewable raw materials. The project is supported by a $1.5 million matching cooperative agreement from the U.S. Department of Energy.

The collaboration aims at enabling fermentation of sugar into 3HPA using a bioengineered microorganism. The 3HPA can subsequently be transformed into a range of valuable chemical derivatives including acrylic acid -- a high value, high volume chemical that goes into a broad range of materials including plastics, fiber, coatings, paints and super-absorbent diapers.

Braskem launches project

for green propylene industrial unit

Braskem, the largest thermoplastic resin producer in the Americas

and a company committed to bringing to market products and

solutions with high technical performance that are aligned with

the principles of the low-carbon economy, announces the

conclusion of the conceptual phase of the project to build a green propylene

plant.

In 2011, work will be concluded on the basic engineering studies

and, once final approval is obtained, the project's installation

will begin, with operational startup expected in the second half

of 2013. The plant should require investment of around US$100

million and have minimum green propylene production capacity of 30 kt/year.

To produce green polypropylene, Braskem will adopt technology

that has already been proven on an industrial scale and use as an

input sugarcane ethanol, which is recognized as the

world's best renewable energy source. The green polypropylene

will have the same technical, processability and performance

properties as polypropylene made using traditional production

routes.

The preliminary eco-efficiency study has shown very favorable

results, given the benefits from the environmental advantages of

green ethylene. The study was conducted in partnership with Fundação Espaço Eco and was based on conceptual

engineering data. Each ton of green polypropylene produced

captures and sequesters 2.3 t of CO2.

Braskem considers this plant part of its strategy to develop

biopolymers and is committed to expanding its portfolio and

production capacity, enabling the growth and adoption of green

plastic by a growing number of clients and applications, thereby

increasing the product's benefits for the environment.

Braskem has been working with green polypropylene for a long

time. In 2008, during BioJapan, the company announced the

production of the first green polypropylene sample made 100% from

renewable resources, which was verified in accordance with ASTM

D6866. Braskem also has research projects to develop a new

production route for green polypropylene, including the

partnerships announced with Novozymes in 2009, as well as with

UNICAMP and LNBio

State of Rio Grande do

Sul guarantees Braskem's R$300 million investment

After several weeks of negotiations involving the Treasury and

Development and Promotion departments of the state of Rio Grande

do Sul, Braskem gave assurances to Governor Tarso Genro that it

would invest R$300 million to double butadiene production at

the Triunfo Petrochemical Complex located in the state. The product

is used to make tires and rubbers in general, and the investment

will provide an opportunity for the growth of the elastomers

chain in the state.

The investment will be

formally announced at Palacio Piratini. On the same date, we plan

to announce the creation of a program to promote the development

of the plastics and rubber chains. The investment provides for

the installation of 100 ktons/year of additional

butadiene production capacity. Braskem’s installed capacity of this

product in the state of Rio Grande do Sul is currently 105

ktons/year.

The decision to invest in this capacity expansion is based on the

potential of the elastomer production chain in the state, whose

main players are Lanxess and Borrachas Vipal, and on the solid results of the

raw material in the international market, with butadiene prices

rising by more than 50% in 2010 from 2009. The increase reflects

factors such as the limited world supply due to the greater

competitiveness of natural gas as feedstock and the reduced use

of naphtha, which limits the supply of byproducts like butadiene.

Lanxess がブラジルの合成ゴムメーカーの Petroflex 買収

Vipal

Vipal Rubber Vipamold precured treads、Rubber Flooring、Compounds

Vipal Plastics Ceiling、Doors、Partition Wall、PVC Hoses

2011/4/3 日本経済新聞

丸紅はブラジルの石油化学品最大手、ブラスケンから自動車用タイヤ生産などに使われる合成ゴム原料、ブタジエンを長期調達することで合意した。近く正式契約する。調達規模は5年間で450億円を見込む。ブタジエンはタイヤ販売の拡大で需要拡大が見込まれるが、供給力の増強が遅れている。ブラスケンは安定した販売先を確保し、大型投資に踏みきる。